We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Pension Returns

Comments

-

Nick9967 said:

You're right i missed pot starting point !Notepad_Phil said:You're planning on taking out £486,000 (presumably valued in today's money) but you've not specified how much you have in your initial pot.Theoretically, with a constant 2.5% real return on your investments you could manage those drawdowns if you started out with something like £375,000, however even just a few years of underperformance at the beginning would throw that completely out and so I'd want to hold quite a bit more (unless you have some leeway over how much you can drawdown) and would probably hold at least a few years in cash.

it should be circa £325,000

Does that mean that your withdrawals are not to be increased by inflation?If they are, then my quick excel calculations would indicate that a starting pot of £325,000 would run out several years early if you use a constant 2.5% real return.It may be that you really do just want to take out £20k in year 22 rather than the approx £30k that you'd need if you were accounting for inflation, in which case you may well be okay but personally I'd be worried about a poor sequence of returns during the early year.0 -

Something to consider.

If for example you transferred a db pension into a dc pension and withdrew flexi drawdown, percentages can be completely opposite to calendar years or any other point in time. The main thing is what your pot was worth when you ‘went in’, and that is your starting point to base all growth calcs thereafter. Some time ago I done some analysis where my pot fell 10% Dec YoY, but grew 10% Aug YoY.0 -

I'm at a bit of a standstill really as far as sequence of returns,Notepad_Phil said:You're right i missed pot starting point !

it should be circa £325,000

Does that mean that your withdrawals are not to be increased by inflation?If they are, then my quick excel calculations would indicate that a starting pot of £325,000 would run out several years early if you use a constant 2.5% real return.It may be that you really do just want to take out £20k in year 22 rather than the approx £30k that you'd need if you were accounting for inflation, in which case you may well be okay but personally I'd be worried about a poor sequence of returns during the early year.

I run 3 spreadsheets now each with a different sequence, one with a flat growth of 5% for all 22 years, one with a sequence starting badly but averaging 4.5% the other averaging 5.3% but with poor years spread in each third of the 22 year cycle.

My withdrawals stay the same with the exception of the middle sequence where the poor years are at the very beginning, my strategy for that is either to delay retirement by 2 years (or whatever is required) or still retire and use some of my cash reserve to cover the couple of bad years, and make no drawdown at all.

The problem is the annual returns are so "finger in the air" change these and the whole picture changes dramatically.

As far as I can see following the 4% withdrawal safe line is built around a pot lasting from retirement to death and not what I need which is for the pot to last 22 years from 58 to 80 with varied withdrawals, so I'm unsure what growth rate (inc. inflation) is best for me to use.

0 -

The way I have mitigated a crash at the start of retirement is currently I hold about 15 years worth of cash (about 40% of my pot) so I would use that initially, I will look at releasing equity when the prices are high. I'm using this strategy as currently very low inflation and therefore real value of cash is not being eroded too much. If inflation creeps up I will be investing in inflation proof equities to ensure I am not losing too much. It's all about timing though as don't want to be late.It's just my opinion and not advice.0

-

What are “inflation proof equities” ?Mortgage free

Vocational freedom has arrived0 -

Defensive stocks maybe???sheslookinhot said:What are “inflation proof equities” ?0 -

As far as I can see following the 4% withdrawal safe line is built around a pot lasting from retirement to death and not what I need which is for the pot to last 22 years from 58 to 80 with varied withdrawals, so I'm unsure what growth rate (inc. inflation) is best for me to use.

There is no safe withdrawal rate. There are some models that claim SWR and use 4% but its just wording that would never be allowed in the retail market. it also uses a range of assumptions that may not be appropriate.

Why do you only need your pension to last until age 80?

You should use a growth rate that is consistent with your underlying assets and knock off a chunk to play it safe.

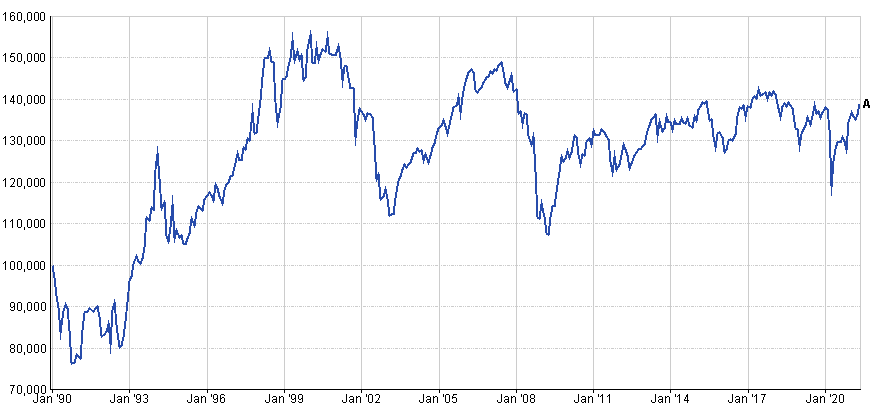

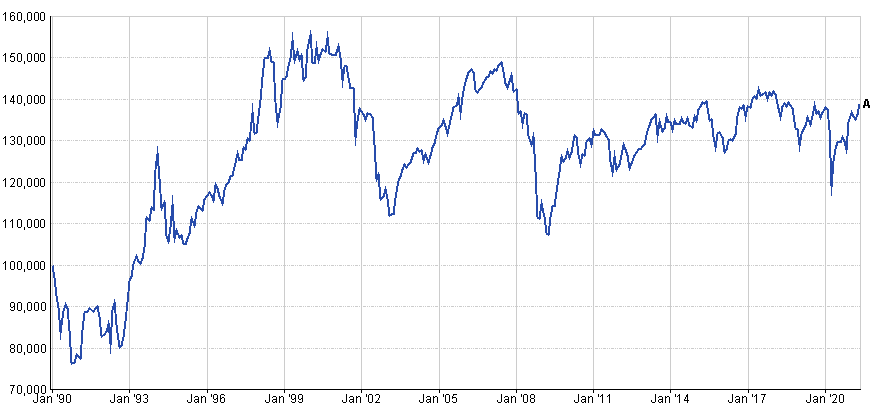

That is a chart that shows someone drawing 4.25% a year (0.36% per month) since Jan 90 based on sector average returns of the 20-60 shares sector (extra 0.25% to cover platform charge). If there was a dot.com style crash now (or near future) then this pot would likely start the cycle of falling values heading to zero as 20 years of inflation is unlikely to see the withdrawal amount being sufficient and there would be a need to increase it. Therefore speeding up the erosion. Indeed, the individual may have already had to start eroding the capital long before now. Or you may be lucky enough to have a frugel lifestyle where the state pension increases are enough or even better, a defined benefit pension with its annually increasing secure income along with the state pension.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

Nick9967 said:As far as I can see following the 4% withdrawal safe line is built around a pot lasting from retirement to death and not what I need which is for the pot to last 22 years from 58 to 80 with varied withdrawals, so I'm unsure what growth rate (inc. inflation) is best for me to use.The 4% SWR over a lifetime is based on US data and is higher than what UK data suggests.Personally I'd be happy to rely on a 4% SWR to last 22 years, but you're talking about a 6.15% withdrawal rate for the first 5 years - so if markets fall say 15% and remain low over that 5 year period then your pot will be at nearly half of its initial £325,000, which then has to last another 17 years.If you're happy to reduce your drawdowns during market downturns then there are ways to attempt to make a pot sustainable (e.g. Guyton-Klinger) but if the withdrawals are set in stone then you either have to have a lot more in cash to hopefully cover any down periods, or a lot more in investments so that you get down towards a 4% withdrawal rate.I've been early-retired for several years now and before deciding that yes, I could retire, I checked that we could survive the reductions in drawdown amounts that would be necessary to live through an immediate 50% drop in world stockmarkets followed by only inflationary rises from then on. For us it meant that at the start of retirement we held a lot more in cash then most and obviously we'd have a lower standard of living if my pessimistic forecast ever came about. But knowing that we would still be okay meant that I could stop the 'just one more year' syndrome and just get on with enjoying retirement.1

-

In answer to the "why only till 80" , essentially I have a combination of:dunstonh said:As far as I can see following the 4% withdrawal safe line is built around a pot lasting from retirement to death and not what I need which is for the pot to last 22 years from 58 to 80 with varied withdrawals, so I'm unsure what growth rate (inc. inflation) is best for me to use.There is no safe withdrawal rate. There are some models that claim SWR and use 4% but its just wording that would never be allowed in the retail market. it also uses a range of assumptions that may not be appropriate.

Why do you only need your pension to last until age 80?

You should use a growth rate that is consistent with your underlying assets and knock off a chunk to play it safe.

That is a chart that shows someone drawing 4.25% a year (0.36% per month) since Jan 90 based on sector average returns of the 20-60 shares sector (extra 0.25% to cover platform charge). If there was a dot.com style crash now (or near future) then this pot would likely start the cycle of falling values heading to zero as 20 years of inflation is unlikely to see the withdrawal amount being sufficient and there would be a need to increase it. Therefore speeding up the erosion. Indeed, the individual may have already had to start eroding the capital long before now. Or you may be lucky enough to have a frugel lifestyle where the state pension increases are enough or even better, a defined benefit pension with its annually increasing secure income along with the state pension.

- A second property (which we own) that will be available to sell at the very latest the 21/22 point, past this means there would be some records broken for longevity! so I'm ok with that. After paying tax on the profit I'll have sufficient to see us through, minimum another £250k in cash

- A younger wife's SP and smallish LGPS will have started by then

I'm not sure I'm missing anything from expenditure , if i am that may be an issue of course:

BUT when i consider currently I finance a family of 4 (2 teenagers 13/17) and pay a £300 mortgage and live well on £3300 pm then i consider my expenses are if anything over egged, and i should be able to be comfortable in my retirement;

My starting expenses point is:Monthly Annual Water £65 £780 Gas £65 £780 Elec £80 £960 Council Tax £220 £2,640 House Ins. £35 £420 Broadband £35 £420 TV Package £50 £600 Mobiles £50 £600 TV License £15 £180 Life Ins £12 £144 Car Ins x 2 £50 £600 Car Tax x 2 £42 £504 MOT & Service £55 £660 Xmas £125 £1,500 Holiday £400 £4,800 Calamity Savings £150 £1,800 Hobby x2 £100 £1,200 Fuel £150 £1,800 Food £400 £4,800 Clothing £100 £1,200 Dental £50 £600 Replacement Car £200 £2,400 Monthly spending adhoc £500 £6,000 University 2022-2029 £350 £4,200

I've learnt a lot from this sight in the past 12 months and its been invaluable, I've come to the conclusion the more detail I add and the more open I am the useful the feedback is hence my openness about monthly ex's etc

0 -

With regards to university, I have found this has cost me approx £7200 annually per person, so may be something worth considering. It is very depdendent where the university is, unfortunately both my children chose expensive university cities in respect to accommodation.

It's just my opinion and not advice.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards