We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Illustration retracted

Comments

-

@kingstreet I don't know if policy has changed very recently but since the prior year is <50k, doesn't Halifax take the lower of the two years?kingstreet said:Halifax works from average director remuneration and dividends evidenced by latest two years tax calculations/SA302s and accompanying tax year overviews. If the latest year is lower, they will discard the average and work from the latest year instead.

How have these changed in the period in question?I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

@jglews Not necessarily when it's Halifax. For self-employed income <50k/year, they will take the lower of the two years, not the average. But even that wouldn't explain a 50% drop in affordability.Jglews said:Earnings were as described, broker had sa302’s prior to going to lenders, my Ltd company profits increased this year by net 6.5k, which is the only change but shouldn’t an increase improve affordability?

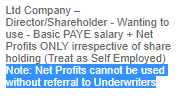

I think what may have happened here is the the broker may have applied for borrowing based on salary+netprofit (which Halifax will consider subject to referral to full underwriting)

The underwriter may have reviewed and declined to use net-profits and fallen back on salary+dividends which gives you a lower borrowing figure.

Just an educated guess based on the limited info in this thread.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Good point. Forgot that.K_S said:

@kingstreet I don't know if policy has changed very recently but since the prior year is <50k, doesn't Halifax take the lower of the two years?kingstreet said:Halifax works from average director remuneration and dividends evidenced by latest two years tax calculations/SA302s and accompanying tax year overviews. If the latest year is lower, they will discard the average and work from the latest year instead.

How have these changed in the period in question?I am a mortgage broker. You should note that this site doesn't check my status as a Mortgage Adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice. Please do not send PMs asking for one-to-one-advice, or representation.0 -

Thankyou to all that commented, it helped me get a better understanding,

Im still in talks with the advisor (although the original one has since left the company)

fingers crossed I can get sorted,1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards