We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

AVC Fund Choices Clerical Medical

draiggoch

Posts: 157 Forumite

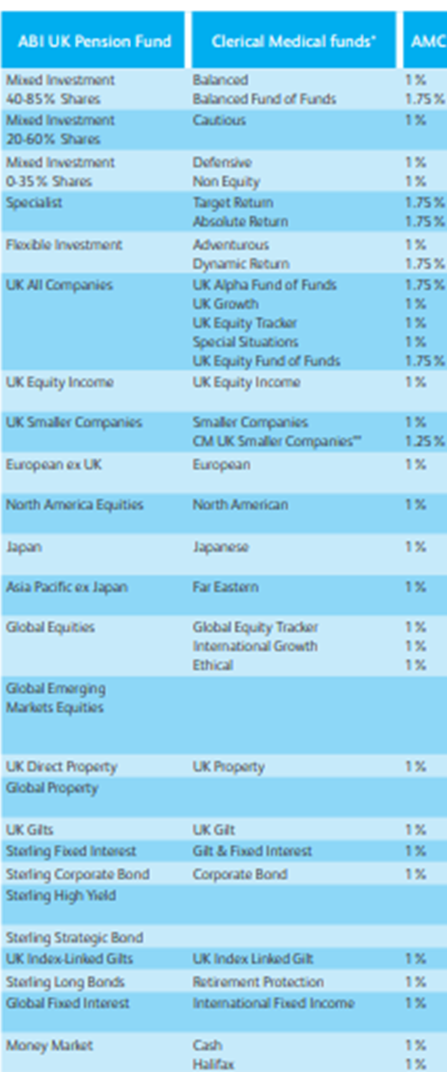

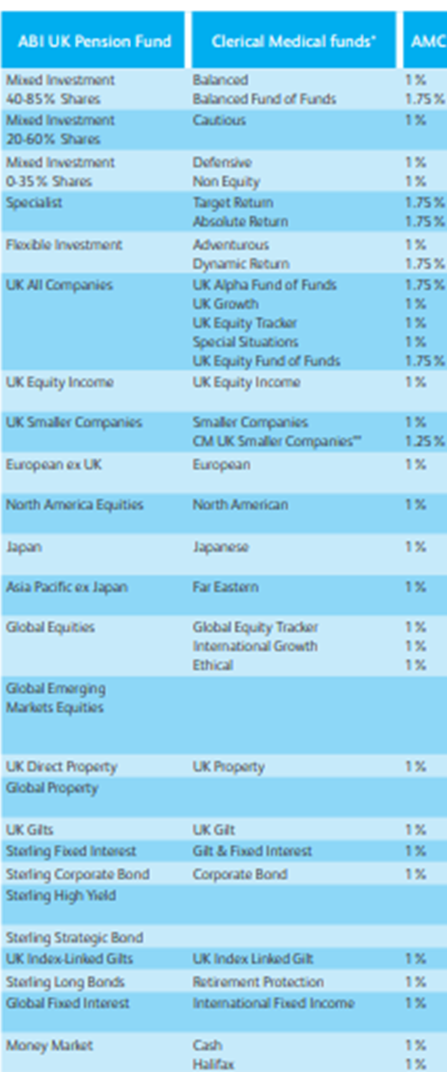

I'm just signing up to a salary sacrifice AVC with the LGPS and it is run via Clerical Medical. I have taken a snapshot of the funds they offer via the AVC scheme.

They also offer BlackRock Uk Equity Fund and BlackRock World (Ex UK) Fund.

I don't plan to take the pension and AVC for another 13 years. I have had a look at past performance and what they consist of, I was just wondering if there were any recommendations or ideas. For my SIPP i have just tended to stick to a cheap international equities tracker.

Thanks

D.

They also offer BlackRock Uk Equity Fund and BlackRock World (Ex UK) Fund.

I don't plan to take the pension and AVC for another 13 years. I have had a look at past performance and what they consist of, I was just wondering if there were any recommendations or ideas. For my SIPP i have just tended to stick to a cheap international equities tracker.

Thanks

D.

0

Comments

-

Does it have to be with CM?

My LA offered CM and Standard Life AVC options. Initially I went with CM but quickly realised that their IT and admin systems were about 20 years behind the rest of the world. No online portal, everything had to be done by letter from the scheme trustees after you requested them to ask CM to XXXX.

Wouldn't even tell you account value over phone.

Transferred to SL as soon as I could.

Their investment choices were pretty poor as well.

What asset allocation are you aiming for? 100% equities or a mix of Equities / Bonds / Property etc?

If you think about that you can at least come up with your own personal short list.0 -

I would at least avoid the funds charging more than 1% and the absolute return fund.0

-

I am surprised that the funds are still showing as 1%. When Clerical Medical closed for new business in March 2012, their pension products for the retail market before that were around 0.7% AMC (could be better with fund based discounts).

With the requirement to offer AVCs removed in 2006, many scheme administrators stopped focusing on the AVC product and those that still offer them are often old fashioned contracts without yesteryear pricing that is higher than retail individual pensions.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Clerical medical is the only option unfortunately, the charges are what I could find on the internet. There are no fees or charges shared in the paperwork I received from my LGPS. I was thinking of just sticking it all in equities maybe 80% International growth (I believe this only includes about 5% UK exposure) and 20% UK Growth.

As it is salary sacrifice the NI benefits should outweigh most charges I would have thought in comparison to sticking it in my SIPP. Without forgetting the option to take all the AVC tax free against the value of my LGPS annual pension.

Thanks0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards