We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

We are looking to get a shared ownership mortgage this year, ideally with Barclays. Problem is I have 3 defaults, 2 are utility and under £100 and satisfied over 18 months. 3rd default is 3 years in June, settled and worth £503. I have no debt and other half has a glowing credit history.What’s the likelihood of Barclays giving us a AIP and considering an application? Brokers rarely tell us the lender they are thinking of but say it will be specialist.Advice please 🙏🏼 we are looking to borrow 95%.Thanks, Marcella0

-

I must add the utility defaults are 3 years old in May and November this year.0

-

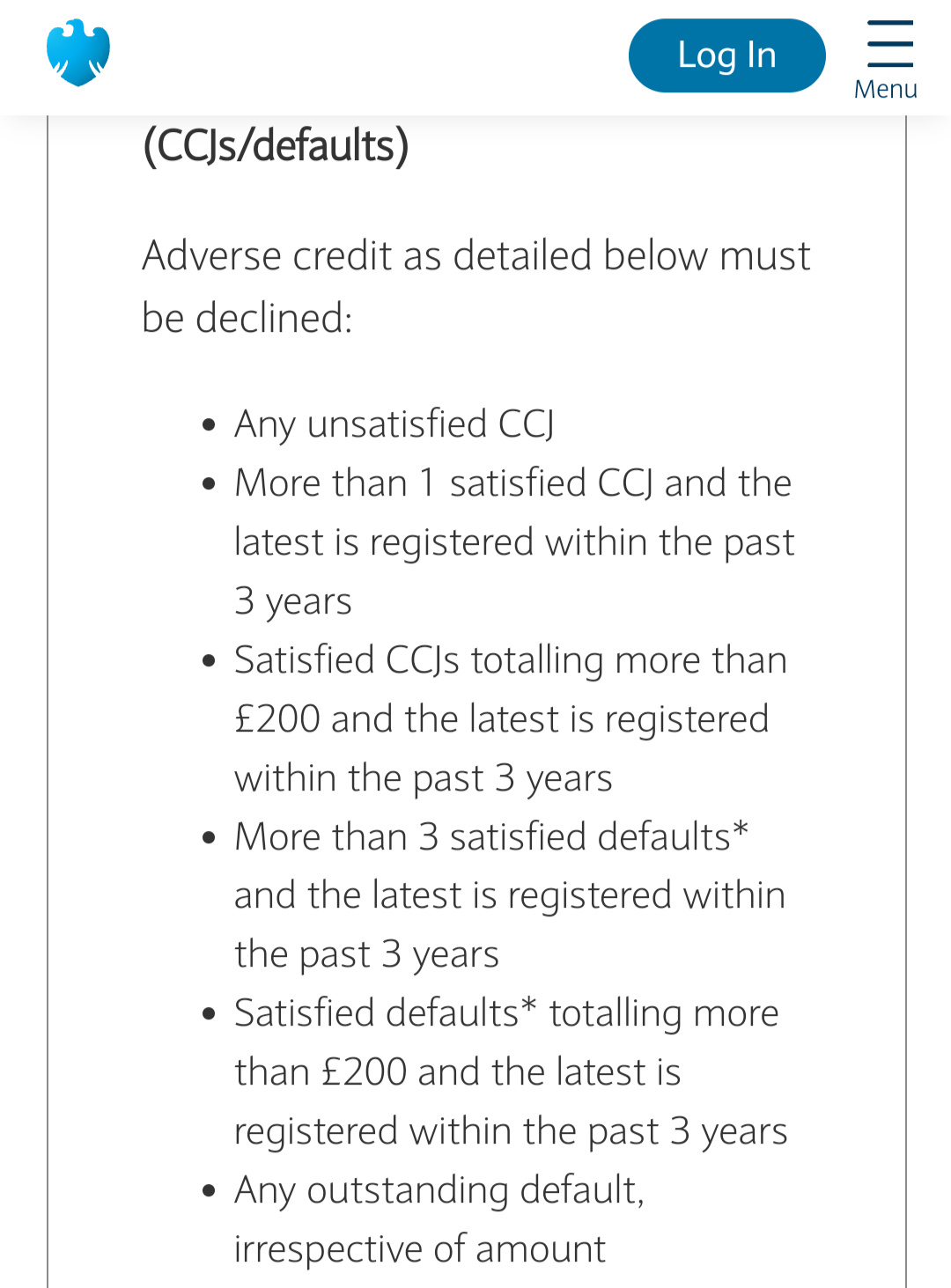

@md64 This is Barclays published adverse criteria. Meeting it doesn't mean that they will lend for your specific case. If you think you meet it, you could consider doing a Barclays DIP (it's a soft footprint credit check when done direct so no adverse impact on your credit file).md64 said:We are looking to get a shared ownership mortgage this year, ideally with Barclays. Problem is I have 3 defaults, 2 are utility and under £100 and satisfied over 18 months. 3rd default is 3 years in June, settled and worth £503. I have no debt and other half has a glowing credit history.What’s the likelihood of Barclays giving us a AIP and considering an application? Brokers rarely tell us the lender they are thinking of but say it will be specialist.Advice please 🙏🏼 we are looking to borrow 95%.Thanks, Marcella

https://intermediaries.uk.barclays/home/lending-criteria/residential/

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Thank you, my accountant sent an email saying...K_S said:

@mrbounce It's hard to say definitively as it may also depend on the case as a whole. However, limited to the self-employment aspect, given that they are happy to say that earnings will be similar to prior year, I'd imagine that would be sufficient...MrBounce said:Halifax have requested a letter from my accountant for my wife, as she has only 1 years self employed accounts...

The accountant has said they would write they estimate her earnings to be similar to the previous year, without giving a figure as they haven't finalised this last years accounts yet..

Would this be sufficient for a bank?

We write at the request of our above-named client to confirm, based on her tax return for 20/21 and subsequent VAT returns submitted to HMRC, that we project her income for 21/22 to be at the same level of the previous year at £XPlease note that the foregoing information is provided on the strict understanding that no express or implied liability is accepted on our part.

We are trying to get them to put it onto a letter instead of an email from them...

Really stressed now...

Halifax underwriter have only aaked for this letter and details of her previous experience in this role....

That was the only 2 things they requested....

Would they normally send the whole list together of everything... Or could they ask for more even if this satisfies their queries they initially asked about..0 -

Hi

wanted to get some thoughts on my situation if possible please

I had some credit card debts and a loan which were all cleared within the last 30 days. (Never missed a payment, no defaults etc so pretty much a spotless payment record). As these debts are recently cleared, will they negatively impact a mortgage application?I can prove everything has been paid off and most credit lines closed apart from 2 credit cards which ive left to demonstrate existing high credit limits0 -

@anonymou55e It's hard to say as it depends on your affordability numbers with/without the debt, the specific numbers and what's in your credit report.Anonymou55e said:Hi

wanted to get some thoughts on my situation if possible please

I had some credit card debts and a loan which were all cleared within the last 30 days. (Never missed a payment, no defaults etc so pretty much a spotless payment record). As these debts are recently cleared, will they negatively impact a mortgage application?I can prove everything has been paid off and most credit lines closed apart from 2 credit cards which ive left to demonstrate existing high credit limits

With mainstream lenders, at the DIP stage (where the soft credit check happens and the lender picks up data from the report), there is no opportunity to clarify that debt showing on the report has been cleared. Unless you pass the DIP stage you can't go on to a full app.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

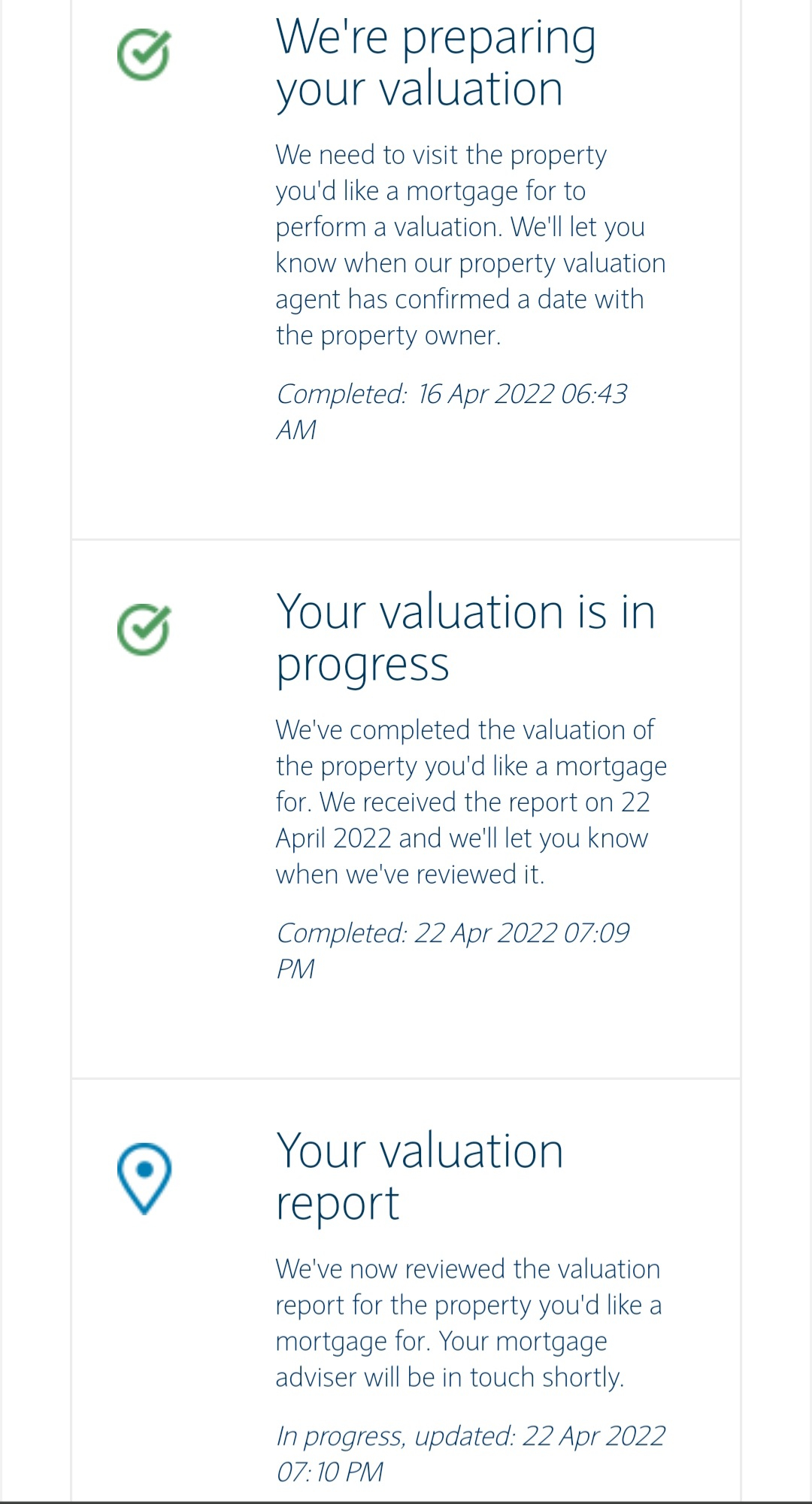

Hello people, I hope its ok to post this image in here ? There isn't anything personal or confidential on there.

This is the Barclays mortgage tracker which was updated this evening post valuation, I'm worried that it says valuation has been reviewed and mortgage advisor will be in touch shortly... it also says in progress and not completed like the other steps shown.

Why would we need to wait to hear from the mortgage advisor regarding this, I'm assuming it means the property is likely to have been down valued?

Can anyone shed any light on this please 😁

Thanks0 -

Hello.

How often/likely is it that a lender would withdraw their offer once made?

I have had a mortgage offer made nearly 4 month ago. However it has only just been revealed that their could be issues with the lenders requirements on the property, relating to an estate rentcharge. I have been told that the lender is only now going to be made aware of the rentcharge and we are possibly waiting to see if they will accept an indemnity insurance (which research tells me they probably won't).

Now what really concerns me about this is that I would have expected the lender to only make an offer once they are absolutely certain that they are happy to do so and that the property is completely acceptable to them. Which they definitely cannot have done since they obviously made the offer without even knowing that there was a rentcharge on the property. The worst case scenario here, as my solicitor has already warned me about in one of their letters, is that whilst unlikely, it is theoretically possible for the lender to withdraw their offer even after exchange of contracts, meaning I would lose my deposit.

Is their any kind of protection for the client in this situation? In other words do we really run the risk of losing a house deposit, which for some is their entire life savings, due to a mistake being made by a lender or a solicitor? I would understand if I had submitted wrong information or my circumstances had changed, but if it is their mistake or they changed their mind about the offer, can they actually just withdraw?

Thanks for any information.

0 -

@troy_af Quick thoughts -

Troy_af said:Hello.

How often/likely is it that a lender would withdraw their offer once made?

I have had a mortgage offer made nearly 4 month ago. However it has only just been revealed that their could be issues with the lenders requirements on the property, relating to an estate rentcharge. I have been told that the lender is only now going to be made aware of the rentcharge and we are possibly waiting to see if they will accept an indemnity insurance (which research tells me they probably won't).

Now what really concerns me about this is that I would have expected the lender to only make an offer once they are absolutely certain that they are happy to do so and that the property is completely acceptable to them. Which they definitely cannot have done since they obviously made the offer without even knowing that there was a rentcharge on the property. The worst case scenario here, as my solicitor has already warned me about in one of their letters, is that whilst unlikely, it is theoretically possible for the lender to withdraw their offer even after exchange of contracts, meaning I would lose my deposit.

Is their any kind of protection for the client in this situation? In other words do we really run the risk of losing a house deposit, which for some is their entire life savings, due to a mistake being made by a lender or a solicitor? I would understand if I had submitted wrong information or my circumstances had changed, but if it is their mistake or they changed their mind about the offer, can they actually just withdraw?

Thanks for any information.

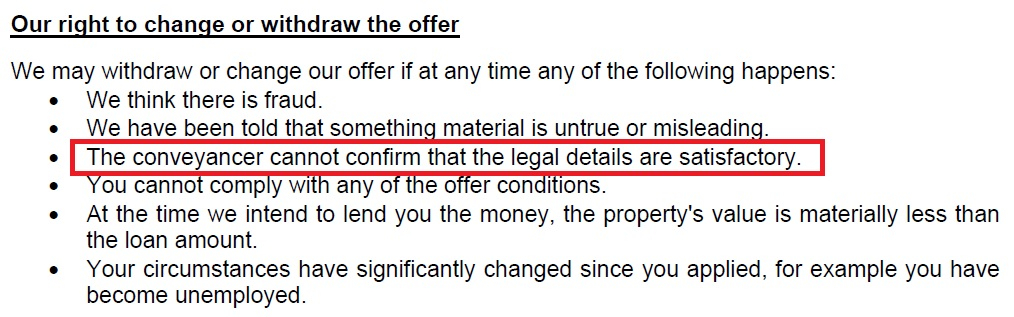

- I appreciate that you don't agree that it's right but issues with rent-charges/leases/ground-rent/etc. only ever come up during conveyancing as it's a legal matter.

- Having said that, on occasion some lenders/valuers will ask for rent-charge details for new-build properties as the builder/developer is usually willing to confirm the relevant details. In used property transactions, it's different as the EA will be totally clueless and the vendor often has no clue of rent-charges, etc.

- Normally, it will be your solicitor's responsibility to not proceed to exchange until the above is confirmed as suitable for the lender to lend. I've never come across a rent-charge issue which only came up after exchange and led to the withdrawal of the offer. And normally, the lender will tell you what an acceptable remedy is - for example a variation to the deed.

- the reasons for which lenders can withdraw offers is usually listed in their offer documents. Here's an example below.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Hi - Can you let me know whether I'm classed as self-employed for mortgage purposes please? I have recently started working as an administrator for a disabled lady. She gets my services fully paid for by the DWP Access to Work scheme - so she has funding for me to work 16hrs a week for the next 3 years. I give her an invoice each month, we fill out the Access to Work claim form . This is sent to the DWP and then DWP pay her, and she transfers the payment to me. I will have to do a tax return to pay income tax and NI. I started this work in November 22 and I need a £25,000 mortgage as I want to move from my (owned outright) home and need a bit more cash than I currently have. I don't do any other work. Thank you.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards