We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

@narges Given that you've passed the DIP, hopefully you should be fine. Even if it's subject to a manual review, the fact that it's a utility and satisfied should play in your favour.Narges said:

Unfortunately, they have reported it to both Equifax and TransUnion and Nationwide have checked both these reports. we have tried to ask them taking it off, complaining that they have not explained it completely at the time but they refused to take it down!K_S said:

@narges As you're past the DIP stage, you *should* be fine.Narges said:Hello-is it impossible to secure a mortgage with AR on credit file?

My partner and I have applied for a mortgage via Nationwide and our valuation is booked for tomorrow so not sure how long it will take after that to hear the decision. what worries me its my Partner's credit history, he had a two year Arrangement to Pay with a Water company, which has been stopped on March 2020 and the account has been closed on Apr 2021 and marked satisfied. at the time that he agreed to AP plan he wasn't clear about the negative impact it will have on his credit file. however, other than this black mark he doesn't have any other issue and has been paying a hire to purchase loan he had since 2019 on time till now, and my credit is clean without any problems. we are applying for 90%LTV, and we have a good amount of saving other than our deposits(£33k), close to £25K. we are both in full time employment for over 3 years. I'm stressed as I have read really frustrating comments about not being able to secure a mortgage with AR mark on credit file! does anyone have any experience with these type of issue?

Water companies usually report to only one of Experian or Equifax so it may also be the case that Nationwide never picked it up on their credit search. Does the arrangement to pay show on both reports Exp and Equifax?

Worst case scenario, if the underwriter declines it at manual review due to this, you can use a lender that checks only Experian and doesn't explicitly ask about adverse history.

Hope the Nationwide offer comes through, good luck!I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

@choirgrl Your maximum term will depend on the following -Choirgrl said:I am about to set out on being a FTB at the age of 49. This means that the end of my mortgage term and the start of my retirement are likely to fall close together. I plan to retire age 70. Am I right in thinking I’ll have access to a wider range of mortgages if I specify a 20 year term, rather than 21 year one (which would take me past my 70th birthday)?I actually hope to be able to pay it off by my mid 60s through a mixture of regular additional payments and likely receipt of an inheritance during the mortgage term, but I’m aware this will be irrelevant to lenders.

- your intended retirement age

- lender policy (some will cap at 70, some at 75, some at 80)

- the kind of role you are in (if desk-based then a longer term is plausible)

You are right that by specifying a maximum term that goes no further than 70, you will have access to the maximum breadth of mainstream lenders.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Thank you very much for the input.K_S said:@choirgrl Your maximum term will depend on the following -

- your intended retirement age

- lender policy (some will cap at 70, some at 75, some at 80)

- the kind of role you are in (if desk-based then a longer term is plausible)

You are right that by specifying a maximum term that goes no further than 70, you will have access to the maximum breadth of mainstream lenders.0 -

Use a term of 70 minus age next birthday, so for a 49 year old, 20 years should be used with a selected retirement age of 70 on the application.Choirgrl said:I am about to set out on being a FTB at the age of 49. This means that the end of my mortgage term and the start of my retirement are likely to fall close together. I plan to retire age 70. Am I right in thinking I’ll have access to a wider range of mortgages if I specify a 20 year term, rather than 21 year one (which would take me past my 70th birthday)?I actually hope to be able to pay it off by my mid 60s through a mixture of regular additional payments and likely receipt of an inheritance during the mortgage term, but I’m aware this will be irrelevant to lenders.I am a mortgage broker. You should note that this site doesn't check my status as a Mortgage Adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice. Please do not send PMs asking for one-to-one-advice, or representation.1 -

Thank youkingstreet said:Use a term of 70 minus age next birthday, so for a 49 year old, 20 years should be used with a selected retirement age of 70 on the application.0 -

Hello , I am a limited company day rate contractor and have applied for a cash advance on my mortgage with halfiax. They have asked for a pay slip but I don’t get payslips due to the nature of my work. My broker has told them I am a contractor etc

is there anything I can give to satisfy them ?0 -

@thomson_adam For contractors where a payslip isn't issued, the alternative that Halifax will accept is bank statements with payments coming in from the client.thomson_adam said:Hello , I am a limited company day rate contractor and have applied for a cash advance on my mortgage with halfiax. They have asked for a pay slip but I don’t get payslips due to the nature of my work. My broker has told them I am a contractor etc

is there anything I can give to satisfy them ?I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

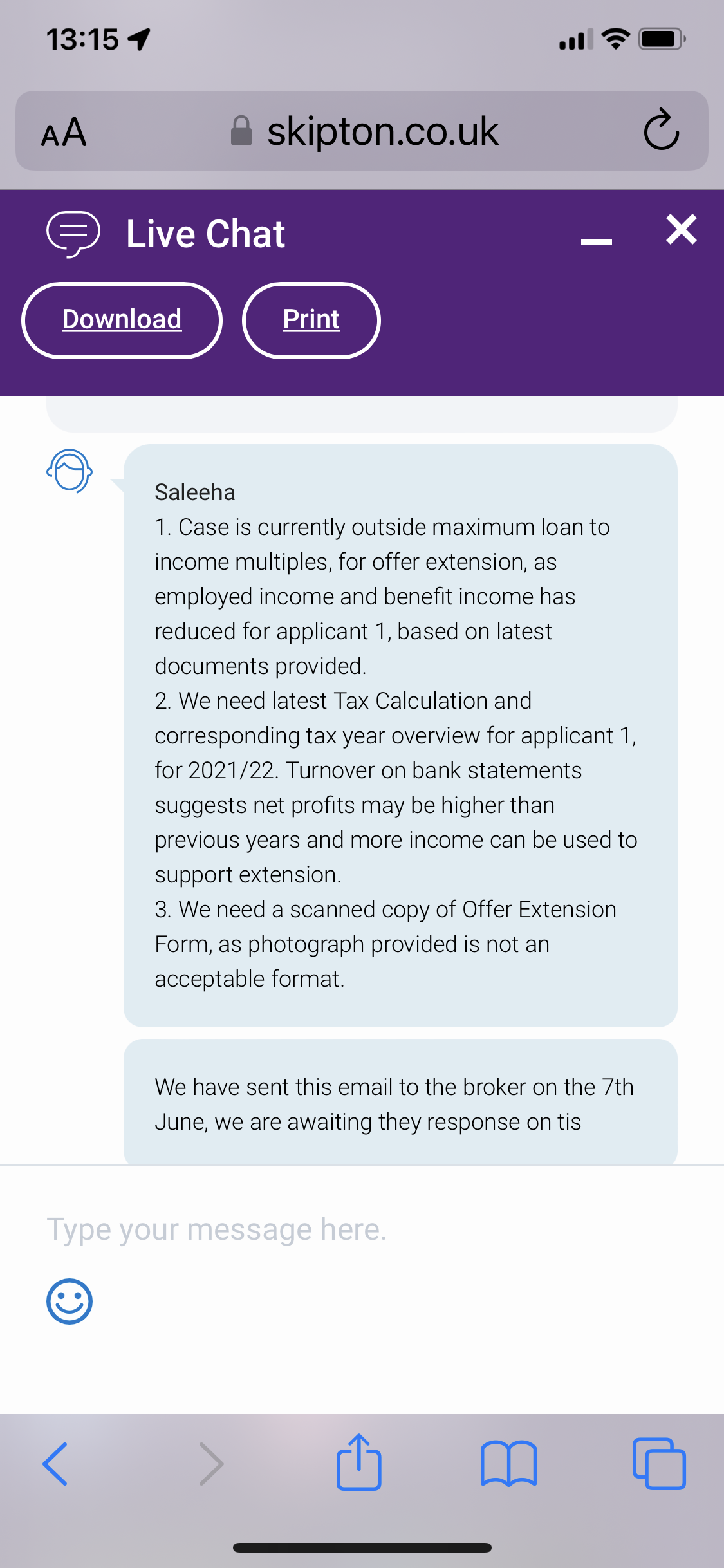

hi my broker applied for a extension with skipton as this what they said what is mean do i need to do tax return say income has reduced then saying its increased.

ehat 0

ehat 0 -

@tab99uk It looks like your broker has applied for an offer extension and sent across latest pay documents which show that- your employed income has gone done

- your benefits income has gone down

Because of this, you no longer meet affordability for the borrowing amount so they can't give an extension for the original amount.

However, Skipton are suggesting, that based on the bank statements it looks like your self-employed income is doing better than before BUT to take that into account they will need an SA302+Tax year overview for 2021-22, for which you'll need to submit your self-assessment.

Alternatively, if you have extra cash, it may be worth reducing the loan amount to fit affordability.

I just want to point out that everything I've said above is based on the very limited info in front of me so might well be way off the mark.

Your broker would be the person best placed to answer your questions and suggest a way forward, good luck!I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Hello, we currently have a mortgage application with Natwest and they have twice requested via our broker for my latest trading accounts signed off by an accountant. I am self employed / sole trader, and I have submitted two years' SA100s, I thought trading accounts were only a requirement for limited companies? I keep my own accounts via Xero, and only use an accountant to file my VAT returns, so I am not sure what is required?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards