We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Embarrassed 40 year old - no pension.

Comments

-

A small update here. I took a risk by investing £5K a few weeks back on the risky AIM market and just got it up to £36K!!!!!!

That's the credit card debt of £10K paid off leaving me £26K to draw out as an Emergency fund. That said, i'm likely to pump that into a reliable main market (not AIM) UK or USA stock.

The only debt I now have is the £450 left on the washing machine, which i am paying off at 0% interest. And the mortgage at £81K @ £350 per month over the next 23 years.

I've also consolidated my previous pensions (Aviva and Clerical Medical) under my current Workplace Pensions provider, Legal and General and kept the 70/20/10 fund split intact. The total pension is worth £37,000

The changes above have now led me to increase my salary sacrifice to £2,000 per month. Sheesh. From £200 to £2000 in just over a month.

Ill tell you what ladies and gents - THANK YOU.

This forum thread has been so inspirational and educational. It has literally changed my life status around from an 'Embarrassed 40 year old with no pension' to a 'Comfortable and happy 40 year old with a pension'.

I was wondering if in my position - would you guys increase the mortgage payments to pay off the house faster? I can afford to pump up another £500 a month to total £850. Of course I can't do that monthly so I can shift the extra £500 into a savings account and pay the annual accumulated amount (£6000) as a lump sum on the anniversary of my mortgage, Barclays lets me pay 10% off the balance on each anniversary without incurring a fee. The extra £500 will come from the money I would usually be paying towards the £10K credit card debt.

Or do I just simply keep paying £350 for 23 years. I'd be interested to learn your wise thoughts. They haven't let me down thus far!

3 -

sho_me_da_money said:

I was wondering if in my position - would you guys increase the mortgage payments to pay off the house faster?...Or do I just simply keep paying £350 for 23 years. I'd be interested to learn your wise thoughts. They haven't let me down thus far!Compare the (guaranteed) interest payments you'll avoid with the (not guaranteed) growth you'd get from the same money in your pension or even a SSISA. Then decide whether you're feeling lucky.Full disclosure: I chose to pay off the mortgage.N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.2 -

23 years is long enough timeframe to consider investing the money instead. The longer you hold investments the closer your compound return will be to the long-term compound return of equities - which /should/ be more than your mortgage payments.sho_me_da_money said:A small update here. I took a risk by investing £5K a few weeks back on the risky AIM market and just got it up to £36K!!!!!!

That's the credit card debt of £10K paid off leaving me £26K to draw out as an Emergency fund. That said, i'm likely to pump that into a reliable main market (not AIM) UK or USA stock.

The only debt I now have is the £450 left on the washing machine, which i am paying off at 0% interest. And the mortgage at £81K @ £350 per month over the next 23 years.

I've also consolidated my previous pensions (Aviva and Clerical Medical) under my current Workplace Pensions provider, Legal and General and kept the 70/20/10 fund split intact. The total pension is worth £37,000

The changes above have now led me to increase my salary sacrifice to £2,000 per month. Sheesh. From £200 to £2000 in just over a month.

Ill tell you what ladies and gents - THANK YOU.

This forum thread has been so inspirational and educational. It has literally changed my life status around from an 'Embarrassed 40 year old with no pension' to a 'Comfortable and happy 40 year old with a pension'.

I was wondering if in my position - would you guys increase the mortgage payments to pay off the house faster? I can afford to pump up another £500 a month to total £850. Of course I can't do that monthly so I can shift the extra £500 into a savings account and pay the annual accumulated amount (£6000) as a lump sum on the anniversary of my mortgage, Barclays lets me pay 10% off the balance on each anniversary without incurring a fee. The extra £500 will come from the money I would usually be paying towards the £10K credit card debt.

Or do I just simply keep paying £350 for 23 years. I'd be interested to learn your wise thoughts. They haven't let me down thus far!

Based on that alone it will probably make sense to invest the money rather than overpay the mortgage, but there are always considerations like keeping your emergency fund topped up, going into a different LTV band, potentially needing the money not locked away.

0 -

Hi All.

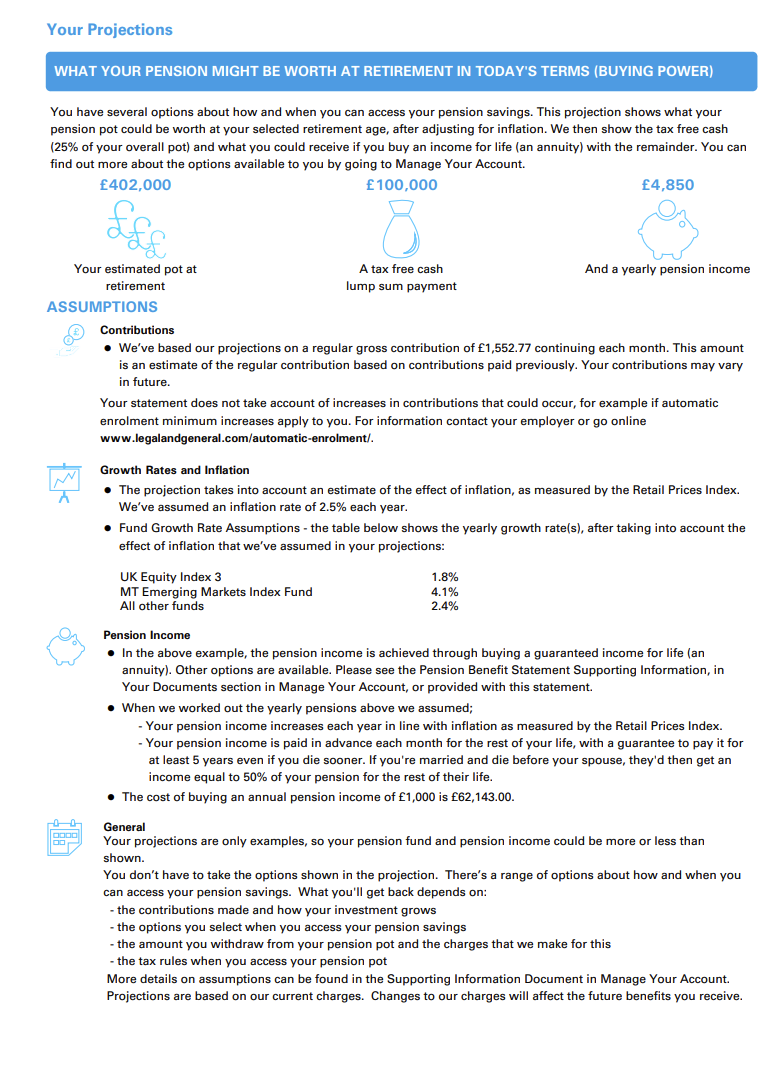

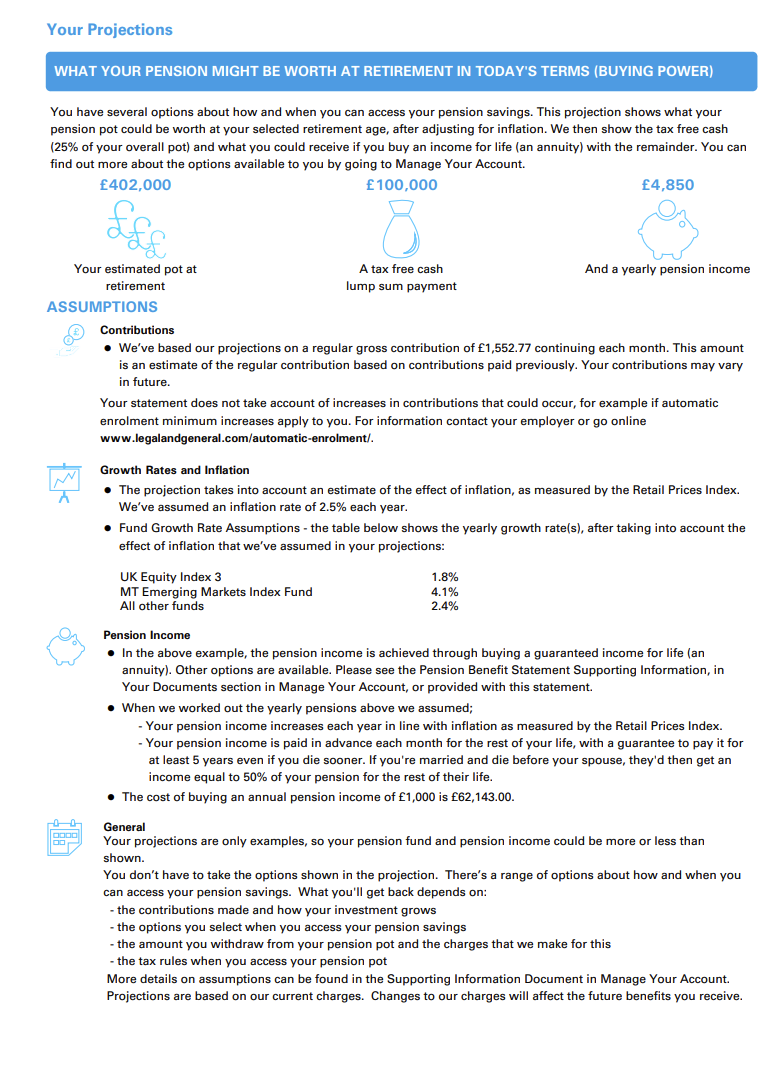

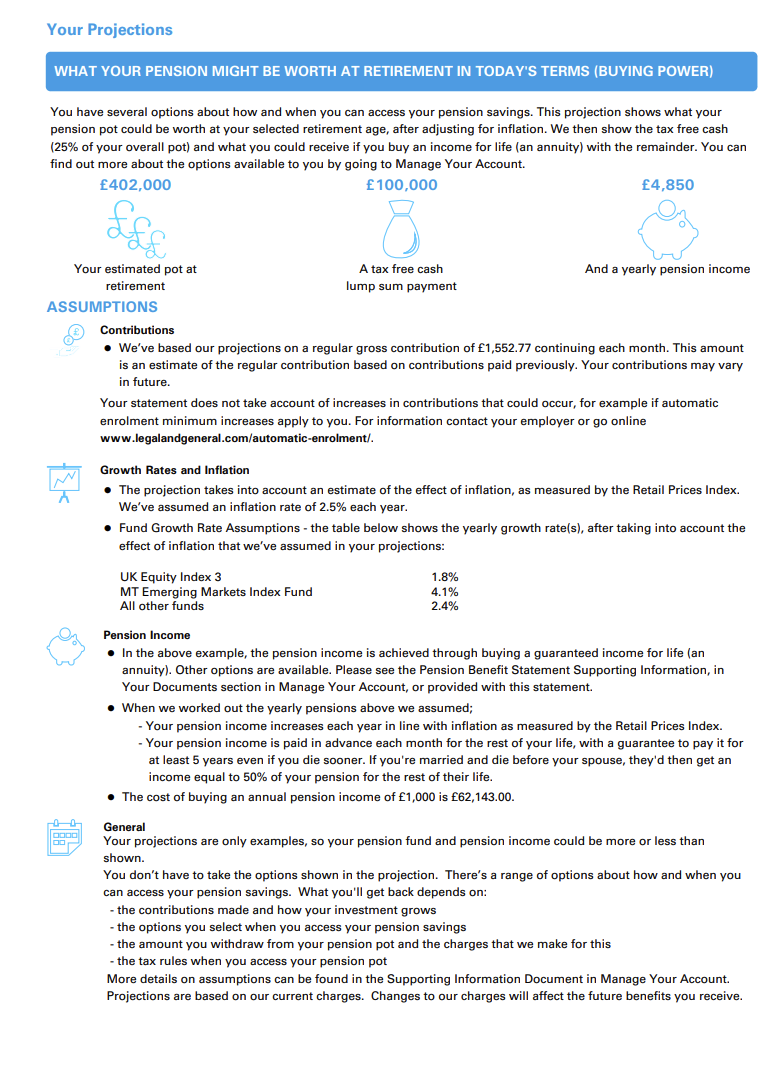

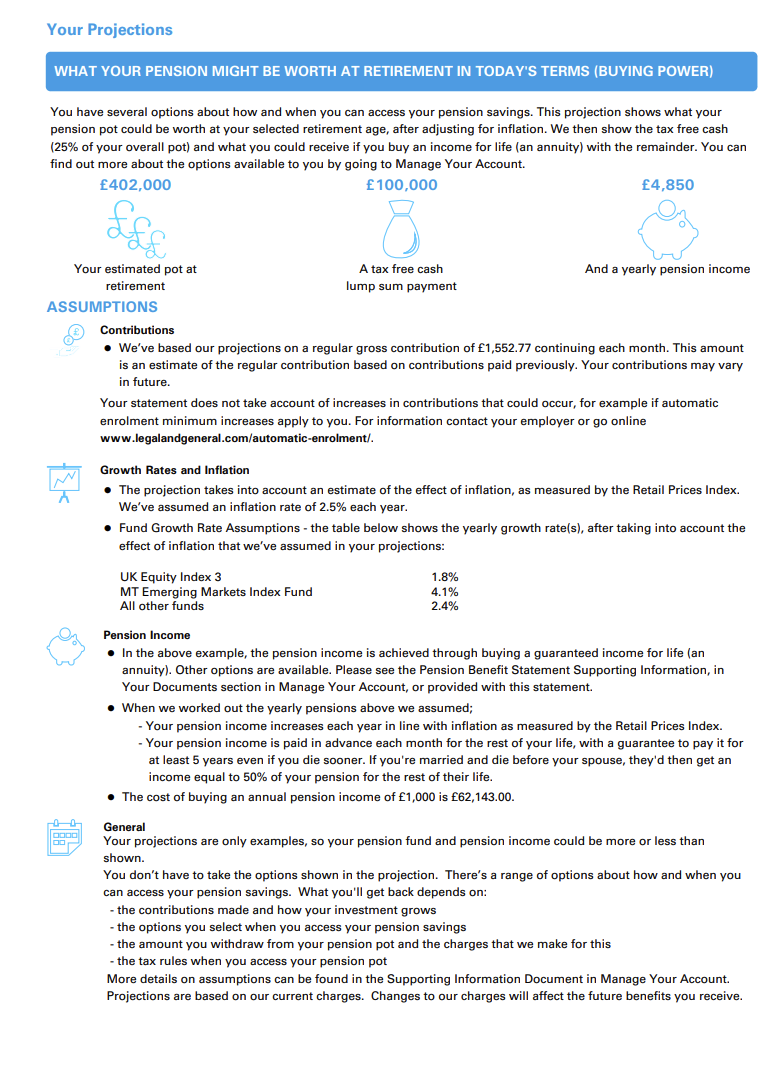

It is coming closer to a year since my last post and i wanted to resurrect this thread instead of starting a new one as a progress update. I recently received my pension benefit statement from L&G and this is what the forward looking view shows:

One key difference from what is shown above is that I recently (a couple of months back) increased my monthly contribution amount from £1552.77 to £2500. When you add the employers contribution to the new amount, I am basically shifting in £2850 each month.

My current total balance stands at around £56K.

Now, the one thing I don't like is the Fund Growth Rate Assumptions. I intend to retire at 57 (that will be the new earliest private pension age) which gives me 16 years left between now and then. I am not a fan of my current product split:

10% in L&G PMC UK Equity Index 3 at a growth rate of 1.8%

10% in L&G MT Emerging Markets Index Fund at a growth rate of 4.1%

80% in L&G PMC World (Ex-UK) Equity Index 3 at a growth rate of 2.4%

I am seriously thinking of adjusting and increasing my risk as follows:

25% or 30% in L&G MT Emerging Markets Index Fund at a growth rate of 4.1%

75% or 70% in L&G PMC World (Ex-UK) Equity Index 3 at a growth rate of 2.4%

If the objective was to maximise returns in 16 years using a high risk/high reward strategy, do you think my intentions are reasonable or will I be shooting myself in the foot?

p.s. I am now officially 41 years old.0 -

25-30% in EM seems rather too high for a balanced diversification. More EM certainly adds to risk, hoever whether it adds to long term returns is less clear. Also exactly what constitutes "EM" can differ in different funds. If you want to increase your risk in a more diversified way with better historical justification I suggest you look at Small Companies across the world.sho_me_da_money said:Hi All.

It is coming closer to a year since my last post and i wanted to resurrect this thread instead of starting a new one as a progress update. I recently received my pension benefit statement from L&G and this is what the forward looking view shows:

One key difference from what is shown above is that I recently (a couple of months back) increased my monthly contribution amount from £1552.77 to £2500. When you add the employers contribution to the new amount, I am basically shifting in £2850 each month.

My current total balance stands at around £56K.

Now, the one thing I don't like is the Fund Growth Rate Assumptions. I intend to retire at 57 (that will be the new earliest private pension age) which gives me 16 years left between now and then. I am not a fan of my current product split:

10% in L&G PMC UK Equity Index 3 at a growth rate of 1.8%

10% in L&G MT Emerging Markets Index Fund at a growth rate of 4.1%

80% in L&G PMC World (Ex-UK) Equity Index 3 at a growth rate of 2.4%

I am seriously thinking of adjusting and increasing my risk as follows:

25% or 30% in L&G MT Emerging Markets Index Fund at a growth rate of 4.1%

75% or 70% in L&G PMC World (Ex-UK) Equity Index 3 at a growth rate of 2.4%

If the objective was to maximise returns in 16 years using a high risk/high reward strategy, do you think my intentions are reasonable or will I be shooting myself in the foot?

p.s. I am now officially 41 years old.

Ignore the growth rate assumptions. As the Projection says, they are examples. Examples are not predictions.

I*n my view, a better way of monitoring progress is to make a spreadsheet model:

1) Assume inflation rate

2) Specify annual contribution increasing with inflation

3) Specify retirement date

4) Calculate what lump sum you need at current prices to provide the income you need in retirement.

5) Calculate with the spreadsheet model what return you need to get the lump sum by the date you retire

Repeat adjusting (1)-(5) until you have a plan that satisfies you

Review in a year's time to see if you are on track. If not change (1)-(5)1 -

Linton said:

25-30% in EM seems rather too high for a balanced diversification. More EM certainly adds to risk, hoever whether it adds to long term returns is less clear. Also exactly what constitutes "EM" can differ in different funds. If you want to increase your risk in a more diversified way with better historical justification I suggest you look at Small Companies across the world.sho_me_da_money said:Hi All.

It is coming closer to a year since my last post and i wanted to resurrect this thread instead of starting a new one as a progress update. I recently received my pension benefit statement from L&G and this is what the forward looking view shows:

One key difference from what is shown above is that I recently (a couple of months back) increased my monthly contribution amount from £1552.77 to £2500. When you add the employers contribution to the new amount, I am basically shifting in £2850 each month.

My current total balance stands at around £56K.

Now, the one thing I don't like is the Fund Growth Rate Assumptions. I intend to retire at 57 (that will be the new earliest private pension age) which gives me 16 years left between now and then. I am not a fan of my current product split:

10% in L&G PMC UK Equity Index 3 at a growth rate of 1.8%

10% in L&G MT Emerging Markets Index Fund at a growth rate of 4.1%

80% in L&G PMC World (Ex-UK) Equity Index 3 at a growth rate of 2.4%

I am seriously thinking of adjusting and increasing my risk as follows:

25% or 30% in L&G MT Emerging Markets Index Fund at a growth rate of 4.1%

75% or 70% in L&G PMC World (Ex-UK) Equity Index 3 at a growth rate of 2.4%

If the objective was to maximise returns in 16 years using a high risk/high reward strategy, do you think my intentions are reasonable or will I be shooting myself in the foot?

p.s. I am now officially 41 years old.

Ignore the growth rate assumptions. As the Projection says, they are examples. Examples are not predictions.

I*n my view, a better way of monitoring progress is to make a spreadsheet model:

1) Assume inflation rate

2) Specify annual contribution increasing with inflation

3) Specify retirement date

4) Calculate what lump sum you need at current prices to provide the income you need in retirement.

5) Calculate with the spreadsheet model what return you need to get the lump sum by the date you retire

Repeat adjusting (1)-(5) until you have a plan that satisfies you

Review in a year's time to see if you are on track. If not change (1)-(5)

Great advice and I wouldn't have a clue on how to start that or make those assumptions for 1. Any help? Any spreadsheet that you have that I can use as a benchmark for this year based on assumed inflation rate?

Here's what I know for sure:- I am 41 years old and would like to retire at 57

- My current pension pot is showing a total of £56,861.81 comprised of:

Transfers In - £33,105.58

Regular Contributions - £23,756.23

The above total confuses me. Since the total of the two figures amounts to the pension pot size, I have ZERO idea what appreciation I made via my existing investments over the past year. To me it sounds like i made nothing. Is that even correct?

- I am going to sacrifice £2500.00 every month

- My employer will be adding £345.83 to my sacrifice meaning £2845.83 should be going into the pot each month

- I am single and have no children

- My main debt is my mortgage on which I owe £79,000. The house value is around £270-£300K

- I have no other investments

- It would be nice to earn £25-40K per year in retirement

- My L&G equity funds are limited to X number of funds. I know I do not get the full list that would be available to non-workplace pension customers. I cannot seem to access the list of them just yet but I think I posted them all in a previous message on this thread.

- I have just set my allocations to 30% EM and 70% WORLD (EX-UK)

Are you able to propose a plan?

I do not mind taking the risk since I am playing catch up.0 -

In my early retirement plan I assumed 3% inflation and 4% return in £ terms. The numbers were chosen to be what seemed at the time (2005) very pessimistic. Your initial assumptions dont matter too much, with annual reviews you will soon find out if they are wildly out.sho_me_da_money said:Linton said:

25-30% in EM seems rather too high for a balanced diversification. More EM certainly adds to risk, hoever whether it adds to long term returns is less clear. Also exactly what constitutes "EM" can differ in different funds. If you want to increase your risk in a more diversified way with better historical justification I suggest you look at Small Companies across the world.sho_me_da_money said:Hi All.

It is coming closer to a year since my last post and i wanted to resurrect this thread instead of starting a new one as a progress update. I recently received my pension benefit statement from L&G and this is what the forward looking view shows:

One key difference from what is shown above is that I recently (a couple of months back) increased my monthly contribution amount from £1552.77 to £2500. When you add the employers contribution to the new amount, I am basically shifting in £2850 each month.

My current total balance stands at around £56K.

Now, the one thing I don't like is the Fund Growth Rate Assumptions. I intend to retire at 57 (that will be the new earliest private pension age) which gives me 16 years left between now and then. I am not a fan of my current product split:

10% in L&G PMC UK Equity Index 3 at a growth rate of 1.8%

10% in L&G MT Emerging Markets Index Fund at a growth rate of 4.1%

80% in L&G PMC World (Ex-UK) Equity Index 3 at a growth rate of 2.4%

I am seriously thinking of adjusting and increasing my risk as follows:

25% or 30% in L&G MT Emerging Markets Index Fund at a growth rate of 4.1%

75% or 70% in L&G PMC World (Ex-UK) Equity Index 3 at a growth rate of 2.4%

If the objective was to maximise returns in 16 years using a high risk/high reward strategy, do you think my intentions are reasonable or will I be shooting myself in the foot?

p.s. I am now officially 41 years old.

Ignore the growth rate assumptions. As the Projection says, they are examples. Examples are not predictions.

I*n my view, a better way of monitoring progress is to make a spreadsheet model:

1) Assume inflation rate

2) Specify annual contribution increasing with inflation

3) Specify retirement date

4) Calculate what lump sum you need at current prices to provide the income you need in retirement.

5) Calculate with the spreadsheet model what return you need to get the lump sum by the date you retire

Repeat adjusting (1)-(5) until you have a plan that satisfies you

Review in a year's time to see if you are on track. If not change (1)-(5)

Great advice and I wouldn't have a clue on how to start that or make those assumptions for 1. Any help? Any spreadsheet that you have that I can use as a benchmark for this year based on assumed inflation rate?

Here's what I know for sure:- I am 41 years old and would like to retire at 57

- My current pension pot is showing a total of £56,861.81 comprised of:

Transfers In - £33,105.58

Regular Contributions - £23,756.23

The above total confuses me. Since the total of the two figures amounts to the pension pot size, I have ZERO idea what appreciation I made via my existing investments over the past year. To me it sounds like i made nothing. Is that even correct?

- I am going to sacrifice £2500.00 every month

- My employer will be adding £345.83 to my sacrifice meaning £2845.83 should be going into the pot each month

- I am single and have no children

- My main debt is my mortgage on which I owe £79,000. The house value is around £270-£300K

- I have no other investments

- It would be nice to earn £25-40K per year in retirement

- My L&G equity funds are limited to X number of funds. I know I do not get the full list that would be available to non-workplace pension customers. I cannot seem to access the list of them just yet but I think I posted them all in a previous message on this thread.

- I have just set my allocations to 30% EM and 70% WORLD (EX-UK)

Are you able to propose a plan?

I do not mind taking the risk since I am playing catch up.

Are you reading your statement correctly? The numbers look like just the inputs to the pension rather than a valuation since they add up exactly to the 1p - that's too close surely to be pure chance.

To show what one can deduce wIth a very quick and possibly erroneous spreadsheet:

Working in current £ terms assuming:

1) £56861 in the pot and £34152 going in each year for 16 years

2) An income of £25K/year + full SP=£34.65K increasing with inflation requires a pot of £25K/3.5%+£9.65K X 11 years= approx £820K. This ignores paying off your mortgage which I assume you can treat as normal expenditure.

You would need an ambitious return of approx 5% above inflation to get to the £34.5K/year from aged 57 including covering the missing SP 57-68.

However assuming my pessimistic value of 1% return above inflation you would have the required pot size in 20 years time.

So with a fair wind you should be OK within a few years. I suggest you dont chase overly ambitious returns. You dont want too much risk as the majority of your pot will come from your and employer contributions rather than returns, that is the downside of starting late.3 -

I have ZERO idea what appreciation I made via my existing investments over the past year. To me it sounds like i made nothing. Is that even correct?

Nearly all investments have gone down this year. If your pot is similar now to this time last year, this would not be a surprise.

Am I in LaLaLand or can I make this happen?

Strictly a back of the fag packet calculation could be as follows.

£60K now + £640K added over 16 years ( assuming some gradual increase in contributions each year ) = £700K

Growth of 2% above inflation for 16 years , will give approx £115K ( in real terms as inflation is accounted for ) so £815K.

At age 57 a drawdown rate of say 3.25 % would be sensible = £26K minus some tax = £23K pa . One possibility is to increase the drawdown rate, with a view to decreasing it again when SP kicks in. 4.5% would give you approx £33K after tax .

It is all very very approx but with a 16 year time horizon, you have to make so many assumptions anyway .

2 -

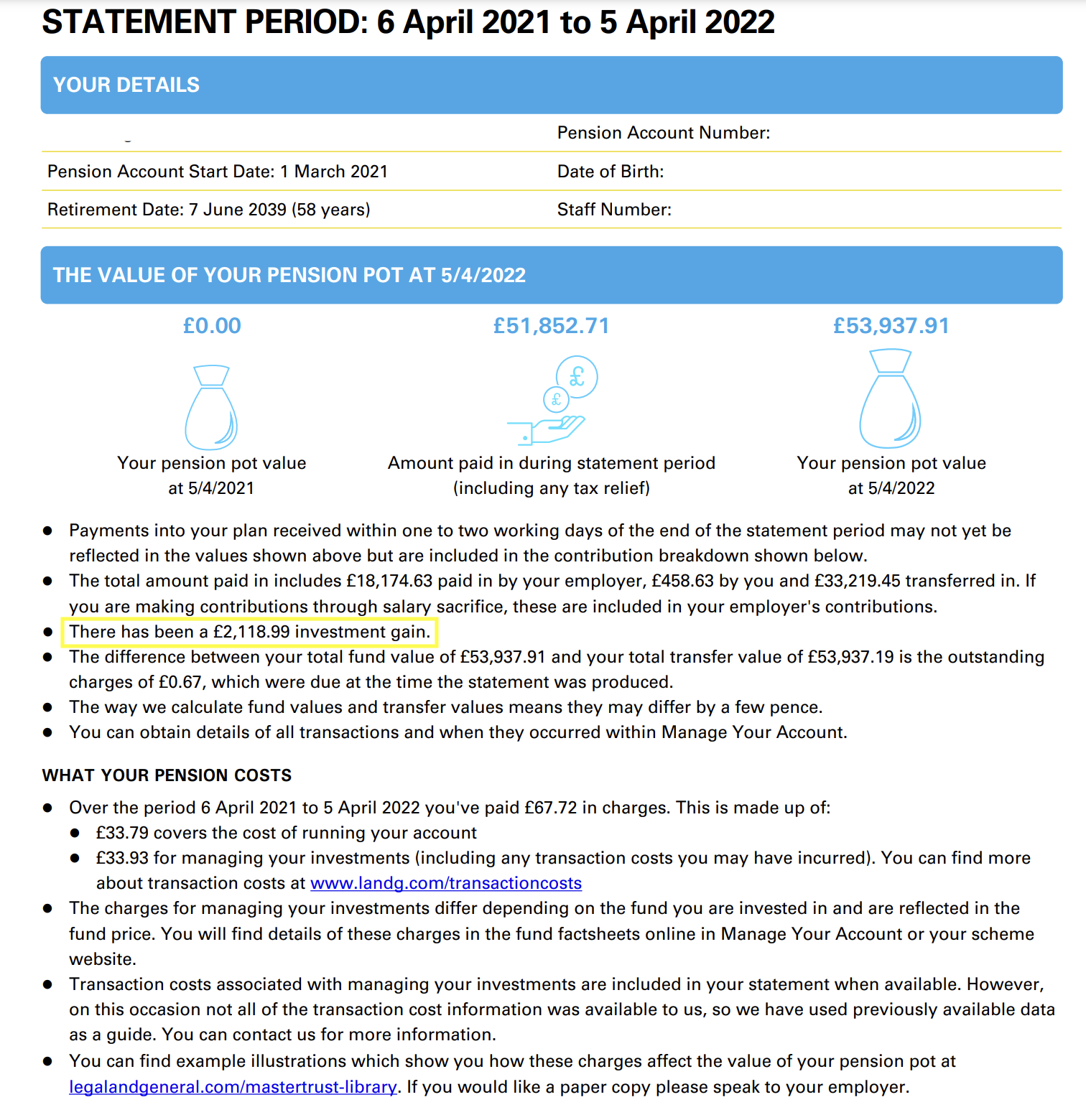

- I have ZERO idea what appreciation I made via my existing investments over the past year. To me it sounds like i made nothing. Is that even correct?

I have an L&G pension and I receive pension statements that look exactly as you have shown above (on page 5).

If it's the same as mine:

On page 3 entitled 'Your Statement', there is a section outlining the current value. The third bullet states: 'There has been a £XXX investment gain', which tells you exactly how much it has moved over the 12 months to the statement date.

0 -

Bemma said:

- I have ZERO idea what appreciation I made via my existing investments over the past year. To me it sounds like i made nothing. Is that even correct?

I have an L&G pension and I receive pension statements that look exactly as you have shown above (on page 5).

If it's the same as mine:

On page 3 entitled 'Your Statement', there is a section outlining the current value. The third bullet states: 'There has been a £XXX investment gain', which tells you exactly how much it has moved over the 12 months to the statement date.

Brilliant.

I found it! I made a gain of just over £2K by paying in £18K of salary sacrifice and splitting my funds as folllows:

80% (world ex-UK)

10% (Emerging Markets)

10% (UK) split.

The £2,000 gain is approximately a 5% gain last year.

I would be interested to learn what comes of this year based on the fact that my salary sacrifice has increased to £2850 (includes my employers contribution) and my fund split adjusted as follows:

70% (world ex-UK)

30% (Emerging Markets).

I just have a strong suspicion that China and Asia in general is going to boom.

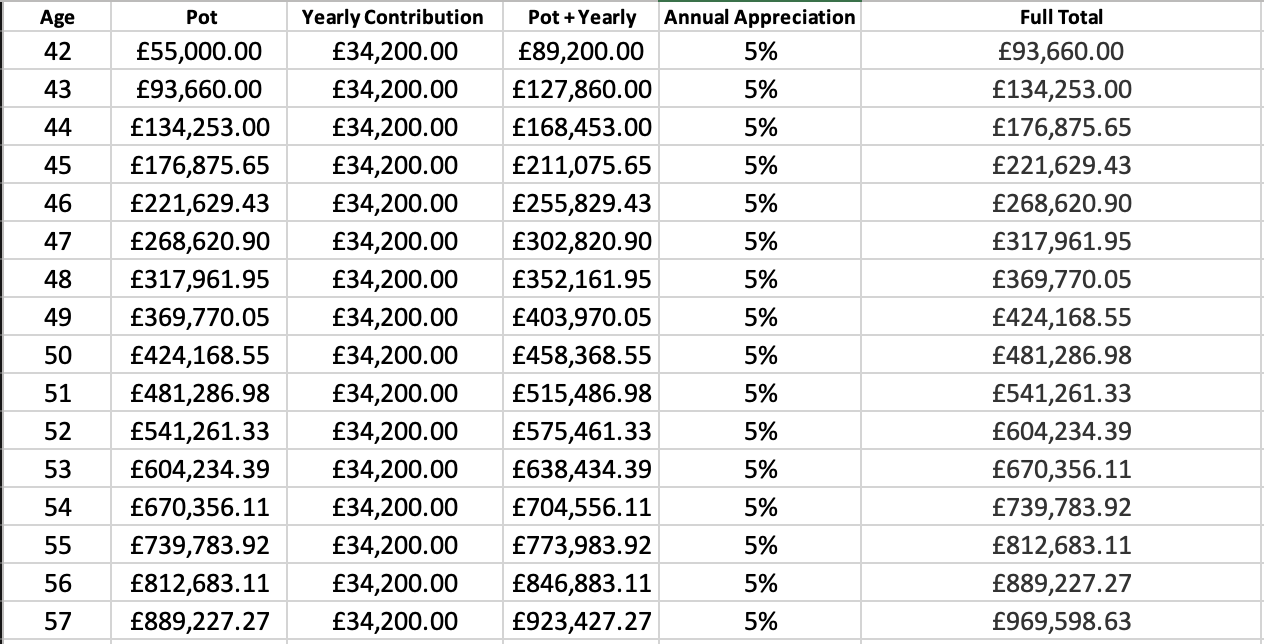

I also did did some a basic (well advanced for me) excel spreadsheet. Is my math correct?

The following assumes I load £34,200 into my pension per year (£2850 x 12) based on my salary today. If I was fortunate to get a raise over the coming years, I would simply increase my salary sacrifice. However, I understand this is capped at £40,000 per year.

<side question> - Is the £40,000 cap net of what my employer adds or is it a gross combination of my amount + employers contribution?

The spreadsheet further assumes that my pot will appreciate by 5% each year until 57.

If the math is correct then the figure at 57 shows £969.598.63

Can anyone validate please?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards