We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

What constitutes official advice

stcyrus

Posts: 55 Forumite

in Cutting tax

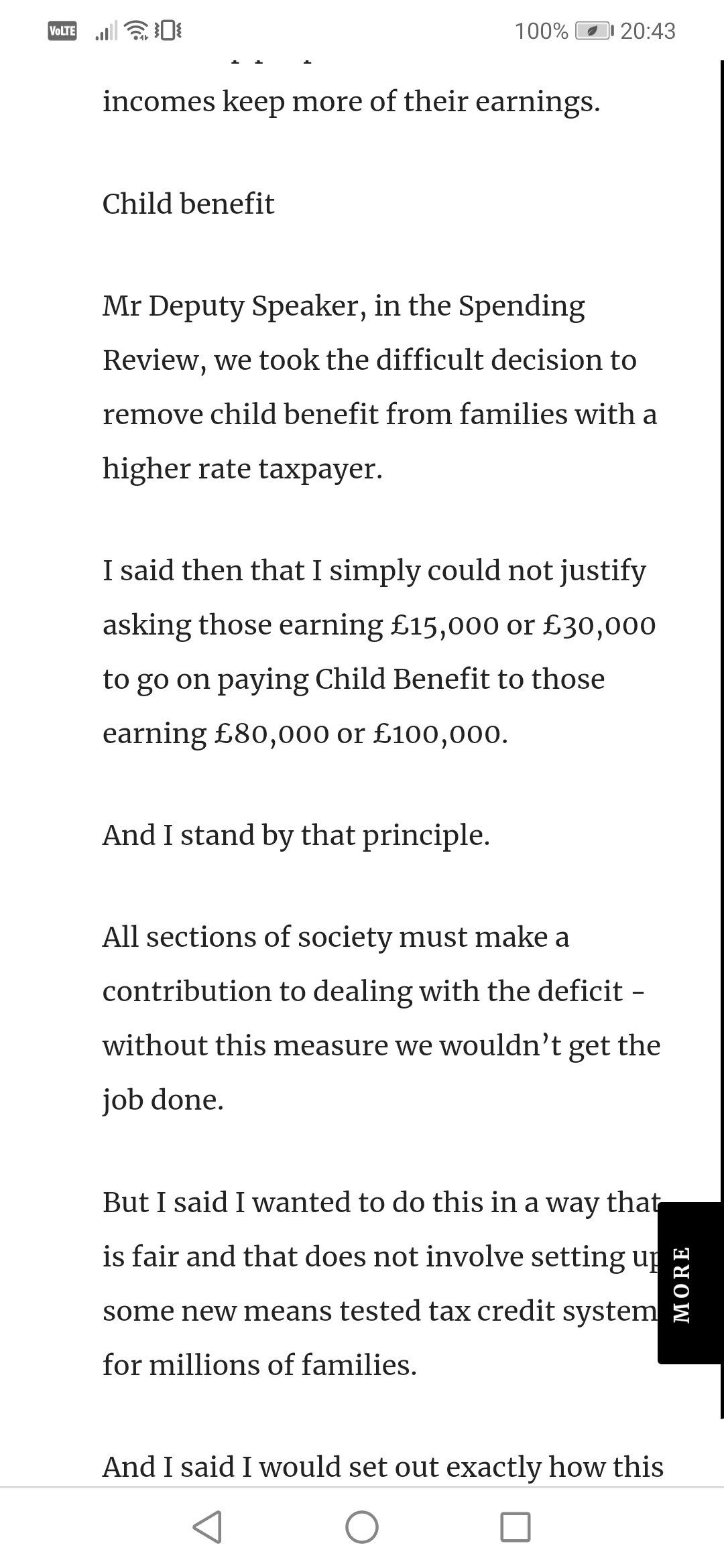

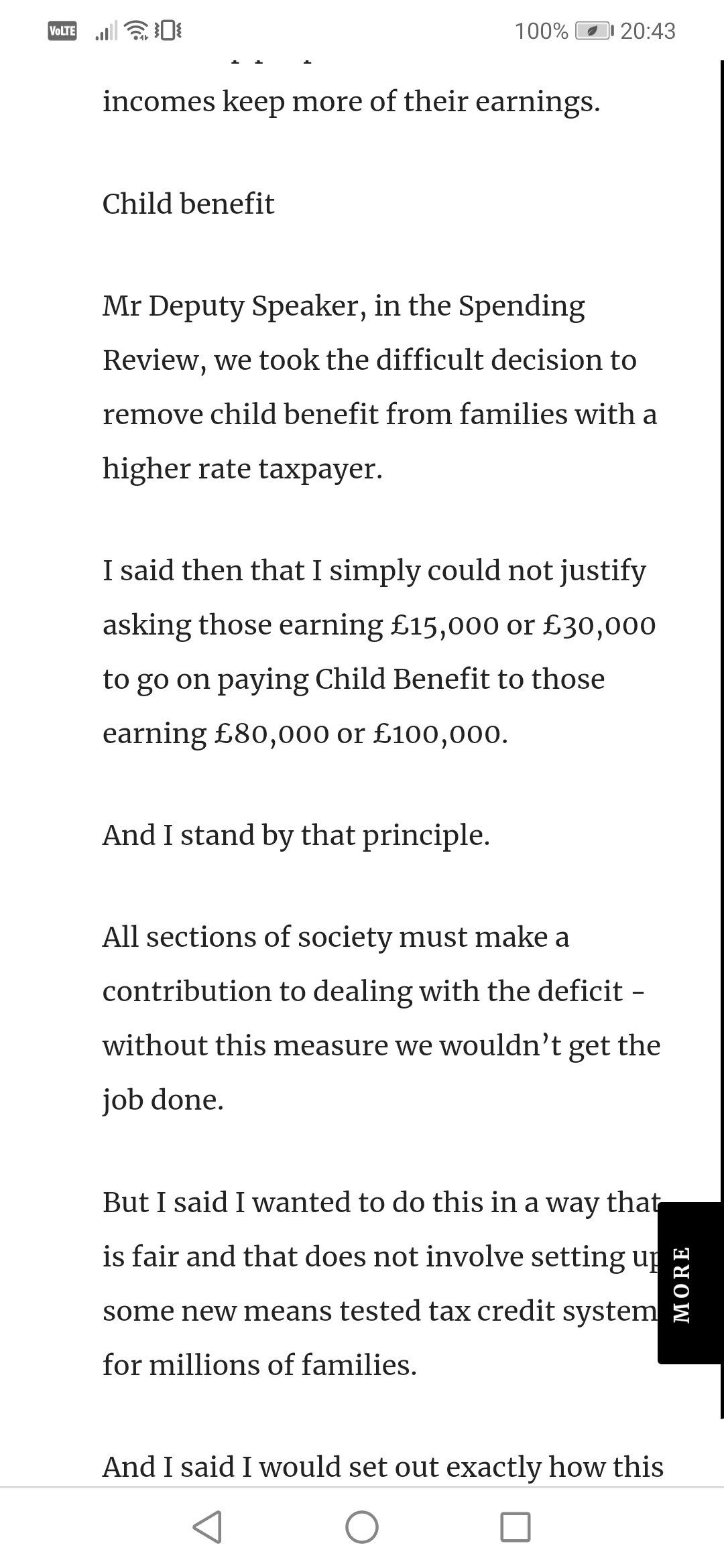

I was reviewing the march 2012 UK budget speech by the the then chancellor George Osborne.

Under the high income child benefit charge he set out the premise that

would this be classified as official advice. The person making the speech is of a senior position, the speeches content would have been vetted for factual errors the content of the speech was disemmenated by print and TV media.

would this be classified as official advice. The person making the speech is of a senior position, the speeches content would have been vetted for factual errors the content of the speech was disemmenated by print and TV media.

Now I understand that the Hicbc used earning levels 50 % lower at 50, 000 as the starting point for the "taper" which to me seems disingenuous as the premise of the argument is firmly ankored at a far higher income level. £80000.

Would it be reasonable for an individual to come to the conclusion that the threshold would be £80000 based on the speech made.

For clarity the lower figures are outlined later on in the speech but the rationale is as reproduced above.

Regards

Under the high income child benefit charge he set out the premise that

would this be classified as official advice. The person making the speech is of a senior position, the speeches content would have been vetted for factual errors the content of the speech was disemmenated by print and TV media.

would this be classified as official advice. The person making the speech is of a senior position, the speeches content would have been vetted for factual errors the content of the speech was disemmenated by print and TV media. Now I understand that the Hicbc used earning levels 50 % lower at 50, 000 as the starting point for the "taper" which to me seems disingenuous as the premise of the argument is firmly ankored at a far higher income level. £80000.

Would it be reasonable for an individual to come to the conclusion that the threshold would be £80000 based on the speech made.

For clarity the lower figures are outlined later on in the speech but the rationale is as reproduced above.

Regards

0

Comments

-

Does it also mean that only people being paid £15k or £30k are the only ones paying toward CB for those being paid £80k or £100k?

It is an intro so doesn't necessarily have the complete details just an idea of the aim of the change.0 -

Firstly, that doesn't constitute official advice. The £15k, £30k, £80k, £100k figures are giving the rationale behind the decision.

Secondly, before mentioning any of those figures£, it says "decision to remove child benefit from families with a higher rate tax payer."

The taper has been exactly aligned with tax bands.0 -

Thanks for your replies.

On the question of reasonable Would it be reasonable for an individual to come to the conclusion that the threshold would be £80000 based on the speech made or in that region of earnings.

The reasonable individual not been a tax expert or specialist in uk tax law

0 -

No.stcyrus said

Would it be reasonable for an individual to come to the conclusion that the threshold would be £80000

It clearly says, before mentioning £80k, it will apply to "higher rate tax payer".

A reasonable person can use a search engine to find out when higher rate tax comes in if they do not know.

Why is this old speech of interest?2 -

No, especially because the paragraphs right after the bit you've quoted states:stcyrus said:Thanks for your replies.

On the question of reasonable Would it be reasonable for an individual to come to the conclusion that the threshold would be £80000 based on the speech made or in that region of earnings.

The reasonable individual not been a tax expert or specialist in uk tax lawAnd I said I would set out exactly how this measure would be implemented in this Budget.

We want to avoid a cliff-edge that means people lose all their Child Benefit when they earn just a pound more.

So I can today confirm that instead of withdrawing child benefit all at once when people earn more than the higher rate threshold – the benefit will only be withdrawn when someone in the household has an income of more than £50,000.You keep using that word. I do not think it means what you think it means - Inigo Montoya, The Princess Bride0 -

I have had personal reasons to look into the HICBC and at each turn I find it to be more farcical. The justification that an individual earning 80,000 should have a universal benefit removed plays well to the masses, far less so when the individual earns 50000. That is why Mr Osborne opted to us the figures he did. As the COE he made a choice to be less than clear on the people who would be impacted. I consider this aspect of the speech to be misleading and crafted to obscure.

When a state official chooses to obscure then the state can hardly claim its the individual who is at fault0 -

Do we gather from all this that you have become liable to the HICBC and are trying to find a way to mitigate any penalties or late payment interest?

Or is there some other reason?1 -

https://forums.moneysavingexpert.com/discussion/6186609/high-income-child-benefit-charge-letter/p1Dazed_and_C0nfused said:Do we gather from all this that you have become liable to the HICBC and are trying to find a way to mitigate any penalties or late payment interest?

Or is there some other reason?

2 -

It depends who you class as "the masses", many do not agree with the payment of child benefit at all, others think it should be universal. If we think that income over £50k pa should be charged at 40% (up to the additional rate threshold and removal of personal allowance) then it would be reasonable that was also the taper point for child benefit, if one accepted the principal of tapering child benefit.stcyrus said:The justification that an individual earning 80,000 should have a universal benefit removed plays well to the masses, far less so when the individual earns 50000.

He was making an example to allow people to begin to understand, the policy was later refined and published.stcyrus said:That is why Mr Osborne opted to us the figures he did.

You might, in my opinion you would be wrong. He made a speech, later, the policy was defined, published, worked it's way through parliament, was commented on in the news extensively for over a year and finally was made law and brought into force. None of that was designed to mislead or obscure.stcyrus said:As the COE he made a choice to be less than clear on the people who would be impacted. I consider this aspect of the speech to be misleading and crafted to obscure.

The official was not obscuring. Are you saying you watched the 2012 speech, the ignored everything else in the news since? If so that would be a very odd course of action. The change was incredibly well communicated, both in the news media and with HMRC sending notifications via email (if subscribed) and letters to those in receipt of child benefit, new applicants were also notified at the point of application. If you chose to ignore or not read those notifications and ignore the news and government published information for years then that is your fault, not that of the government.stcyrus said:When a state official chooses to obscure then the state can hardly claim its the individual who is at fault

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards