We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Increase to Minimum Pension age from 55 to 57 on 6th April 2028

Comments

-

Thanks for posting that reply. It seems a bit strange Fidelity can't provide a clear answer to this question. The Finance Act that legislated for these changes was passed over a year ago now, 24th February 2022 to be precise. They must employ at least one person (if not more) who should know this stuff inside out and ought to be giving clear answers to reasonably straightforward questions like this. Grumble, grumble.ussdave said:

I chased Fidelity again and got a fairly straight answer from them. Sadly it's a "we don't know yet" answer, but at least it was fairly clear.Having checked with the pensions team, I can confirm the below:

Your Fidelity SIPP was opened before 4 November 2021. As such, it benefits from a protected pension age of 55, which will apply to any past and future contributions added to your pension.

If you decide to transfer any other pensions you may hold into your Fidelity SIPP, we are waiting for Treasury confirmation on whether these funds will also benefit from your Fidelity SIPPs protected pension age of 55, or whether the age when you can access the transferred funds will depend on the rules of the scheme the funds are transferred from.

Please also note that tax treatment depends on individual circumstances and all tax rules may change in the future.

1 -

"State pension age rise to 68 will not be brought forward - government to say":

https://www.bbc.co.uk/news/business-65120317

Sounds positive...1 -

Or rather kick the can down the road after the general election. 😉

0 -

Quite possibly, but that can kicking might just get us close enough to the existing timescales to make changes, with appropriate notice(?), not worth it...🤞0

-

The 5 year review is set in law. The Government is required to take into account what the review said. The previous one said hold off as life expectancy increases are slowing but wait for more data, and apparently, the latest review says the same. We will know once it is published. So, it was probably more down to luck than anything else.JoeCrystal said:Or rather kick the can down the road after the general election. 😉I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.3 -

Picking up a thread of discussion started elsewhere...Alexland said:masonic said:It seems it is not as straightforward as I thought. If it is correct that a transfer from a scheme with a protected NMPA to one without protection will have the transferred benefits ring-fenced and still accessible at age 55, then I need to look right back to the origin of the contributions. For me, all of my contributions have been made into a workplace scheme and then transferred out, so I'd need to look back as far as a GPP held with Axa, which became Friends Life, which became Aviva, whereupon I made a couple of partial transfers to create my SIPPs. I would only need to find enough protected money to cover a maximum of 2 years PA when I am 55 (assuming I no longer have any earned income by that point). It would just give me an additional couple of years of the window in which I could potentially draw down a tax free income before the state pension kicks in.I'm guessing you have read something I haven't seen can you share the link please? Maybe we should continue on the relevant thread in the pensions board? As I understood it you don't go back as far as the origins of the contributions just the rules of the scheme on 11th Feb 2021 that held the assets with nobody joining from 4th November 2021 getting the benefit of the earlier access age.I have not seen anything stopping someone transferring assets from their age 55 scheme to another provider just that nobody in the market seems to be confirming they will preserve the access age. For example some providers whose customers did not benefit from the protection may prefer to keep their IT systems simple and not to offer an earlier access age to those transferring in and may even want to decline the transfer unless the customer evdences they have no desire to use the earlier access they might surrender, etc.The articles I found around this, both authored by individuals at AJ Bell, suggest that transferred benefits would retain ringfencing:"When someone transfers from a scheme with a ‘protected pension age’ to one without a protected pension age, they will be able to retain the lower pensions access age on the transferred funds."and"There are also complexities regarding transfers. A transfer from a scheme with a protected NMPA to one without protection will have the transferred benefits ring-fenced and still accessible at age 55. So two retirement ages in one scheme. If a block transfer is made with at least one other person, then all the benefits under the new scheme will inherit the protected age of 55, and this is without the need to crystallise everything at the same time. This will complicate matters from a planning perspective and will also cause issues with simpler statements and providing information on the pension dashboard."This appears to be the relevant section of the Pensions Tax Manual backing this up:It is noteworthy that the whole arrangement must be transferred in order to qualify for the retained protection, so for example where I have made a partial transfer, then some years later transferred out the replenished GPP account in full, only the latter could qualify.0

-

I agree it's possible but surely the assets will only be able to retain the protected access age if the receiving scheme offers it within their revised scheme rules? It's a business decision for the trustees of the scheme and their administrator if they want to implement the IT functionality and business processes to support the ringfencing of assets by access age. I haven't seen anything that compels them to do this or accept transfers from those looking to preserve early access age? I've also not heard of anyone doing such transfer recently and finding that their assets have been segregated.masonic said:This appears to be the relevant section of the Pensions Tax Manual backing this up:Also I can't see anything in those links that mentions the source of the contributions going back years earlier just that the assets were in a scheme in 2021 that either did or didn't get the protection. I am still not aware for your situation if AJ Bell have yet made a statement about their interpretation of their own scheme rules on 11th Feb 2021.0 -

Alexland said:

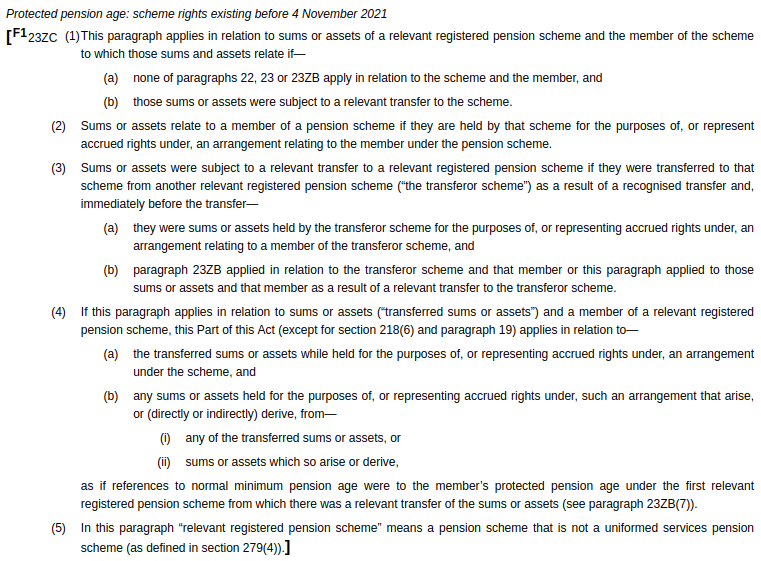

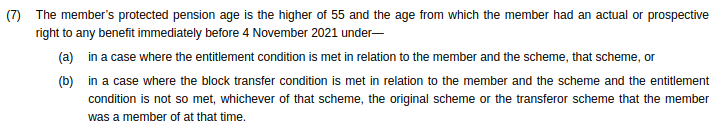

I agree it's possible but surely the assets will only be able to retain the protected access age if the receiving scheme offers it within their revised scheme rules?masonic said:This appears to be the relevant section of the Pensions Tax Manual backing this up:That's not a question I can answer, but the answer would lie in the relevant legislation 23ZB(7):

23ZB(7):

IANAL, but my reading of the above is that the legislation itself protects the accrued rights upon transfer "as if references to [NMPA] were to a member's protected pension age under the first relevant registered pension scheme..."Alexland said:It's a business decision for the trustees of the scheme and their administrator if they want to implement the IT functionality and business processes to support the ringfencing of assets by access age. I haven't seen anything that compels them to do this or accept transfers from those looking to preserve early access age? I've also not heard of anyone doing such transfer recently and finding that their assets have been segregated.To my mind, it cannot be in the gift of the pension provider. That would be unsatisfactory on a number of levels, including that the protection could be removed at any time, through mergers/takeovers, or even changes to the scheme rules. For those of us still some way off NMPA, this lack of durability would be highly concerning. It seems from my reading, however, the member's protected pension age is a matter determined entirely within the legislation. Any attempt by the scheme to prevent a member from accessing from their protected pension age would therefore be possible to the extent that the scheme could ordinarily choose its own minimum access age above the NMPA.All just my legally uninformed opinion of course and perhaps some legal cases are needed to bring clarity.

Neither am I, but I don't hold up a great deal of hope for that. My best avenue of pursuit is probably my full transfer directly from Aviva to Fidelity, although I don't know if ex-Friends Life GPPs had a protected pension age. The whole situation looks such a mess that I can easily see it changing again before I get there!Alexland said:Also I can't see anything in those links that mentions the source of the contributions going back years earlier just that the assets were in a scheme in 2021 that either did or didn't get the protection. I am still not aware for your situation if AJ Bell have yet made a statement about their interpretation of their own scheme rules on 11th Feb 2021.0 -

Yup and in the meantime Fidelity can charge me whatever they like (hope they are not reading this) as there's no way I am doing any transfers that might jeopardise my pension access age...masonic said:The whole situation looks such a mess that I can easily see it changing again before I get there!

0 -

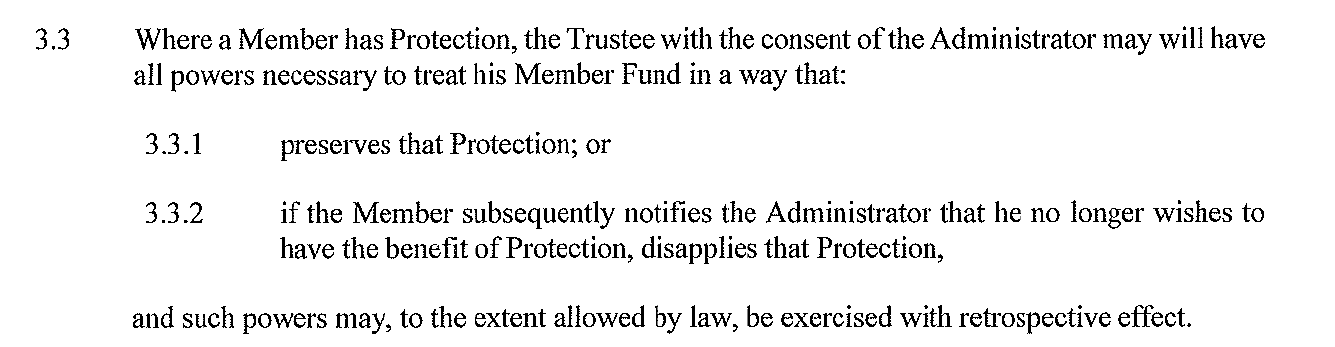

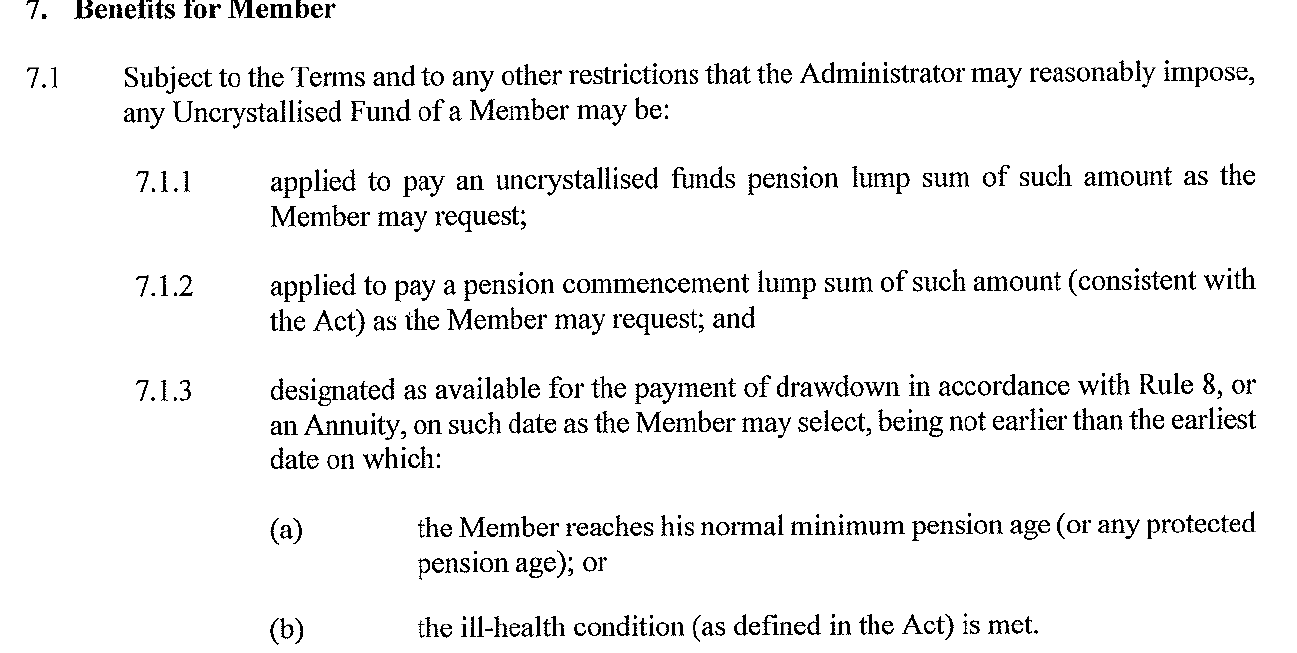

This echos what I was thinking based on what I'd read; the protected right is granted if the scheme rules offered an unqualified right in Feb 21. I've been speaking to Vanguard and they seem to be taking the view that they are not offering drawdown at 57 and declare that as if it's the end of the issue. What I'm trying to understand is whether the right exists irrespective of you pension providers willingness to implement that right for you. If it does then there could be scope to transfer to a provider who offer an age 55 protected right. Hopefully by 2028 we might have a couple of providers who are firmly offering this. I'm stil trying to work out if vangaurd scheme rules offer a protected right. I can't totally fathom them but these seem to be the most likely clauses which would determine it if anyone with a good head for legals can help:?masonic said:To my mind, it cannot be in the gift of the pension provider. ...... It seems from my reading, however, the member's protected pension age is a matter determined entirely within the legislation. Any attempt by the scheme to prevent a member from accessing from their protected pension age would therefore be possible to the extent that the scheme could ordinarily choose its own minimum access age above the NMPA.

0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards