We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Completing tax return next week.. can commercial providers help?

I work in the UK but not from here and previously a third party company which my employer has a deal with helped me complete my tax returns.

This year, however, they have not yet contacted me and as the self-assessment deadline is Jan 31 I am a little worried.

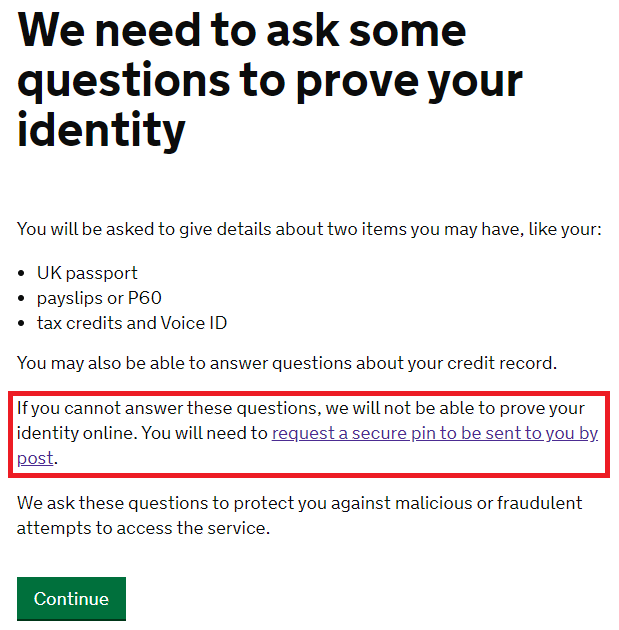

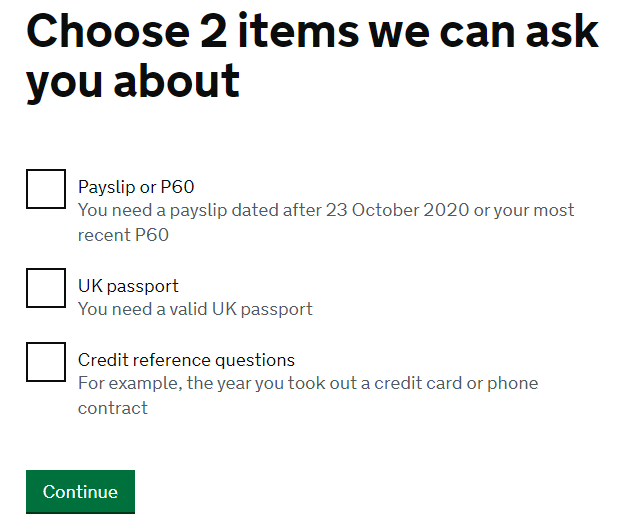

I am waiting for their response but in the meantime also checked government gateway website. It seems I am registered to be able to do my self-assessment but need an activation code for which I need my P60, payslips, credit history, etc. I have requested some of these from my employer already but not sure if I will be able to answer "credit history related questions" before Jan 31 because it says they will share my info with a 3p company and wait for their validation etc. which might not be done in a week?

I wonder if someone knows a commercial provider (KPMG, gosimpletax, etc.) which can be reliable and help me finalize this?

I am happy to pay, just do not want to look like I have missed the deadline..

Many thanks in advance for your insights!

Comments

-

You have left this rather late to deal with as tax return preparers will not have the time to take on a new client. Even if they did, presumably the third party company you mention is your agent, and a new adviser would have to get clearance to act, then go through all the authorisation procedure. I have no knowledge about Taxscout, and this forum is not the appropriate place for recommendations.

This leaves you with the existing arrangement, or doing it yourself. Whichever you decide, it makes sense to set up your government gateway account. In your shoes, I would be asking my employer about this, as they are the ones who have engaged the third party company, and I would contact that company as well.1 -

Thank you for sharing your insights!Jeremy535897 said:You have left this rather late to deal with as tax return preparers will not have the time to take on a new client. Even if they did, presumably the third party company you mention is your agent, and a new adviser would have to get clearance to act, then go through all the authorisation procedure. I have no knowledge about Taxscout, and this forum is not the appropriate place for recommendations.

This leaves you with the existing arrangement, or doing it yourself. Whichever you decide, it makes sense to set up your government gateway account. In your shoes, I would be asking my employer about this, as they are the ones who have engaged the third party company, and I would contact that company as well.

I will call HMRC first thing in the morning and followed up with my employer and the third party..

totally missed the deadline was nearing as I was expecting a comms from 3p.. let's see if I can win this race against time.0 -

Also, one more question please.Jeremy535897 said:You have left this rather late to deal with as tax return preparers will not have the time to take on a new client. Even if they did, presumably the third party company you mention is your agent, and a new adviser would have to get clearance to act, then go through all the authorisation procedure. I have no knowledge about Taxscout, and this forum is not the appropriate place for recommendations.

This leaves you with the existing arrangement, or doing it yourself. Whichever you decide, it makes sense to set up your government gateway account. In your shoes, I would be asking my employer about this, as they are the ones who have engaged the third party company, and I would contact that company as well.

I am registered with HMRC self-assessment but it asks me to request an activation code.

My question is; does it take 7-10 working days even if I do online verification as asked below or do I get it instantly if I verify online and 7-10 days is only for the option marked in red?

It would be very helpful to know if someone had experience with this because if it takes 7-10 days regardless, then this means there is nothing I can do at this stage to meet the deadline.

Many thanks in advance!

0 -

If you were served with a £100 penalty, a reasonable excuse can be an agent overwhelmed with work due to coronavirus, and it may be that if that excuse was not accepted, the agent should pay it. You might also have interest if you normally have a tax bill.blackeagle said:

Thank you for sharing your insights!Jeremy535897 said:You have left this rather late to deal with as tax return preparers will not have the time to take on a new client. Even if they did, presumably the third party company you mention is your agent, and a new adviser would have to get clearance to act, then go through all the authorisation procedure. I have no knowledge about Taxscout, and this forum is not the appropriate place for recommendations.

This leaves you with the existing arrangement, or doing it yourself. Whichever you decide, it makes sense to set up your government gateway account. In your shoes, I would be asking my employer about this, as they are the ones who have engaged the third party company, and I would contact that company as well.

I will call HMRC first thing in the morning and followed up with my employer and the third party..

totally missed the deadline was nearing as I was expecting a comms from 3p.. let's see if I can win this race against time.0 -

Why do you not already have your own payslips and P60? Regardless of the activation code issue, if you do not have the paperwork yet, then it's unlikely that you will be able to do the calculations and input before the deadline now. You won't find an accountant willing or able to do this before the deadline, it's their busiest week of the year.

No free lunch, and no free laptop 0

0 -

I cannot reach payslips now due to a technical problem with the our internal system which I hope will get resolved early next week. That said, I can see HMRC already has a full breakdown of all my monthly earnings, tax, NI etc. on the government gateway portal for last tax year. So, my main issue is not the payslips but the self-assessment activation code at the moment.macman said:Why do you not already have your own payslips and P60? Regardless of the activation code issue, if you do not have the paperwork yet, then it's unlikely that you will be able to do the calculations and input before the deadline now. You won't find an accountant willing or able to do this before the deadline, it's their busiest week of the year.0 -

HMRC has now announced that late filing penalties will not be levied until 28 February 2021 for 2019/20 self assessment returns, although interest will be charged on tax due but not paid by 31 January 2021. The fact that this date is before Budget Day still allows the possibility of 2019/20 being relevant for SEISS 4.0

-

I thought, when I read it, the extension was for self employed only whereas OP appears to be employed (can’t find the statement again to check it!)Jeremy535897 said:HMRC has now announced that late filing penalties will not be levied until 28 February 2021 for 2019/20 self assessment returns, although interest will be charged on tax due but not paid by 31 January 2021. The fact that this date is before Budget Day still allows the possibility of 2019/20 being relevant for SEISS 4.Information I post is for England unless otherwise stated. Some rules may be different in other parts of UK.0 -

I don't think so. Email from HMRC read:

"Today HMRC has announced that Self Assessment customers will not receive a penalty for filing their 2019-20 tax return late, as long as they file online by 28 February. We are still encouraging customers who have not yet filed to do so by 31 January, if possible.

Customers still need to pay their Self Assessment tax bill by 31 January. Interest will be charged from 1 February on any outstanding liabilities. Customers can pay online, or through their bank, or by post before they file.

If any customer cannot afford to pay by 31 January, they may be able to set up an affordable plan and pay in monthly instalments. But they will need to file their 2019-20 tax return before setting up a time to pay arrangement."

0 -

Thanks Jeremy - as I said I couldn't find the webpage I read it on yesterday.Jeremy535897 said:I don't think so. Email from HMRC read:"Today HMRC has announced that Self Assessment customers will not receive a penalty for filing their 2019-20 tax return late, as long as they file online by 28 February. We are still encouraging customers who have not yet filed to do so by 31 January, if possible.

Customers still need to pay their Self Assessment tax bill by 31 January. Interest will be charged from 1 February on any outstanding liabilities. Customers can pay online, or through their bank, or by post before they file.

If any customer cannot afford to pay by 31 January, they may be able to set up an affordable plan and pay in monthly instalments. But they will need to file their 2019-20 tax return before setting up a time to pay arrangement."

Have since found it here No Self Assessment late filing penalty for those who file online by 28 February - GOV.UK (www.gov.uk)

I think there is a separate statement about a relaxation for s/e claimants reporting their income for Tax Credits and I got the two muddled up.Information I post is for England unless otherwise stated. Some rules may be different in other parts of UK.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.3K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards