We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Getting shot of the mortgage sooner than 2049!

Comments

-

Hugs for the poorlies and 👏 for the improv meal 😊

I have a feeling that I should take a lesson from you about social media ….

KKAs at 15.12.25:

- When bought house £315,995 mortgage debt and end date at start = October 2039 - now £227,385

- OPs to mortgage = £12,881 Estd. interest saved = £6,203 to date

c. 16 months reduction in term

Fixed rate 3.85% ends October 2030

Read 0 books of target 52 in 2026 as @ 1st January

Produce tracker: £0 of £400 in 2026

Watch your thoughts, they become your words.

Watch your words, they become your actions.Watch your actions, they become your reality.3 -

Only in dire straits @Baileys_Babe. He’s quite willing, but it doesn’t make financial sense as he loses a day’s pay AND his bonus, which is only paid if they have no sick days or unpaid leave! While me doing it stresses me out, it doesn’t cost us anything. So we only get him to stay off if I can’t (eg if they are still ill on Wednesday he will have to, because I have an away day to go to and can’t work from home).Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)2 -

Meant to pop over before to say how exciting about Paris, it will be lovely for you to get away for a few days.

My kids just seem constantly ill right now, DS is just getting over an ear infection and has a terrible cough (again!) and DD is now getting the cough (again!). 😩 Hope your two are better for school.

The social media skincare craze with the young girls is so odd to me as a lot of the products (although not all) are expensive and actually not for young kids but older skin.I don't think it's a bad thing to look after your skin from a (relatively) young age but 9/10 seems very young. I do think the pressures of SM are dangerous to kids in so many ways though and would like to keep mine away from it as long as I can. Realistically though, I will only be able to do that for so many years and don't want to have them doing it behind my back as that then has its own dangers! It's so difficult and obviously this is only in theory as mine are only 6 & 4!

I must admit that I'm on SM quite a bit, I'm in skincare and running groups and enjoy the chat and information but can also see how it can be a toxic place at times. It's also an alarming time sink and I need to be careful not to waste time scrolling away instead of doing things IRL. It must be so much harder for kids/teens who haven't fully developed their impulse control as it's so addictive.Success is not final, failure is not fatal: it is the courage to continue that counts. Car loan 1 £9,707 Car loan CC 0% BT £4500. Debt Free Diary to try & keep spending in check.3 -

Ah Sashy, the illness is never ending this time of year isn’t it! Fingers crossed your two are better soon as well.

Had a really lovely walk this afternoon. I needed a break - I rarely feel like I need a break from the kids now, because they are good company/not hard work now they’re older, and we are apart so much because of school/work anyway.But after this dire week almost being house-bound plus flying solo yesterday (Red was out having a day air softing with my sister’s husband, which I do not begrudge him at all!) I did feel like I needed to get OUT. I would have been happy to go out with the kids, but Bambi was still feeling unwell and Monkey didn’t want to come, so I went by myself.

A glorious hour and a half getting muddy along the river, through the woods makes all the difference when I have a low mood. I didn’t hurry, and took the time to go right to the river’s edge and dip my hands in - it wasn’t as cold as you might think and I was tempted to get my feet in, if I’d had a little towel with me I probably would have as I’ve waded in at that part lots of times in the summer. I LOVE getting my feet in the sea or any kind of outdoor water, I find it so relaxing and grounding.Because I was by myself and didn’t take headphones, I had a lot of time to think. I’ll share more later as it would take me an age to write all my thoughts down! But I was thinking very deeply on meaning and fulfilment in life - on how I can align my finances better with the kind of life I’d like to live. And lots of thoughts on how I’d like to build a closer-knit community around ourselves.Before my walk, I went and did the shopping at Tesco. I don’t know if I said, but my online order got cancelled on the day last Sunday and that’s the third time that’s happened with short notice in the past two months (and the first time, they didn’t refund me and I had to call and hassle them to get it). So this is why I went in person today, I’m a bit disillusioned with the grocery delivery thing atm!I spent £119.58 in total. I’ve indicated brands if it was value or premium, everything else would just be Tesco brand:

FRUIT & VEG

Grapes

Raspberries (finest)

Vine cherry tomatoes (finest)

Broccoli

Avocado x2Frozen petit pois

Coriander

Garlic bulbs x2

Celery

Mushrooms

Limes x5

Bananas x9

Cavolo Nero (finest)

Spring onions

Sweet gem lettuce

Ginger

Lemons x4

Peppers 3pk

Canteloupe melon

MEAT & DAIRY

Greek yoghurt (creamfields)

YS haddock fillets x4 (reduced from £8.80 to £2.20!!)

Whole milk 4 pints x2

Bacon 10 rashers

Butter x2

Parmesan

Chicken breast 1kg

Extra mature cheddar

YS trout fillets x6 (finest) £4.47 instead of £17.85!

Smoked ham (finest) x2

OTHER

Tinned black beans x2

Tinned chickpeas x2

Canned Potts chicken stock x2

Canned Potts beef stock

Honey (Stockwell)

Strong white flour

Instant coffee

Passata x2

Extra virgin olive oil

Tomato puree

Tinned tuna x2

Tinned butter beans

Tinned cannelini beans

Crunchy peanut butter 1kg (nuts about nature)

Chopped tomatoes x4 (grower’s harvest)

Macaroni 1kg

Tinned green lentils

JUNK/PROCESSED

Crisps 6pk x2

Seeded loaf

Diet cola (tesco) x4

2x kids’ lollies (placebo for helping a sore throat! 😂)

HOUSEHOLD

Burts bees lip balm x2

Sure deodorant

Toilet roll (Springforce)

Button batteries (Duracell)

Seems such a lot! But as you can see, we ran out of almost all tinned goods, olive oil and butter this week 😂

I was really pleased about the YS fish because our Tesco is really, really rubbish for YS. I don’t normally even look at it because they normally only knock about 20p off even when stuff is wilted and at death’s door 🙄 it’s all been slung in the freezer. There are two meal’s worth of trout, because the kids would share a fillet between them, and a big meal’s worth of haddock for making HM fish fingers.Unfortunately I forgot to get kids’ nurofen, which we needed, so I ended up back in Tesco after my walk 🙄 a further £14.55 spent on nurofen, vitamin D (for me) and vitamins for the kids (alleged immune support ones with C, D and zinc among others). I’m not normally a vitamin believer, but have been meaning to get vitamin D for a while as I think we probs should take it in the winter.Dinner tonight was pot roast brisket with carrots, peas and mashed potato/sweet potato. Monkey normally hates this kind of food, and we didn’t get any potato in him (his most hated food of all) beyond a pea-sized taste, but he did eat loads of beef with bread, plus all his veg, so I’m counting that as a win!Bambi conversely normally loves meat and potato food but was still under the weather and very awkward about eating anything, so you can’t win them all 😂

I have a portion of brisket and veg left for lunch. Mad though how you can spend over £10 now on a joint of meat which only feeds your family once, with just one leftover lunch!Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)4 -

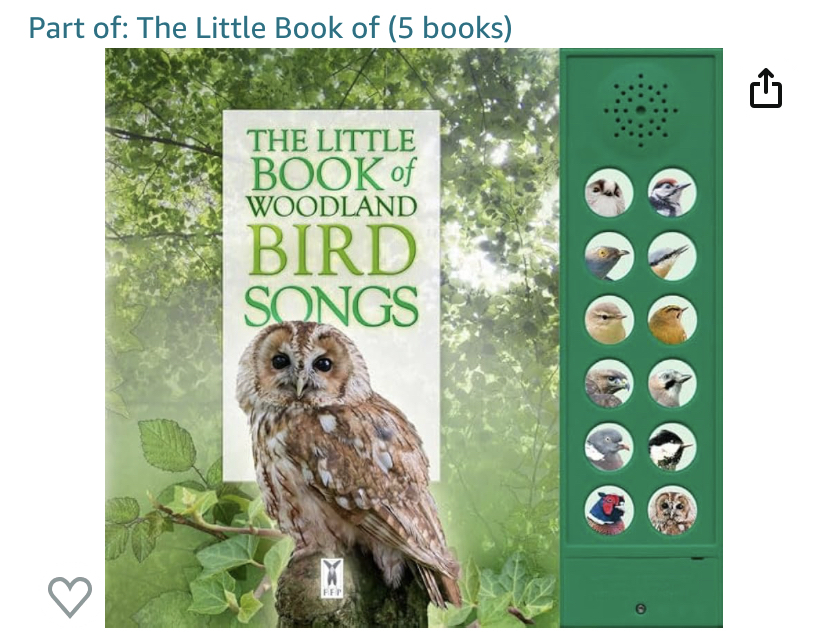

Oh forgot to say. Red had some very frugal fun with Monkey today doing the RSPB bird watch thing while I was shopping. Monkey got very into it and they sat in the conservatory for the hour with his binoculars and several bird books 😍 it’s amazing how many little birds you notice if you actually sit and look for them!If anyone has little ones who are into birds, my two have books with sound buttons for playing recordings of real bird calls - one for garden birds and one for woodland birds - the series has more general animal books too (my kids also have the night time animals with the calls of creatures like badgers and owls, and a safari animal version with hyenas and cheetahs etc too).Unlike most “sound books” which are aimed at babies, these are really educational and they’ve loved them for years.

Part time working mum of DS (2015) and DD (2018).

Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)1 -

Have you tried Waitrose for food deliveries.I find them excellent & order mainly Waitrose essentials.I am a Forum Ambassador and I support the Forum Team on Mortgage Free Wannabe & Local Money Saving Scotland & Disability Money Matters. If you need any help on those boards, do let me know.Please note that Ambassadors are not moderators. Any post you spot in breach of the Forum Rules should be reported via the report button , or by emailing forumteam@moneysavingexpert.com. All views are my own & not the official line of Money Saving Expert.

Lou~ Debt free Wanabe No 55 DF 03/14.**Credit card debt free 30/06/10~** MFW. Finally mortgage free O2/ 2021****

"A large income is the best recipe for happiness I ever heard of" Jane Austen in Mansfield Park.

***Fall down seven times,stand up eight*** ~~Japanese proverb. ***Keep plodding*** Out of debt, out of danger. ***Be the difference.***

One debt remaining. Home improvement loan.3 -

No I haven’t @beanielou, always thought that would be more pricey 🤔 I suppose I could test it out and do the same order on both to see what the difference is.Red gets paid at midnight tomorrow and (having put some petrol in the car this AM) I don’t think I have any further anticipated spending this calendar month 🤞🏼 so going to round it up below with some thoughts inspired by Your Money or Your Life.

Note of “hours of life energy cost” - For the purpose of the “real hourly wage” exercise, I’ve worked this out as an average of £15p/h for both of us, inc pension contributions, minus taxes/commute costs etc.

Note - this is not a full month as I was over a week in when I signed up to YNAB again. The mortgage and car loan and internet/TV license/Netflix had already been paid, I’d done a big shop and had filled the car.NEEDS £1,194.16

Life insurance - £28.39 1.89hr

Council tax - £334 (two months’ worth) 22.27hr

Energy - £269.73 (actual use) 17.98hr

Nursery fund - £32.98 (monthly levy for consumables, our only childcare cost, will end in June when she leaves nursery) 2.2hr

Groceries - £486.80 32.45hr

Petrol - £35.27 2.35hr

Car maintenance - £6.99 (screen wash) 0.46hr

WANTS (family) £488.50

Subscriptions - £12.99 (YNAB) 0.87hr

Learning - £30.96 (swimming entry x2, kids’ books) 2.06hr

Home - £12.99 (spray mop) 0.87hr

Celebrations - £175.86 (many birthdays, yearly photo book) 11.72hr

Adventures - £68.95 (archery expenses, new kids’ sledge) 4.6hr

Paris trip - £121.75 (travel insurance and new passport) 8.12hr

WANTS (me) £159.71

Subscriptions - £48.16 (phone bill, online membership) 3.21hr

Clothes & make up - £82.60 (2x dresses, make up) 5.51hr

Hobbies & books - £19.25 (kindle books & planner) 1.28hr

Fun/misc - £9.70 (2x work lunches) 0.65hrI’m going to come back later and do the reflective questions from the book, but it’s already interesting to go back to thinking of spending in terms of hours of life energy.I’m interested, for example, to learn that I’ve spent 5.5 hours working this month to pay for clothes and make up, and I’m curious as to whether I’d feel the need to have bought those if I had achieved FIRE and wasn’t working 🤔 I’m also surprised at the nearly 12 hours for Celebrations, though we do have a lot of birthdays in Jan - it was MIL’s birthday, Red’s sister’s 50th, BIL’s birthday, and the kids had three birthday parties.Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)3 -

Interesting, I've never worked out that calculation! That does indeed sound like a lot of celebratory activity in one day (EDIT: Month, obviously 😂) 😂1

-

I did an exercise a while back where I worked out my hourly rate in my job, after tax and pension contribution (literally take home pay per month) but including commuting time in my working hours I.e. how many hours I wasn’t living MY life - so how long it takes to earn £10, £50, £100 etc. It was very illuminating and made me reflect on what I was spending on and if it was really worth it.KKAs at 15.12.25:

- When bought house £315,995 mortgage debt and end date at start = October 2039 - now £227,385

- OPs to mortgage = £12,881 Estd. interest saved = £6,203 to date

c. 16 months reduction in term

Fixed rate 3.85% ends October 2030

Read 0 books of target 52 in 2026 as @ 1st January

Produce tracker: £0 of £400 in 2026

Watch your thoughts, they become your words.

Watch your words, they become your actions.Watch your actions, they become your reality.4 -

How are you enjoying being back at YNAB? These immediate reports are for me a big part of the benefit - so easy to see where we are choosing to spend our money - I have not done the hr of work life calculation

on your dresses - I am also a dress lady - the sheer effort of having to find tops - I refuse to do it and they are so easily dressed up or down

my teenage niece ‘s Xmas list changed last year and had things like Dior lip oil on (14 yrs old!)

she now loves Charlotte Tilbury but it’s so expensive cos of the branding - and I don’t think it’s that great and certainly not better than MAC

on creams the No 7 boots range are all great and they have deals such as 3 for 2 a lot

DON'T BUY STUFF (from Frugalwoods)

No seriously, just don’t buy things. 99% of our success with our savings rate is attributed to the fact that we don’t buy things... You can and should take advantage of discounts.... But at the end of the day, the only way to truly save money is to not buy stuff. Money doesn’t walk out of your wallet on its own accord.

https://forums.moneysavingexpert.com/discussion/6289577/future-proofing-my-life-deposit-saving-then-mfw-journey-in-under-13-years#latest1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards