We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Getting shot of the mortgage sooner than 2049!

Comments

-

In further defence of our gift giving, we only give gifts for each other’s birthday and Christmas.Valentine’s, our anniversary, Mother’s Day and Father’s Day are NOT shop bought gift-worthy holidays here. We do handmade cards (both from the kids but we also both make cards ourselves, it’s cute as is the only time Red crafts 😂). And we have a rule about writing proper long messages inside them.

Sometimes the special person gets a lie in, a cake baked or a special dinner made - if we’re feeling flush we may buy a bottle of something to celebrate or occasionally order a takeaway for valentines. But we definitely save money on all these occasions as I know lots of women who get jewellery etc for anniversaries and Mother’s Day. I’m quite happy with a handmade card though 😆Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)3 -

Ah, okay, written out like that it makes sense. I had forgotten the child-factor (not having any myself), I hope you don’t feel I was picking at you?Better luck with the car this month!! 😉

KKAs at 15.12.25:

- When bought house £315,995 mortgage debt and end date at start = October 2039 - now £227,385

- OPs to mortgage = £12,881 Estd. interest saved = £6,203 to date

c. 16 months reduction in term

Fixed rate 3.85% ends October 2030

Read 80 books of target 52 in 2025, as @ 25th December

Produce tracker: £457 of £300 in 2025

Watch your thoughts, they become your words.

Watch your words, they become your actions.Watch your actions, they become your reality.1 -

Of course not, it’s a very valid point and I’ve had many good tips from commenters on here 🙂 it’s always good to challenge assumptions and try to look at things a different way.Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)2 -

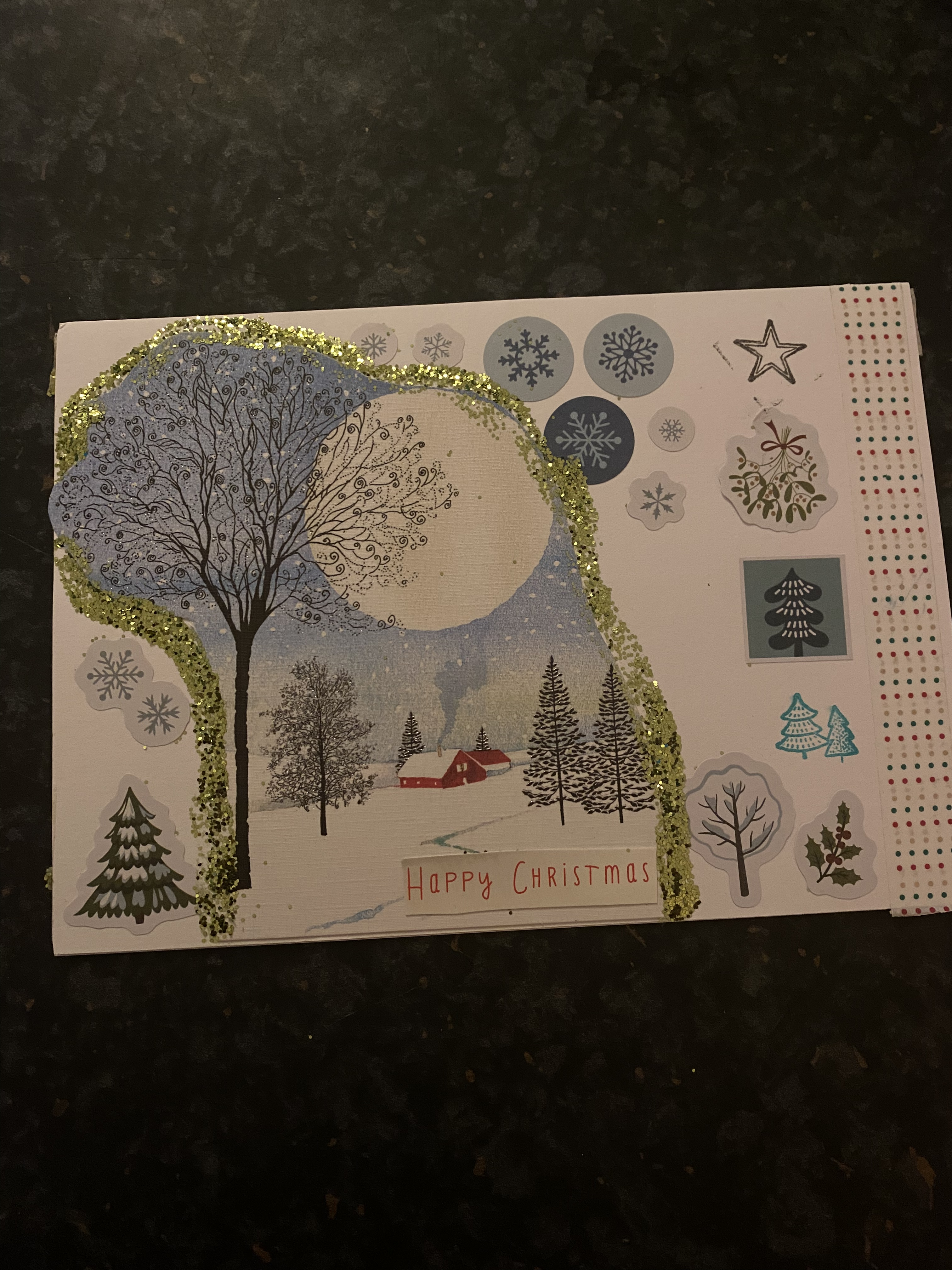

I thought I’d share the Christmas card I made Red this year as I was quite happy with it 😂 as you can see, we don’t aim for a polished finish like the handmade cards you can buy.

I’ve started keeping the fronts of old greetings cards we’re given in a plastic envelope and when the children or I are crafting we pull them out to cut up as you can see in this example 😂We aren’t totally frugal with art supplies - the children have a huge art station in our dining room - but two ways I save are with keeping things like greetings cards, old paintings of theirs and toilet roll tubes to reuse (the key is keeping it organised so you can find it again), and asking my sister to refill their art supplies each Christmas instead of buying them toys 🙂Part time working mum of DS (2015) and DD (2018).

I’ve started keeping the fronts of old greetings cards we’re given in a plastic envelope and when the children or I are crafting we pull them out to cut up as you can see in this example 😂We aren’t totally frugal with art supplies - the children have a huge art station in our dining room - but two ways I save are with keeping things like greetings cards, old paintings of theirs and toilet roll tubes to reuse (the key is keeping it organised so you can find it again), and asking my sister to refill their art supplies each Christmas instead of buying them toys 🙂Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)6 -

That card is beautiful 🤩The one thing I quite enjoy doing is turning Christmas cards into present tags for the following year. They are a lot bigger than the shop bought ones and I get to write something meaningful on the tag related to the gift. I put them away in the spare room in the same plastic box as the Christmas cards and the crackers that Mr KK insists we have …. 🙄😂😉

KKAs at 15.12.25:

- When bought house £315,995 mortgage debt and end date at start = October 2039 - now £227,385

- OPs to mortgage = £12,881 Estd. interest saved = £6,203 to date

c. 16 months reduction in term

Fixed rate 3.85% ends October 2030

Read 80 books of target 52 in 2025, as @ 25th December

Produce tracker: £457 of £300 in 2025

Watch your thoughts, they become your words.

Watch your words, they become your actions.Watch your actions, they become your reality.1 -

Happy New Year all 🙂

Nice chilled out day - we all pitched in taking down the Christmas decorations (takes ages as we have so much up 😂) and went for a lovely walk on the canal.

Stats for 2023

Books read: 1 (ok, I started it the other day but they get counted when they are finished, not started!)

Hours outdoors: 1.5

Emergency fund: £2,284.74 / £7,200 (doesn’t include the Help to Save money)

Craft projects complete: 0

Daily phone use hours: 2hr 25 min (eek!)

Spending today

£29 Monkey’s football

Monthly direct debit

£348.61 Annual car insurance

Unavoidable but large expense for the first day of low spend month 😂

£3.79 Stormsure welly repair glue

In a bid to avoid buying both kids new welliesPart time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)3 -

Ooh, there exists such a thing as welly repair glue …..? I never knew that! Does it work well?

KKAs at 15.12.25:

- When bought house £315,995 mortgage debt and end date at start = October 2039 - now £227,385

- OPs to mortgage = £12,881 Estd. interest saved = £6,203 to date

c. 16 months reduction in term

Fixed rate 3.85% ends October 2030

Read 80 books of target 52 in 2025, as @ 25th December

Produce tracker: £457 of £300 in 2025

Watch your thoughts, they become your words.

Watch your words, they become your actions.Watch your actions, they become your reality.1 -

@KajiKita I’ll let you know once I’ve tried it! 😆Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)2 -

Happy New Year @Bluegreen143 and family, may 2023 be everything you wish for.Fashion on a ration 2025 0/66 coupons spent

79.5 coupons rolled over 4/75.5 coupons spent - using for secondhand purchases

One income, home educating family1 -

Another chilled out day today 🙂 I think I’m denial about having to go back to work on Wednesday though! I’ve so enjoyed this time off.Managed to do quite a bit of tidying. Our downstairs looks great, and much bigger now we’ve put away all the Christmas stuff. Also spent some time in the garden tidying up and pruning fruit trees 😁Frugal wins1. Our eight seater dining table has always been a tiny bit big to comfortably fit in the space we have (and we only have four chairs at it anyway!), so it’s a bit of a squeeze between it and the kitchen island, if more than one of you is going past. Red persuaded me to let him shorten the table today (it’s a really lovely, and not cheap, solid wood table so we don’t want to replace it). The whole dining room actually looks so much better and more spacious and you can’t tell where he’s shortened it because he’s put that side against the wall (he is going to carve the end to match the other end but for just now it’s plain). So it’s a little project that cost us nothing 🙂

2. Made lentil soup and homemade bread for dinner.

3. Baked a tray of flapjack for Monkey’s school snacks once he’s back.

Stats for 2023

Books read: 2

Hours outdoors: 3

Emergency fund: £2,284.74 / £7,200

Craft projects complete: 0Average daily phone use (this week): 3hr 8 min (eek!)

Spending today

£6.99 Netflix

£160 Car loan

Repayment to my mum - new loan balance £4,860Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards