We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Change tax code after pension

Scw83

Posts: 22 Forumite

in Cutting tax

Wonder if anyone can help my step mother. Apologies if I am being thick..

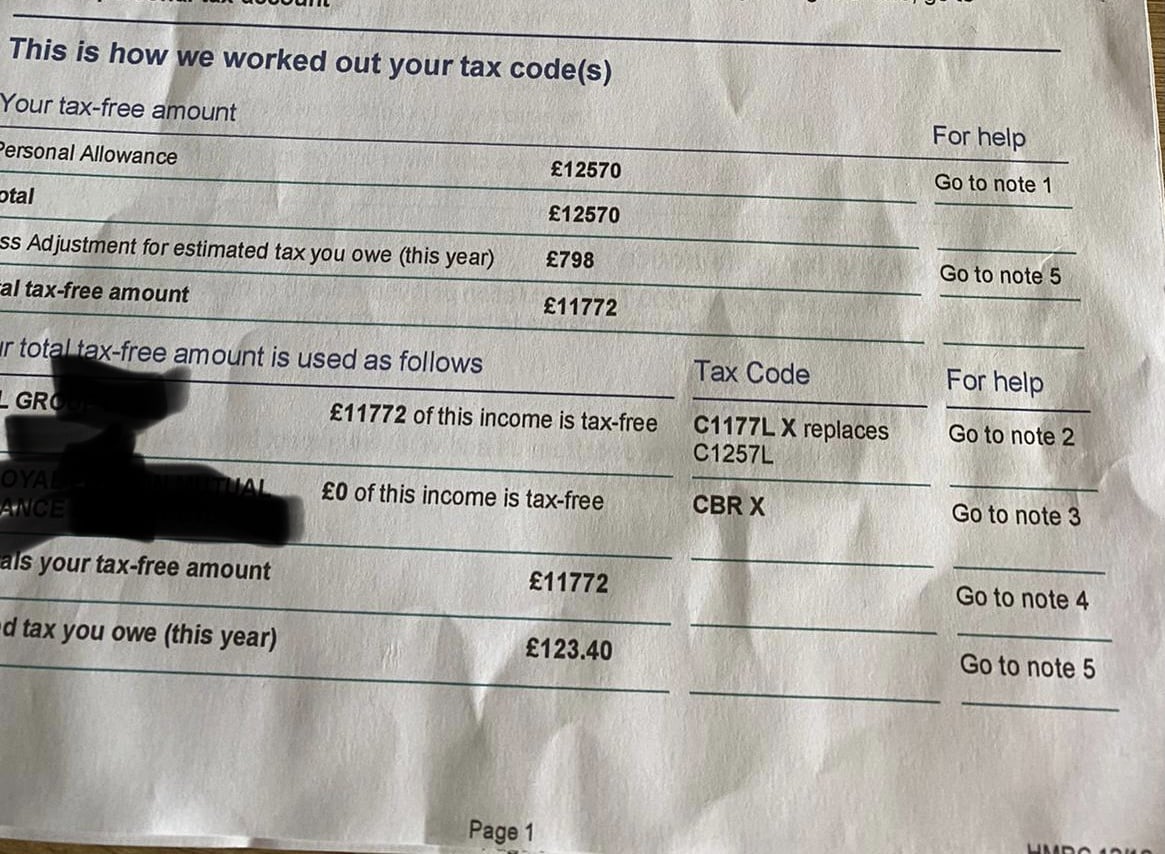

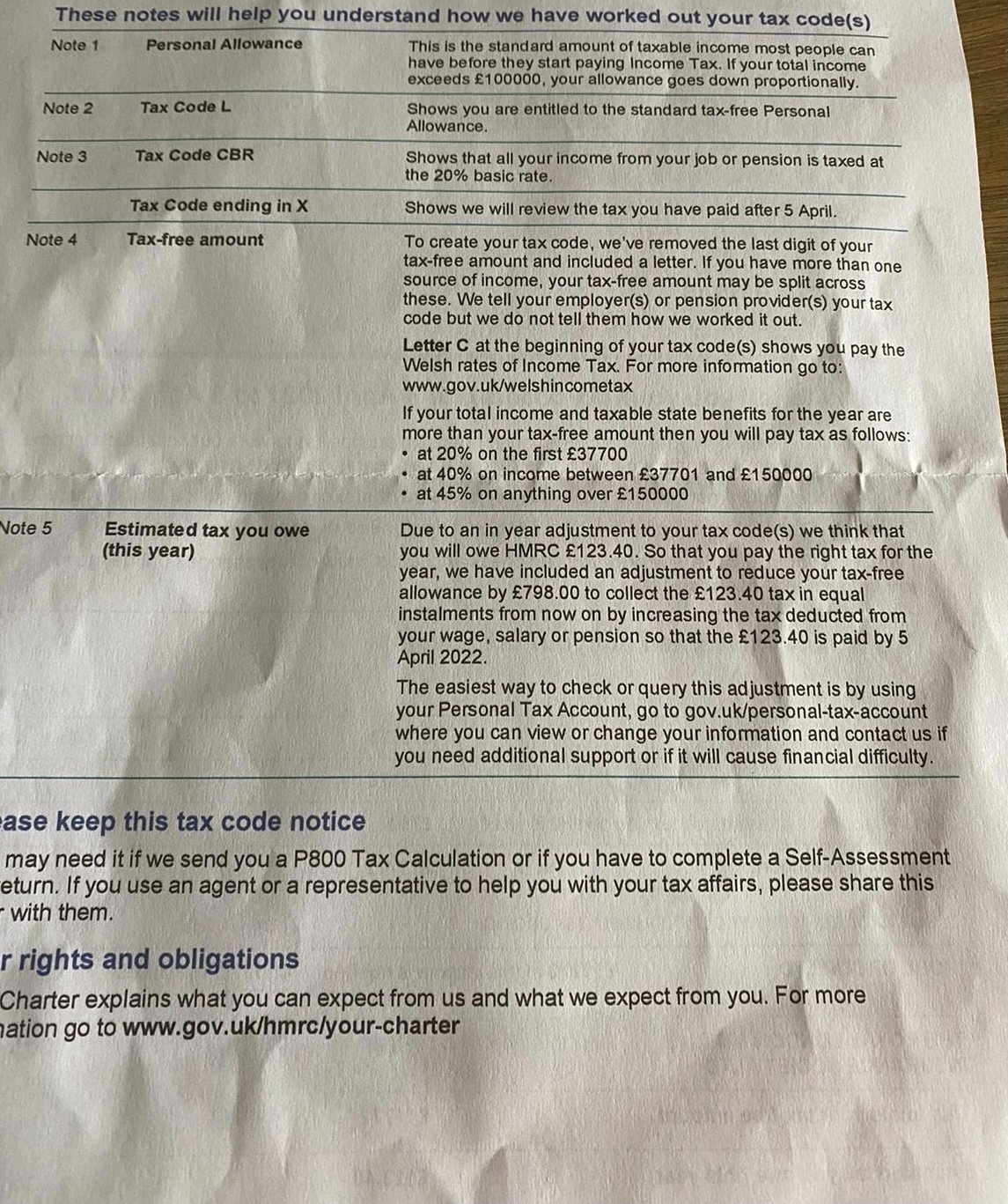

Wonder if anyone can help my step mother. Apologies if I am being thick..She’s just turned 60 and has taken a lump sum from her pension and today received a letter from HRMC for 21/22 with change of tax code.

It says that they predict she will owe money and taking it out in equal instalments.

Will this be from her remaining pension she gets paid monthly? Or as she is currently still working (different company) will it be taken from that?

I will upload the letter..

Will this be from her remaining pension she gets paid monthly? Or as she is currently still working (different company) will it be taken from that?

I will upload the letter..

0

Comments

-

It will be taken from whatever income the C1177LX tax code is used. Because it has been reduced from the standard 1257L code she will pay an extra 20% or so on the £800.1

-

She has 2 income streams and tax will be deducted from both of them according to the codes shown. The first one she will pay tax on anything over £977.43 per month / £225.57 per week and the second she will pay tax at 20% on all income.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards