We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Voyant - cash growth rate of 3% - huh?

MrBobbins

Posts: 27 Forumite

Are there any people here actively using Voyant?

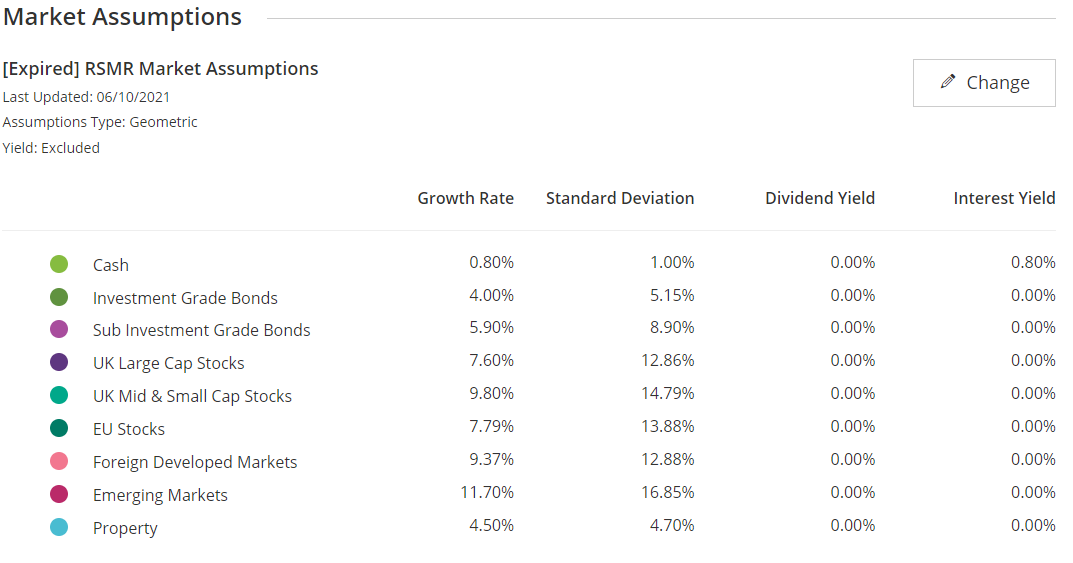

I’ve just signed up for the free month’s trial and I’ve been very impressed with it so far. Some of the defaults have confused me a bit so far though, specifically the market assumption for cash growth rate of 3%! I’d been trying to simulate a 2 year cash buffer to avoid sequence of returns risk, but it feels like this default assumption would give an unrealistically optimistic effect on the overall simulation. Obviously I can override this (and have), but just wondered if anyone could explain the figure? Have I misunderstood what it represents?

I’ve just signed up for the free month’s trial and I’ve been very impressed with it so far. Some of the defaults have confused me a bit so far though, specifically the market assumption for cash growth rate of 3%! I’d been trying to simulate a 2 year cash buffer to avoid sequence of returns risk, but it feels like this default assumption would give an unrealistically optimistic effect on the overall simulation. Obviously I can override this (and have), but just wondered if anyone could explain the figure? Have I misunderstood what it represents?

0

Comments

-

Investment grade bonds 7%? Is this a demo system rather than real time data. As your screenshot is dated as at 06/10/2021.0

-

Some of the defaults have confused me a bit so far though, specifically the market assumption for cash growth rate of 3%I don't use it but it is possible that they leave it for you to decide the defaults and have only input dummy figures to get you started. The figures seem unrealistic across the board.

Calculating your cash buffer without inputting defaults for dividends and interest won't give you an accurate projection on your cash buffer use either.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Yeah, I wondered about that too. Would be interesting to hear from anyone with a paid subscription to see if it’s different.Thrugelmir said:Investment grade bonds 7%? Is this a demo system rather than real time data. As your screenshot is dated as at 06/10/2021.0 -

dunstonh said:Some of the defaults have confused me a bit so far though, specifically the market assumption for cash growth rate of 3%I don't use it but it is possible that they leave it for you to decide the defaults and have only input dummy figures to get you started. The figures seem unrealistic across the board.

Calculating your cash buffer without inputting defaults for dividends and interest won't give you an accurate projection on your cash buffer use either.

I'd previously changed the assumed rate of returns for my individual accounts, but I've just now clicked on the "change" button shown in my image. I was expecting it to allow changing each item individually, but it actually lets you choose between either the current "Dimensional funds" one, or a "[Expired] RSMR Market Assumptions" one. I tried that, and while being just as out of date, it looks a lot more usable as a base, at least for Cash:

0 -

I ignore the Dimensional Fund and RSMR market assumptions. The way I set this up is to select chosen "inflation / growth"values in "plan settings". I have "Grow all investments and retirement accounts using asset allocation" in "Calculation Settings" set to "No". This ensures the only inflation / growth values active are the ones I have set. I currently have Inflation set at 3%, Savings set at 1%, Investments set at 5% (2% real). These are not set and forget parameters - they are subject to review and I have the investment and savings rates intentionally conservative.0

-

"Are there any people here actively using Voyant?"MrBobbins said:Are there any people here actively using Voyant?

I’ve just signed up for the free month’s trial and I’ve been very impressed with it so far. Some of the defaults have confused me a bit so far though, specifically the market assumption for cash growth rate of 3%! I’d been trying to simulate a 2 year cash buffer to avoid sequence of returns risk, but it feels like this default assumption would give an unrealistically optimistic effect on the overall simulation. Obviously I can override this (and have), but just wondered if anyone could explain the figure? Have I misunderstood what it represents?

yes

"specifically the market assumption for cash growth rate of 3%"

These are (or should be) long term assumptions.

"I’d been trying to simulate a 2 year cash buffer to avoid sequence of returns risk"

I'm not sure how a 2-year cash buffer will help when it's most needed, and Voyant probably isn't the best tool to simulate this - Timeline is better.0 -

2% real on investments isn't necessarily conservative.DreZZ said:I ignore the Dimensional Fund and RSMR market assumptions. The way I set this up is to select chosen "inflation / growth"values in "plan settings". I have "Grow all investments and retirement accounts using asset allocation" in "Calculation Settings" set to "No". This ensures the only inflation / growth values active are the ones I have set. I currently have Inflation set at 3%, Savings set at 1%, Investments set at 5% (2% real). These are not set and forget parameters - they are subject to review and I have the investment and savings rates intentionally conservative.0 -

Very true. It depends on the asset allocation and the investment time horizon.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards