We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How many years NI needed for full payment

howmuch4

Posts: 10 Forumite

Im 61 and apart from a couple of years spent studying in my late 20's I have paid full time NI from 16 until being made redundant in 2015. Do I still need to be paying full NI to hopefully get a full pension at some point in the future.

Thks all

Thks all

0

Comments

-

Does not appear to be any consistency, it tells me I need 35 years, yet some were contracted out and apparently they don't count and so have another 2 years to contribute before I am 67 to get the full state pension, which is achievable for me. But that would be more than 35 years of paying NI.

Best bet would be to check your state pension online on the gov.uk website1 -

It’s too complicated to answer that question.Check your state pension forecast here:-

https://www.gov.uk/check-state-pension2 -

You are under transitional rules so the only way to know for certain is to follow MX5Huggy's suggestion and check your State Pension forecast.

It is important you read the whole thing, not just the likely headline of £179.60.

It is quite possible you will need to purchase post 2016 years to reach £179.60.

1 -

Thanks all...had no idea we can chk NI on line.0

-

The 35 years only applies if you started work post 2016. For those who started before then they are caught under the old rules and also the new rules - hence why doing a State Pension check is the easiest way to work it out.RoadToRiches said:Does not appear to be any consistency, it tells me I need 35 years, yet some were contracted out and apparently they don't count and so have another 2 years to contribute before I am 67 to get the full state pension, which is achievable for me. But that would be more than 35 years of paying NI.

Best bet would be to check your state pension online on the gov.uk website2 -

Well the Gov site tells me Ive got 42 years contributions...and apprently in five years time i can claim the full amount...but what it doesnt say is if I still have to keep paying NI?jimi_man said:

The 35 years only applies if you started work post 2016. For those who started before then they are caught under the old rules and also the new rules - hence why doing a State Pension check is the easiest way to work it out.RoadToRiches said:Does not appear to be any consistency, it tells me I need 35 years, yet some were contracted out and apparently they don't count and so have another 2 years to contribute before I am 67 to get the full state pension, which is achievable for me. But that would be more than 35 years of paying NI.

Best bet would be to check your state pension online on the gov.uk website0 -

howmuch4 said:

Well the Gov site tells me Ive got 42 years contributions...and apprently in five years time i can claim the full amount...but what it doesnt say is if I still have to keep paying NI?jimi_man said:

The 35 years only applies if you started work post 2016. For those who started before then they are caught under the old rules and also the new rules - hence why doing a State Pension check is the easiest way to work it out.RoadToRiches said:Does not appear to be any consistency, it tells me I need 35 years, yet some were contracted out and apparently they don't count and so have another 2 years to contribute before I am 67 to get the full state pension, which is achievable for me. But that would be more than 35 years of paying NI.

Best bet would be to check your state pension online on the gov.uk websiteWhat EXACTLY does your forecast say ?It should either say something like 'your forecast up to April 2021 is £xxx.xx. this forecast cannot be improved any further'or ' Up to April 2021 you are forecast to get £xxx.xx. If you contribute a further y years you can improve this to £zzz.zz.'In either case it will tell you how many more years you have available to contribute between now and the end of the tax year prior to you reaching your state pension age. (If you are still working, you can't simply opt out of paying NI becasue you have reached the maximum state pensino amount , you have to keep paying). If you are not working but your forecast says that it can be improved then you can make voluntary contributions or investigate ways to get credits).(sorry, I cannot remember the precise wording off the top of my head)0 -

Hi,

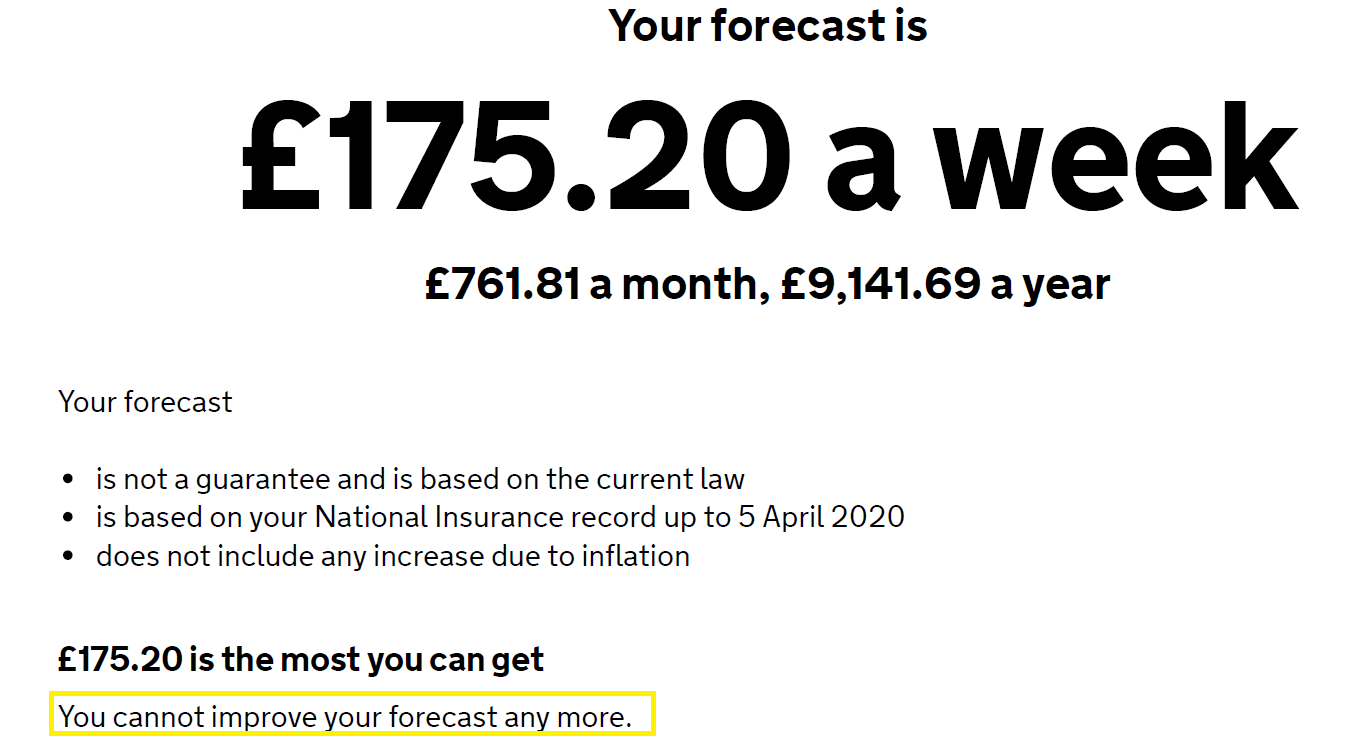

I've got 44 years contributions and 7 years until SPA. This is what my pension forecast looked like last year. If you check on yours where I have put a yellow box, does it say the same or say you need X more years' contributions?

2 -

If you earn enough then yes you will have to pay NI.

Having 42 years doesn't mean you are guaranteed the full £179.60.

What did it say you had actually accrued by 5 April 2021?0 -

The forecast will tell you precisely how many more years, if any, you need to contribute to reach the headline figure. If you are still working you still need to pay NI irrespective of whether it will add to your pension entitlement or not.howmuch4 said:Well the Gov site tells me Ive got 42 years contributions...and apprently in five years time i can claim the full amount...but what it doesnt say is if I still have to keep paying NI?

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards