We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Pension Contribuition Sequencing - Any Tax advantage?

JamTomorrow

Posts: 169 Forumite

Question

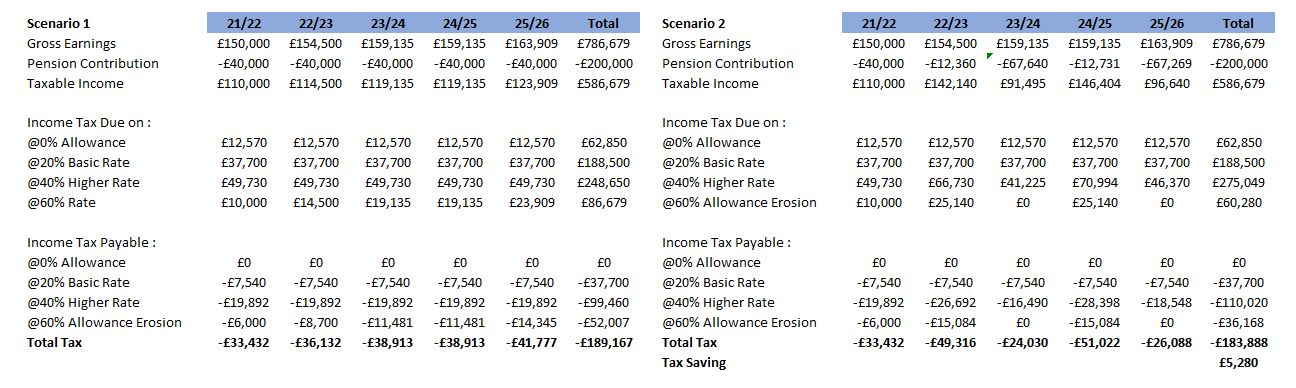

Rather than make £40k year pension contributions annually is there any advantage in phasing those contributions differently when leaving taxable income in the effective 60% rate?

My analysis suggests that over a 5 year period (see image) that by sequencing pension contributions as ~£12k year 1 and ~£68k year 2 that I can manage incidence of tax and therefore cost of pension contributions more effectively. Outcome being that 5 year pension contributions of £200k would cost me ~£5k less if managed in a 'lumpy' approach rather than flat £40k annually. This is being driven by over the 5 year period shifting £26k of taxable income from 60% to 40%.

However, my thinking and/or modelling could be incorrect and would apprecaite views and pressure test of modelling.

Background :

- Currently making £40k/year contributions with no unused annual allowance from prior years

- Moving into a phase of earnings where I cannot get my taxable income below £100k; therefore leaving some income in the effective 60% rate when my personal allowance gets eroded

- May overshoot LTA but I am ok with this

Assumptions

- Salary grows at 3%/year

- Annual allowances, tax rates & bands remain unchanged

- Minimum pension contribution of 8%/year

- No other options available to reduce Gross Earnings further (other than reduce working days - an option in 5 years)

Rather than make £40k year pension contributions annually is there any advantage in phasing those contributions differently when leaving taxable income in the effective 60% rate?

My analysis suggests that over a 5 year period (see image) that by sequencing pension contributions as ~£12k year 1 and ~£68k year 2 that I can manage incidence of tax and therefore cost of pension contributions more effectively. Outcome being that 5 year pension contributions of £200k would cost me ~£5k less if managed in a 'lumpy' approach rather than flat £40k annually. This is being driven by over the 5 year period shifting £26k of taxable income from 60% to 40%.

However, my thinking and/or modelling could be incorrect and would apprecaite views and pressure test of modelling.

Background :

- Currently making £40k/year contributions with no unused annual allowance from prior years

- Moving into a phase of earnings where I cannot get my taxable income below £100k; therefore leaving some income in the effective 60% rate when my personal allowance gets eroded

- May overshoot LTA but I am ok with this

Assumptions

- Salary grows at 3%/year

- Annual allowances, tax rates & bands remain unchanged

- Minimum pension contribution of 8%/year

- No other options available to reduce Gross Earnings further (other than reduce working days - an option in 5 years)

0

Comments

-

You start by saying 3% increase per year but don't actually implement that all the time so I think you have avoided bringing the 45% tax rate into the equation when it should be relevant.

The old phrase time in the market not timing the market springs to mind. Although not trying to time the market you are keeping £54k out of the market for longer with this option.

1 -

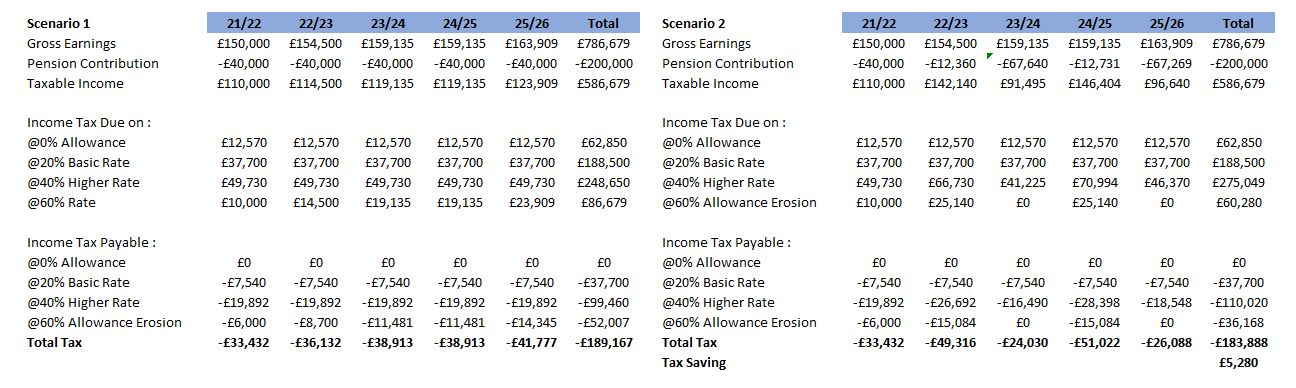

Thanks. The 3% pa salary increase is reflected in the gross earnings but it was a good catch on the 45% rate as in the year when I minimise pensions contributions (24/25) I would have some income in the 45% rate (£1.4k) and would need to manage this by paying a little more into my pension in that year.Dazed_and_C0nfused said:You start by saying 3% increase per year but don't actually implement that all the time so I think you have avoided bringing the 45% tax rate into the equation when it should be relevant.

The old phrase time in the market not timing the market springs to mind. Although not trying to time the market you are keeping £54k out of the market for longer with this option.

Agree on the 'time not timing' but whilst I can't control the market it is within my gift to control whether to pay £5k additional tax or not. In addition, in those years when I minimise the pension contributions, the extra after tax income would be invested into an ISA which would partially mitigate the timing risk.1 -

The gross earnings for 2023:24 and 2024:25 are both £159,135.1

-

Thank you for picking up my spreadsheet error! Updated now with capping off taxable income at £150k in 24/25 so as not to incur any 45% tax rate.Dazed_and_C0nfused said:The gross earnings for 2023:24 and 2024:25 are both £159,135.

0 -

To step it up to the next level - have you checked to see if you can sequence your monthly contributions within a tax year to take advantage of NI working on a pay period basis as described in the comment below from @zagflesAs I understand it, if on one or more months in a tax year you can arrange you pension contributions so that the monthly taxable pay is below the NI upper earnings limit you can avoid paying 12% NI on part of your salary compared to the case of equally distributed monthly payments throughout the tax year.If the company allows you to vary the sal sac every month, you could save even more NI by making lumpy contributions.

NI works on a pay period basis, for monthly pay the rate drops from 12% to 2% when the month's income exceeds £3750. Tax works on an annual basis.

As an example, say you earn £57k, ie £4750 a month. You want to pay in £12k to your pension to take full advantage of higher rate relief.

If you pay that £12k in the normal way ie £1,000 a month, monthly pay £3750 after sal sac, you'll get 40% tax relief and 2% NI relief on the whole £12k.

But if instead you pay in £3,000 in for 4 months, and nothing for the other 8 months, the same £12k has gone in but you'd get 12% NI relief on two thirds of it! Because your monthly pay is reduced to £1750 for the 4 months, giving you 2% NI relief on the first £1,000 and 12% on the next £2,000.

Obviously you should always pay enough in to get maximum company contributions, and you can't go below NMW (about £1300 a month).

You need to understand the cumulative nature of PAYE to understand how much tax you'll pay every month, but assuming you've got a normal tax code you'll end up paying the same tax on the same annual income regardless of how income is spread in the year.

0 -

Your low/high or even low/low/high plan is sensible in your circumstances.

You can further increase the NI benefit in the high concentration years by concentrating the contributions into the smallest possible number of months at minimum wage. This is because NI is calculated for each pay period. It'll get you some 12% instead of 2% NI reduction from the sacrifice. But in your specific situation this is a bad idea. By sacrificing to below 50k/12 in a month to get any 12% NI reduction you'd be severely increasing the number of low pension contribution years where you cannot save your income tax nil rate band by sacrificing to no more than 100k.

What @areader quoted zagfles as saying is correct, but the wrong choice for your situation.0 -

Sorry if it wasn't clear, but my suggestion was to keep with the original (100k/60% income tax) annual pension contribution sequencing but combine with the monthly concentrating of pension payments for the NI reduction. Unless I've misunderstood things both can work together?(Assuming the aim is to minimise tax, although "time in the market" issues raised above etc.)1

-

Sorry, I was wrong.

To see why, consider that to get from 100k to 50k takes 50k of pension contributions, before you see any basic rate NI saving. If you concentrate that into one month it's still going to take 50k/12 and then another roughly 36k/12 to get down to minimum wage. That's 7.6k.

Here, we have a person who can't get to below 100k by using the full 40k annual allowance and they are having to arrange some carry-forward to manage it. That person can and should consider concentrating their contributions in as few months as possible at minimum wage. It's just that it'll be very few months because there's so much of a higher rate cut needed given that they are already risking being over 150k. If we start at 150k and go down to say 14k as a minimum wage approximation that takes 136k /12 = 11.3k of sacrifice per month. So at that starting point and well above it there is still scope to benefit.2 -

Thanks jamesd.jamesd said:Sorry, I was wrong.

To see why, consider that to get from 100k to 50k takes 50k of pension contributions, before you see any basic rate NI saving. If you concentrate that into one month it's still going to take 50k/12 and then another roughly 36k/12 to get down to minimum wage. That's 7.6k.

Here, we have a person who can't get to below 100k by using the full 40k annual allowance and they are having to arrange some carry-forward to manage it. That person can and should consider concentrating their contributions in as few months as possible at minimum wage. It's just that it'll be very few months because there's so much of a higher rate cut needed given that they are already risking being over 150k. If we start at 150k and go down to say 14k as a minimum wage approximation that takes 136k /12 = 11.3k of sacrifice per month. So at that starting point and well above it there is still scope to benefit.I need to take a look at modelling this monthly as my added complexity/opportunity will be that April is my bonus month. This is around £20k-£25k and I normally Sal Sac this. March is then when my LTI crystallises at £15k-£20k but I don’t think this is subject to NI.0 -

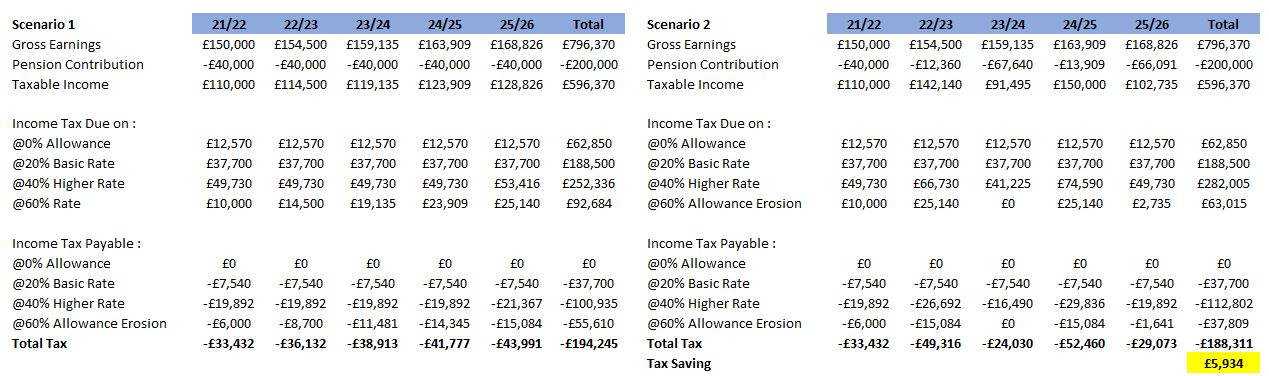

I've now updated the modelling to reflect monthly cash flows and the more lumpy nature of my gross earnings (bonus in April and LTI maturing in March). I've also built in an approach to pay in pension as quickly as possible to manage NI as suggested which by bringing my monthly pay below the upper accrual point will reduce some NI payments in the Upper Accrual Point / 13.25%.

My conclusions from this is that a combination of sequencing £80k pension contributions over 2 years unevenly and making pension contributions as quickly as possible in the tax year I can save ~£8k of tax/NI over the next 4 tax years (~£6k from tax and ~£2k from NI).

Assumptions

- Still preserve minimum wage (assuming ~£1,600/month)

- Assuming minimum pension contribution of 8% in any one month (although need to explore whether bonus and LTI count for minimum pension contributions)

Would appreciate pressure testing of my logic and modelling as snipped below. It also has my wondering why I have not thought of ths until now and if others in a similar situation are already doing this this lumpy sequencing of pension contributions.

Thanks.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards