We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Partial Repayment

pablo_honey1981

Posts: 8 Forumite

in Loans

I am no stranger to personal loans, and have often made partial repayments when I can. I am now in a position to make a partial lump sum repayment of about £3k. The loan is with Natwest and I have noticed their practices do seem to be a bit different to other loans I have had.

Normally when I have made a repayment, for instance with Tesco, it has simply been a case of sending the money to the right account. Simple as that.

With Natwest, as I also bank with them, I had to request a partial repayment illustration.

I've just received this (stating what my payments would go down to - even though I stated I wanted to reduce the term not the payments) and it says this would include an 'Additional payment fee interest charge of £12.24.

I've never been charged for making a partial payment before, as I thought by law you were entitled to do this with no penalty. Am I wrong?

Normally when I have made a repayment, for instance with Tesco, it has simply been a case of sending the money to the right account. Simple as that.

With Natwest, as I also bank with them, I had to request a partial repayment illustration.

I've just received this (stating what my payments would go down to - even though I stated I wanted to reduce the term not the payments) and it says this would include an 'Additional payment fee interest charge of £12.24.

I've never been charged for making a partial payment before, as I thought by law you were entitled to do this with no penalty. Am I wrong?

0

Comments

-

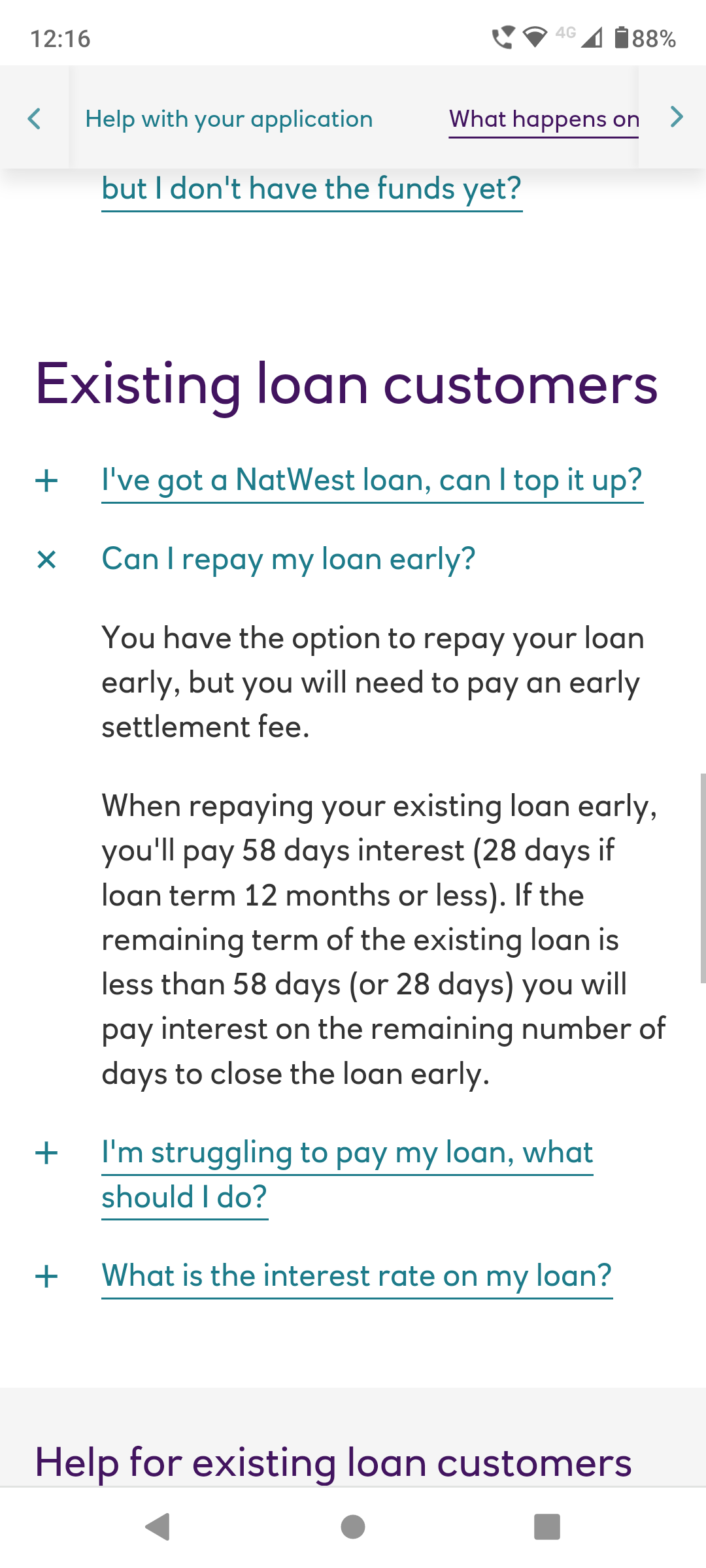

You are wrong - the UK Early Settlement Regulations were amended when the European Credit Directive introduced the right to make Partial Repayments - There had been no previous entitlement to make partial repayments although some lenders did allow them.

The amended Early Settlement Regulations allow lenders to charge an early settlement fee on both partial and full early settlement. The charge arises because the lender is permitted to post-date the assumed date of partial/full settlement for up to 58 days. Some lenders don't apply the rule to partial settlements, but others do.

The lender can offer to shorten the term or reduce the future payments however it is at their discretion whether to offer only one option or both.

Nat West normally offer both options so you should check that with them to clarify1 -

NatWest T & C says they do make a charge for early redemption.....

1

1 -

4justice2

You are correct however what you've cut and pasted is actually in respect of a full early settlement rather than a partial settlement. The Partial Settlement "rules" are on a different page.

https://supportcentre.natwest.com/Help-with-your-product/Loan/913206872/Can-I-make-an-extra-payment-on-my-loan.htm#:~:text=Can I make,your monthly payments.1 -

It is worth looking at the detailed agreement terms, sometimes you can make a smaller payment without triggering the rules, so it may be possible to make a few smaller payments rather than 1 large one.Credit card debt - NIL

Home improvement secured loans 30,130/41,000 and 23,156/28,000 End 2027 and 2029

Mortgage 64,513/100,000 End Nov 2035

2022 all rolling into new mortgage + extra to finish house. 125,000 End 20362

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards