We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Passive investing

Comments

-

Thanks.dunstonh said:There is also little evidence that IFAs are better at picking investments than the layman. However, they might be be better at picking the right one for your circumstances.The layman is typically clueless about investing and has no understanding of investing. Do not mistake the contributors of this board as being typical consumers. The contributors here have a higher level of knowledge compared to the layman.

IFA qualifications include training on portfolio building, different strategies and methodology. So, compared to the layman, they are in a much better position. Very different to how it was 10 years ago where there was virtually nothing in the IFA qualifications about portfolio structure etc. However, the primary requirement of any investment advice is suitability. The IFAs job is to put something in place that is suitable for the individual and structured accordingly. Nowadays that means the IFA buys in the data for the asset weightings as virtually impossible for a typical sized IFA firm to do that in-house. They buy in the research, governance and due diligence. The IFA effectively picks the funds from that research, governance & due diligence to match. So, you could say that the IFA is more of a facilitator/coordinator of all the data and software that they buy in. That is not to say that all IFAs are doing it. There will be some dinosaurs out there winging it. Basically, you have three camps. Those that pay for the data, governance, due diligence etc and use that to build the portfolio. Those that use a DFM and get the client to pay for it and those that are still living in the 1990s and winging it.... so for most people passive funds are likely to better value (Unless you know better or want to take a bigger gamble).I would say for the layman DIY investor, multi-asset is likely to be the best option rather than a portfolio of passive funds (unless looking at 100% equity - where a global tracker would fit). The layman is generally cautious (through lack of experience and knowledge). So, it's likely they should have gilts, bonds, cash etc in their mix. A multi-asset fund like VLS or HSBC GS fits perfectly for them. A lot of contributors on this site invest at a higher volatility level than the average consumer.

I broadly agree and fully agree with the last paragraph.

Although, I would probably extend this advice beyond the "clueless about investing" layman to people who think they know a fair bit about investing but in reality don't know more than the market, I include myself in this category despite reading plenty of books on the subject and (over)frequenting forums. I suspect there is a bit of a Illusory superiority effect (e.g. 88% of American drivers consider themselves above average)

1 -

There is also little evidence that IFAs are better at picking investments than the layman.

I'm not aware of any half-way reliable evidence on that question, either way. If there is any, bring it on.

But assuming 'no evidence' of being better, it's not the same as evidence they are no better.

0 -

... but higher management charges and IFA fess are real and indisputable. That that there is little evidence to say they perform any better notwithstanding the extra charges is pretty scathing IMO.There is also little evidence that IFAs are better at picking investments than the layman.I'm not aware of any half-way reliable evidence on that question, either way. If there is any, bring it on.

But assuming 'no evidence' of being better, it's not the same as evidence they are no better.

0 -

There are multiple ways of looking at that.2nd_time_buyer said:

... but higher management charges and IFA fess are real and indisputable. That that there is little evidence to say they perform any better notwithstanding the extra charges is pretty scathing IMO.There is also little evidence that IFAs are better at picking investments than the layman.I'm not aware of any half-way reliable evidence on that question, either way. If there is any, bring it on.

But assuming 'no evidence' of being better, it's not the same as evidence they are no better.

The most common IFA charge is 0.50%. So, that is effectively the only additional cost of having an IFA.

The DIY market has cheap platforms and expensive platforms but the DIY market is dominated by a platform with a high 0.45% charge. A similar mainstream platform via an IFA would cost around 0.25%. So, the difference could be just 0.3% for having an adviser vs going DIY on a platform. There are cheaper platforms for both DIY and IFA but as we are talking layman, it makes sense to stick with what is most likely.

On that same basis, on that DIY platform you often see their very expensive own-brand funds and most are in the top 10 list of funds bought and most funds are full active (and notably having just looked, virtually all very high risk except their own brand fund).

So, if you have an IFA portfolio at 0.35% OCF, IFA charge at 0.50% and platform charge of 0.25% = 1.10%, is that really expensive when so many DIY investors are paying 0.45% platform, 0% adviser and 0.7% fund = 1.15% (noting again that you can get cheaper and more expensive with both but we are looking at layman).

We have recently taken on a client who was a bit squiffy about our charges and tried to get a discount. They were your typical layman investor previously and had put tens of thousands into LC&F. Already they have approached us about whether they should put money into two other things (a fake crypto site and another mini-bond that was a scam). We obviously stopped them. In all my decades of doing this, the discussion with clients on the investments takes up the least time with most. The average client is looking for someone to do the work for them as they a) don't want to do it even if they are capable of doing it and b) want the comfort of having an IFA as a sounding board and that it is being done right.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

dunstonh said:

There are multiple ways of looking at that.2nd_time_buyer said:

... but higher management charges and IFA fess are real and indisputable. That that there is little evidence to say they perform any better notwithstanding the extra charges is pretty scathing IMO.There is also little evidence that IFAs are better at picking investments than the layman.I'm not aware of any half-way reliable evidence on that question, either way. If there is any, bring it on.

But assuming 'no evidence' of being better, it's not the same as evidence they are no better.

The most common IFA charge is 0.50%. So, that is effectively the only additional cost of having an IFA.

The DIY market has cheap platforms and expensive platforms but the DIY market is dominated by a platform with a high 0.45% charge. A similar mainstream platform via an IFA would cost around 0.25%. So, the difference could be just 0.3% for having an adviser vs going DIY on a platform. There are cheaper platforms for both DIY and IFA but as we are talking layman, it makes sense to stick with what is most likely.

On that same basis, on that DIY platform you often see their very expensive own-brand funds and most are in the top 10 list of funds bought and most funds are full active (and notably having just looked, virtually all very high risk except their own brand fund).

So, if you have an IFA portfolio at 0.35% OCF, IFA charge at 0.50% and platform charge of 0.25% = 1.10%, is that really expensive when so many DIY investors are paying 0.45% platform, 0% adviser and 0.7% fund = 1.15% (noting again that you can get cheaper and more expensive with both but we are looking at layman).

We have recently taken on a client who was a bit squiffy about our charges and tried to get a discount. They were your typical layman investor previously and had put tens of thousands into LC&F. Already they have approached us about whether they should put money into two other things (a fake crypto site and another mini-bond that was a scam). We obviously stopped them. In all my decades of doing this, the discussion with clients on the investments takes up the least time with most. The average client is looking for someone to do the work for them as they a) don't want to do it even if they are capable of doing it and b) want the comfort of having an IFA as a sounding board and that it is being done right.

... but do you ever advise to self invest in a "multi-asset fund like VLS or HSBC GSV" with no ongoing IFA charges?.

it seems to me that the client often gets steered towards ongoing charges where a one-off fee advice has the potential to be better value and more "independent".0 -

Well this reports suggests that the average Hargreaves Lansdown DIY investor doesn't even manage to beat one of the most expensive FAs around - St James Place. Nevermind a simple index or multi asset fund. Very likely because in general they don't use either cheap passive funds or carefully selected active funds, because if they did the results wouldn't be that poor.2nd_time_buyer said:

... but higher management charges and IFA fess are real and indisputable. That that there is little evidence to say they perform any better notwithstanding the extra charges is pretty scathing IMO.There is also little evidence that IFAs are better at picking investments than the layman.I'm not aware of any half-way reliable evidence on that question, either way. If there is any, bring it on.

But assuming 'no evidence' of being better, it's not the same as evidence they are no better.

SJP vs Hargreaves: Which offers more bang for clients’ bucks? - Citywire

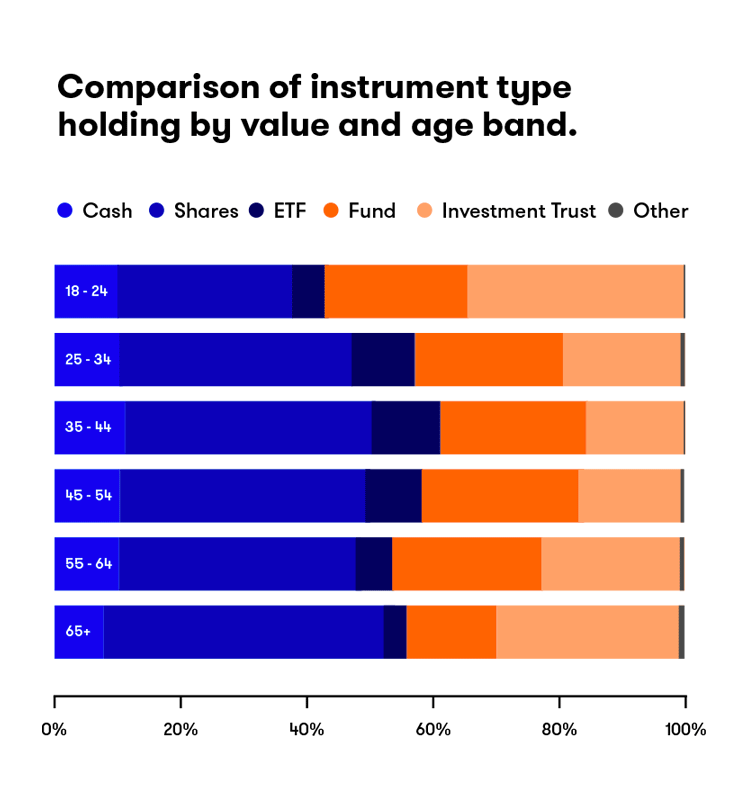

We can also see what a average II investor is holding and it looks pretty active to me.

4 -

There is some Canadian research; no suggestion that the findings are generalisable to anywhere else or to any other time period. But it makes no comparison with unadvised investors.'Our analysis contributes three insights to the literature on financial advice. First, we find little support for the view that advisors’ value added resides in tailoring portfolios to clients’ charac-terisitics. Second, we find that advisors are nevertheless a major determinant of asset allocation. Understanding the intermediation process is therefore crucial for theories seeking to explain house- hold portfolios. Third, we show that advisors’ own risk-taking influences how much risk their clients assume.'''we show that financial advisors exert substantial influence over their clients’ asset allocation, but provide limited customization.

An advisor’s own asset allocation strongly predicts the allocations chosen on clients’ behalf. This one-size-fits-all advice does not come cheap. Advised portfolios cost 2.5% per year, or 1.5% more than lifecycle funds.'

Retail Financial Advice: Does One Size Fit All?∗ October 2016.

And:

'A common view of retail finance is that conflicts of interest contribute to the high cost of advice. Within a large sample of Canadian financial advisors and their clients, however, we show that advisors typically invest personally just as they advise their clients. Advisors trade frequently, chase returns, prefer expensive, actively managed funds, and underdiversify. Advisors’ net returns of −3% per year are similar to their clients’ net returns. Advisors do not strategically hold expensive portfolios only to convince clients to do the same; they continue to do so after they leave the industry.'

The Misguided Beliefs of Financial Advisors∗ Journal of Finance, May 2020.

1 -

... but do you ever advise to self invest in a "multi-asset fund like VLS or HSBC GSV" with no ongoing IFA charges?.Frequently. Indeed, three are on my desk at the moment to complete on that basis. I would put ours around 50/50.it seems to me that the client often gets steered towards ongoing charges where a one-off fee advice has the potential to be better value and more "independent".Although our in-house portfolios have outperformed both VLS and HSBC GS after charges. So, which person is getting better value. The one that had lower charges but a lower return or the one that paid more but got a better return. However, you also need to remember that the one with ongoing servicing has had comfort conversations and all annual work, such as annual CGT allowance, Bed & ISA, Bed & LISA, Bed & Pension, top-slicing surrenders etc carried out within that as well as all the investment work. The one without the ongoing charge gets none of that. Not doing annual allowance work can cost far more than than the adviser charge.Canada appears to be expensive compared to the UK then. Although the UK has expensive ones as well. Maybe the UK market is more efficient as the wording of the Canadian research suggests all adviser portfolios cost 2.5% a year. That would be false in the UK.An advisor’s own asset allocation strongly predicts the allocations chosen on clients’ behalf. This one-size-fits-all advice does not come cheap. Advised portfolios cost 2.5% per year, or 1.5% more than lifecycle funds.'

Retail Financial Advice: Does One Size Fit All?∗ October 2016.A common view of retail finance is that conflicts of interest contribute to the high cost of advice. Within a large sample of Canadian financial advisors and their clients, however, we show that advisors typically invest personally just as they advise their clients. Advisors trade frequently, chase returns, prefer expensive, actively managed funds, and underdiversify. Advisors’ net returns of −3% per year are similar to their clients’ net returns.A major difference with North America is that UK advisers do not trade and apparently, the most common model currently with in the UK for non DFM is hybrid (mix of active and passive). A decade ago, it would have been mostly, if not all active.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.3 -

Although our in-house portfolios have outperformed both VLS and HSBC GS after charges. So, which person is getting better value. The one that had lower charges but a lower return or the one that

Meaningless comments like this, without any reference to a meaningful time period or risk would worry me. As indeed any advisor touting outperformance.

0 -

Not as if they are high benchmarks to beat performance wise.Deleted_User said:Although our in-house portfolios have outperformed both VLS and HSBC GS after charges. So, which person is getting better value. The one that had lower charges but a lower return or the one thatMeaningless comments like this, without any reference to a meaningful time period or risk would worry me. As indeed any advisor touting outperformance.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards