We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

@steviek83 All I can suggest is looking for an alternate lender asap. If it's gone through all this with Halifax, it's been manually reviewed and they are very unlikely to overturn it.Steviek83 said:I had a DIP from halifax. Explained prior that i had some defaults. Was told this wasn't an issue due to the age. They are all over 5 years old. Submitted a mortgage application, was asked to provide a covering letter to explain the defaults. Was told this was fine. My Application was then rejected due to me agreeing a payment plan with the company who brought one of the debts. There is no Arrangement to pay markers on my credit file.I Really am in limbo as we've had an offer on a house accepted, all searches etc done. Any advice would be appreciated.

Based on the limited info in your post, you *should* have options.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Thankyou. The Default is for £2100, issued in June 2016. I have had no issues since. In a well paid job and zero other debts.K_S said:

@steviek83 All I can suggest is looking for an alternate lender asap. If it's gone through all this with Halifax, it's been manually reviewed and they are very unlikely to overturn it.Steviek83 said:I had a DIP from halifax. Explained prior that i had some defaults. Was told this wasn't an issue due to the age. They are all over 5 years old. Submitted a mortgage application, was asked to provide a covering letter to explain the defaults. Was told this was fine. My Application was then rejected due to me agreeing a payment plan with the company who brought one of the debts. There is no Arrangement to pay markers on my credit file.I Really am in limbo as we've had an offer on a house accepted, all searches etc done. Any advice would be appreciated.

Based on the limited info in your post, you *should* have options.0 -

My husband is trying to get a mortgage for a flat. He has worked in his main job for 5 years at a train station. He recently got a second part time job at a restaurant to help save more money towards a flat. He has been in his second job for 3 months. When looking for a mortgage will all brokers only consider the second job once he has been there 6 or more months? Or are there brokers who will be fine with 3 months?0

-

@rumana03 You'll need 6 months. It's not the broker stipulating this, it's the lender criteria.Rumana03 said:My husband is trying to get a mortgage for a flat. He has worked in his main job for 5 years at a train station. He recently got a second part time job at a restaurant to help save more money towards a flat. He has been in his second job for 3 months. When looking for a mortgage will all brokers only consider the second job once he has been there 6 or more months? Or are there brokers who will be fine with 3 months?

There are a few lenders who don't specify a minimum time in second job, but they will do the necessary work to satisfy themselves that the job is sustainable and isn't being used simply to increase borrowing. I hope that makes sense.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

How much will a short term direct debit affect my ability to get a mortgage? I am thinking of paying for a one year diploma by DD which would last 18months, will this significantly affect the amount I will be able to borrow?0

-

@naomi_louise84 It may count as a committed outgoing and depending on the size of it, your income, age, etc it might impact your max borrowing. Just play around with a couple of lender calculators to see what the impact might be.naomi_louise84 said:How much will a short term direct debit affect my ability to get a mortgage? I am thinking of paying for a one year diploma by DD which would last 18months, will this significantly affect the amount I will be able to borrow?

https://online.accordmortgages.com/public/mortgages/quick_enquiry.do

https://www.santanderforintermediaries.co.uk/calculators-and-forms/affordability/

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Hi,

I sold my house in Sep 21. Moved in with family now buying another. Did an AIP with HSBC and Barclays but but failed. Spoke to L&C who advised to check credit history. Found that in September Yorkshire Water cancelled the direct debit at the same time as closing the account, and had no forwarding address for me. Anyway the £44 final payment went missed in Oct/Nov/Dec before they wrote it off. I have contacted and they are investigating but I am not holding out any hope. What are my options for getting a mortgage now? This problem with Yorkshire Water is the only thing I've ever had.0 -

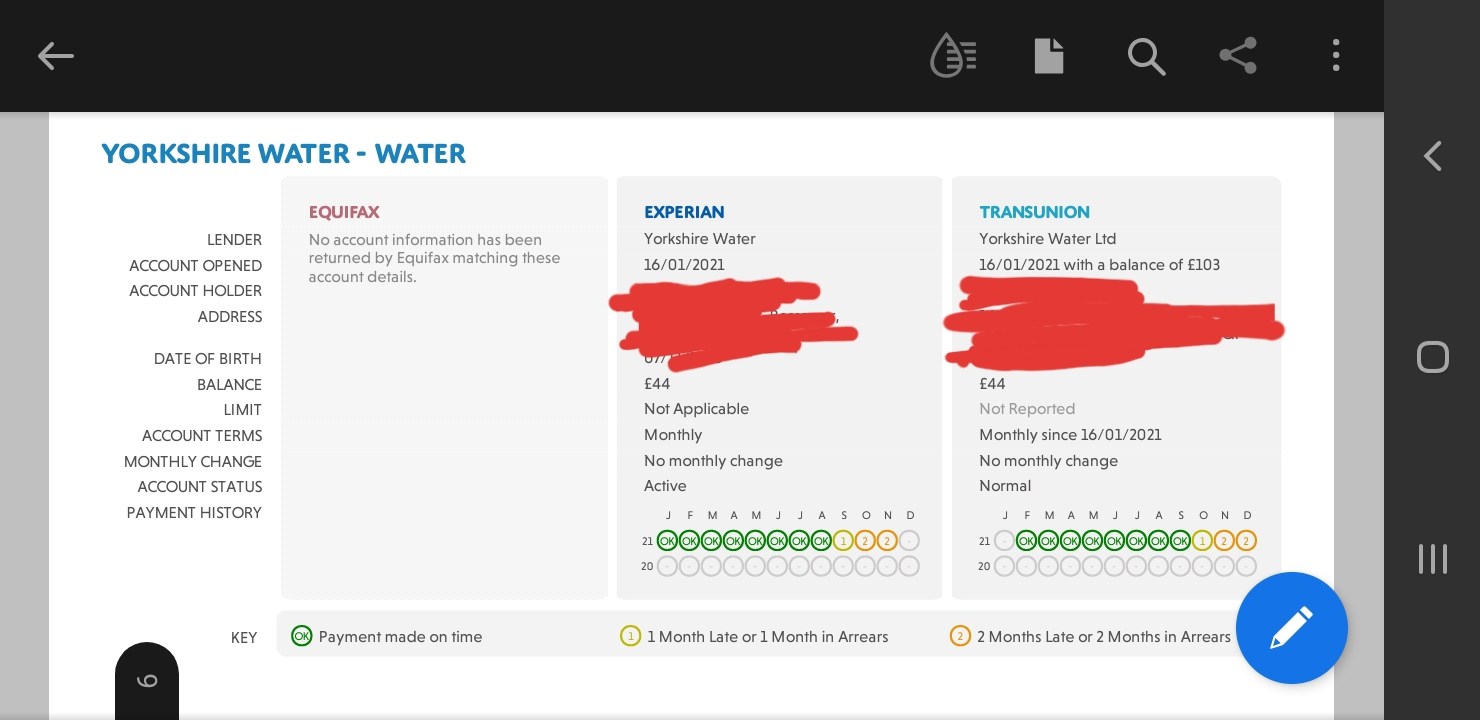

@kiyonari It depends on what exactly it looks like on the credit-report. Is it a series of status '6' or a 1-2-3 and then closed? Does the Yorkshire Water account appear on both Experian and Equifax (usually water cos only report to one of the two) or just one? Does it still show an account balance or not? The answers to these questions (and the rest of the circumstances/requirements) will help determine the direction to take but based on the limited info in your post, you should be able to access mainstream/ish rates.

The issue is the recency of it unfortunately and hence the inability to pass the lenders' automated scoring for DIPs.

What is L&C suggesting as a way forward?I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Thanks for getting back to me.K_S said:@kiyonari It depends on what exactly it looks like on the credit-report. Is it a series of status '6' or a 1-2-3 and then closed? Does the Yorkshire Water account appear on both Experian and Equifax (usually water cos only report to one of the two) or just one? Does it still show an account balance or not? The answers to these questions (and the rest of the circumstances/requirements) will help determine the direction to take but based on the limited info in your post, you should be able to access mainstream/ish rates.

The issue is the recency of it unfortunately and hence the inability to pass the lenders' automated scoring for DIPs.

What is L&C suggesting as a way forward?

It shows as a 1, 2, 2 on Transunion and Experian, the account doesnt show on Equifax. It does show a balance, I'll try and attach a picture. L&C guy has said he is going to try ans find a suitable lender. 0

0 -

@kiyonari Well, first-off the account is still showing as active, so if you haven't already, it may be advisable to pay off the balance so that Yorkshire updates it to satisfied and closed. That'll draw a line under that. At the same time, if there is any mistake at all by Yorkshire water, it may be worth putting in a formal complaint asking them to remove the late markers. I've had clients in the past who have been able to get the utility co to change the late payment markers to 'Q' (query) which is a neutral marker.

Given that it's only on Experian and Transunion, it also could be an option to use a lender that only used Equifax at DIP or app stage AND does not ask about arrears on the app form so that there is no risk of making a false declaration.

If none of the above work, you still have the fall-back option of using lenders that don't 'credit-score'. The rates will not be as good as HSBC, Barclays but won't be too far off either.

I'm sure the L&C adviser will find an alternate lender, good luck!I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards