We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

What's your equity split?

solidpro

Posts: 676 Forumite

I'm 30 years away from retirement so I have 6 figures invested in Pensions and ISAs which are 'adventurous' and roughly 80-100% equity. The split across all funds is roughly:

50% North America

25% APAC

15% EU

10% UK

What are you doing, and why?

50% North America

25% APAC

15% EU

10% UK

What are you doing, and why?

0

Comments

-

I've a high risk portfolio, 100% equity. Pension is slightly different split to this with more US bias.

30% USA

25% UK

10% Europe

10% Asia

5% Japan

10% Emerging

10% specialist

Probably a bit overweight in UK but that's a historic anomaly and is biased to FTSE250 not 100 so has been a decent performance.Remember the saying: if it looks too good to be true it almost certainly is.0 -

No particular concerns with geographical location of the brass plate when selecting investments. Other than to ensure that I'm not overly exposed to emerging or frontier markets through direct holdings.0

-

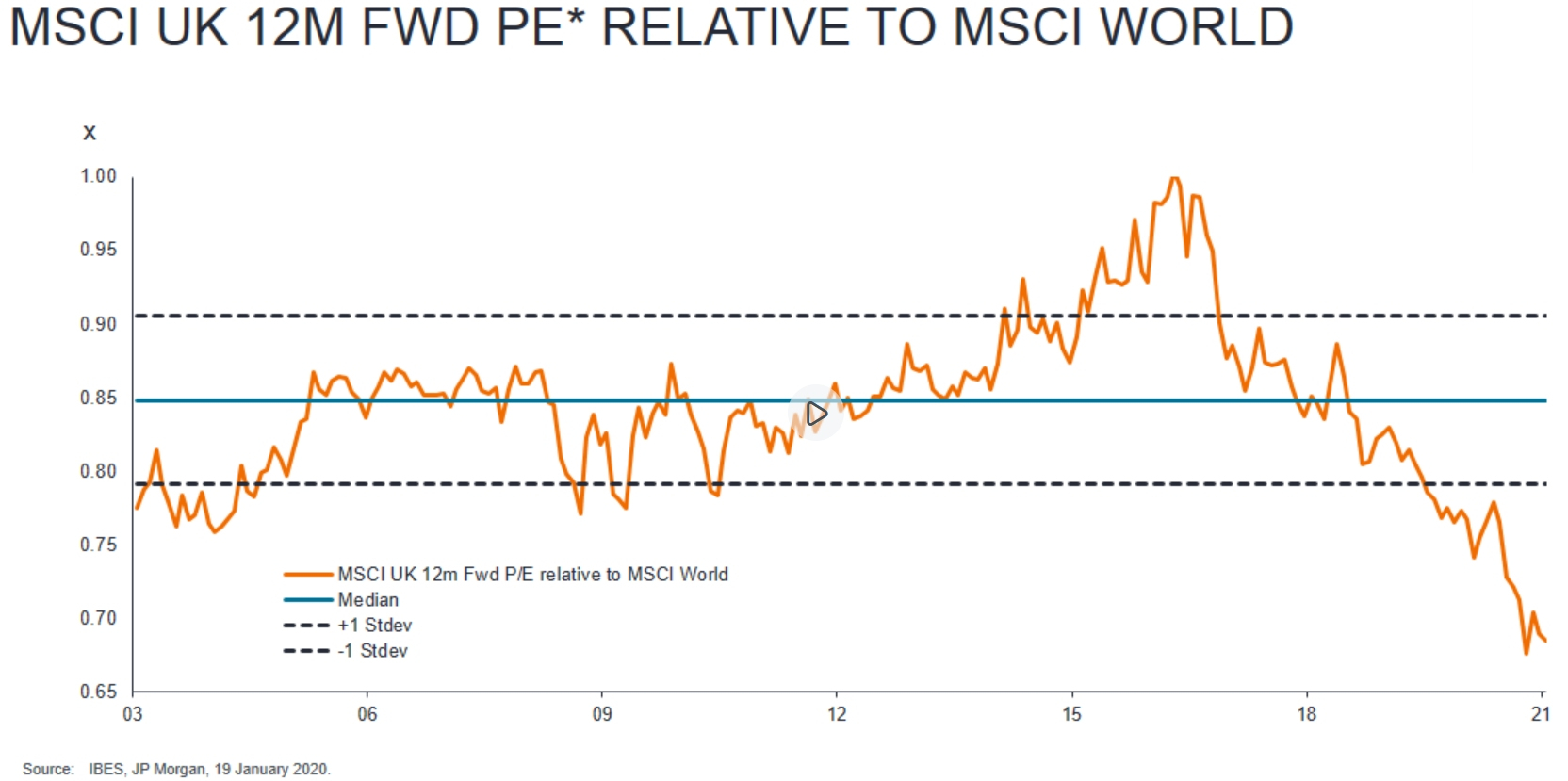

This year our equities are around 15% UK, 10% Emerging Markets and 75% Developed World ex-UK. I tend to tilt on valuations as UK listed companies now are looking significantly better value than their long term average compared to the US and rest of world. I wouldn't mind a bit more UK.

2

2 -

I'm up to about 17% UK (from 5% a few years ago) and planning to increase further with new contributions, and down to 23% USA (from 34%). More or less neutral elsewhere, slightly overweight Japan (12%) due to recent performance but that's not intentional and will be rebalanced away in due course.

0 -

100% equity growth portfolio:

Geography

---------------

Asia 24%

Japan 9%

SE Asia 15%

Europe32%

UK 8%

Rest 24%

Americas 44%

US 41%

Canada 1%

Latin America 2%

Size

-------

Large 53%

Medium 29%

Small 18%

Style

-------

Value 13%

Blend 38%

Growth 49%

Largest underlying holding: Apple 1.6%

Rationale: High diversification over all factors. Style could be more evenly balanced. However this is mitigated by my income and wealth preservation portfolios which are much more Value oriented.1 -

I'm 37 and currently only have one fund; Fidelity Index World

I've got 30 years until I need the money so planning on staying in equities for the foreseeable but not sure if I need to add another fund yet1 -

30% UK, 15% EM, 15% Europe, 25% US, 10% Japan, 5% cash/gold.

My high UK weighting isn't a home bias but a position that I've developed substantially over the last year due to valuations - the allocation is broadly all value stocks, split between large and med cap. That element of my portfolio has delivered 12% returns so far, not including dividends, so pretty pleased with it albeit understand that's not really any better than had I allocated elsewhere given global gains. .1 -

I am only about 3 years from retirement so my retirement portfolio probably isn't as risky as yours:solidpro said:

What are you doing, and why?

29% Equities (mainly Vhyl)

21% REIT

21% Bonds

16% DB pension

11% BTL

2% Savings

Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0 -

solidpro said:I'm 30 years away from retirement so I have 6 figures invested in Pensions and ISAs which are 'adventurous' and roughly 80-100% equity. The split across all funds is roughly:

50% North America

25% APAC

15% EU

10% UK

What are you doing, and why?I dont see the point of geographic splits, because mostly they are misleading.For example, in your "North America" there will be some Apple and in UK, Unilever.But Apple does maybe 60% of its sales outside NA, and Unilever perhaps 95% of its business outside the UK. Rinse and repeat for nearly every company.etc. eg the notional geographic split is meaningless. Another example, a couple years ago, Unilever nearly moved overnight from UK to Europe just because they were going to move their HQ. Their business would have been unchanged.I think if you do want to diversify (thats why you have these splits, right?) then you'd be better to do it across industry sectors. For example energy, finance, technology, banking, healthcare, etc. Even then it gets blurred because companies get moved from one sector to another. One day Facebook is technology and the next its communications or whatever (made up example)Now, i dont really do splits as such but i have made "bets" on a couple of sectors, I woudl never though make a bet on say APAC or UK, because in todays global world, unless you pick very niche companies you are really always getting companies that sell globally.the only real split ive done and thats quite recent and should have been ages ago, is instead of a generic global fund, i have a generic global fund plus a couple of "smaller companies" funds (note, mostly "smaller" companies are still multi billion dollar companies.Good on you for being nearly all equities as you have 30 years to go. All bonds will do, over that time period, is marginally smooth out a lower return.3 -

I would agree that geographic split should not be a predominant connsideration but it is not completely meaningless. For large companies it is can be a proxy for variations in sector allocations. For example a tech company in the Far East is likely to be a manufacturer whereas one in the US is more likely to be software or a product designer. If you purely invested in the UK on the grounds that most large UK companies are global then you would miss out on the tech sector completely.

For small companies geographic allocation is important. Correlations between small companies in different parts of the world can be relatively low allowing for the fact that they are all equity.5

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards