We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

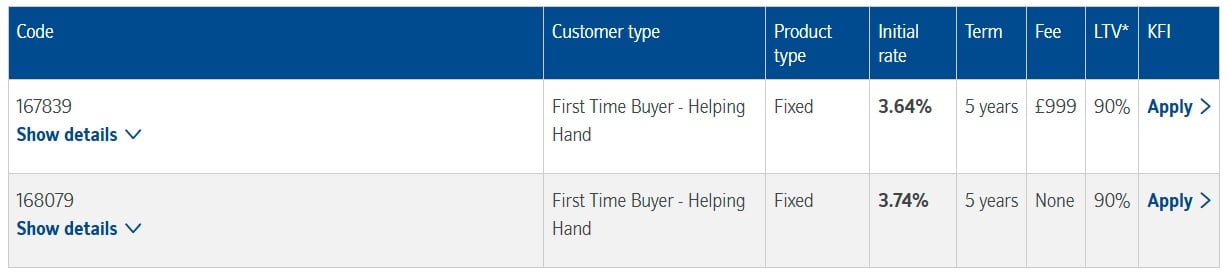

@bromine These are the rates as of today for the 2 90% LTV products that qualify for Helping Hands. You can play around with all the available products using the product finder here.bromine said:Hi, please could you advise roughly what interest rate I can expect as a first time buyer with 10% deposit with the Nationwide Helping Hands mortgage?

https://www.nationwide-intermediary.co.uk/products/product-finder

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

@comperinha I don't have anything useful to add beyond what @silvercar has suggested above. It may be worth speaking to your current lender as I would expect them to have internal processes to help in this sort of situation.comperinha said:Any brokers here experienced with arranging re-mortgages for terminally ill people? Would appreciate a PM with regards to potential options for reducing monthly cost to a minimum amount as possible since income will drop. Alternatively increasing mortgage term to maximum with the understanding that it will be paid off upon death.

Imho, it's unlikely that they would enable an extension of the term but quite possible that they will let you move on to interest-only or give you a payment holiday. If it's a joint mortgage, it's perhaps also worth understanding from the lender what impact any arrangement may have on the joint-borrower's credit history. In situations like these, lenders can usually exercise a large amount of discretion so don't be hesitant to ask for any accommodations that you wouldn't normally expect them to allow.

Good luck, I hope you're able to get an acceptable arrangement.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Hi There,

My 5 year initial mortgage term is coming to an end in 7 months, but looking on my natwest mortgage app they already have 4 new products I can change to, before being put in the SVR.

Unfortunately I'm not in a position to remortgage as my original loan was based on my salary and my wife's, and currently my wife is a stay at home mum to our baby boy, and with my salary alone it will be impossible to get the amount I need to remortgage.

So my only option is to accept one of the offers from Natwest, which even at 75% LTV, is more expensive than my original 90% LTV, due to the recent rate rises.

My question is with more rate rises in the near future, It makes sense for me to lock in one of the new offers, but my deal only expires in 6 months, will I be moved to the new rate straight away, or will it only start when my current deal expires.

Lastly is it recommended to sign up for 2 years, or 5 years, I would love a 3 year, but that offer isn't on the table.

Thank you very much0 -

@tugaville NatWest has recently extended their roll-off period for product-transfers (PT) from 4 months to 6 months. This is the schedule they've communicated to us.Tugaville said:Hi There,

My 5 year initial mortgage term is coming to an end in 7 months, but looking on my natwest mortgage app they already have 4 new products I can change to, before being put in the SVR.

Unfortunately I'm not in a position to remortgage as my original loan was based on my salary and my wife's, and currently my wife is a stay at home mum to our baby boy, and with my salary alone it will be impossible to get the amount I need to remortgage.

So my only option is to accept one of the offers from Natwest, which even at 75% LTV, is more expensive than my original 90% LTV, due to the recent rate rises.

My question is with more rate rises in the near future, It makes sense for me to lock in one of the new offers, but my deal only expires in 6 months, will I be moved to the new rate straight away, or will it only start when my current deal expires.

Lastly is it recommended to sign up for 2 years, or 5 years, I would love a 3 year, but that offer isn't on the table.

Thank you very much

Afaik the the completion on the PT will only take place when the existing fixed rate expires, or ASAP where the existing rate has already expired.

Just to be clear, the above is based on the intermediary PT process, I don't know if it's any different direct.

I don't have any comments on the length of the fix as that could be construed as advice and depends on factors individual to you such as your attitude to risk, how long you plan to stay in the house, what direction you expect rates to take, etc.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

The difference between 2 and 5 years not much.Tugaville said:Hi There,

My 5 year initial mortgage term is coming to an end in 7 months, but looking on my natwest mortgage app they already have 4 new products I can change to, before being put in the SVR.

Unfortunately I'm not in a position to remortgage as my original loan was based on my salary and my wife's, and currently my wife is a stay at home mum to our baby boy, and with my salary alone it will be impossible to get the amount I need to remortgage.

So my only option is to accept one of the offers from Natwest, which even at 75% LTV, is more expensive than my original 90% LTV, due to the recent rate rises.

My question is with more rate rises in the near future, It makes sense for me to lock in one of the new offers, but my deal only expires in 6 months, will I be moved to the new rate straight away, or will it only start when my current deal expires.

Lastly is it recommended to sign up for 2 years, or 5 years, I would love a 3 year, but that offer isn't on the table.

Thank you very much

Would say 5 years fixed considering you arenot looking to move in the short term.0 -

Thank you for this information, really appreciated.

Is there a different rate for brokers, or are they the same rates I'm being offered, as this is a product change.

Current offer

Duration Rate Product fee LTV Monthly Cost

5 years 3.12% £995 fee 75% £1,157.02

2 year s 3.01% £995 fee 75% £1,142.04

Duration Rate Product fee LTV Monthly Cost

5 years 3.33% £0 75% £1185.95

2 years 3.32 % £0 75% £1184.56

Thank again K_S

0 -

@tugaville You can see the current broker PT rates on the link below. They are pulling rates and adding new PT products tomorrow, so recheck tomorrow as well.Tugaville said:Thank you for this information, really appreciated.

Is there a different rate for brokers, or are they the same rates I'm being offered, as this is a product change.

Current offer

Duration Rate Product fee LTV Monthly Cost

5 years 3.12% £995 fee 75% £1,157.02

2 year s 3.01% £995 fee 75% £1,142.04

Duration Rate Product fee LTV Monthly Cost

5 years 3.33% £0 75% £1185.95

2 years 3.32 % £0 75% £1184.56

Thank again K_S

https://www.intermediary.natwest.com/intermediary-solutions/products.html#currentproducts

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Help / advice / magic wand desperately needed!

I am selling my house and buying elsewhere with my partner.

Offers accepted in Feb and only NOW am I finding out that the mortgage company for my buyer has refused to progress the application because my address is incorrect on whatever searches the mortgage company does.

The address should be 43 Rockhampton Street, but when searched it comes up as Flat 1 and Flat 2 (it's never been flats so I don't know why it does this). It comes up wrong on almost every automated address search engine, despite me correcting it with Royal Mail.

My solicitor has sent across land registry details that prove the address is in fact 43, but apparently the mortgage company won't progress until the address issue is fixed.

I'm at a loss and not sure what more can be done. Getting further info from the buyer is also proving tricky because my agent appears to pick and chose when they want to answer my calls/emails.

Does anyone know what address search might be being carried out? Or have any ideas as to how I can rectify this?

We're at a point where everything else in the chain is complete and we SHOULD be looking at exchange dates. Me and my partner are heartbroken that this might all fall through now because of this

0 -

If I swap from Sky broadband to Gigaclear before completion will this go against me if Gigaclear do a hard credit check. Or will they just see it as swapping utility companies?0

-

@kee89 It's hard to pinpoint the issue from your post - whether it's something lender specific or not, whether this is something that has come up prior to the mortgage offer or during conveyancing, etc. Generally speaking, lenders can use non standard addresses if need be so I wouldn't expect something like what you've said to be a show stopper.kee89 said:Help / advice / magic wand desperately needed!

I am selling my house and buying elsewhere with my partner.

Offers accepted in Feb and only NOW am I finding out that the mortgage company for my buyer has refused to progress the application because my address is incorrect on whatever searches the mortgage company does.

The address should be 43 Rockhampton Street, but when searched it comes up as Flat 1 and Flat 2 (it's never been flats so I don't know why it does this). It comes up wrong on almost every automated address search engine, despite me correcting it with Royal Mail.

My solicitor has sent across land registry details that prove the address is in fact 43, but apparently the mortgage company won't progress until the address issue is fixed.

I'm at a loss and not sure what more can be done. Getting further info from the buyer is also proving tricky because my agent appears to pick and chose when they want to answer my calls/emails.

Does anyone know what address search might be being carried out? Or have any ideas as to how I can rectify this?

We're at a point where everything else in the chain is complete and we SHOULD be looking at exchange dates. Me and my partner are heartbroken that this might all fall through now because of this

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards