We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Request Offer Extension or Pay ERP?

My wife and I are coming towards the end of our five year fixed-rate deal. Having seen that rates were starting to rise, I started looking around early and received a mortgage offer from Kensington back in July. The offer is at 3.26%, fixed for the remainder of our mortgage (22 years).

Somewhat frustratingly, despite my mortgage broker knowing the details of when my current mortgage deal expires, the offer from Kensington expires one week before our current fixed rate deal and early repayment charge period. I queried this on receipt of the offer and was told that, subject to no significant changes to our circumstances, it should just be a formality to request an extension to the offer two weeks before its expiry.

Obviously things have changed in the mortgage market over the last couple of weeks and 3.26% is a fair bit lower than anything else that's around at the moment. My worry therefore is that if we request an extension Kensington might actually look for excuses to withdraw the offer rather than grant an extension.

In terms changes to our financial situation, a bonus pay-out from work means I now have more savings and less debt that at the time of application, but my wife has very recently - last week - started a new job, same hourly rate, but more hours.

So, my question is: should we hang on and ask for an extension of our offer to see us past the expiry of our current mortgage fixed rate period, or pay the £1800 early repayment fee to be sure we keep the deal we've currently been offered?

Thanks for your thoughts.

Comments

-

What's the capital amount left owing? Simply, you could take it down to maths. Let's say you've 200k left owing, and a five year fix is say 4.5% now. On that basis, you'd pay £1195. However, on your offered rate, you'd pay £1062, so £133 difference a month. It'd take just over a year for paying the ERC to be worthwhile.

However, for the sake of a week and a phone call, it might equally save you 1800 quid.0 -

you can only wait till closer the date and then ask the question

" Can we extend our mortgage offer by 2 weeks " and see what they say ?0 -

L&C had me apply for a Santander deal that expired in March but my renewal wasn't until April. Had they not made a mistake I would have applied for another deal with a better rate than I ended up with.

When I pointed this out, L&C were very apologetic. When I completed, they sent me the £££ difference between the two products.

The valid dates for products is absolutely something a broker should know. I would ask about your broker's complaints process.0 -

@slowcyclist I don't know Kensington's non-new-build extension policy off of the top of my head but in your place I would just reconfirm with the broker that an extension can indeed be done. He/she can then check with Kensington again and confirm the same.

Kensington's FFT products are funded differently to their shorter fixes so I wouldn't expect there to be any significant issues if Kensington does indeed have a process for short extensions. In any case, they'll still make money on your deal as the funds would've already been secured at a certain cost back when you applied.slowcyclist said:Hi,

My wife and I are coming towards the end of our five year fixed-rate deal. Having seen that rates were starting to rise, I started looking around early and received a mortgage offer from Kensington back in July. The offer is at 3.26%, fixed for the remainder of our mortgage (22 years).

Somewhat frustratingly, despite my mortgage broker knowing the details of when my current mortgage deal expires, the offer from Kensington expires one week before our current fixed rate deal and early repayment charge period. I queried this on receipt of the offer and was told that, subject to no significant changes to our circumstances, it should just be a formality to request an extension to the offer two weeks before its expiry.

Obviously things have changed in the mortgage market over the last couple of weeks and 3.26% is a fair bit lower than anything else that's around at the moment. My worry therefore is that if we request an extension Kensington might actually look for excuses to withdraw the offer rather than grant an extension.

In terms changes to our financial situation, a bonus pay-out from work means I now have more savings and less debt that at the time of application, but my wife has very recently - last week - started a new job, same hourly rate, but more hours.

So, my question is: should we hang on and ask for an extension of our offer to see us past the expiry of our current mortgage fixed rate period, or pay the £1800 early repayment fee to be sure we keep the deal we've currently been offered?

Thanks for your thoughts.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

2 -

Thanks for the reply.K_S said:@slowcyclist I don't know Kensington's non-new-build extension policy off of the top of my head but in your place I would just reconfirm with the broker that an extension can indeed be done. He/she can then check with Kensington again and confirm the same.

Kensington's FFT products are funded differently to their shorter fixes so I wouldn't expect there to be any significant issues if Kensington does indeed have a process for short extensions. In any case, they'll still make money on your deal as the funds would've already been secured at a certain cost back when you applied.slowcyclist said:Hi,

My wife and I are coming towards the end of our five year fixed-rate deal. Having seen that rates were starting to rise, I started looking around early and received a mortgage offer from Kensington back in July. The offer is at 3.26%, fixed for the remainder of our mortgage (22 years).

Somewhat frustratingly, despite my mortgage broker knowing the details of when my current mortgage deal expires, the offer from Kensington expires one week before our current fixed rate deal and early repayment charge period. I queried this on receipt of the offer and was told that, subject to no significant changes to our circumstances, it should just be a formality to request an extension to the offer two weeks before its expiry.

Obviously things have changed in the mortgage market over the last couple of weeks and 3.26% is a fair bit lower than anything else that's around at the moment. My worry therefore is that if we request an extension Kensington might actually look for excuses to withdraw the offer rather than grant an extension.

In terms changes to our financial situation, a bonus pay-out from work means I now have more savings and less debt that at the time of application, but my wife has very recently - last week - started a new job, same hourly rate, but more hours.

So, my question is: should we hang on and ask for an extension of our offer to see us past the expiry of our current mortgage fixed rate period, or pay the £1800 early repayment fee to be sure we keep the deal we've currently been offered?

Thanks for your thoughts.

I've checked with the broker and they have said that an extension can be requested within two weeks of the offer expiry date, but that it will involve a new credit check and have to go back in front of an underwriter for review. They have said that there are three potential outcomes to this:

1. Extension granted

2. Extension refused but offer remains valid

3. Extension refused and offer withdrawn

Obviously, the first outcome is our preferred. We have confirmed with our solicitor that if the extension is refused but the offer remains valid we can pay the ERP and complete before the offer deadline (subject to the extension request being reviewed and responded to in a reasonable time period), but I am wondering whether the recent mortgage market turmoil means that a lender is likely to look for excuses to withdraw an offer, over ad above their normal due-diligence.0 -

@slowcyclist I would discount outcome 3 unless your circumstances have changed materially since the application.

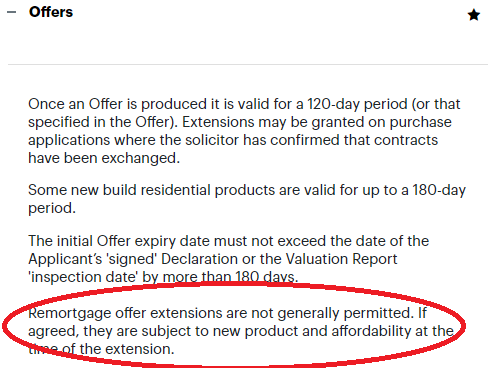

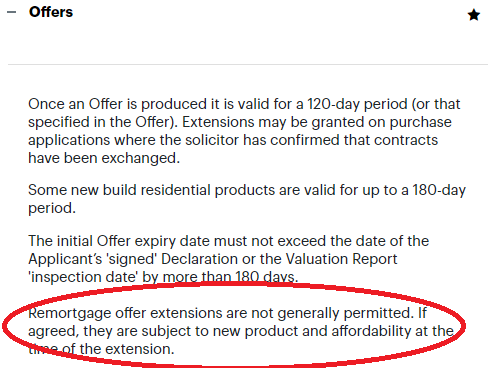

I just trawled through Kensington's criteria pages and this is what it says about remortgage extensions.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Many thanks for that - it seems that I need to talk to our broker again!K_S said:@slowcyclist I would discount outcome 3 unless your circumstances have changed materially since the application.

I just trawled through Kensington's criteria pages and this is what it says about remortgage extensions. 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards