We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

If it will be in your personal name, there are one or two lenders who will accept confirmation from your Accountant the vehicle cost comes out of business earnings before net profit is set hence not affecting your mortgage affordability.bubby08 said:Thank you very much that’s very helpful I was planning to use it as a business expense not sure if that makes it better or worse in terms of mortgage.I am a mortgage broker. You should note that this site doesn't check my status as a Mortgage Adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice. Please do not send PMs asking for one-to-one-advice, or representation.0 -

Myself and my partner are FTB looking for a 95 LTV 2/5yr fix residential mortgage. We’ve got several agreement/decision in principles which more than cover the properties we are looking at and I’ve never missed any payment or had a bad mark on my credit file ever (with several credit agreements).We currently have a £9k loan each and I have £8k pcp car finance in my name.My worry is when I have checked my bank statements there is a large number of small (£5) or so gambling transactions. I have since stopped this but am conscious lenders may need 3 months bank statements.Can you advise which lenders don’t request bank statements as part of their standard application process? I’d rather them not see this but would also rather not wait 3 months if possible. I have read Virgin Money may not but this was a while ago - assume things may have changed post-Covid.Thanks0

-

So sorry to repost but just wondering if anyone had any advice on my query above?? Thanks so much xInAPickle76 said:We are looking to remortgage as we are with The One Account and the interest seems to be going up every month!! We had a DMP back in October 2014 originally with StepChange then went self managed about 3 years ago which is all going really well.

My concern is that when the mortgage company asks for the past 3 months' bank statements it is going to show all the payments to the creditors (we have 8 in total (with 3 different creditors) paying £5 per month) even though the defaults have all dropped off our credit files and our credit scores are now excellent.

Is there anything we can do?? Will the lenders be likely to decline us due to the ongoing creditor payments on our bank statements?

Many thanks for reading 0

0 -

In my unqualified opinion, those payments won't mean anything. I have small direct debits set up to keep accounts open, you would have no way of knowing if they were to savings accounts or to debts.InAPickle76 said:

So sorry to repost but just wondering if anyone had any advice on my query above?? Thanks so much xInAPickle76 said:We are looking to remortgage as we are with The One Account and the interest seems to be going up every month!! We had a DMP back in October 2014 originally with StepChange then went self managed about 3 years ago which is all going really well.

My concern is that when the mortgage company asks for the past 3 months' bank statements it is going to show all the payments to the creditors (we have 8 in total (with 3 different creditors) paying £5 per month) even though the defaults have all dropped off our credit files and our credit scores are now excellent.

Is there anything we can do?? Will the lenders be likely to decline us due to the ongoing creditor payments on our bank statements?

Many thanks for reading I'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.0

I'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.0 -

Moving to HSBC in June and have picked a tracker. When I want to switch rates in the future, moving from the tracker rate to a fixed rate, can I pick a switch date? I have been told that you can only pick a switch date if I am moving FROM a fixed rate. Is this correct?

0 -

Hello,I’m a longtime reader of the MSE Forum, but first time poster.Apologies if this is in the wrong space but I had a query about a home where there are two mortgage products from the one provider; we ported our old product from our old house to our new one plus addn borrowing with same lender.

My partner and I will have approx £250K owing on the mortgage when the terms finish:

1) £100K @ 2.5%2) £150K @ 2.1% which ends 6 months after the first product

Both have Early Repayment Fees of ~10%What are my options when the first product term ends? Are the following exhaustive:

(A) Product transfer each separately on term expiry - leaves us locked into lender as we’ll always have two products

(B) Let first product lapse onto SVR until we can look at product transfer or remortgage for the lot - would this be 6 to 4 months out from product end date of the second mortgage?We’re reluctant to pay an early repayment penalty, but equally want to maximise our options as our current lender isn’t always the most competitive on the market.Thanks in advance :-)0 -

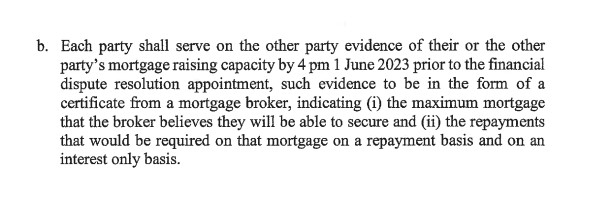

I've been asked by the court to provide evidence of my mortgage capacity.

I've struggled to find anyone who can do this apart from some online companies who charge ££££

Can someone direct me to a company who could help?

0 -

@atlasmm Other than Halifax, off of the top of my head I can't think of any mainstream lenders that do not ask for bank statements for a 95% LTV FTB app as part of minimum packaging requirements. There may well be others, but I can't think of any from recent memory.atlasmm said:Myself and my partner are FTB looking for a 95 LTV 2/5yr fix residential mortgage. We’ve got several agreement/decision in principles which more than cover the properties we are looking at and I’ve never missed any payment or had a bad mark on my credit file ever (with several credit agreements).We currently have a £9k loan each and I have £8k pcp car finance in my name.My worry is when I have checked my bank statements there is a large number of small (£5) or so gambling transactions. I have since stopped this but am conscious lenders may need 3 months bank statements.Can you advise which lenders don’t request bank statements as part of their standard application process? I’d rather them not see this but would also rather not wait 3 months if possible. I have read Virgin Money may not but this was a while ago - assume things may have changed post-Covid.ThanksPlease note, the above is as per my experience with Halifax intermediary applications, I've absolutely no idea if it's any different direct.As I'm sure you are aware, there's nothing stopping the lender from asking the applicant for more documents/info once the application is submitted or picked up for assessment/underwriting.I wouldn't worry too much about a handful of £5 gambling transactions, it's not uncommon at all. With most lenders it's only ever an issue if it looks like problem gambling which is a subjective matter but pretty easy to assess.If you want additional assurance, consider using a broker and mentioning the gambling transactions specifically. The MSE guide here will help you find a fee-free oneGood luck!I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

@iamiam If its HSBC that has told you it's not possible then I guess that would be the case. I've no idea how direct PTs work.IAMIAM said:Moving to HSBC in June and have picked a tracker. When I want to switch rates in the future, moving from the tracker rate to a fixed rate, can I pick a switch date? I have been told that you can only pick a switch date if I am moving FROM a fixed rate. Is this correct?I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

@croesus_IfOnly ERC of 10% or 1%?Croesus_IfOnly said:Hello,I’m a longtime reader of the MSE Forum, but first time poster.Apologies if this is in the wrong space but I had a query about a home where there are two mortgage products from the one provider; we ported our old product from our old house to our new one plus addn borrowing with same lender.

My partner and I will have approx £250K owing on the mortgage when the terms finish:

1) £100K @ 2.5%2) £150K @ 2.1% which ends 6 months after the first product

Both have Early Repayment Fees of ~10%What are my options when the first product term ends? Are the following exhaustive:

(A) Product transfer each separately on term expiry - leaves us locked into lender as we’ll always have two products

(B) Let first product lapse onto SVR until we can look at product transfer or remortgage for the lot - would this be 6 to 4 months out from product end date of the second mortgage?We’re reluctant to pay an early repayment penalty, but equally want to maximise our options as our current lender isn’t always the most competitive on the market.Thanks in advance :-)

If your current lender offers any no/low ERC no/low fee tracker/discount products, then you may have a few more permutations and combinations to try.

Also, for PTs, some lenders will waive the ERC within x months of fix-end so you may be able to get away with a 3 month period on SVR. And a very small number of lenders will have pro-rated ERCs in the last year so check that as well.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards