We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

K_S said:

@kazzyb123kazzyb123 said:

Thanks for the reply, what is the BDM??K_S said:

@kazzyb123 I'd have to run it past the BDM to be sure as off of the top of my head they (unlike some lenders) don't have a specific max age for child related benefits but the underwriter needs to be happy that it's sustainable and only a small portion of total income. I'm pretty sure my clients have been ok with 12-13 year olds using CB.kazzyb123 said:Hi,

Do you know if Nationwide accept tax credits and child benefit as income if it is a 5 yr deal and they will stop in September 2025 because my daughter is 15.

thanks

if we have a DIP from nationwide does it lock in that rate for 90 days? I think it does.

Also if we stay with NatWest and do a product transfer is that immediate so can’t wait 6 months to take up the offer like we could with a new lender?Thanks again

Nationwide - A broker will have a specific person at each lender that answers any criteria queries, complex case requirements, ongoing application queries, etc. They are called a BDM (Business Development Manager).

When doing a broker DIP with Nationwide I can do it with reserving a product/rate (for a specific property address) or without product/rate. If a product reservation is done, it's valid for 90 days by which time the full offer must be issued. Apologies, I've no idea how it works direct.

NatWest - As long there isn't an ERC involved, you should be able to book a PT to kick in in 6 months.Thanks,There is an ERC to pay for Natwest which is a PT as they are our current lender and our deal doesnt end until August next year. Does that mean we would have to take up the offer immediately or can we reserve it for 6 months?0 -

@kazzyb123 Sorry I've no clue what Natwest policy is for a PT with ERC as it can differ across lenders.kazzyb123 said:K_S said:

@kazzyb123kazzyb123 said:

Thanks for the reply, what is the BDM??K_S said:

@kazzyb123 I'd have to run it past the BDM to be sure as off of the top of my head they (unlike some lenders) don't have a specific max age for child related benefits but the underwriter needs to be happy that it's sustainable and only a small portion of total income. I'm pretty sure my clients have been ok with 12-13 year olds using CB.kazzyb123 said:Hi,

Do you know if Nationwide accept tax credits and child benefit as income if it is a 5 yr deal and they will stop in September 2025 because my daughter is 15.

thanks

if we have a DIP from nationwide does it lock in that rate for 90 days? I think it does.

Also if we stay with NatWest and do a product transfer is that immediate so can’t wait 6 months to take up the offer like we could with a new lender?Thanks again

Nationwide - A broker will have a specific person at each lender that answers any criteria queries, complex case requirements, ongoing application queries, etc. They are called a BDM (Business Development Manager).

When doing a broker DIP with Nationwide I can do it with reserving a product/rate (for a specific property address) or without product/rate. If a product reservation is done, it's valid for 90 days by which time the full offer must be issued. Apologies, I've no idea how it works direct.

NatWest - As long there isn't an ERC involved, you should be able to book a PT to kick in in 6 months.Thanks,There is an ERC to pay for Natwest which is a PT as they are our current lender and our deal doesnt end until August next year. Does that mean we would have to take up the offer immediately or can we reserve it for 6 months?

Some lenders require you to switch asap (or 1st of next month) if an ERC is involved, some will allow you to delay it. Not sure which bucket NatWest falls in.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Hi

If you have to pay 3% ERC once you have used up your 10% free overpayment allowance is this 3% of the overpayment amount or 3% of the outstanding mortgage

Thanks for any replies0 -

Usually 3% of the overpayment amount above the overpayment allowance.skye_blue said:Hi

If you have to pay 3% ERC once you have used up your 10% free overpayment allowance is this 3% of the overpayment amount or 3% of the outstanding mortgage

Thanks for any repliesI'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.2 -

Hello.

Just looking for some advice on this if possible or if you have ever come across a similar situation. My partner has a general power of attorney to deal with all finances on my behalf, as my job involves working away for long periods without communication. Would you happen to know if my partner can take out a joint mortgage and sign mortgage deeds on my behalf?

0 -

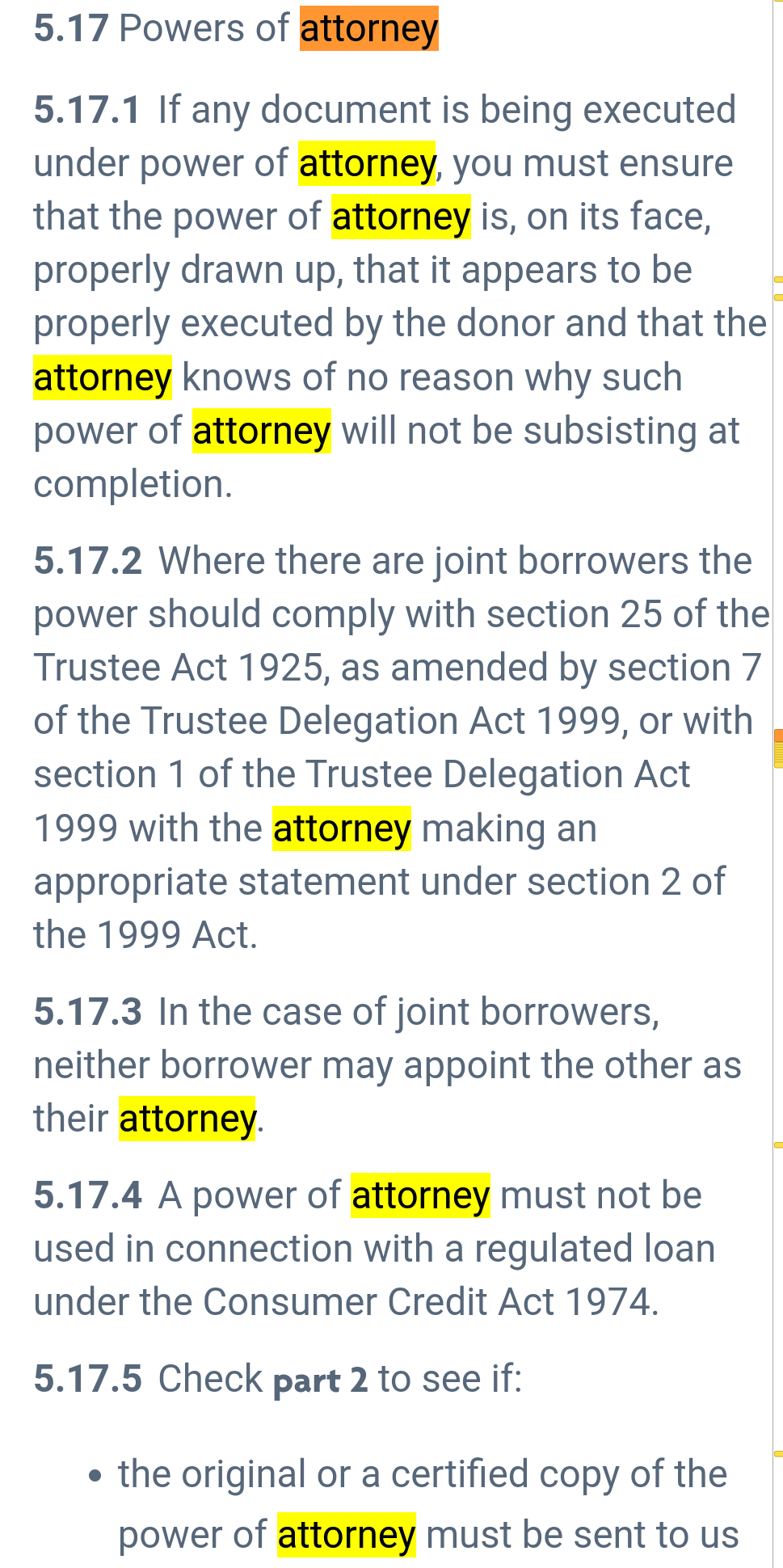

@troy_af This question would be best answered by the conveyancer. The CML handbook for conveyancers https://lendershandbook.ukfinance.org.uk/lenders-handbook/ might be able to thrown some light on your specific lender's policy.Troy_af said:Hello.

Just looking for some advice on this if possible or if you have ever come across a similar situation. My partner has a general power of attorney to deal with all finances on my behalf, as my job involves working away for long periods without communication. Would you happen to know if my partner can take out a joint mortgage and sign mortgage deeds on my behalf?

For example, the excerpt below is Halifax's. I'm no legal expert but it looks like in the case of Halifax, they will not allow one of the joint borrowers to be the attorney for the other. But I might be interpreting it incorrectly and your specific lender might well have a different policy.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Hi,

In the current market which all lenders offer remortgage with HTB ?

Thanks

m0 -

Hi can you give me some advice, son in law is currently working in a factory but has a masters degree in what he wants to do, he has just been offered a job where he can use his masters, but they are currently waiting for a mortgage offer from NW, if he takes the job would it impact the offer, his current employer have said they will give him a letter to say they would take him back if anything happened to his new job0

-

Hi,

I'm a company director applying for my first mortgage, the lender is Kent Reliance. My broker put in a full application on 22nd September over a week after he told me it had been done (so I ended up with a much higher rate), he told me that all my documents had been viewed by his pre-underwriting team and it was a straight forward application with an offer expected in 4-6 weeks. He has now been sacked. I only found out because I chased for an update and got an automatic email from his outbox.

Each tine I chase the new case worker for an update I get a request for documents that have already been sent and a new expected offer date. The latest request is for my last 3 years full accounts (which I have already submitted) and a new expected offer date of about another 10 days. Other requests have been things like i.d etc which again, the broker already had from me

The vendor is getting very fed up with the delays, he accepted my offer at the beginning of August and is questioning whether or not I am likely to get a mortgage offer.

Kent Reliance have done a mortgage valuation but haven't done a credit check on me.

Is all of this fairly normal and to be expected or am I looking at a likely rejection? Having never done this before I am starting to have a bit of a panic.Total debt at LB Moment (Nov 2007) = £6583 £4649 20.03.09

£5060 Black horse Loan - £4114 as of 20.03.09

£940 o/d with hsbc - -£535 as of 20.03.090 -

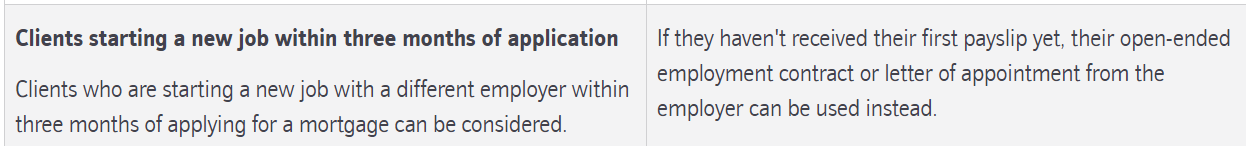

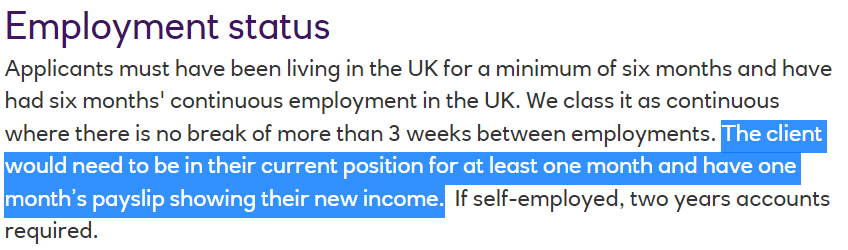

@Polmop Nationwide or NatWest? The criteria for jobs yet to start -Polmop said:Hi can you give me some advice, son in law is currently working in a factory but has a masters degree in what he wants to do, he has just been offered a job where he can use his masters, but they are currently waiting for a mortgage offer from NW, if he takes the job would it impact the offer, his current employer have said they will give him a letter to say they would take him back if anything happened to his new job

Nationwide

NatWest

The case might also need to be "re-scored", the impact (if any) of which will be dependent on the details.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards