We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Vanguard Life Strategy vs Target Retirement

Comments

-

You can see the impact of moving asset allocation in the video here around the 3:30 mark.zagfles said:BritishInvestor said:zagfles said:jamesd said:zagfles,

Your posts in this discussion might be worth reviewing, since while you appear to be totally correct in at least most instances, all anyone needs to do to disagree with you is quote your own post for a point, then quote another one of yours for the counter-argument.

You appear to believe that:

1. High equities is best for for younger people. Not sure whether you value the known improvement from some rebalancing with ten to twenty percent bonds or prefer 100% equities. I'd add that significant smaller company and emerging markets holdings have also historically been useful.

2. Where analysis uses historic sequences for drawdown around 50-60% equities tends to be good, with more equities for longer periods.

3. Reducing risk before retirement is good. You gave three examples, two of which seem to cut equities to 0% and the third to 30%.

4. You assert that you don't want investor psychology considered, just pure best case answers.1b. While you think high equities is best you then give three balanced managed default funds as examples and these do not use high equities.

2b. BritishInvestor is correct that if historic return variations but not historic sequences are used, safe withdrawal rates normally increase all the way to 100% equities. Morningstar has some published work covering this. This is the main case where quoting parts of your posts doesn't have you disagreeing with yourself.

3b. All three default funds with lifestyling derisk before retirement so much that a substantial increase in risk - equity holdings - is required to achieve the equity percentage you seem to think is desirable for retirement drawdown.

4b. All three funds incorporate investor risk tolerance and use lower equity holdings than strictly desirable as a result. Unfortunate though it is, younger people tend to have a very low risk tolerance and strong adverse reaction to loss. NEST goes as far as using low growth investments in the early years to avoid scaring customers away, instead of explaining about ups and downs.1b, you've been whooshed. I was using them purely as examples of funds that derisk approaching retirement. That was in response to BI's assertion that derisking as you approach retirement is not generally recommended by retirement experts. So I posted examples of workplace providers all of which derisk and challenged him to give examples of some that don't. He couldn't. Nothing whatsoever to do with actual % equities, just the fact that derisk.2b, historic sequences obviously need accounting for, the stockmarket isn't a roulette wheel. That's where I think Prime Harvesting has something to offer.3b I already said that eg Vanguard is too low in equities. I've not even looked at the others, other than the fact that they derisk. The only point was that they derisk. OK? Nothing to do with the actual equity %, just the fact that it changes with age particularly in the years before retirement. And no comment on any other aspect of their investment strategy.4b. So what? Have I said that the major funds don't account for risk tolerance? I just said I wasn't interested in discussing it, I'm more interested in discussing an analytical approach to the correct fund balance not emotional.

"and challenged him to give examples of some that don't. He couldn't. "

I wouldn't even begin to try because, believe it or not, workplace pension providers are not (typically) considered the golden source for retirement planning expertise. I gave an example previously where equities were "derisked" into inflation-linked bonds as retirement approached.

We'll have to agree to disagree on this unless you are willing to start digging into the evidence - the offer is always open.

"Offer" of what exactly? If you've got evidence post a URL to a reputable study on the issue. Otherwise I'm not interested in any "offer". You're starting to sound like a spammer.

https://www.timelineapp.co/blog/what-factors-influence-sustainable-withdrawal-rates/

0 -

zagfles said:

Really? Can you point me at some of this "enormous" evidence that shows a 20 year old should have the same % equity in their pension as a 60 year old? What % equity at 20 would be sensible do you think? I'd have thought 100% equity at 20 would almost always provide the best outcome, given that a crash could even be advantageous as they'd be buying at a lower price. Whereas 100% at 60 would not."And if that equity balance is higher at 20 than 60, by definition it needs to reduce over the years. "

It doesn't need to, and potentially shouldn't, as an enormous amount of evidence shows.

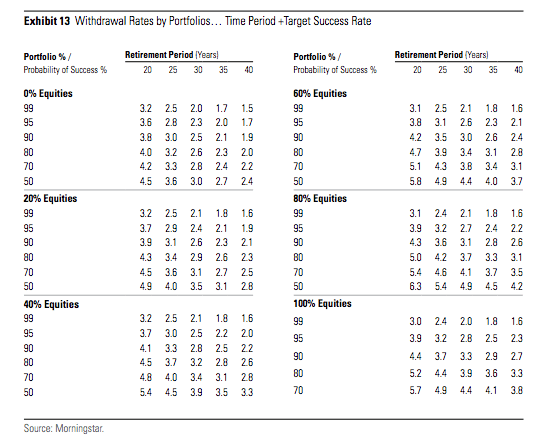

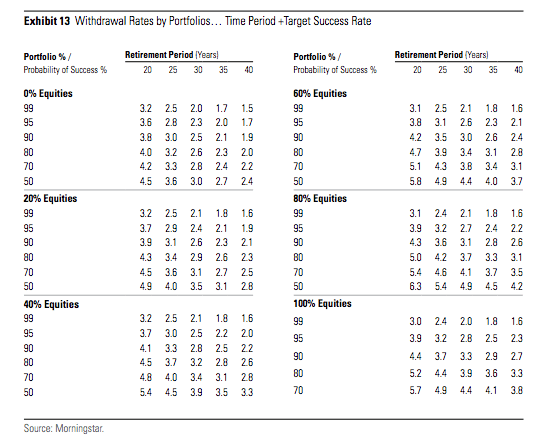

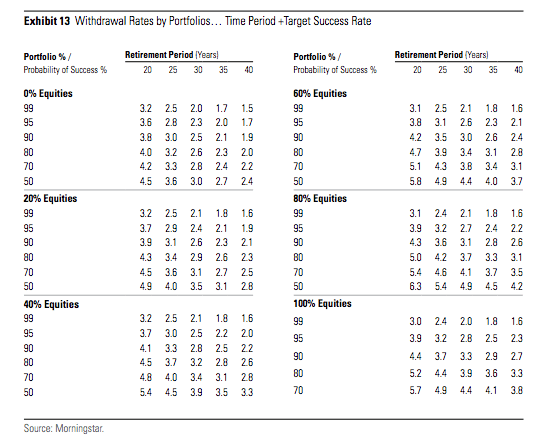

Notice that in this Morningstar research the SWR for UK retirees increases as the equity percentage rises towards and reaches 100%.

Thus it follows that your assertion that 100% could be best for a twenty year old but not a sixty year old is disproven, since the research shows that it is best for the retiree.

As I'd previously mentioned, the optimal equity percentage depends on the analysis, with random sequences of historic variation tending to produce 100% equity as best, while historic sequences tend to be in the 50:50 to 75:25 range depending on drawdown rule and planned number of life years.

The picture is from Abraham Okusanya in his discussion of the Morningstar research at Morningstar’s Research: Why Safe Withdrawal Rate Is Still Pretty Safe.

0 -

jamesd said:zagfles said:

Really? Can you point me at some of this "enormous" evidence that shows a 20 year old should have the same % equity in their pension as a 60 year old? What % equity at 20 would be sensible do you think? I'd have thought 100% equity at 20 would almost always provide the best outcome, given that a crash could even be advantageous as they'd be buying at a lower price. Whereas 100% at 60 would not."And if that equity balance is higher at 20 than 60, by definition it needs to reduce over the years. "

It doesn't need to, and potentially shouldn't, as an enormous amount of evidence shows.

Notice that in this Morningstar research the SWR for UK retirees increases as the equity percentage rises towards and reaches 100%.

Thus it follows that your assertion that 100% could be best for a twenty year old but not a sixty year old is disproven, since the research shows that it is best for the retiree.

As I'd previously mentioned, the optimal equity percentage depends on the analysis, with random sequences of historic variation tending to produce 100% equity as best, while historic sequences tend to be in the 50:50 to 75:25 range depending on drawdown rule and planned number of life years.

The picture is from Abraham Okusanya in his discussion of the Morningstar research at Morningstar’s Research: Why Safe Withdrawal Rate Is Still Pretty Safe.So using random sequences 100% equity is best, but using actual historic sequences, a lower equity % is best!Why would you use random sequences? The stockmarket isn't a roulette table. The above table is based on "Monte Carlo", not real historic sequences. So IMO is worthless. That plus it probably assumes fixed asset allocations, fixed withdrawals etc.0 -

Historic sequences are good because they include the real links between one year and the next. Their disadvantage is that they don't cover every eventuality, so there's a role for Monte Carlo as well. Because those catch some worse sequences their SWR is normally lower. It's nice to see that sort of lower bound as a confidence check on the historic sequences that I prefer.0

-

jamesd said:zagfles said:

Really? Can you point me at some of this "enormous" evidence that shows a 20 year old should have the same % equity in their pension as a 60 year old? What % equity at 20 would be sensible do you think? I'd have thought 100% equity at 20 would almost always provide the best outcome, given that a crash could even be advantageous as they'd be buying at a lower price. Whereas 100% at 60 would not."And if that equity balance is higher at 20 than 60, by definition it needs to reduce over the years. "

It doesn't need to, and potentially shouldn't, as an enormous amount of evidence shows.

Notice that in this Morningstar research the SWR for UK retirees increases as the equity percentage rises towards and reaches 100%.

Thus it follows that your assertion that 100% could be best for a twenty year old but not a sixty year old is disproven, since the research shows that it is best for the retiree.

As I'd previously mentioned, the optimal equity percentage depends on the analysis, with random sequences of historic variation tending to produce 100% equity as best, while historic sequences tend to be in the 50:50 to 75:25 range depending on drawdown rule and planned number of life years.

The picture is from Abraham Okusanya in his discussion of the Morningstar research at Morningstar’s Research: Why Safe Withdrawal Rate Is Still Pretty Safe.

I dont think those numbers are as convincing as you state:

1) Going down to 50% likelihood of success seeems to be stretching the concept of Safe WRs somewhat.

2) All other things being equal having less equity is better as it reduces stress. And for 99% success rate they are pretty equal. In fact 0% equity would only give a marginally lower SWR than 100% equity. Generally 100% equity is not that much better than 60% equity.

3) It looks like if you want security you could be financially better off with an annuity than 100 % equity even at the current rates. The HL website tells me that for a single 65 male the annuity rate for an RPI linked annuity is about 2.867. This would correspond to a 100% equity 30 year SWR at 95% success rate or 35year SWR at 90%.

And of course an annuity protects you against problems that have not occurred in the past 100 years.

The numbers are based on what seems to be equity split 50% UK 50% Global. The article does link to the Morningstar report which provided the basic data but sadly the link is dead.

1 -

If the market goes into a bear cycle thats generally a good thing if you have many years of adding money to the pot. If you are retired and are only taking money out, a prolonged downturn is going to seriously impact how much you can safely withdraw. The reason to hold bonds in retirement is that they are generally negatively correlated with equities so would slow the losses. At 20 you should have everything in equities and welcome any market crashes because that is what will make you the most money.1

-

Which market though? Markets can and do move independently.lvader said:If the market goes into a bear cycle thats generally a good thing if you have many years of adding money to the pot.0 -

Linton said:

I dont think those numbers are as convincing as you state:

1) Going down to 50% likelihood of success seeems to be stretching the concept of Safe WRs somewhat.

2) All other things being equal having less equity is better as it reduces stress. And for 99% success rate they are pretty equal. In fact 0% equity would only give a marginally lower SWR than 100% equity. Generally 100% equity is not that much better than 60% equity.

3) It looks like if you want security you could be financially better off with an annuity than 100 % equity even at the current rates. The HL website tells me that for a single 65 male the annuity rate for an RPI linked annuity is about 2.867. This would correspond to a 100% equity 30 year SWR at 95% success rate or 35year SWR at 90%.

And of course an annuity protects you against problems that have not occurred in the past 100 years.

The numbers are based on what seems to be equity split 50% UK 50% Global. The article does link to the Morningstar report which provided the basic data but sadly the link is dead.

You don't think they show that higher equity holdings lead to higher SWRs when historic variations and random sequences are used? The research place is reputable and so is the analysis method so it looks to me to be entirely convincing and consistent with other work using the same approach.

But you seem to actually have other points.

1. Morningstar's lead US researcher produced an interesting paper linking target success rates to how well your guaranteed income covers your needs. If you're highly flexible and have guaranteed income covering all of your needs a 25% success rate might be fine, meaning that you'd either need to adjust beyond the drawdown rule or accept eventually losing the top-up 75% of the time. The failure will normally be well into retirement so it could match normal spending reductions, effectively boosting initial income with a fair chance of doing it for life.

The difference between 2.1% and 4.4% income for 60% equities on a 30 year plan at 99% vs 50% success rate is huge, more than doubling income. And that's not going to take any adjusting if you live through an average period.

It's worth remembering that the 4% rule 100% success SWR is extremely cautious, causing under-spendjng in almost all cases. That takes adjusting upward. Taking a lower success rate with this rule is just saying you'll pay attention and cut if needed.

On the other hand, if you're totally inflexible or relying on it for 100% of income, you might need a high success rate and accept having to adjust income upwards from time to time to avoid dying with more money than you started with.

2. What stresses people and how much varies. If you have all of your core needs covered by guaranteed income why be stressed with 100% or 50 equities?

For 99% success rate on a 30 year plan both 0% and 100% equities give a 2.0% income level. Twenty, forty, sixty and eighty percent give 2.1%. The differences become less small at lower success rates.

3. What HL don't tell you about is state pension deferral, which pays 5.8%. If you want security you could use a 100% success SWR then spend capital to both increase security and increase income.

But it's also important to note that the annuity guarantees no extra increases, while a high success rate SWR usually will have increasss because you're unlikely to live through the worst case that set the limit.

It's perhaps interesting that I tend to advocate state pension deferring and eventually annuity buying to get people into the position where at least their core needs are covered by guaranteed income.0 -

jamesd said:Historic sequences are good because they include the real links between one year and the next. Their disadvantage is that they don't cover every eventuality, so there's a role for Monte Carlo as well. Because those catch some worse sequences their SWR is normally lower. It's nice to see that sort of lower bound as a confidence check on the historic sequences that I prefer.If you're going to assume what happened in the past will happen in the future, then use historic sequences.If you're not going to assume what happened in the past will happen in the future, then you have nothing to go on.The idea of using historic data jumbled in a random way seems pointless. If the future is not going to be a repeat of the past, why assume historic averages will repeat? Future stockmarket returns may be on average lower than past returns. That seems about as likely as average returns being the same but in some random jumbled order.

1 -

I was thinking of something along the lines of 2000-2004, so quite broad and relatively long lasting, if you were well into retirement and 100% in equities thats going to sting.Thrugelmir said:

Which market though? Markets can and do move independently.lvader said:If the market goes into a bear cycle thats generally a good thing if you have many years of adding money to the pot.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards