We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

As the valuation of the property for the mortgage will be based on current condition rather than post-improvement you should be careful what you do before the (assumed) surveyor visit. I can't see what you have mentioned being a major issue if the new fence is good quality and well installed.rwarren10 said:Hi, just looking a bit of advice please as we are planning on applying for a mortgage next year - 2024.

Basically we own our house at the minute (mortgage free, it was gifted to my wife after her grandmothers passing). It is a small cottage house and we are planning a major extension & renovation - planning permission & building control all passed.

We are currently paying down some credit card debt (related to the architect fees for planning permission) before we are trying for a mortgage as we want the highest amount in affordability calculator.

If we were to undertake some site clearance i.e. removing hedges that run the full length of the garden & the house and replacing with a fence (this will need done when it comes to extension time anyway) would this be frowned upon by lenders ? As we have started some work out of our own pockets before going to the lender for the mortgage next year for the actual foundations & build maybe they would look badly upon this ?

ThanksI am a mortgage broker. You should note that this site doesn't check my status as a Mortgage Adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice. Please do not send PMs asking for one-to-one-advice, or representation.1 -

We are buying our new home at £295, 000 and have to get a 65,000 mortgage, currently mortgage free. I’m wondering whether to go fixed for 3 or 5 years, I know you can’t predict on the future interest rates but any advice would be appreciated. Also seen talk re just going standard variable rate, it’s such a minefield. If you were in this position, what would you do?

thanks Jo0 -

My current deal ends 01/02/2024 thought the 2 years starts then but virgin money stated will end 01/12/2025.kingstreet said:

As fixed rates are constructed using rate swaps it's usual for an end date rather than a number of months or years from completion, so a two year fix may well be upto 31/12/2005.london21 said:I am remortgaging within 6 months of y current fix ending. Virgin money current deal ends 01/02/2024 and new 2 years fixed selected been told ends 01/12/2025 not exactly 2 years product?

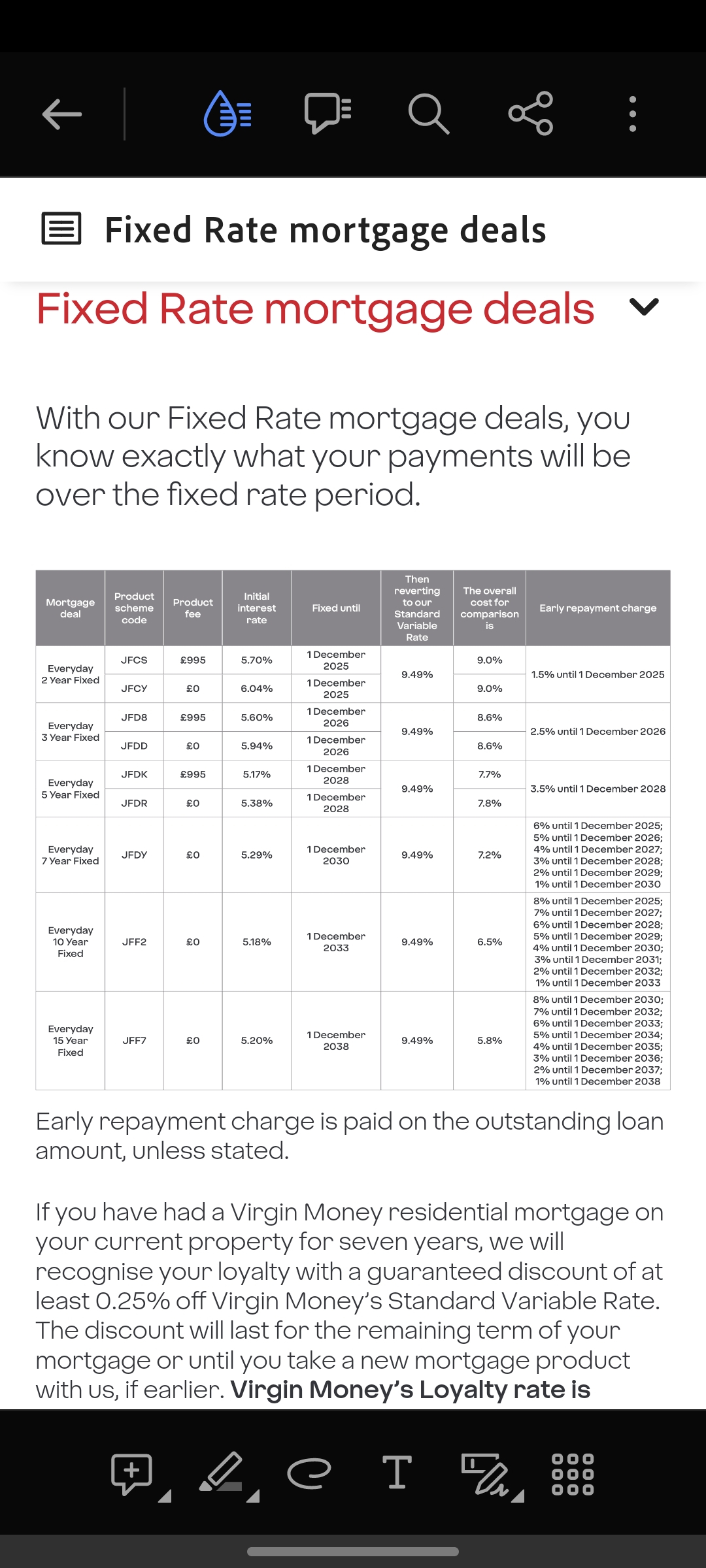

2 years 5.7%

5 years now 5.17%

I have not remortgaged months ahead before maybe that's why i am not familiar with it.

Still unbelievable, made overpayment of £6500 increased term from 26 years to 30 and my monthly payment going from £1110 to £1599.

44% increase.

0 -

Hello, i have a two years fixed mortgage. I would like to overpay every month so that in two years time when i need to renegotiate the mortgage, my monthly payment will (hopefully) be lower.Is that a good strategy or should i put my extra money in a saving account that has a higher interest rate than my mortgage and put that money + interest in my mortgage just before i need to renegotiate.

my repayments will be less than 10% of the mortgage value.

what do you think?0 -

@joben Impossible to say what might turn out better in hindsight unfortunately. My guess about rates is as good as yours. I never thought rates would remain so low for so long and didn't expect rates to rise as rapidly as they did. So whatever I say has no predictive value at all.JOBEN said:We are buying our new home at £295, 000 and have to get a 65,000 mortgage, currently mortgage free. I’m wondering whether to go fixed for 3 or 5 years, I know you can’t predict on the future interest rates but any advice would be appreciated. Also seen talk re just going standard variable rate, it’s such a minefield. If you were in this position, what would you do?

thanks Jo

Personally, if I were taking out a mortgage now, it would probably be on a 2 year fix or a 2 year tracker. But that's just me.

In your case given that it's a relatively small low LTV mortgage, the impact in £ terms of making the 'wrong' call is hopefully not too big one way or the other.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

@tostaky One factor would be what the difference is between your current rate and the 'best' savings rate that you can get.tostaky said:Hello, i have a two years fixed mortgage. I would like to overpay every month so that in two years time when i need to renegotiate the mortgage, my monthly payment will (hopefully) be lower.Is that a good strategy or should i put my extra money in a saving account that has a higher interest rate than my mortgage and put that money + interest in my mortgage just before i need to renegotiate.

my repayments will be less than 10% of the mortgage value.

what do you think?

For example if your current rate is 2-3% then I'd definitely be putting surplus money into a 5%+ easy access or notice savings account rather than overpaying the mortgage. But if the mortgage rate was above 4% then I might not bother and simply overpay.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

kingstreet said:

Any decent broker could deal with your enquiry.HunterHome said:I am a foster carer and my partner a teacher. Would any broker be able to help with a mortgage or are there specialist ones? I have seen one called Mortgage Brain but hoped there were other options.

Thanks

Thank you. I have had something back from one broker specialising in fostering income but thought it would be a good idea to explore another,

I'm not really sure where to start looking as everyone I knew went directly to a lender.0 -

Regarding my re-mortgage at Virgin money they said the mortgage offer has to be signed and returned within 14 days of been received.

the 2 years fixed at 5.7% is due to start 01/02/2024, if rates drop can I change this offer?

I was going to go for 2 years tracker but thought rates will keep going up so it's great that rates have stayed the same today.

There are BOE 3 more meetings until 1st Feb 2024

2 November, 14 December and 1 February

The banks probably know rates will drop soon is why Virgin money's 5 years fix now 5.17%

0 -

Nationwide overpayments:

You get 3 options when overpaying with nationwide. I don't know if this is standard across the board as I've only ever been with Nationwide.

https://www.nationwide.co.uk/mortgages/existing-mortgage-members/overpayments/You are in control of your overpayment preferences – you can tell us how you want your overpayment money to be used to best suit your individual mortgage needs. For example, reduce monthly payments, reduce term (excluding interest only) or keep both the payments and term the same.

So when you overpay but keep everything the same, it says you get the choice to reduce term/monthly payments at a later date if you want. It gives you the option.

I'm curious - how long is that option 'live' for?

So say you take out a 5yr fixed & you overpay the max in year 1, in my case £10,200. How long do I have the option to drop the term (for example)? I'll assume it's not 'forever' so is it once I hit year 2 that option ceases to exist or what?0 -

@b0bbyEwing This is from what I can remember when I had a NW mortgage a while ago.B0bbyEwing said:Nationwide overpayments:

You get 3 options when overpaying with nationwide. I don't know if this is standard across the board as I've only ever been with Nationwide.

https://www.nationwide.co.uk/mortgages/existing-mortgage-members/overpayments/You are in control of your overpayment preferences – you can tell us how you want your overpayment money to be used to best suit your individual mortgage needs. For example, reduce monthly payments, reduce term (excluding interest only) or keep both the payments and term the same.

So when you overpay but keep everything the same, it says you get the choice to reduce term/monthly payments at a later date if you want. It gives you the option.

I'm curious - how long is that option 'live' for?

So say you take out a 5yr fixed & you overpay the max in year 1, in my case £10,200. How long do I have the option to drop the term (for example)? I'll assume it's not 'forever' so is it once I hit year 2 that option ceases to exist or what?

If you choose to keep payments and term unchanged, then it stays that way until the next natural changing point, which is usually when the current fix/product ends, so in your case 5 years. When the fix ends, the monthly payment is recalculated downwards.

As I understand it, at any point until then you can choose to change your preference (not sure if you can do it online or whether you'll need to call them) and the overpaid capital until then will be used to either reduce your term or the monthly payment, as per your preference.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards