We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

40% tax bracket

newcastle_1986

Posts: 7 Forumite

in Cutting tax

Hi All

probably a silly question and i apologise if it is

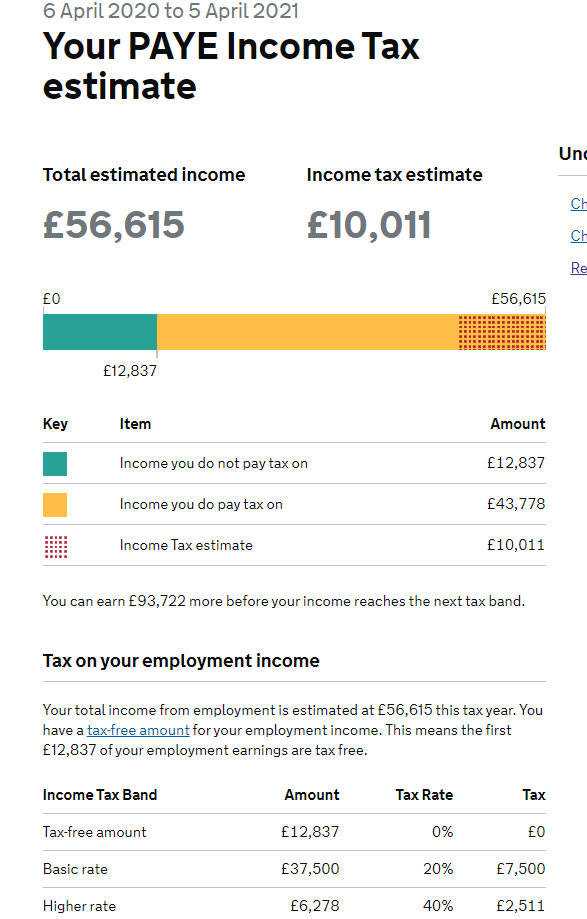

if earn above £50,000 which this year im estimated to make £56,000

will i only see the extra tax deductions on my last 2 payslips once i hit the 50k or does it average out over the 12months im a bit lost

Tax Code: 1282L Cumulative Tax Period: 2020 / 10 is my current tax code

probably a silly question and i apologise if it is

if earn above £50,000 which this year im estimated to make £56,000

will i only see the extra tax deductions on my last 2 payslips once i hit the 50k or does it average out over the 12months im a bit lost

Tax Code: 1282L Cumulative Tax Period: 2020 / 10 is my current tax code

0

Comments

-

my current details on payslip for january

Total gross 47,337.15

Taxable pay 47,463.05

Tax paid 8,458.80

Employee NIC 4,158.14

0 -

It is averaged out over the whole year. January is month 10 and any earnings above 41940 at that point since the start of the tax year (10/12 x50329) would be charged at 40%. So, you have already had earnings of 5523 which had tax deducted at 40% rate. Your personal allowances appear to be 12829 which, added to the basic rate band of 37500, equates to 50329, the amount that you can earn in this tax year without having any deducted at 40%.

Strange that your taxable pay, which I have used, exceeds your gross pay?1 -

By my rough calculation you're going to pay about £11,400 in income tax this year (assuming you earn £56k). So over the next two months you're going to pay about £1,500 per month in tax. So almost double what you've paid in the last 10 months.

Is your monthly salary a steady amount? Did your employer know at the start of this tax year that you were going to earn £56k this year? This might explain why you won't have paid the same amount of tax each month.

It might be worth putting £4,800 (£6,000 gross) into a pension, if you can afford. Then you can claim back the higher rate tax you've paid.1 -

ah great so my next 2 payslips should still be the same? im not going to see a crazy tax figure for my last 2 months am i?1

-

You have been paying higher rate tax all along! If your salary of the next two months is the same as for January, the tax will be the same.1

-

my pay is different every month due to my job and most pay is from bonus

that makes sense now, so if i have £1500 tax to pay it will be £750 a month for the next 2 months which is what i usually pay

thanks for the help guys!

0 -

Very rough🤔 - you are about £1700 out. I make it 9768 tax due on 56k.El_Torro said:By my rough calculation you're going to pay about £11,400 in income tax this year (assuming you earn £56k). So over the next two months you're going to pay about £1,500 per month in tax. So almost double what you've paid in the last 10 months.

Is your monthly salary a steady amount? Did your employer know at the start of this tax year that you were going to earn £56k this year? This might explain why you won't have paid the same amount of tax each month.

It might be worth putting £4,800 (£6,000 gross) into a pension, if you can afford. Then you can claim back the higher rate tax you've paid.1 -

Looks like I need to brush up on my "back of a fag packet" calculations. I think I might have double counted somewhere. Anyway, at least there were others here to provide the correct information[Deleted User] said:Very rough🤔 - you are about £1700 out. I make it 9768 tax due on 56k. 1

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards