We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

@lyd00 I would say don't worry too much until there's actually something to worry about. Santander is UK's third-largest mortgage lender so they can't be all that badLyd00 said:I'm a FTB so a complete newbie to this.

My broker submitted all my paperwork to Santander on Friday. Is it too late to cancel? I've been reading awful reviews about Santander and it's made me panic. Slow to process applications, refusing to lend at the 11th hour etc. We were going to submit to platform but my broker thought Santander would be more straight forward. I'm worried they won't be

Thanks

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Morning, first off great thread btw.

We moved into our new build house in 2018, purchased for £127,995. 30 year mortgage was taken out for £115,000 on with a 2.15% fix for 2 years.

In 2020 we remortgaged with current provider to avoid any issues due to the pandemic at the time, rate changed to 2.3% and we now pay £447pm

Our current fix is due to expire in June 2022. Currently we have £105,000 left to pay off so this will be around £104,000 when our fix ends.

An exact property as ours sold on the estate in Oct 2020 for £145,000 and have used this figure on our mortgage searches which lowers the LTV.

I'm trying to work out the best way to go about remortgaging. We have some money in savings and unsure if we should pay off some of the mortgage before getting our new deal.

Also with 26 years left to pay off the remainder, my current mortgage searches are bringing up monthly payments of around £370. Should we look to get a mortgage that reduces the term to say 21 years or should we continue on a 26 year term and overpay the mortgage to the amount we currently pay per month?

Thanks for any help provided.0 -

Hey,

Me and my partner are currently remortgaging early to gain access to some cash/equity to finish renovating our home. We are currently with Halifax and moving across to NatWest - the survey for the valuation is booked in next Thursday 3rd Feb. How long after a valuation should you expect the process to be completed and the funds in your account? We have a pretty big chunk of money we need to pay by Feb 27th and hoping its all completed by then!

Thanks so much

0 -

K_S said:

@homeless9 How much one can borrow depends primarily on your "affordability" as the lender calculates it and that depends on your income and outgoings. The maximum 'loan-to-income" that the lender will consider offering can change a bit according to the LTV. For example, for the same lender the maximum LTI at 95% LTV might be 4x, at 85% LTV might be 4.75x and at 75% LTV 5x. I hope that makes sense.

I would recommend playing around with a few lender affordability calculators so you can get a very rough idea of what numbers to expect.

https://online.accordmortgages.com/public/mortgages/quick_enquiry.do#section

https://www.santanderforintermediaries.co.uk/calculators-and-forms/affordability/

Thanks.

With this situation with Help To Buy....where someone wants to remortgage to pay it off, but that bank/lender declines due to affordability, therefore the person has to start paying the interest costs to Help To Buy which are approx £800 a year, so £67 per month. Would the bank/lender not recognise that the person will end up having to pay extra costs anyway that the bank might as well just let the person borrow the extra money from them?

I'd assume they don't take this into consideration. They'll just say 'we don't think you can afford these extra mortgage payments based on affordability checks, but you can stick with your current mortgage and pay off the £67 per month extra interest to Help To Buy, even though we don't think you can afford an extra £67 cost per month seeing as you didn't pass affordability checks'.0 -

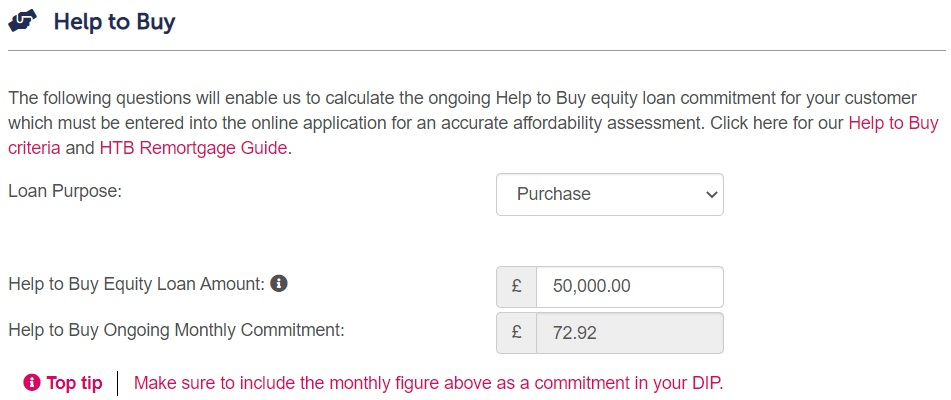

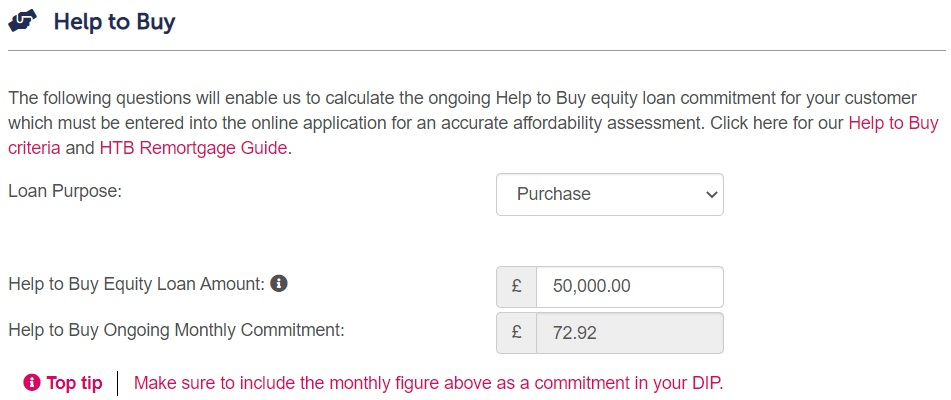

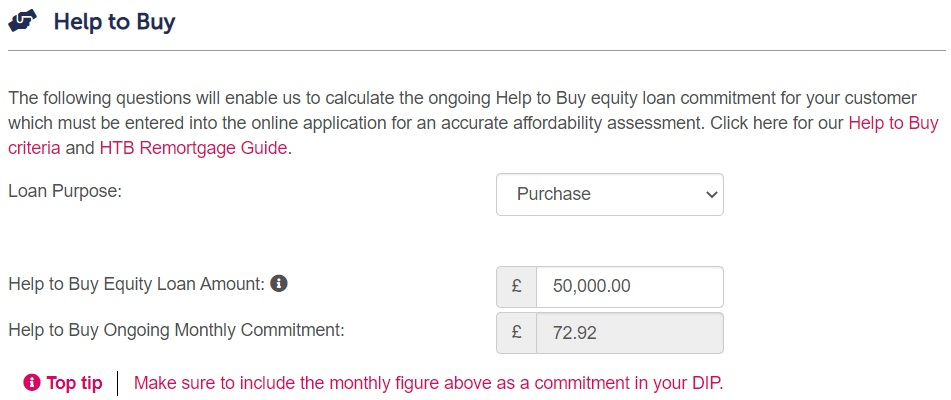

@homeless9 The cost of the future interest H2B payments over the term of the mortgage is already factored in to their H2B affordability calculators, so it's already been accounted for when they initially loaned you the money. Plus H2B automatically applies a max loan to income cap of 4.5x, which is significantly lower than the up to 5-6x that you could potentially get with non-H2B lending.homeless9 said:K_S said:

@homeless9 How much one can borrow depends primarily on your "affordability" as the lender calculates it and that depends on your income and outgoings. The maximum 'loan-to-income" that the lender will consider offering can change a bit according to the LTV. For example, for the same lender the maximum LTI at 95% LTV might be 4x, at 85% LTV might be 4.75x and at 75% LTV 5x. I hope that makes sense.

I would recommend playing around with a few lender affordability calculators so you can get a very rough idea of what numbers to expect.

https://online.accordmortgages.com/public/mortgages/quick_enquiry.do#section

https://www.santanderforintermediaries.co.uk/calculators-and-forms/affordability/

Thanks.

With this situation with Help To Buy....where someone wants to remortgage to pay it off, but that bank/lender declines due to affordability, therefore the person has to start paying the interest costs to Help To Buy which are approx £800 a year, so £67 per month. Would the bank/lender not recognise that the person will end up having to pay extra costs anyway that the bank might as well just let the person borrow the extra money from them?

I'd assume they don't take this into consideration. They'll just say 'we don't think you can afford these extra mortgage payments based on affordability checks, but you can stick with your current mortgage and pay off the £67 per month extra interest to Help To Buy, even though we don't think you can afford an extra £67 cost per month seeing as you didn't pass affordability checks'.

Here's an example from one lender.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

@bell455 If your conveyancing is done by the time an offer is issued, then you *should* be able to hit the deadline in your post.bell455 said:Hey,

Me and my partner are currently remortgaging early to gain access to some cash/equity to finish renovating our home. We are currently with Halifax and moving across to NatWest - the survey for the valuation is booked in next Thursday 3rd Feb. How long after a valuation should you expect the process to be completed and the funds in your account? We have a pretty big chunk of money we need to pay by Feb 27th and hoping its all completed by then!

Thanks so muchI am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

@robgoode I'm not entirely sure what your question is but with regard to shorter term vs overpaying, my opinion is the same as Martin's https://blog.moneysavingexpert.com/2014/10/dont-shorten-your-mortgage-term-if-you-can-overpayrobgoode said:Morning, first off great thread btw.

We moved into our new build house in 2018, purchased for £127,995. 30 year mortgage was taken out for £115,000 on with a 2.15% fix for 2 years.

In 2020 we remortgaged with current provider to avoid any issues due to the pandemic at the time, rate changed to 2.3% and we now pay £447pm

Our current fix is due to expire in June 2022. Currently we have £105,000 left to pay off so this will be around £104,000 when our fix ends.

An exact property as ours sold on the estate in Oct 2020 for £145,000 and have used this figure on our mortgage searches which lowers the LTV.

I'm trying to work out the best way to go about remortgaging. We have some money in savings and unsure if we should pay off some of the mortgage before getting our new deal.

Also with 26 years left to pay off the remainder, my current mortgage searches are bringing up monthly payments of around £370. Should we look to get a mortgage that reduces the term to say 21 years or should we continue on a 26 year term and overpay the mortgage to the amount we currently pay per month?

Thanks for any help provided.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

K_S said:

@homeless9 The cost of the future interest H2B payments over the term of the mortgage is already factored in to their H2B affordability calculators, so it's already been accounted for when they initially loaned you the money. Plus H2B automatically applies a max loan to income cap of 4.5x, which is significantly lower than the up to 5-6x that you could potentially get with non-H2B lending.homeless9 said:K_S said:

@homeless9 How much one can borrow depends primarily on your "affordability" as the lender calculates it and that depends on your income and outgoings. The maximum 'loan-to-income" that the lender will consider offering can change a bit according to the LTV. For example, for the same lender the maximum LTI at 95% LTV might be 4x, at 85% LTV might be 4.75x and at 75% LTV 5x. I hope that makes sense.

I would recommend playing around with a few lender affordability calculators so you can get a very rough idea of what numbers to expect.

https://online.accordmortgages.com/public/mortgages/quick_enquiry.do#section

https://www.santanderforintermediaries.co.uk/calculators-and-forms/affordability/

Thanks.

With this situation with Help To Buy....where someone wants to remortgage to pay it off, but that bank/lender declines due to affordability, therefore the person has to start paying the interest costs to Help To Buy which are approx £800 a year, so £67 per month. Would the bank/lender not recognise that the person will end up having to pay extra costs anyway that the bank might as well just let the person borrow the extra money from them?

I'd assume they don't take this into consideration. They'll just say 'we don't think you can afford these extra mortgage payments based on affordability checks, but you can stick with your current mortgage and pay off the £67 per month extra interest to Help To Buy, even though we don't think you can afford an extra £67 cost per month seeing as you didn't pass affordability checks'.

Here's an example from one lender.

So would that mean the lender would likely be happy to add the help to buy loan onto the mortgage when I remortgage?

Instead of me paying the HTB loan interest per month, I pay the lender back each month for covering the loan on the new mortgage?....

This all assuming my affordability was at least the same as when I first took out the mortgage, as well as interest rates not changing too much.0 -

Hi, it’s a definite freehold flat, block of 4 have a covenant agreement re maintenance shared between 4 flats but no lease.K_S said:

@sr24 Depends on what you mean by 'freehold'. Are you talking about a situation where the freehold is shared between the 4 flats and there is lease for each property? If yes then it should be fairly straightforward.SR24 said:Hi. Freehold flat (two storey only and a block of 4 purpose built).

Are mortgages available?

Small LTV mortgage required less than 15% LTV.

Wondering what current situ is re lending in this scenario please.

If it's a 'true freehold' (I've seen them in some parts of the NE and SW) with no lease, then it gets more complicated.Complicated to obtain a mortgage… does this mean less choice and higher mortgage rates?Assume it may be a property that can only attract certain scenarios of buyer so not going to be easy to resale due to freehold?0 -

@homeless9 Sorry if that's how it came across, but no that's not what I meant to sayhomeless9 said:K_S said:

@homeless9 The cost of the future interest H2B payments over the term of the mortgage is already factored in to their H2B affordability calculators, so it's already been accounted for when they initially loaned you the money. Plus H2B automatically applies a max loan to income cap of 4.5x, which is significantly lower than the up to 5-6x that you could potentially get with non-H2B lending.homeless9 said:K_S said:

@homeless9 How much one can borrow depends primarily on your "affordability" as the lender calculates it and that depends on your income and outgoings. The maximum 'loan-to-income" that the lender will consider offering can change a bit according to the LTV. For example, for the same lender the maximum LTI at 95% LTV might be 4x, at 85% LTV might be 4.75x and at 75% LTV 5x. I hope that makes sense.

I would recommend playing around with a few lender affordability calculators so you can get a very rough idea of what numbers to expect.

https://online.accordmortgages.com/public/mortgages/quick_enquiry.do#section

https://www.santanderforintermediaries.co.uk/calculators-and-forms/affordability/

Thanks.

With this situation with Help To Buy....where someone wants to remortgage to pay it off, but that bank/lender declines due to affordability, therefore the person has to start paying the interest costs to Help To Buy which are approx £800 a year, so £67 per month. Would the bank/lender not recognise that the person will end up having to pay extra costs anyway that the bank might as well just let the person borrow the extra money from them?

I'd assume they don't take this into consideration. They'll just say 'we don't think you can afford these extra mortgage payments based on affordability checks, but you can stick with your current mortgage and pay off the £67 per month extra interest to Help To Buy, even though we don't think you can afford an extra £67 cost per month seeing as you didn't pass affordability checks'.

Here's an example from one lender.

So would that mean the lender would likely be happy to add the help to buy loan onto the mortgage when I remortgage?

Instead of me paying the HTB loan interest per month, I pay the lender back each month for covering the loan on the new mortgage?....

This all assuming my affordability was at least the same as when I first took out the mortgage, as well as interest rates not changing too much.

I would recommend playing around with a few lender affordability calculators so you can get a very rough idea of what numbers to expect.

Just plug in the numbers and see what is the maximum borrowing figure it indicates. If it shows a figure which is close to your current mortgage + equity loan, then you may be ok at remo time.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards