We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

ERC seems low

hufc2002

Posts: 329 Forumite

Hi all

2 year fix @1.84% with HSBC comes to an end with HSBC 30/09/2022.

2 year fix mortgage offer @2.10% with Virgin ends 28/09/2022.

Solicitor has asked if I want to complete 01/09/2022 however doing so I would incur an ERC of £113.34. This seems low to me but could it be correct? I have copy of the redemption statement issued by HSBC.

If this was you with no guarantee of Virgin extending the mortgage offer by just a few days, would you complete before my current fix ends.

Owe just over £159k. Property value £230k.

Thanks in advance.

2 year fix @1.84% with HSBC comes to an end with HSBC 30/09/2022.

2 year fix mortgage offer @2.10% with Virgin ends 28/09/2022.

Solicitor has asked if I want to complete 01/09/2022 however doing so I would incur an ERC of £113.34. This seems low to me but could it be correct? I have copy of the redemption statement issued by HSBC.

If this was you with no guarantee of Virgin extending the mortgage offer by just a few days, would you complete before my current fix ends.

Owe just over £159k. Property value £230k.

Thanks in advance.

0

Comments

-

That £113, is that an ERC or is that a deeds release fee?

I dont know if this is possible, but most solicitors draw down on the money a couple of days before completion to ensure the money is in hand in advance. 1-2 days is not uncommon.

Could your solicitor not draw down on the money with virgin on the 28th and then complete on the 30th? When I bought my house, my solicitor had the money in their bank account on the wednesday, we completed on Friday.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

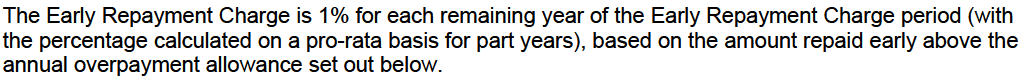

@hufc2002 HSBC does a pro-rated ERC, so you'll only be paying for the 30 days (so roughly 1% x 30 / 365 x 159k) between completion and end of fix. This is the excerpt from a typical HSBC offer.hufc2002 said:Hi all

2 year fix @1.84% with HSBC comes to an end with HSBC 30/09/2022.

2 year fix mortgage offer @2.10% with Virgin ends 28/09/2022.

Solicitor has asked if I want to complete 01/09/2022 however doing so I would incur an ERC of £113.34. This seems low to me but could it be correct? I have copy of the redemption statement issued by HSBC.

If this was you with no guarantee of Virgin extending the mortgage offer by just a few days, would you complete before my current fix ends.

Owe just over £159k. Property value £230k.

Thanks in advance.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

So is the ERC quoted on the redemption statement correct? I was expecting it to be hundreds even thousands.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards