We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Help to buy repayments

valenathan

Posts: 3 Newbie

Hi all,

I’m approaching the 6th year of my help to buy equity loan. I’m wondering if the changes in inflation or rising interest rates will have any impact on my future payments?

I understand I’ll pay 1.75% of my £28k loan this coming year, but the below confuses me for year 7 onwards;

The interest rate increases every year in April, by adding the Consumer Price Index (CPI) plus 2%.

many thanks!

I’m approaching the 6th year of my help to buy equity loan. I’m wondering if the changes in inflation or rising interest rates will have any impact on my future payments?

I understand I’ll pay 1.75% of my £28k loan this coming year, but the below confuses me for year 7 onwards;

The interest rate increases every year in April, by adding the Consumer Price Index (CPI) plus 2%.

many thanks!

0

Comments

-

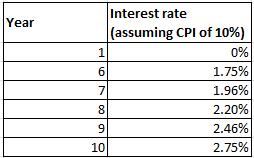

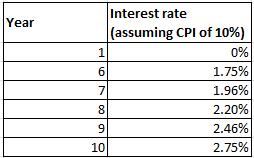

@valenathan The interest rate is uprated by (CPI+2%). So if CPI is 10%, the interest rate will go up by 12% of the previous year's interest rate. In year 7 that would be : 1.75% x 1.12 = 1.96%valenathan said:Hi all,

I’m approaching the 6th year of my help to buy equity loan. I’m wondering if the changes in inflation or rising interest rates will have any impact on my future payments?

I understand I’ll pay 1.75% of my £28k loan this coming year, but the below confuses me for year 7 onwards;

The interest rate increases every year in April, by adding the Consumer Price Index (CPI) plus 2%.

many thanks!

In subsequent years, even if you assumed a worst case scenario of CPI running at 10% every year, you'd still only be paying a 2.75% interest rate in year 10, a fixed rate that you can't probably get for your mortgage right now.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

2 -

That’s great, thank you!K_S said:

@valenathan The interest rate is uprated by (CPI+2%). So if CPI is 10%, the interest rate will go up by 12% of the previous year's interest rate. In year 7 that would be : 1.75% x 1.12 = 1.96%valenathan said:Hi all,

I’m approaching the 6th year of my help to buy equity loan. I’m wondering if the changes in inflation or rising interest rates will have any impact on my future payments?

I understand I’ll pay 1.75% of my £28k loan this coming year, but the below confuses me for year 7 onwards;

The interest rate increases every year in April, by adding the Consumer Price Index (CPI) plus 2%.

many thanks!

In subsequent years, even if you assumed a worst case scenario of CPI running at 10% every year, you'd still only be paying a 2.75% interest rate in year 10, a fixed rate that you can't probably get for your mortgage right now. 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards