We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Decisions decisions which fund should I choose?

RoadToRiches

Posts: 221 Forumite

I am undecided which one to go for, what are your thoughts?

Vanguard Life Strategy 100% Equity or Vanguard FTSE All World ETF

I am leaning towards the ETF only because of the UK bias on the VLS funds.

Or anything else like Scottish Mortgage Fund - but think that is over bought right now.

Vanguard Life Strategy 100% Equity or Vanguard FTSE All World ETF

I am leaning towards the ETF only because of the UK bias on the VLS funds.

Or anything else like Scottish Mortgage Fund - but think that is over bought right now.

0

Comments

-

VLS is a good range but the 100 is the weakest of the bunch. it is effectively a global managed fund. So, you need to compare it with other global equity funds and you then tend to find it doesn't stack up as well.

Either go with a pure global tracker or one that is similar to your chosen weightings or build your own portfolio with weightings as you want them to be.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.2 -

So the ETF then0

-

How long is it before you start drawdown? 100% equities could be a bit risky0

-

If your looking at FTSE All World Trackers then you should look at HSBC version it’s fee is 0.13% compared with VG’s of 0.22. It’s not an ETF but a Fund but this make little difference for a long term hold. But you need to consider platform fees as well.1

-

Why the ETF? Why not Vanguard FTSE Global All Cap OEIC?RoadToRiches said:I am undecided which one to go for, what are your thoughts?

Vanguard Life Strategy 100% Equity or Vanguard FTSE All World ETF

I am leaning towards the ETF only because of the UK bias on the VLS funds.

Or anything else like Scottish Mortgage Fund - but think that is over bought right now.

Personal Responsibility - Sad but True

Sometimes.... I am like a dog with a bone2 -

Why is it the "weakest" of the VLS range, they all do the same thing just with differing bond %s (and arguably having a VLS 100 is pointless).dunstonh said:VLS is a good range but the 100 is the weakest of the bunch. it is effectively a global managed fund. So, you need to compare it with other global equity funds and you then tend to find it doesn't stack up as well.

Either go with a pure global tracker or one that is similar to your chosen weightings or build your own portfolio with weightings as you want them to be.

Are you saying it doesn't "stack up as well" on the basis that it differs from a vanilla global equity tracker by upweighting the UK from 4-5% to 20-25% and excludes small-cap, or other factors?0 -

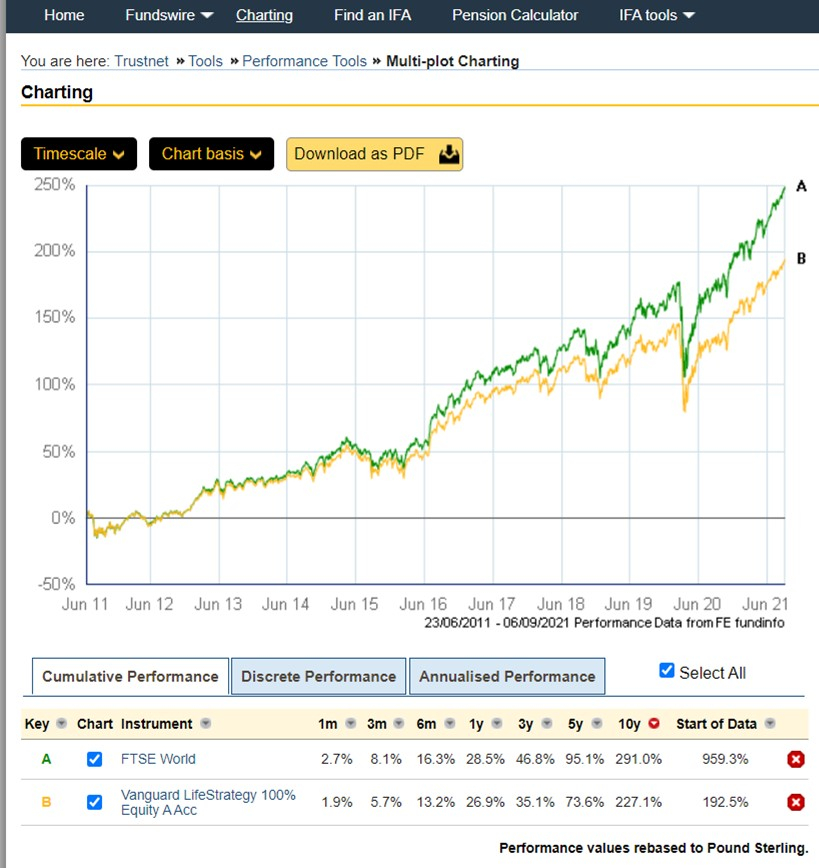

Why is it the "weakest" of the VLS range, they all do the same thing just with differing bond %s (and arguably having a VLS 100 is pointless).VLS 20,40,60 & 80 are multi-asset funds. VLS100 is a global managed fund. I suspect VLS100 exists for completeness and they have plenty of people using it. So, commercially it makes sense.Are you saying it doesn't "stack up as well" on the basis that it differs from a vanilla global equity tracker by upweighting the UK from 4-5% to 20-25% and excludes small-cap, or other factors?As it is not a global tracker, you would not expect it to behave like a global tracker. It is a managed fettered fund of funds using underlying passives. With 100% equities, there are lots of options that could be considered more desirable. VLS100 is a pretty consistent bottom half performer with both discrete and cumulative performance. Quartile performance is Q3 YTD, Q4 2020, Q3 2019 Q3 2018 Q3 2017. You may expect it to do better using cumulative performance but 3 month, 6 month, 1 year, 3 year and 5 year are all quartile 3 (5 year is ranked 200 out of 308)

The other VLS funds are up against alternative multi-asset funds and do better against those than VLS100 does against the global equity funds.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.4 -

An S&P 500 ETF tracker. Might as well go for it.RoadToRiches said:I am undecided which one to go for, what are your thoughts?

Vanguard Life Strategy 100% Equity or Vanguard FTSE All World ETF

I am leaning towards the ETF only because of the UK bias on the VLS funds.

Or anything else like Scottish Mortgage Fund - but think that is over bought right now.

1 -

Recent performance is a factor of US outperforming for over a decade. It underperformed in the prior decade. When selecting your strategy for a combination of passive funds recent performance does not come into it because it’s meaningless in relation to future performance.Things that matter:

- asset allocation

- completeness of market coverage/number of stocks

- strategy for outweighing the home market

- cost0 -

Firstly is it easy to see that it does behave like a global tracker. Edit: I've been a complete div and got the wrong fund.dunstonh said:Why is it the "weakest" of the VLS range, they all do the same thing just with differing bond %s (and arguably having a VLS 100 is pointless).VLS 20,40,60 & 80 are multi-asset funds. VLS100 is a global managed fund. I suspect VLS100 exists for completeness and they have plenty of people using it. So, commercially it makes sense.Are you saying it doesn't "stack up as well" on the basis that it differs from a vanilla global equity tracker by upweighting the UK from 4-5% to 20-25% and excludes small-cap, or other factors?As it is not a global tracker, you would not expect it to behave like a global tracker. It is a managed fettered fund of funds using underlying passives. With 100% equities, there are lots of options that could be considered more desirable. VLS100 is a pretty consistent bottom half performer with both discrete and cumulative performance. Quartile performance is Q3 YTD, Q4 2020, Q3 2019 Q3 2018 Q3 2017. You may expect it to do better using cumulative performance but 3 month, 6 month, 1 year, 3 year and 5 year are all quartile 3 (5 year is ranked 200 out of 308)

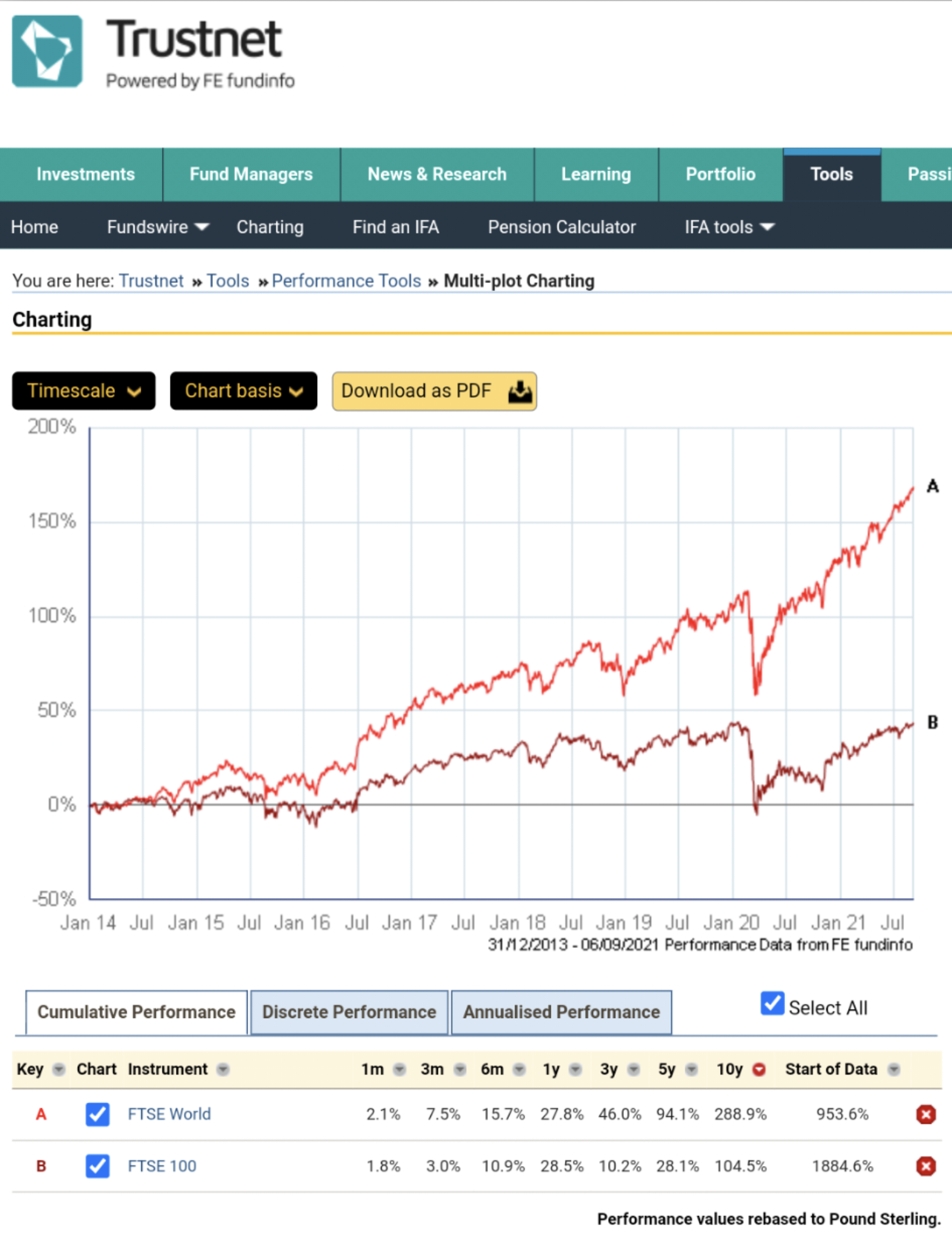

The other VLS funds are up against alternative multi-asset funds and do better against those than VLS100 does against the global equity funds. Secondly, I'm not sure less than 5 years of data is sufficient to judge a fund as a "consistent" underperformer or draw a conclusion about its quality. Obviously its UK upweighting has dragged its returns down as compared with a vanilla global tracker. Extrapolating less than 5 years returns data (for UK large cap which obviously makes up the majority of the UK weight, and for VLS100 specifically) to me doesn't seem robust. I know you have said previously you think UK large cap is a dire, consistent underperformer and has been for decades. I have yet to see convincing evidence of this. For example here is the FTSE 100 vs the FTSE world for the first 20 years that FTSE world data is available, I checked and this is in £, e.g. the FTSE world returned 16.3% in USD in 2020 but on trustnet the return in £ is over 30%.

Secondly, I'm not sure less than 5 years of data is sufficient to judge a fund as a "consistent" underperformer or draw a conclusion about its quality. Obviously its UK upweighting has dragged its returns down as compared with a vanilla global tracker. Extrapolating less than 5 years returns data (for UK large cap which obviously makes up the majority of the UK weight, and for VLS100 specifically) to me doesn't seem robust. I know you have said previously you think UK large cap is a dire, consistent underperformer and has been for decades. I have yet to see convincing evidence of this. For example here is the FTSE 100 vs the FTSE world for the first 20 years that FTSE world data is available, I checked and this is in £, e.g. the FTSE world returned 16.3% in USD in 2020 but on trustnet the return in £ is over 30%. From the end of that chart to the present is when I see broadly consistent underperformance.

From the end of that chart to the present is when I see broadly consistent underperformance. However there have been plenty of times the UK underperformed, and plenty of times the UK outperformed the global market. I don't see why this run of underperformance should be extrapolated as the new normal anymore than you might have said the US was "finished" after the Dot Com boom. Why is this time different, and isn't the oldest lie in finance "this time is different"?1

However there have been plenty of times the UK underperformed, and plenty of times the UK outperformed the global market. I don't see why this run of underperformance should be extrapolated as the new normal anymore than you might have said the US was "finished" after the Dot Com boom. Why is this time different, and isn't the oldest lie in finance "this time is different"?1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards