We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Mortgage with bad credit

poppyegg22

Posts: 21 Forumite

Me and my partner are looking for a mortgage. He has no history of anything ‘bad’ on his credit file but I have a few missed payments over the years the last one dated august 2019. I am stressed and losing sleep that this means we won’t get a mortgage. At present I don’t owe any credit on anything.

0

Comments

-

@poppyegg22 FWIW, if all that's adverse on your credit file is a few missed payments from 18+ months ago, that by itself shouldn't stop you from getting a mortgage.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Thanks for the reassurance. I have done a credit check on checkmyfile and I’ve got 2 adverse accounts from these missed payments but like I said the last missed payment was august 2019. Checkmyfile has me in the red part saying I need more work.I don’t have any finance or anything now and my partner doesn’t and never has. He has an Argos card but has always made payments and has never borrowed much on it. I have had car finance in the past but it has now ended and I paid it off last April.I am an overthinker and a worrier0

-

Your other post says August 2020 was last missed payment. Which was it?

In any event I do not think it will prevent you getting a mortgage, but you may find your options more limited at 90% if it was August 2020.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.2 -

August 2019, that must’ve been a misprint. Last one was definitely august 2019.0

-

It will have to pass credit score and there are some lenders I would be more inclined to avoid than others but I think you will be fine.

Just for the record, a few late payments is not the same as defaults or a DMP, your not in a similar position to the other poster so no need to worry so much.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.2 -

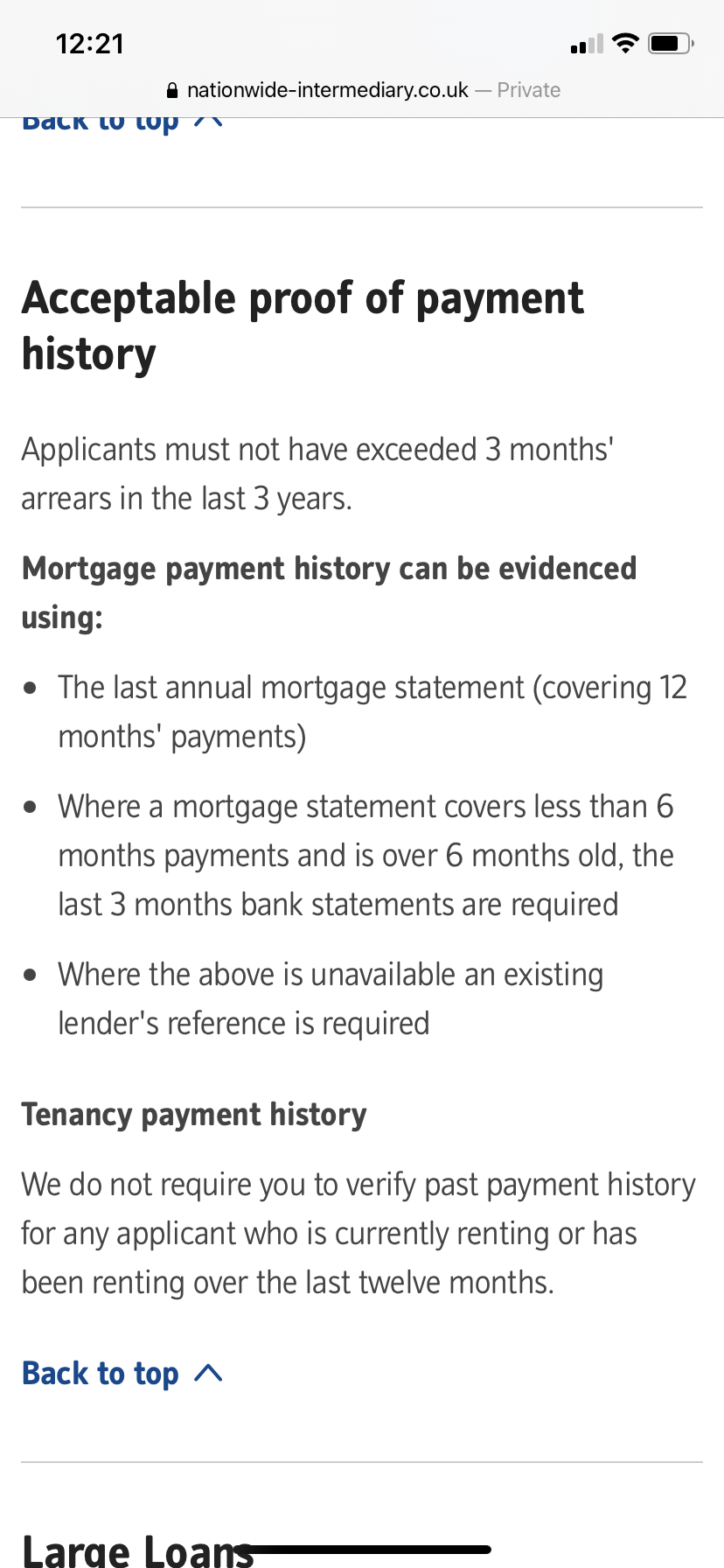

Ok, I have been looking at a nationwide mortgage and their lending criteria. Says 3 months arrears in last 3 years does that mean 3 consecutive months? Or 3 single months spread across the years.

0

0 -

You would need to check with them.

If I answer and it is wrong, I am potentially liable.

The key thing with anything like this is not a case of whether you fit criteria but whether you are likely to pass the credit check - the 2 can be very different.

Great example, I did a Decision in principle for a couple yesterday, they fit criteria, pass affordability etc, but they failed the credit check. No reason as such, they just did not meet the minimum scoring requirements. Like you, he has a few arrears. We went to a different lender and they now have a DIP.

If you are applying directly, you need to check with the lender that you fit criteria and also see if they can say whether or not you are likely to pass the credit check based on their experience - I know we have account managers who will give us honest answers on whether or not it is likely to pass, I am not sure what it is like if you go direct as I have never had to speak to those departments.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.1 -

Personally I think you’d be better using a broker. They know which lenders to go to for your circumstances and will ‘hold your hand’ through the process. I think you’d find it less stressful than trying to find a lender yourself xpoppyegg22 said:Me and my partner are looking for a mortgage. He has no history of anything ‘bad’ on his credit file but I have a few missed payments over the years the last one dated august 2019. I am stressed and losing sleep that this means we won’t get a mortgage. At present I don’t owe any credit on anything.MFW 2026 #50: £3,583.49/£25,00007/03/25: Mortgage: £67,000.00

Mortgage:

07/03/26: £34,418.15

16/01/26: £56,794.25

02/01/26: £60,223.17

12/08/25: Mortgage: £62,500.00

12/06/25: Mortgage: £65,000.00

18/01/25: Mortgage: £68,500.14

27/12/24: Mortgage: £69,278.38

Savings: £20,0001 -

Personally I think you’d be better using a broker. They know which lenders to go to for your circumstances and will ‘hold your hand’ through the process. I think you’d find it less stressful than trying to find a lender yourself xpoppyegg22 said:Me and my partner are looking for a mortgage. He has no history of anything ‘bad’ on his credit file but I have a few missed payments over the years the last one dated august 2019. I am stressed and losing sleep that this means we won’t get a mortgage. At present I don’t owe any credit on anything.MFW 2026 #50: £3,583.49/£25,00007/03/25: Mortgage: £67,000.00

Mortgage:

07/03/26: £34,418.15

16/01/26: £56,794.25

02/01/26: £60,223.17

12/08/25: Mortgage: £62,500.00

12/06/25: Mortgage: £65,000.00

18/01/25: Mortgage: £68,500.14

27/12/24: Mortgage: £69,278.38

Savings: £20,0000 -

Thanks we have a DIP from Halifax, tsb & Barclays but I know that doesn’t guarantee a mortgage or does that mean we have passed the credit check?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.9K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards