We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage overpayments question

Comments

-

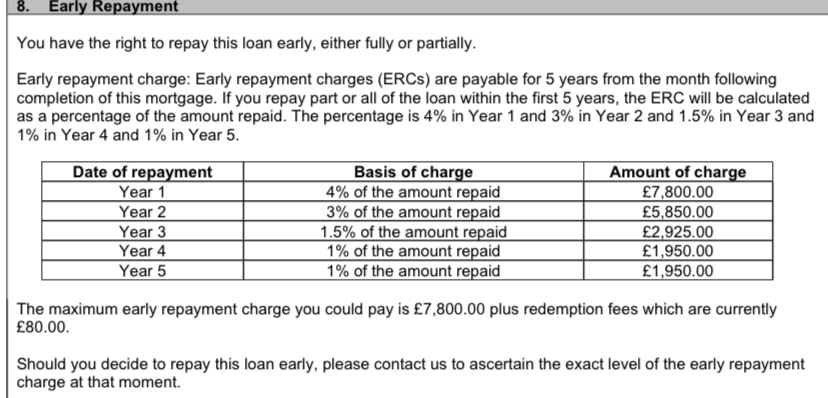

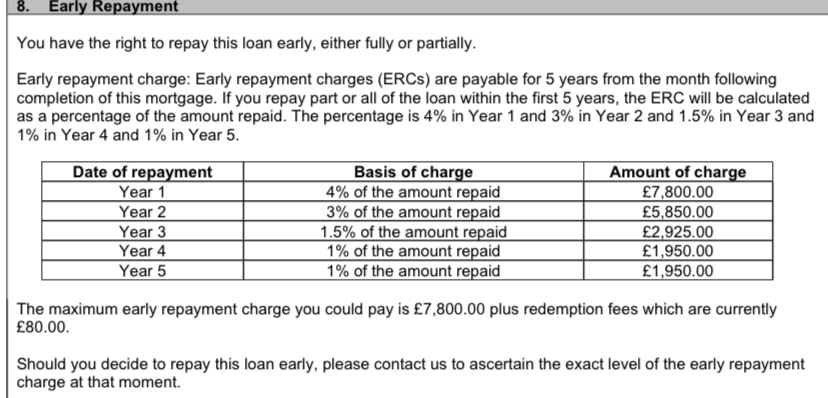

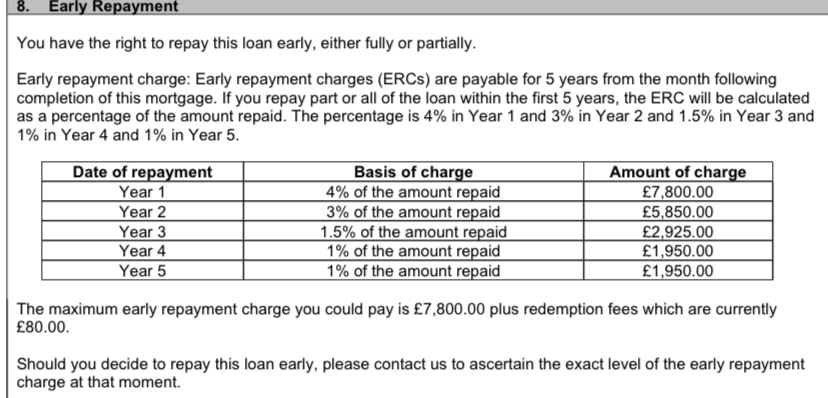

What part? It’s pretty straightforward.If you repay early you will pay a % of the amount outstanding.2

-

So basically I can overpay any amount as long as the full amount is not paid within 5 years?MFiT-T6 #70

-

Is there a separate sections for overpayments in your paperwork? What you've quoted here only seems to cover repayments0

-

@girlie1412 You can, but you may be charged a penalty (ERC) as per the rates in your post.girlie1412 said:So basically I can overpay any amount as long as the full amount is not paid within 5 years?

Most lenders will allow a fee-free annual overpayment allowance, which is normally 10% of the outstanding amount. If so, that will be mentioned in your illustration under 'incentives' or 'features'. If it's a specialist lender, some of them do not allow any fee-free overpayments.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Which lender is this.girlie1412 said:Can someone please explain to me below overpayments charges..

Makes it a lot easier for people to respond if you provide the essential information.0 -

This is the box for repayment of the mortgagegirlie1412 said:Can someone please explain to me below overpayments charges..

I think you are referring to making overpayments not paying off the mortgage? Is there another section on overpayments?MFW 2026 #50: £3,583.49/£25,00007/03/25: Mortgage: £67,000.00

Mortgage:

16/01/26: £56,794.25

02/01/26: £60,223.17

12/08/25: Mortgage: £62,500.00

12/06/25: Mortgage: £65,000.00

18/01/25: Mortgage: £68,500.14

27/12/24: Mortgage: £69,278.38

Savings: £20,0000 -

Mortgage lender is Kensington- so yes specialist lender.This is in overpayments

9. Flexible featuresYou do not have the right to transfer this loan to another lender or property.Additional features: OverpaymentsIf you make an overpayment (as defined in the mortgage conditions), or a series of overpayments that amount to: Less than £5,000, unless we agree otherwise, we will not apply this to reduce your loan balance, but it will reduce the amount of interest you have to pay straight away. If we do agree to reduce your loan balance you may have to pay an early repayment charge (as detailed in the section 8 above) and an administration fee, as detailed in our tariff (also detailed in section 8 above) and we will change the amount of your monthly payment. £5,000 or more we will use this to reduce your loan balance and this will reduce the amount of interest you have to pay straight away, you may have to pay an early repayment charge and an administration fee. We will also change the amount of your monthly payment unless we agree otherwise.If you make an overpayment we will not refund the overpayment to you unless it is greater than your loanMFiT-T6 #70 -

@girlie1412 With Kensington, if you make an overpayment (or multiple overpayments) less than 5k, it will not automatically incur a penalty and will not reduce your monthly payment. However, you will pay no interest on the amount overpaid. For example imagine your original monthly payment was 1000, and 600 went to capital repayment and 400 to interest payment. After you make the <5k overpayment, you'll still have a monthly payment of 1000 but the capital repayment portion of it will go up slightly and the interest paid will reduce slightly.

At the end of the loan, when the o/s balance equals this overpaid amount (< 5,000), the mortgage is deemed to have been paid. I don't know why they do it this way but that's how they explain it.

What it boils down to is that you can save interest on an overpayment of less than 5k without incurring a penalty, so not a lot unfortunately. They don't really want you to make a lot of overpayments.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

@K_S thanks so much for your answer. Am I right in thinking that my maximum overpayment without penalty can be less then £5000 for the mortgage term?Apologies for all the questions I am very new to this and I have already made some overpayments in the year one although less the £5k. I am hoping to make further overpayments and diner want to get stuck with the massive penalty at the end of it all.MFiT-T6 #70

-

@girlie1412 Apologies, I can't remember off of the top of my head whether it's an annual allowance or across the whole fixed term. The way it reads I suspect it's over the 2/5 year fixed term.

In any case, I'd recommend either dropping an email to your broker or calling Kensington, they must get this query every day.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards