We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

Hoping for some help I have a small satisfied default but it only shows on experian .....I saw an article advising if your default only shows on one CRA to try a lender than doesn't check it...are there some lenders only check transunion and equifax? I think Nationwide maybe?0

-

Hi. I received notification that my mortgage with Santander was approved last Thursday. I've been told that it normally takes a week for the paperwork to find its way to the solicitor. As of this morning my solicitor who is on the Santander panel says nothing is on Lender Exchange portal.

I'm unclear what the process is at this point - when does it go onto the portal or is it the paperwork that gets sent in the post to the solicitor the important bit?

Realistically, how long should the legal work take before exchange can take place (everything else is complete)?

Thanks!0 -

BuckfastLover said:Hi, just looking for some clarifications around Klarna/Buy Now Pay Later/Finance Plan.

I'm a FTB with 25% deposit, will be borrowing about 3.5x my salary, will apply for mortgage in the next 2 to 3 months.

I'm looking to buy a TV at the moment and am thinking of using 0% finance plan to spread the cost over 6 months, would this affect my mortgage application? I have read recent news about people being declined mortgage due to having Klarna etc. so a bit worried.@buckfastlover I haven't seen it myself with my clients but have heard of this happen anecdotally.If I see a Clearpay/Klarna type payment on my client's bank statement I include it as a commitment on the application form if it meets the criteria for that. So that way it may impact affordability depending on the numbers.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Hoping for some help I have a small satisfied default but it only shows on experian .....I saw an article advising if your default only shows on one CRA to try a lender than doesn't check it...are there some lenders only check transunion and equifax? I think Nationwide maybe?@desperatelytryingtoimprove There are plenty of lenders who will check only one of the credit files. However, the problem with that approach is that the application form may ask about defaults that you have had in the last x years. If you picked a lender who asked that question, you would have to misrepresent your situation to get past that hurdle. Additionally, some lenders will have a backup credit-file in case they aren't able to match details on the preferred one.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

hillwalker2004 said:Hi. I received notification that my mortgage with Santander was approved last Thursday. I've been told that it normally takes a week for the paperwork to find its way to the solicitor. As of this morning my solicitor who is on the Santander panel says nothing is on Lender Exchange portal.

I'm unclear what the process is at this point - when does it go onto the portal or is it the paperwork that gets sent in the post to the solicitor the important bit?

Realistically, how long should the legal work take before exchange can take place (everything else is complete)?

Thanks!@hillwalker2004 I'm not sure how long it takes. Usually, when the offer is issued I download the broker copy of the offer and email it to the client and their solicitor so that they aren't waiting for the details and can proceed with the rest of the conveyancing.The solicitor copy usually makes its way to them in a few days at most.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

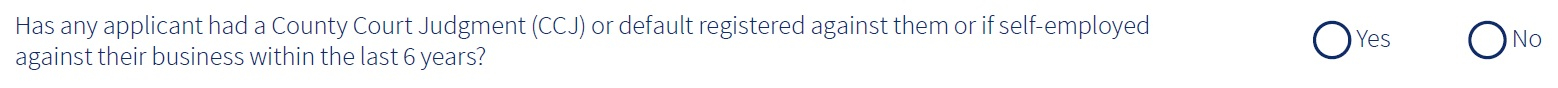

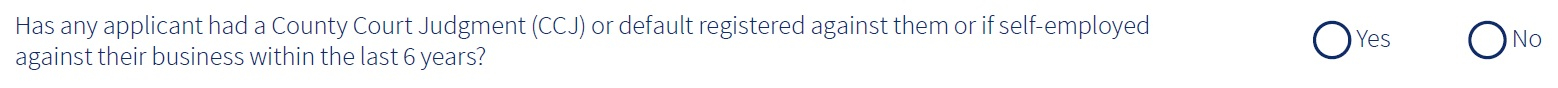

on nationwide they definately didn't ask about defaults only ccjs and I got the aip it was more so if there are a list of which banks check which CRaK_S said:Hoping for some help I have a small satisfied default but it only shows on experian .....I saw an article advising if your default only shows on one CRA to try a lender than doesn't check it...are there some lenders only check transunion and equifax? I think Nationwide maybe?@desperatelytryingtoimprove There are plenty of lenders who will check only one of the credit files. However, the problem with that approach is that the application form may ask about defaults that you have had in the last x years. If you picked a lender who asked that question, you would have to misrepresent your situation to get past that hurdle. Additionally, some lenders will have a backup credit-file in case they aren't able to match details on the preferred one. 0

0 -

Do all brokers work with people who are using the HTB Equity Loan, and Lifetime ISA's? Or would they be specialist brokers?0

-

@kel_bels I know of brokers who don't (or only rarely) do shared-ownership, but everyone that I know of does HTB Equity Loan mortgages. The broker has very little to do with using LISAs/HTB ISAs towards the deposit, that is handled by the conveyancer.Kel_bels said:Do all brokers work with people who are using the HTB Equity Loan, and Lifetime ISA's? Or would they be specialist brokers?

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

I'm in the same boat, was advised by my mortgage advisor a week ago my mortgage offer was on it's way to me. I've had notification from my bank that a dd mandate has been set up for the lender but had nothing either via email or post. I know the post is slow in some areas at the moment - am I right to assume the official offer will definitely come by post and not email?hillwalker2004 said:Hi. I received notification that my mortgage with Santander was approved last Thursday. I've been told that it normally takes a week for the paperwork to find its way to the solicitor. As of this morning my solicitor who is on the Santander panel says nothing is on Lender Exchange portal.

I'm unclear what the process is at this point - when does it go onto the portal or is it the paperwork that gets sent in the post to the solicitor the important bit?

Realistically, how long should the legal work take before exchange can take place (everything else is complete)?

Thanks!28th April - MIP submitted and issued

23rd June - Offer Finally Accepted On A House!

23rd June - Full application submitted through broker

19th July - Mortgage offer received

23rd July - Draft contract received

26th July - Searches requested

2nd August - Survey completed0 -

We were supposed to complete on our purchase tomorrow but can’t exchange as the seller is waiting for a redemption statement. This is coming from Paragon bank. Are they usually slow? Our conveyancer seems to think they won’t fax it until the day of completion.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards