We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Will IFAs give you one-off advice without the ongoing review?

Comments

-

I think this is a reasonable suggestion.Bobziz said:OP have you posted your plans on this site for opinions ? Lots of very knowledgeable people who may be able to go some way to providing the assurance that you're looking for.

There may be a fine difference between IFA/FA advice, and helpful considered guidance.

The former clearly should cover more, should give you well-informed advice, should include many years of experience in the area.....& also has more weight for complaints later (if needed), because it requires the giver to comply with MIFID and other rules. The trouble, as you are finding, is that frankly I would bet the vast majority of IFAs would much rather have a regular annual income from a large number of individuals which comes with relatively low effort. Same reason why many areas of our lives have a subscription model (streaming services, car 'ownership', etc!)

The latter can potentially provide a very wide consolidation of thoughts: I personally prefer a good forum hive mind to a single perspective - even IFAs are human, and individual humans can be more prone to error, or bias! It can allow you many times to tweak your questions at no cost, and indeed may be all you really need....

OP, what are the areas you are particularly concerned about?

Maybe you don't need to provide absolute figures if you prefer to not put it all on here - I would be that way inclined - but areas, percentages, etc?

Or are you looking for something specific to funds/IHT/other?

We went to one seminar given by a well-regarded local IFA firm....& came out distinctly underwhelmed by the content of their ~2 hour presentation. The tea mid-way through was worthy of an SJP set of fees, but the way they framed everything was incredibly basic!

I firmly believe there are many who can benefit from IFAs and proper financial advice, but the on-going extraction of a % of funds is 100% detrimental to the future value of those funds.

If there are specific technical areas (business, personal) that need such advice, then for sure, take it, but I also firmly believe that many who take an interest are very capable of making reasonable confident decision with some helpful guidance, & this is one of a few forums that could help provide that from a broad range of people. Or dogs. Remember, on the internet, nobody knows if you are a human or not!!

Ramble over!

Plan for tomorrow, enjoy today!0 -

You don't have to use their platform, they are offering one-off advice. It's up to you if you want to take it. So the platform fee is irrelevant at this stage.dunstonh said:two issues here. HL's platform is around twice the cost of a platform from an IFA. Plus, HL now use their own brand funds.

I note that their ongoing advice fee is .365% which is cheaper than yours and may compensate for the higher platform fee. Not that I would ever advocate using them for ongoing advice. The OP is asking about one-off advice, which they do offer for a one-off fee.

I am sure the OP could make it clear that they want recommendations based on every fund offered on the HL platform rather than just the HL multi-manager funds. If HL wouldn't do that then they are not offering what the OP needs.0 -

As that would create more work, I would personally add an explicit charge to cover the increased administration. It would also put me on guard that you would be a potential trouble maker for not allowing such a simple routine request.want_to_save said:Fabtasia said:

Go Back To them and get them to amend the letter. That's what I did and they were happy to do so.ajfielden said:The IFA sent me a letter of authority, which is fine. However this letter also includes a statement to transfer all servicing rights to them. So am I right in thinking this would then start to pay them any trail commission/fees etc associated with the pension fund?

Ask them to provide you with a Letter of Authority for Information only to sign that way they can obtain the information but do not transfer the servicign rights across

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Genuinely interesting response from dunstonh on LOA with a perspective of looking down the other end of the telescope at LOA. Two loops = added cost and a potentially difficult client.

From my end of the telescope - in a world of electronic pension transfers and a "pull" request model to a new (UK) platform from the old - directed by the authorised IFA. As a wary consumer doing this sort of transaction for the first time. I am extremely reluctant to sign "for action" LOA with people that I have just met. Requires confidence, trust and a leap of faith - as it is a significant financial asset under discussion. And the path to remedy if something goes awry is unconvincing.

Clearly it's not the "good" IFA I am worried about - they won't do anything terrible. But is the one I have found on the internet both who they claim to be and "good" or not ? The signing of paperwork to "act for you" comes very early in the process for my taste.

Authority to contact and gather information only would be easier to stomach at the consumer end - and does cost slightly more - as the customer agreement loop gets done twice if the process runs to completion.

At the end of my DIY planning - I went seeking one off advice and was presented with a DC transfer review and recommendation, proposed platform and fund choice to the discussed risk appetite, compliance cashflow forecast and related stuff on minor admin recommendations. There was very little flexibility in the fact find, risk process - probably for the reasons discussed in this thread procedures around compliance. So it is possible to find a one off review with contingent fees (upon accepting the transfer).

0 -

You know what the IFA I spoke to today was talking about? What's the transfer value of my DB fund?

Now correct me if I'm wrong, but transferring out of a DB scheme is almost certainly the wrong thing to do.

You see it's conversations like this that don't give me a good feeling about financial advisers.

I'm starting to trust @dunstonh the most, as at least he seems to speak fairly openly about things. Doubt he'd take me on as a client though as I'm probably flagged as a 'troublesome' type, haha!

0 -

cfw1994 said:

I think this is a reasonable suggestion.Bobziz said:OP have you posted your plans on this site for opinions ? Lots of very knowledgeable people who may be able to go some way to providing the assurance that you're looking for.

There may be a fine difference between IFA/FA advice, and helpful considered guidance.

The former clearly should cover more, should give you well-informed advice, should include many years of experience in the area.....& also has more weight for complaints later (if needed), because it requires the giver to comply with MIFID and other rules. The trouble, as you are finding, is that frankly I would bet the vast majority of IFAs would much rather have a regular annual income from a large number of individuals which comes with relatively low effort. Same reason why many areas of our lives have a subscription model (streaming services, car 'ownership', etc!)

The latter can potentially provide a very wide consolidation of thoughts: I personally prefer a good forum hive mind to a single perspective - even IFAs are human, and individual humans can be more prone to error, or bias! It can allow you many times to tweak your questions at no cost, and indeed may be all you really need....

OP, what are the areas you are particularly concerned about?

Maybe you don't need to provide absolute figures if you prefer to not put it all on here - I would be that way inclined - but areas, percentages, etc?

Or are you looking for something specific to funds/IHT/other?

What am I concerned about? Good question.

Maybe I'm overthinking this, I tend to worry about things too much anyway.

It's just a feeling that I don't know what I'm doing, and that my money won't be in the right places to fulfil my goals.

I could give you the figures, but I'm wary of posting up personal financial details on a public forum.

I'm not entirely stupid, I can research things, and I'm pretty sure I've got a viable plan, based on my assets, but I'm still left with the feeling that I'd like to run it by a friendly and knowledgeable person. That's all really. I don't want the bells and whistles of a financial review plan, which is currently what I'm getting shoved by all the IFAs I talk to. They send me slick brochures with multi-step review plans. Don't really want that.

0 -

dunstonh said:

As that would create more work, I would personally add an explicit charge to cover the increased administration. It would also put me on guard that you would be a potential trouble maker for not allowing such a simple routine request.want_to_save said:Fabtasia said:

Go Back To them and get them to amend the letter. That's what I did and they were happy to do so.ajfielden said:The IFA sent me a letter of authority, which is fine. However this letter also includes a statement to transfer all servicing rights to them. So am I right in thinking this would then start to pay them any trail commission/fees etc associated with the pension fund?

Ask them to provide you with a Letter of Authority for Information only to sign that way they can obtain the information but do not transfer the servicign rights across

You see even this simple thing dunston, letter of authority, has different content depending on who it's obtained from.

I was genuinely surprised to see that paragraph about transfer of servicing rights, because a previous similar letter I've been sent from another adviser simply had a statement authorising the provider to disclose information about my pension. Nothing about servicing rights at all.

0 -

How would one know whether its right or wrong without knowing the circumstances, including the transfer value? Seems like a reasonable question. And asking it does not mean he will recommend to transfer.ajfielden said:You know what the IFA I spoke to today was talking about? What's the transfer value of my DB fund?

Now correct me if I'm wrong, but transferring out of a DB scheme is almost certainly the wrong thing to do.1 -

ajfielden said:cfw1994 said:

I think this is a reasonable suggestion.Bobziz said:OP have you posted your plans on this site for opinions ? Lots of very knowledgeable people who may be able to go some way to providing the assurance that you're looking for.

There may be a fine difference between IFA/FA advice, and helpful considered guidance.

The former clearly should cover more, should give you well-informed advice, should include many years of experience in the area.....& also has more weight for complaints later (if needed), because it requires the giver to comply with MIFID and other rules. The trouble, as you are finding, is that frankly I would bet the vast majority of IFAs would much rather have a regular annual income from a large number of individuals which comes with relatively low effort. Same reason why many areas of our lives have a subscription model (streaming services, car 'ownership', etc!)

The latter can potentially provide a very wide consolidation of thoughts: I personally prefer a good forum hive mind to a single perspective - even IFAs are human, and individual humans can be more prone to error, or bias! It can allow you many times to tweak your questions at no cost, and indeed may be all you really need....

OP, what are the areas you are particularly concerned about?

Maybe you don't need to provide absolute figures if you prefer to not put it all on here - I would be that way inclined - but areas, percentages, etc?

Or are you looking for something specific to funds/IHT/other?

What am I concerned about? Good question.

Maybe I'm overthinking this, I tend to worry about things too much anyway.

It's just a feeling that I don't know what I'm doing, and that my money won't be in the right places to fulfil my goals.

I could give you the figures, but I'm wary of posting up personal financial details on a public forum.

I'm not entirely stupid, I can research things, and I'm pretty sure I've got a viable plan, based on my assets, but I'm still left with the feeling that I'd like to run it by a friendly and knowledgeable person. That's all really. I don't want the bells and whistles of a financial review plan, which is currently what I'm getting shoved by all the IFAs I talk to. They send me slick brochures with multi-step review plans. Don't really want that.I have a heightened sense of overthinking things to the nth degree, so I know what you mean.We've always been wary of financial advice costs. For specific things (mortgage, house move, even life insurance), then sure, investigate - you know it is a one-off task, with associated costs that you can clearly understand.Managing investments is a trickier area.Hence I chose to read up a lot on fund options with my work pension scheme.....picked a spread of 4 (sometimes 5) funds - review regularly (quarterly), increase amounts invested from time to time (now done filling it up!). Occasionally change funds, or % spread. Nothing major: tweaks.Have a plan. In our case, this means a spreadsheet. I do love a spreadsheet! FA/IFAs will have some apps like Timeline, but essentially, they are modelling things.

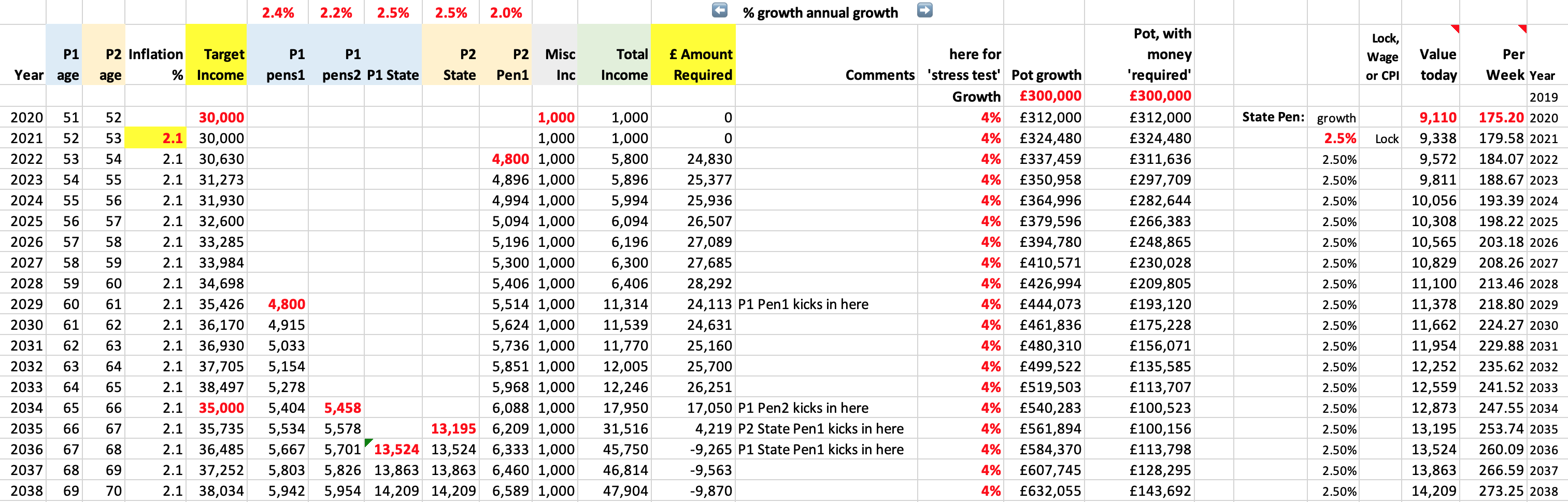

This kind of thing:

Message me if you want a copy to play with.

Others are out there - https://whatapalaver.co.uk/retirement-planning-couples is perhaps the best simple alternative I have found!

Some poo-poo that approach, but it gives us a clear sense of where things may go over an extended period.

With an ability to drop some pessimistic 'growth' expectations.

Let's face it, NONE of us - IFA/FA or just 'guidance counsellors' - have a crystal ball.Be flexible.

Have a plan which has fixed outgoing needs and variable ones, and be flexible with those variable ones when needed.Plan for tomorrow, enjoy today!1 -

I know an adviser that only uses the "information" method because it doesn't trigger any communication from the provider/platform to the existing servicing agent. Whereas an agency transfer does in most cases. Another reason can be that a plan that is showing on your agency which is then cancelled (through transfer or other) shows as a cancelled plan on your stats. For the medium to larger size firms and especially networks, the KPI stats are frequently taken far too literally. So, by not having the plan on your agency, the cancellation will not show your stats in that area. Some advisers use external paraplanners and just pass everything to them and don't see the work that goes on behind the scenes and probably wouldn't care if someone's job is being made easier or not by a certain method.ajfielden said:dunstonh said:

As that would create more work, I would personally add an explicit charge to cover the increased administration. It would also put me on guard that you would be a potential trouble maker for not allowing such a simple routine request.want_to_save said:Fabtasia said:

Go Back To them and get them to amend the letter. That's what I did and they were happy to do so.ajfielden said:The IFA sent me a letter of authority, which is fine. However this letter also includes a statement to transfer all servicing rights to them. So am I right in thinking this would then start to pay them any trail commission/fees etc associated with the pension fund?

Ask them to provide you with a Letter of Authority for Information only to sign that way they can obtain the information but do not transfer the servicign rights across

You see even this simple thing dunston, letter of authority, has different content depending on who it's obtained from.

I was genuinely surprised to see that paragraph about transfer of servicing rights, because a previous similar letter I've been sent from another adviser simply had a statement authorising the provider to disclose information about my pension. Nothing about servicing rights at all.

Some providers do not operate an agency method. e.g. if you bought originally via a tied agent of the firm. Often on those, I will remove the agency transfer wording and just leave it as information only as there is no point confusing the issue.You mention slick brochures. To me, that suggests you are looking at larger firms. Generally, your smaller localised general practitioner IFA won't have slick brochures. Everything they do is on the office printer or print to pdf. The larger ones will. As mentioned previously, the larger the firm gets, the more standardised its processes become. The processes have to cater for the lowest common denominator. Often you find with the larger firms, that the more knowledgeable and experienced advisers start to feel straight-jacketed by that and the inexperienced and less capable advisers feel protected by it. Network advisers are usually the most straight-jacketed in what they can do and most networks are not IFAs anymore. You mentioned a network earlier and I don't believe they are IFAs but FAs.

They send me slick brochures with multi-step review plans. Don't really want that.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.6K Banking & Borrowing

- 253.3K Reduce Debt & Boost Income

- 453.9K Spending & Discounts

- 244.6K Work, Benefits & Business

- 600K Mortgages, Homes & Bills

- 177.2K Life & Family

- 258.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards