We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Are mortgage providers withdrawing offers?

Comments

-

Either it was a Labour plant in the audience telling a porkie (a bit tin hat but has happened before where comments ended up made by activists)Deleted_User said:

I read that as well and wondered what on earth it was about. No context to it or checking. I can only assume if it was true it was potentially a very adverse lender??! But even then it seems a stretch! Very irresponsible reporting.dunstonh said:The telegraph and news night yesterday both suggested mortgage providers are withdrawing/reneging on written offers.Not helped by questionable information being accepted without scrutiny on the BBC. Such as question time last night where someone claimed their mortgage offer went from 4.5% a few weeks ago to 10.4%. Lots of gasps of shock but it was accepted as gospel and not challenged.

Or it was a sub-prime application (sub prime lenders always pull up the drawbridge during financial crisis)

Or it was an Islamic mortgage with overseas funding (affected by exchange rate)

Basically, nothing mainstreamI am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

dunstonh said:

Either it was a Labour plant in the audience telling a porkie (a bit tin hat but has happened before where comments ended up made by activists)Deleted_User said:

I read that as well and wondered what on earth it was about. No context to it or checking. I can only assume if it was true it was potentially a very adverse lender??! But even then it seems a stretch! Very irresponsible reporting.dunstonh said:The telegraph and news night yesterday both suggested mortgage providers are withdrawing/reneging on written offers.Not helped by questionable information being accepted without scrutiny on the BBC. Such as question time last night where someone claimed their mortgage offer went from 4.5% a few weeks ago to 10.4%. Lots of gasps of shock but it was accepted as gospel and not challenged.

Or it was a sub-prime application (sub prime lenders always pull up the drawbridge during financial crisis)

Or it was an Islamic mortgage with overseas funding (affected by exchange rate)

Basically, nothing mainstreamOnly because you've gone political...we do have a Tory PM that's been shamelessly going around telling porkies about the £2,500 energy price cap being a bill cap.The alternative explanation of course is that she doesn't understand how her own policy works.This is very small beer in comparison.2 -

Nothing new there from the BBC, I like you was shocked by not what she said but the fact nobody has questioned the validity of her claim, its reported in the Telegraph as welldunstonh said:The telegraph and news night yesterday both suggested mortgage providers are withdrawing/reneging on written offers.Not helped by questionable information being accepted without scrutiny on the BBC. Such as question time last night where someone claimed their mortgage offer went from 4.5% a few weeks ago to 10.4%. Lots of gasps of shock but it was accepted as gospel and not challenged. "You've been reading SOS when it's just your clock reading 5:05 "1

"You've been reading SOS when it's just your clock reading 5:05 "1 -

Please do tell us what mortgage is currently charging 10.4% then?

Only because you've gone political...we do have a Tory PM that's been shamelessly going around telling porkies about the £2,500 energy price cap being a bill cap.The alternative explanation of course is that she doesn't understand how her own policy works.Its not a policy. Or was that a slip of the tongue? Although you criticise Liz Truss for a slip of the tongue.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

dunstonh said:Please do tell us what mortgage is currently charging 10.4% then?

Only because you've gone political...we do have a Tory PM that's been shamelessly going around telling porkies about the £2,500 energy price cap being a bill cap.The alternative explanation of course is that she doesn't understand how her own policy works.Its not a policy. Or was that a slip of the tongue? Although you criticise Liz Truss for a slip of the tongue.Pray do tell us why you think it's a Labour plant and not a Sunak one or a Green party one or an EU one?Lol, "slip of the tongue", is that what you call a porkie when it's a Tory PM that does it, repeatedly and consistently?Again, you're the one who made this political.1 -

A lady on the BBC said her mortgage offer had been pulled and replaced with one at twice the rate.

I think she used incorrect terminology which has made it look like offers are being pulled.

I imagine at most she had a DIP and a quote, but had not applied. By the time she came to apply, rates had jumped up.

Lenders are just not pulling offers - I think 2 lenders have, but they are small lenders in the specialist markets. I was at a conference yesterday and was talking to the other lenders. They have said they have no intention of pulling offers. They may need to pull products at times due to the uncertainty but not full offers.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.2 -

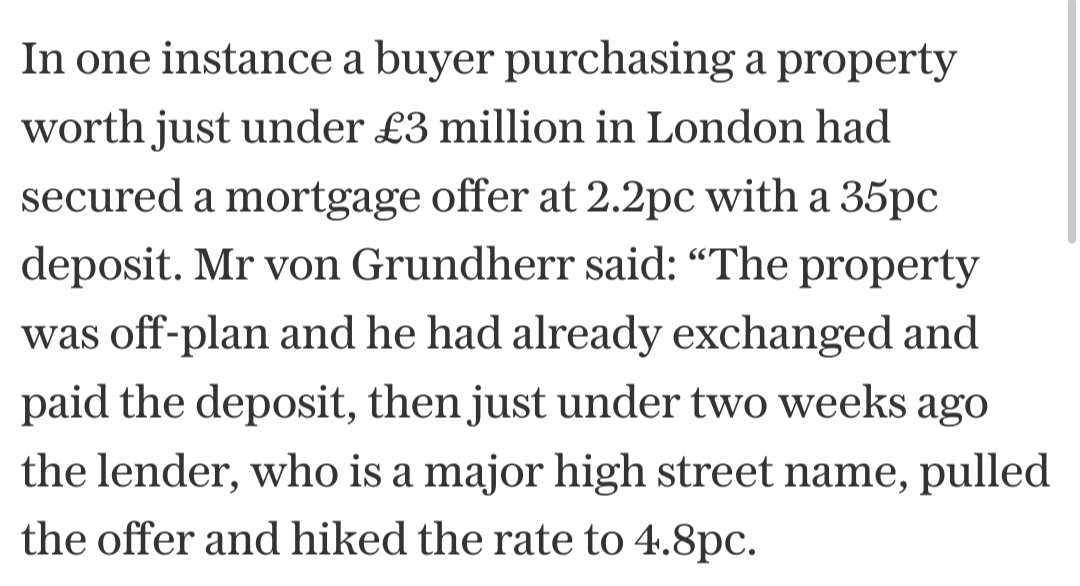

I've just read this article and it looks like a mortgage offer can be pulled at any time (including after exchange)

https://www.msn.com/en-gb/money/other/homebuyers-lose-deposits-after-lenders-pull-mortgages/ar-AA12SdzG?ocid=UP97DHP&li=BBoPWjQ

Saving for Christmas 2023 - £29/£365

Make £2023 in 2023 - £0/£20230 -

We had our mortgage product pulled when the Government made their budget announcement.0

-

I saw that Telegraph article as well, and I am a bit sceptical purely because I simply haven't yet heard of a case where a mainstream lender has pulled a residential mortgage offer or reneged on releasing funds simply due to changed market conditions.

The one case with any details referred to a multi-million pound off plan property purchase. With off plan there will be extensions involved and things often get delayed beyond the initial planned completion date, so it could be that they simply ran out of time and extra time and the lender then said that a new product has to be selected.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards