We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Dual Drawdown Fund Dilemma

Comments

-

Thanks. So do you suggest taking as much of the profit, any good growth in the fund while I can without cannibalising it of course? I was under the impression to leave as much invested and withdraw when you need. Outside the fund, it’s safe but not earning nothing. Inside, it’s invested and earning if you like.shinytop said:

Why what? Get the growth out of the pension to avoid breaching LTA at age 75. But not so much that you pay higher rate tax. But please tell me if that's wrong as it's what I was going to do.NottinghamKnight said:

Why?shinytop said:

You don't have to spend it; just get it out of the pension. But it depends on your tax situation.GSP said:

It’s a bit of a long story, but my IFA thinks I am spending too much too soon already.garmeg said:With a fund that high you probably dont have much LTA left so beware of any LTA charge at age 75 should you not draw down enough from your pot prior to age 75.0 -

No, that's fair enough. We often hear of people who desperately want to get money out of their pension but then have little use for it, and no reason to withdraw but if there are lta issues then it's a sensible precaution.shinytop said:

Why what? Get the growth out of the pension to avoid breaching LTA at age 75. But not so much that you pay higher rate tax. But please tell me if that's wrong as it's what I was going to do.NottinghamKnight said:

Why?shinytop said:

You don't have to spend it; just get it out of the pension. But it depends on your tax situation.GSP said:

It’s a bit of a long story, but my IFA thinks I am spending too much too soon already.garmeg said:With a fund that high you probably dont have much LTA left so beware of any LTA charge at age 75 should you not draw down enough from your pot prior to age 75.1 -

One thing to remember is that modern pensions are just a wrapper. You can invest in the same funds in a pension, an isa or a general investment account. So if you are going to have LTA issues then you can put that money into an isa in the same fund for example. Unwrapped accounts will also benefit from the dividend allowance and there's the potential to use the annual cgt exemption before you pay any tax on unwrapped funds. This would go for your wife as well as yourself.GSP said:

Thanks. So do you suggest taking as much of the profit, any good growth in the fund while I can without cannibalising it of course? I was under the impression to leave as much invested and withdraw when you need. Outside the fund, it’s safe but not earning nothing. Inside, it’s invested and earning if you like.shinytop said:

Why what? Get the growth out of the pension to avoid breaching LTA at age 75. But not so much that you pay higher rate tax. But please tell me if that's wrong as it's what I was going to do.NottinghamKnight said:

Why?shinytop said:

You don't have to spend it; just get it out of the pension. But it depends on your tax situation.GSP said:

It’s a bit of a long story, but my IFA thinks I am spending too much too soon already.garmeg said:With a fund that high you probably dont have much LTA left so beware of any LTA charge at age 75 should you not draw down enough from your pot prior to age 75.0 -

Sorry as my knowledge on pensions is pretty low. All I know is I have fund I have been drawing down on and my IFA looks after the holdings/investments with little contact, apart from withdrawal requests. Talk of ISA’s, wrapped, unwrapped, dividend allowance, cgt, never had anything from him on these. Maybe my type of account isn’t very complicated, just purely drawdown and investments.NottinghamKnight said:

One thing to remember is that modern pensions are just a wrapper. You can invest in the same funds in a pension, an isa or a general investment account. So if you are going to have LTA issues then you can put that money into an isa in the same fund for example. Unwrapped accounts will also benefit from the dividend allowance and there's the potential to use the annual cgt exemption before you pay any tax on unwrapped funds. This would go for your wife as well as yourself.GSP said:

Thanks. So do you suggest taking as much of the profit, any good growth in the fund while I can without cannibalising it of course? I was under the impression to leave as much invested and withdraw when you need. Outside the fund, it’s safe but not earning nothing. Inside, it’s invested and earning if you like.shinytop said:

Why what? Get the growth out of the pension to avoid breaching LTA at age 75. But not so much that you pay higher rate tax. But please tell me if that's wrong as it's what I was going to do.NottinghamKnight said:

Why?shinytop said:

You don't have to spend it; just get it out of the pension. But it depends on your tax situation.GSP said:

It’s a bit of a long story, but my IFA thinks I am spending too much too soon already.garmeg said:With a fund that high you probably dont have much LTA left so beware of any LTA charge at age 75 should you not draw down enough from your pot prior to age 75.0 -

No problem but maybe a question for your adviser? If he's managing your funds then as well as rebalancing then there is the LFA which seems to be of concern, and bed and isa should be addressed by him I would have thought.GSP said:

Sorry as my knowledge on pensions is pretty low. All I know is I have fund I have been drawing down on and my IFA looks after the holdings/investments with little contact, apart from withdrawal requests. Talk of ISA’s, wrapped, unwrapped, dividend allowance, cgt, never had anything from him on these. Maybe my type of account isn’t very complicated, just purely drawdown and investments.NottinghamKnight said:

One thing to remember is that modern pensions are just a wrapper. You can invest in the same funds in a pension, an isa or a general investment account. So if you are going to have LTA issues then you can put that money into an isa in the same fund for example. Unwrapped accounts will also benefit from the dividend allowance and there's the potential to use the annual cgt exemption before you pay any tax on unwrapped funds. This would go for your wife as well as yourself.GSP said:

Thanks. So do you suggest taking as much of the profit, any good growth in the fund while I can without cannibalising it of course? I was under the impression to leave as much invested and withdraw when you need. Outside the fund, it’s safe but not earning nothing. Inside, it’s invested and earning if you like.shinytop said:

Why what? Get the growth out of the pension to avoid breaching LTA at age 75. But not so much that you pay higher rate tax. But please tell me if that's wrong as it's what I was going to do.NottinghamKnight said:

Why?shinytop said:

You don't have to spend it; just get it out of the pension. But it depends on your tax situation.GSP said:

It’s a bit of a long story, but my IFA thinks I am spending too much too soon already.garmeg said:With a fund that high you probably dont have much LTA left so beware of any LTA charge at age 75 should you not draw down enough from your pot prior to age 75.0 -

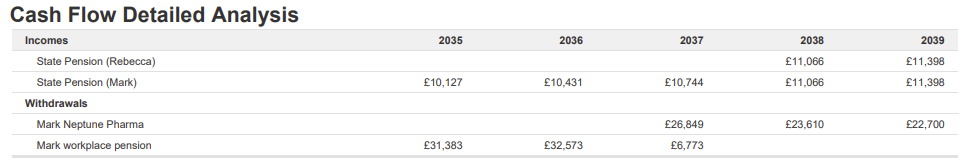

GSP - In your situation the starting point for my drawdown strategy would be based on a spend savings/isa's first, pension drawdown tax efficiency - LTA, IHT, tax relief and income tax based approach.I would imagine the key driver for drawdown level on your £750k pot would be LTA up to age 75, so I would probably aim to drawdown growth only - which if for example you achieve an average of 5% would mean about £37.5k gross a year on average.

After your SP age your income would increase by at least another £10k up to close to £50k gross. If you do get the odd years growth that would take your total income above the basic rate allowance (£50k currently) you may wish to limit drawdowns to keep you within that allowance for a few years incase you get a few years of negative growth later to take up the slack.Edit: For any years of negative growth I would probably still drawdown up to the tax free allowance level (or more if saving depleted).After age 75 then IHT may well become more of a driver for your pot - so you may well consider reducing withdrawals down closer to the tax free allowance minus SP at that stage if you have sufficient funds left outside of the pension to support your lifestyles.

For your wife's £175k I would firstly aim to contribute £3,600 a year until age 75 for the £180-£720 per year tax relief benefit.Edited:It might be worth giving your wife back her married allowance once she is able to start drawdown. I would then aim to withdraw up to the tax free allowance (currently £12,500) level which may well be able to be sustained indefinitely once she takes into account the 20+ extra £3,600 gross contributions, growth and reduced drawdowns once she reaches SP age.I would base your wife crystalisations/tax free lump sum withdrawals on keeping within the tax free lump sum recycling rules.

If your savings ever start to run out using the above approaches I would probably focus additional drawdowns on your wives pension pot first - as she should have plenty of 20% tax band available.0 -

Thanks very much for this. What this is crying out for is a plan, a strategy to work towards, not just being told not to withdraw too much. Should my IFA be offering all sorts of options, advice, a plan of sorts because while others seem very comfortable about investing, to me this is a minefield.ukdw said:GSP - In your situation the starting point for my drawdown strategy would be based on a spend savings/isa's first, pension drawdown tax efficiency - LTA, IHT, tax relief and income tax based approach.I would imagine the key driver for drawdown level on your £750k pot would be LTA up to age 75, so I would probably aim to drawdown growth only - which if for example you achieve an average of 5% would mean about £37.5k gross a year on average.

After your SP age your income would increase by at least another £10k up to close to £50k gross. If you do get the odd years growth that would take your total income above the basic rate allowance (£50k currently) you may wish to limit drawdowns to keep you within that allowance for a few years incase you get a few years of negative growth later to take up the slack.Edit: For any years of negative growth I would probably still drawdown up to the tax free allowance level (or more if saving depleted).After age 75 then IHT may well become more of a driver for your pot - so you may well consider reducing withdrawals down closer to the tax free allowance minus SP at that stage if you have sufficient funds left outside of the pension to support your lifestyles.

For your wife's £175k I would firstly aim to contribute £3,600 a year until age 75 for the £180-£720 per year tax relief benefit.Edited:It might be worth giving your wife back her married allowance once she is able to start drawdown. I would then aim to withdraw up to the tax free allowance (currently £12,500) level which may well be able to be sustained indefinitely once she takes into account the 20+ extra £3,600 gross contributions, growth and reduced drawdowns once she reaches SP age.I would base your wife crystalisations/tax free lump sum withdrawals on keeping within the tax free lump sum recycling rules.

If your savings ever start to run out using the above approaches I would probably focus additional drawdowns on your wives pension pot first - as she should have plenty of 20% tax band available.

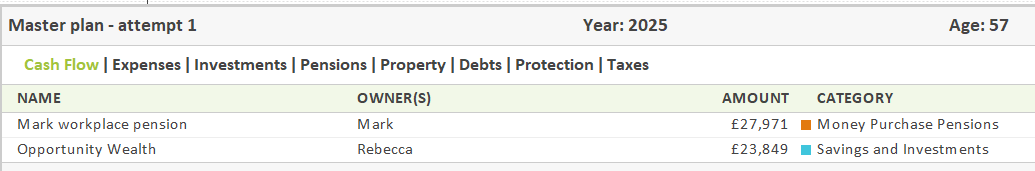

When my wife’s fund becomes available in 2022, it offers another dynamic and opportunity with another personal tax allowance quota. My IFA produced a combined planner for both of us, but I am sure we need two planners as both are independent funds, and may be drawdown quite differently.

I think what you have written above is more than what my IFA has offered in over 3 years.1 -

"Should my IFA be offering all sorts of options, advice, a plan of sorts because while others seem very comfortable about investing, to me this is a minefield."GSP said:

Thanks very much for this. What this is crying out for is a plan, a strategy to work towards, not just being told not to withdraw too much. Should my IFA be offering all sorts of options, advice, a plan of sorts because while others seem very comfortable about investing, to me this is a minefield.ukdw said:GSP - In your situation the starting point for my drawdown strategy would be based on a spend savings/isa's first, pension drawdown tax efficiency - LTA, IHT, tax relief and income tax based approach.I would imagine the key driver for drawdown level on your £750k pot would be LTA up to age 75, so I would probably aim to drawdown growth only - which if for example you achieve an average of 5% would mean about £37.5k gross a year on average.

After your SP age your income would increase by at least another £10k up to close to £50k gross. If you do get the odd years growth that would take your total income above the basic rate allowance (£50k currently) you may wish to limit drawdowns to keep you within that allowance for a few years incase you get a few years of negative growth later to take up the slack.Edit: For any years of negative growth I would probably still drawdown up to the tax free allowance level (or more if saving depleted).After age 75 then IHT may well become more of a driver for your pot - so you may well consider reducing withdrawals down closer to the tax free allowance minus SP at that stage if you have sufficient funds left outside of the pension to support your lifestyles.

For your wife's £175k I would firstly aim to contribute £3,600 a year until age 75 for the £180-£720 per year tax relief benefit.Edited:It might be worth giving your wife back her married allowance once she is able to start drawdown. I would then aim to withdraw up to the tax free allowance (currently £12,500) level which may well be able to be sustained indefinitely once she takes into account the 20+ extra £3,600 gross contributions, growth and reduced drawdowns once she reaches SP age.I would base your wife crystalisations/tax free lump sum withdrawals on keeping within the tax free lump sum recycling rules.

If your savings ever start to run out using the above approaches I would probably focus additional drawdowns on your wives pension pot first - as she should have plenty of 20% tax band available.

When my wife’s fund becomes available in 2022, it offers another dynamic and opportunity with another personal tax allowance quota. My IFA produced a combined planner for both of us, but I am sure we need two planners as both are independent funds, and may be drawdown quite differently.

I think what you have written above is more than what my IFA has offered in over 3 years.

What else would you be paying him for?

"My IFA produced a combined planner for both of us, but I am sure we need two planners as both are independent funds, and may be drawdown quite differently."

It should be one financial plan, optimised for both of the funds.0 -

Yes agree it should be one plan, bringing both funds together. It was just the running of these funds showing what’s going on in two separate planners as I can see the amounts/the % withdrawals to be quite different perhaps?BritishInvestor said:

"Should my IFA be offering all sorts of options, advice, a plan of sorts because while others seem very comfortable about investing, to me this is a minefield."GSP said:

Thanks very much for this. What this is crying out for is a plan, a strategy to work towards, not just being told not to withdraw too much. Should my IFA be offering all sorts of options, advice, a plan of sorts because while others seem very comfortable about investing, to me this is a minefield.ukdw said:GSP - In your situation the starting point for my drawdown strategy would be based on a spend savings/isa's first, pension drawdown tax efficiency - LTA, IHT, tax relief and income tax based approach.I would imagine the key driver for drawdown level on your £750k pot would be LTA up to age 75, so I would probably aim to drawdown growth only - which if for example you achieve an average of 5% would mean about £37.5k gross a year on average.

After your SP age your income would increase by at least another £10k up to close to £50k gross. If you do get the odd years growth that would take your total income above the basic rate allowance (£50k currently) you may wish to limit drawdowns to keep you within that allowance for a few years incase you get a few years of negative growth later to take up the slack.Edit: For any years of negative growth I would probably still drawdown up to the tax free allowance level (or more if saving depleted).After age 75 then IHT may well become more of a driver for your pot - so you may well consider reducing withdrawals down closer to the tax free allowance minus SP at that stage if you have sufficient funds left outside of the pension to support your lifestyles.

For your wife's £175k I would firstly aim to contribute £3,600 a year until age 75 for the £180-£720 per year tax relief benefit.Edited:It might be worth giving your wife back her married allowance once she is able to start drawdown. I would then aim to withdraw up to the tax free allowance (currently £12,500) level which may well be able to be sustained indefinitely once she takes into account the 20+ extra £3,600 gross contributions, growth and reduced drawdowns once she reaches SP age.I would base your wife crystalisations/tax free lump sum withdrawals on keeping within the tax free lump sum recycling rules.

If your savings ever start to run out using the above approaches I would probably focus additional drawdowns on your wives pension pot first - as she should have plenty of 20% tax band available.

When my wife’s fund becomes available in 2022, it offers another dynamic and opportunity with another personal tax allowance quota. My IFA produced a combined planner for both of us, but I am sure we need two planners as both are independent funds, and may be drawdown quite differently.

I think what you have written above is more than what my IFA has offered in over 3 years.

What else would you be paying him for?

"My IFA produced a combined planner for both of us, but I am sure we need two planners as both are independent funds, and may be drawdown quite differently."

It should be one financial plan, optimised for both of the funds.0 -

Once the financial plan is created it is trivial to report on the various withdrawals, either on an individual year or over the whole retirement period.GSP said:

Yes agree it should be one plan, bringing both funds together. It was just the running of these funds showing what’s going on in two separate planners as I can see the amounts/the % withdrawals to be quite different perhaps?BritishInvestor said:

"Should my IFA be offering all sorts of options, advice, a plan of sorts because while others seem very comfortable about investing, to me this is a minefield."GSP said:

Thanks very much for this. What this is crying out for is a plan, a strategy to work towards, not just being told not to withdraw too much. Should my IFA be offering all sorts of options, advice, a plan of sorts because while others seem very comfortable about investing, to me this is a minefield.ukdw said:GSP - In your situation the starting point for my drawdown strategy would be based on a spend savings/isa's first, pension drawdown tax efficiency - LTA, IHT, tax relief and income tax based approach.I would imagine the key driver for drawdown level on your £750k pot would be LTA up to age 75, so I would probably aim to drawdown growth only - which if for example you achieve an average of 5% would mean about £37.5k gross a year on average.

After your SP age your income would increase by at least another £10k up to close to £50k gross. If you do get the odd years growth that would take your total income above the basic rate allowance (£50k currently) you may wish to limit drawdowns to keep you within that allowance for a few years incase you get a few years of negative growth later to take up the slack.Edit: For any years of negative growth I would probably still drawdown up to the tax free allowance level (or more if saving depleted).After age 75 then IHT may well become more of a driver for your pot - so you may well consider reducing withdrawals down closer to the tax free allowance minus SP at that stage if you have sufficient funds left outside of the pension to support your lifestyles.

For your wife's £175k I would firstly aim to contribute £3,600 a year until age 75 for the £180-£720 per year tax relief benefit.Edited:It might be worth giving your wife back her married allowance once she is able to start drawdown. I would then aim to withdraw up to the tax free allowance (currently £12,500) level which may well be able to be sustained indefinitely once she takes into account the 20+ extra £3,600 gross contributions, growth and reduced drawdowns once she reaches SP age.I would base your wife crystalisations/tax free lump sum withdrawals on keeping within the tax free lump sum recycling rules.

If your savings ever start to run out using the above approaches I would probably focus additional drawdowns on your wives pension pot first - as she should have plenty of 20% tax band available.

When my wife’s fund becomes available in 2022, it offers another dynamic and opportunity with another personal tax allowance quota. My IFA produced a combined planner for both of us, but I am sure we need two planners as both are independent funds, and may be drawdown quite differently.

I think what you have written above is more than what my IFA has offered in over 3 years.

What else would you be paying him for?

"My IFA produced a combined planner for both of us, but I am sure we need two planners as both are independent funds, and may be drawdown quite differently."

It should be one financial plan, optimised for both of the funds.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards