We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Suggested portfolio

Comments

-

If your investment was just one VLS multi asset fund, I can't see any need for an IFA unless your other finances and tax matters are complex and you need help with planning.RogerIrvine said:Would you need a VLS fund and an IFA on a yearly basis?1 -

Again, you are not comparing like for like and you are wrong.

This is extremely misleading. And basically false. Let me spell it out.

VTI has $1.3 trillion in funds. There is some management and costs involved in designing and tracking the index as well as the cost of buying and selling shares as they enter/leave the index. These costs are 5 basis points, negligible compared to IFA charges.

If you buy the underlying funds held in VLS then your fund charges will be 0.1x%. However, if you buy VLS then its 0.22%. They are adding around 0.1% for software costs. Vanguard also charge 0.50% p.a. if you want their advice service.You want to call VLS active? Not really but whatever.You referred to an IFA portfolio that works in a similar way as active. So, again, you are using one rule for an IFA and one for Vangaurd.HSBC funds are smaller in terms of funds invested, so the costs are more concentrated but the fund covers fewer companies to keep the costs down. It is more active as allocations are not stable. Still well diversified, very simple and cost efficient. 6 and two 3s, matter of preference.Any weighting decision is an active decision. The fact that Vanguard keep the equity/bond mix fixed is an active decision. They do alter the underlying weightings and have made the active decision to be overweight in the UK.When an advisor sets up and “manages” a portfolio for you using these funds, its another layer of costs and research. You can argue semantics all you like but its another layer. And these costs overwhelm the costs of decent multi-asset funds.Except its not as the adviser firm is paying for the data. And you assume that the multi-asset fund will return greater. What if it doesn't?Much of the 20th century? Interesting interpretation of history. US became world’s largest economy in 1890. Claiming that it was an “emerging economy” during Bogle’s time tells me that you know less about history than what I assumed.I suggest you read up on the subject as you appear to be lacking knowledge and understanding of the US throughout the 20th century.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

Must admit, the Circular discussion above is quite interesting.

My take is.

1) for most,

investing in a very small number of tracker funds via a good-value platform is cheaper and will meet their financial goals

2) IFAs can be useful for some, particularly in the wider context of financial planning.

I like simplicity and appreciate the guaranteed return of low fees and not worrying whether I can beat the market. So I invest in a world tracker.

3 -

Specialist finanial advice can be useful or essential in certain circumstances, eg in matters relating to complex taxation matters and/or inheritance planning.Hardly ever for building and maintaining a standard retirement portfolio. The exception would be if both of the following conditions are met:

1. You know nothing about investing and are unwilling to read a book or two

2. The advisor is good which is far from certain (as we see from post 1).There is another option. In his early days Buffett only charged if his fund returned more than risk-free investment (TIPS), which in those days payed 5%. If you can find someone like that…0 -

Except its not as the adviser firm is paying for the data. And you assume that the multi-asset fund will return greater. What if it doesn't?

You can obfuscate all you like but advisors managing investments provide another layer of costs and the overall resulting costs are noticeably more expensive. What are the total costs to clients for your portfolios including platform, advice and fund fees?

I do not assume that multi-asset fund returns are greater. Future returns, unlike costs, are never guaranteed.

0 -

2nd_time_buyer said:Must admit, the Circular discussion above is quite interesting.

My take is.

1) for most,

investing in a very small number of tracker funds via a good-value platform is cheaper and will meet their financial goals

2) IFAs can be useful for some, particularly in the wider context of financial planning.

I like simplicity and appreciate the guaranteed return of low fees and not worrying whether I can beat the market. So I invest in a world tracker.

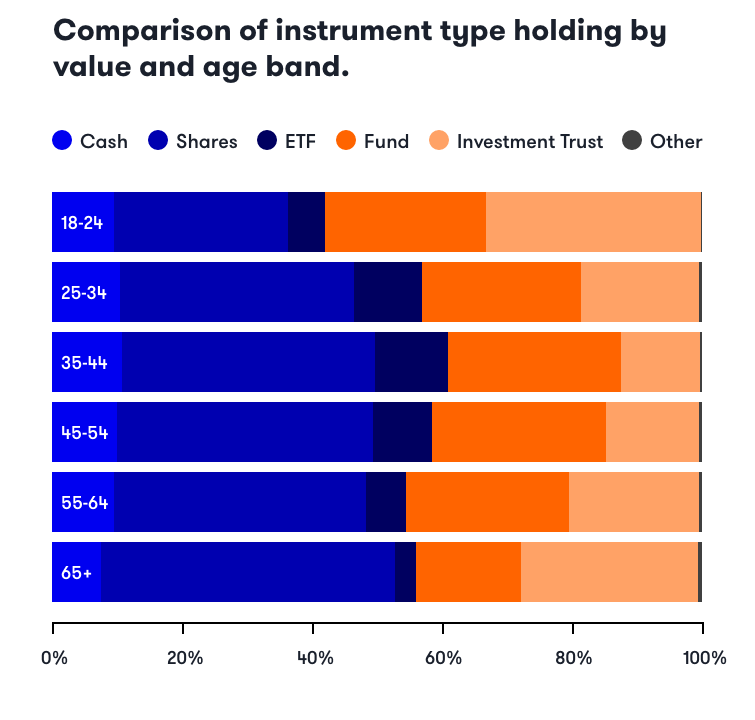

It is interesting to see how few investors seem to follow what is generally good advice. This below is an overview of what II investors hold. I can't imagine the other major platforms are much different and if we add the recent crop of cheap trading platforms into the mix its probably much worse. Tucked away in the fund allocation along with all of the active funds is the VLS range. It looks like many people fancy their chances with individual shares.

This also doesn't take into account poor investor behaviour although another report last year did a comparison of Hargreaves Lansdown investors vs St James Place investors and found that St James Place investors performed better even with more expensive worse performing funds in general.

So, if an IFA can help improve this behaviour then I can't see a problem. Although the portfolio in the first post doesn't look likely to achieve that goal.

3 -

You can obfuscate all you like but advisors managing investments provide another layer of costs and the overall resulting costs are noticeably more expensive. What are the total costs for your portfolios including platform, advice and fund fees?Platform charge is the same regardless of investments funds used. So, we can ignore that.

Advice charge doesn't change whether the person is in multi-asset or the model portfolio. So, we can ignore that.

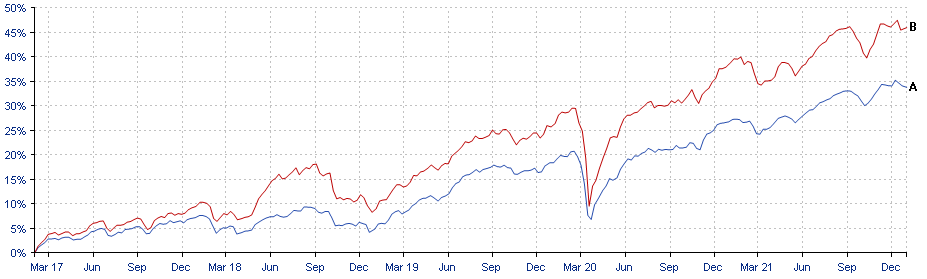

I am actually doing a case now where I am switching someone out of VLS40 into the model portfolio as they have come into extra money. Same risk profile. VLS40 is 0.22% and the model portfolio is 0.25%. So, just a 0.03% difference.

And the performance is below. VLS40 is blue and the model portfolio is in red (both are net of fund charges). There is no DFM charge as I don't believe the extra layer of charges justifies DFMs in most cases. I do wonder if you are mixing up IFAs with DFMs given some of your comments. Just as I suspect the portfolio on the first post is part DFM arranged.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.3 -

"Same risk profile"dunstonh said:You can obfuscate all you like but advisors managing investments provide another layer of costs and the overall resulting costs are noticeably more expensive. What are the total costs for your portfolios including platform, advice and fund fees?Platform charge is the same regardless of investments funds used. So, we can ignore that.

Advice charge doesn't change whether the person is in multi-asset or the model portfolio. So, we can ignore that.

I am actually doing a case now where I am switching someone out of VLS40 into the model portfolio as they have come into extra money. Same risk profile. VLS40 is 0.22% and the model portfolio is 0.25%. So, just a 0.03% difference.

And the performance is below. VLS40 is blue and the model portfolio is in red (both are net of fund charges). There is no DFM charge as I don't believe the extra layer of charges justifies DFMs in most cases. I do wonder if you are mixing up IFAs with DFMs given some of your comments. Just as I suspect the portfolio on the first post is part DFM arranged.

Given the much larger drawdown of the red portfolio in March 2020 I would question that.0 -

I'm still not sure why there is so much focus on IFAs and the investment side, especially in the retirement space which is about so much more than that.Deleted_User said:Specialist finanial advice can be useful or essential in certain circumstances, eg in matters relating to complex taxation matters and/or inheritance planning.Hardly ever for building and maintaining a standard retirement portfolio. The exception would be if both of the following conditions are met:

1. You know nothing about investing and are unwilling to read a book or two

2. The advisor is good which is far from certain (as we see from post 1).There is another option. In his early days Buffett only charged if his fund returned more than risk-free investment (TIPS), which in those days payed 5%. If you can find someone like that…

As I've said before, most financial planners offer portfolios that you could broadly construct yourself - the value is elsewhere.

1 -

I think it goes back to the IFA portfolio "recipe" copied into the opening post.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards