We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Completing National Insurance record when not working.

Comments

-

OK, one of those odd cases where they are looking into it. You will need to speak to them but you have until April 2023 to pay it if necessary.

1 -

Seems like I should definitely file a tax return for 2020/21. Is there any way that I can still file a return for 2019/20? Or is it too late?Dazed_and_C0nfused said:As far as I'm aware if you wish to pay Class 2 NIC due to being self employed then completing a Self Assessment return is required.

If you look at the 2020:21 Self Assessment return and self employment pages on gov.uk you will see it is even possible to state you were self employed and don't need to provide income details (for the self employment) as a result of claiming the Trading Allowance. But you can still pay Class 2 NIC.

If you have made good the 2018:19 and 2019:20 years then your forecast should eventually be updated to show you have accrued £116.88.

A further 12 years will take you to £178.45.

A 13th year will only add the final £1.15 so still worth paying £160 for but not nearly as good a deal if you had to pay Class 3 at c£800.0 -

No it's not too late to file a return but I don't think that would help with Class 2 NIC at this stage.Chomeur said:

Seems like I should definitely file a tax return for 2020/21. Is there any way that I can still file a return for 2019/20? Or is it too late?Dazed_and_C0nfused said:As far as I'm aware if you wish to pay Class 2 NIC due to being self employed then completing a Self Assessment return is required.

If you look at the 2020:21 Self Assessment return and self employment pages on gov.uk you will see it is even possible to state you were self employed and don't need to provide income details (for the self employment) as a result of claiming the Trading Allowance. But you can still pay Class 2 NIC.

If you have made good the 2018:19 and 2019:20 years then your forecast should eventually be updated to show you have accrued £116.88.

A further 12 years will take you to £178.45.

A 13th year will only add the final £1.15 so still worth paying £160 for but not nearly as good a deal if you had to pay Class 3 at c£800.

Why do you think you might need to file a return for 2019/20?0 -

Because you said this: "As far as I'm aware if you wish to pay Class 2 NIC due to being self employed then completing a Self Assessment return is required."

0 -

But were you actually self employed in 2019:20 or are you trying to reinvent history?Chomeur said:Because you said this: "As far as I'm aware if you wish to pay Class 2 NIC due to being self employed then completing a Self Assessment return is required."0 -

Yes I was. But I didn't file a return because HMRC wrote to me to tell me that I didn't need to. They didn't say why.Dazed_and_C0nfused said:

But were you actually self employed in 2019:20 or are you trying to reinvent history?Chomeur said:Because you said this: "As far as I'm aware if you wish to pay Class 2 NIC due to being self employed then completing a Self Assessment return is required."0 -

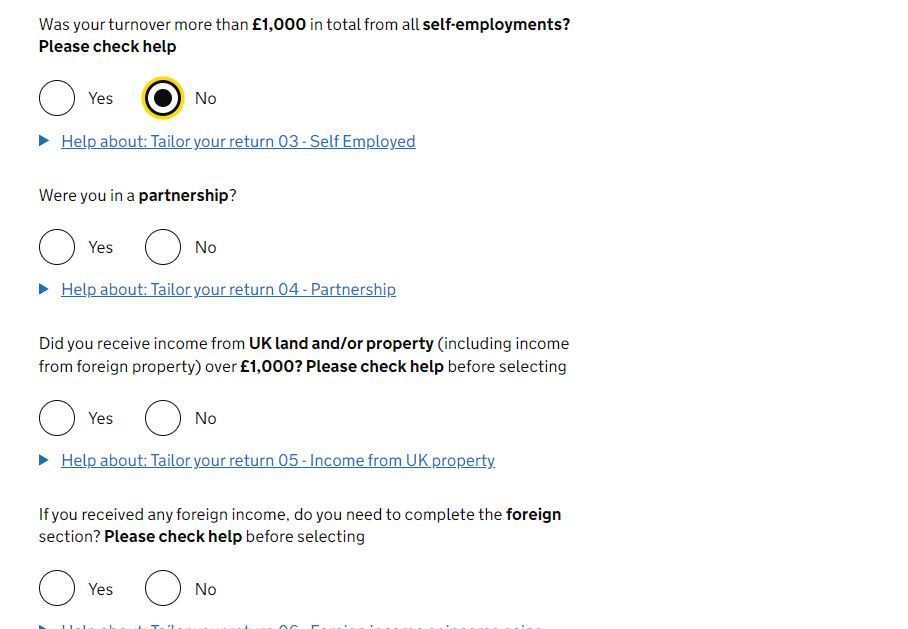

Here's the question: If you are self-employed (mystery shopping, writing a novel et al.) but earn less than £1000/year can you pay Class 2 NIC? Because, if that is the case, it seems to be impossible to complete a tax return with self-employment pages because you get asked about this when going through the preliminary questions, and if you say you didn't have that much turnover then the relevant pages aren't included. I will try to find the original legislation behind this (or if someone can post a link, even better), because that is where the ultimate answer will lie.

Thanks

0 -

I found the Social Security Contributions and Benefits Act 1992

https://www.legislation.gov.uk/ukpga/1992/4/contents. s. 13A is the right to pay additional Class 3 contributions. But I can't see anything equivalent for Class 2. Hmm0 -

Aha! If you are self-employed with income below £1000 you can indeed pay voluntary Class 2 (https://www.gov.uk/voluntary-national-insurance-contributions/who-can-pay-voluntary-contributions). But, if you can't complete self-employed pages in your tax return, how do you do it?0

-

OK, you have to contact the newly self-employed helpline to request a payment request (https://www.gov.uk/voluntary-national-insurance-contributions/who-can-pay-voluntary-contributions). Which is what I did, and then they wrote to me saying "Could you please tell us what the payment is for as Class 2 is now collected through your end of year self-assessment" which contradicts what is on the website. Time for a complaint, I think.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards