We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

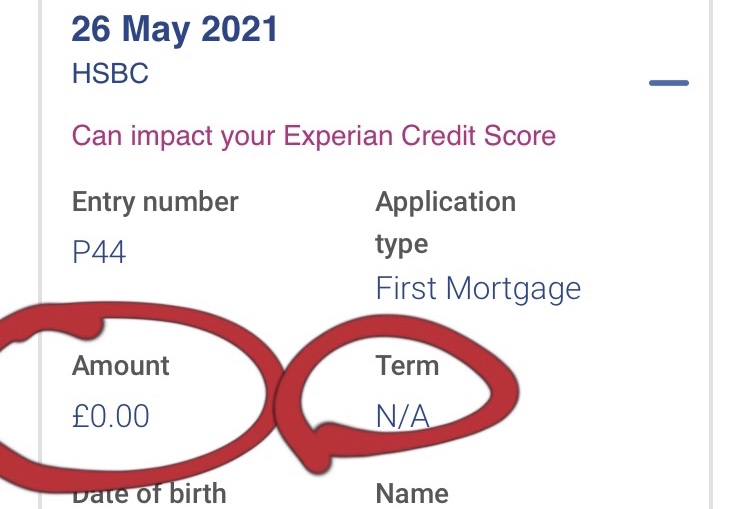

what does mortgage hard search amount 0 mean on credit report? Does it mean refused by the leader? Thank you!0

-

@tracy_l Not entirely sure what you are asking but a hard search on a credit report only shows that you made an application. It does not say whether your application was declined or accepted.tracy_l said:what does mortgage hard search amount 0 mean on credit report? Does it mean refused by the leader? Thank you!

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Thank you for replying, I attached an image of what I saw on hard search, the amount showed 0 and made me worried.K_S said:

@tracy_l Not entirely sure what you are asking but a hard search on a credit report only shows that you made an application. It does not say whether your application was declined or accepted.tracy_l said:what does mortgage hard search amount 0 mean on credit report? Does it mean refused by the leader? Thank you! 0

0 -

I have a mortgage application currently with Vida, its been approx 7 weeks of backwards and forwards with various questions, etc. I've been told today that my status has now changed on the portal, which only broker sees, to the final approval stage. Does this mean the offer stage or could they still decline at this stage? After so long I want to think its a glimmer of hope but so uncertain. Assuming they'll be no more questions now. Anyone any experience with Vida who can give me their view or is it case of wait and see? Is this the final step in the decision process? Thanks 😊0

-

Since writing this post, just had confirmation of the offer. So relieved!1

-

Hi,Since taking a mortgage out 5 years ago my partner has stopped working to look after the kids (no friends or family and kids are not in full time school until sept 2022.) Because we survive on just my wages, whenever the mortgage is up for renewal, I have to accept what they offer me (lloyds bank) because I can't get one else where. Is there any help out there for people like me?0

-

Why are the Coventry BS so slow?!Our application took a week to get on to their system, they ordered a drive by valuation which was done yesterday but haven’t looked at our income proofs yet!Are they likely to want bank statements or would they have asked for these initially? We want to try for end of June and currently everyone else is waiting on us! thanks0

-

McClane54 said:Hi,Since taking a mortgage out 5 years ago my partner has stopped working to look after the kids (no friends or family and kids are not in full time school until sept 2022.) Because we survive on just my wages, whenever the mortgage is up for renewal, I have to accept what they offer me (lloyds bank) because I can't get one else where. Is there any help out there for people like me?@mcclane54 Well, if you want to move away from Lloyds, you will need to meet affordability (as per lender calcs) for the outstanding mortgage. There is no 'help' unfortunately to get over this barrier.If you can give me some rough figures - income, your age, number of dependents, house value and outstanding mortgage, background debt, etc I can give you a very very rough idea of how far off you might be.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Hi!I have a question please if you can let me know . I submitted my application with Halifax on 28/05 through MB. On the same day, 1 hard check and 1 soft check showed on my credit report following 200£ charge on my bank for valuation fee I think. MB told me good news that all credit check passed and all is good. They would contact me soon to book for survey. On that day, my MB contacted me to take mortgage fee from my bank because I did set up limit from my bank for maximum 200£ only that why she could not take money from my bank. After unlock limit set up, she took money necessary.Unfortunately, I just saw that Halifax refund me 200£ on 02/06 without knowing and I haven’t heard anything since. I asked my MB what is happended but she said she have to contact Halifax to find out why they refund that money.

I hope that bank would do something by mistake. My knowing is lenders won’t refund any mortgage fee for any reason.I am very confused and stressed. could you tell me why?

Many thanks0 -

Dom25 said:Hi!I have a question please if you can let me know . I submitted my application with Halifax on 28/05 through MB. On the same day, 1 hard check and 1 soft check showed on my credit report following 200£ charge on my bank for valuation fee I think. MB told me good news that all credit check passed and all is good. They would contact me soon to book for survey. On that day, my MB contacted me to take mortgage fee from my bank because I did set up limit from my bank for maximum 200£ only that why she could not take money from my bank. After unlock limit set up, she took money necessary.Unfortunately, I just saw that Halifax refund me 200£ on 02/06 without knowing and I haven’t heard anything since. I asked my MB what is happended but she said she have to contact Halifax to find out why they refund that money.

I hope that bank would do something by mistake. My knowing is lenders won’t refund any mortgage fee for any reason.I am very confused and stressed. could you tell me why?

Many thanks@dom25 The optimistic explanation is that it could be that due to the limit you set, the payment never went through properly in the first place.The pessimistic explanation could be that the application was declined soon after the full mortgage application was submitted and your valuation fee refunded (as the valuation has not been carried out). It's never happened to me with Halifax so I can't add anything useful to that.Just follow-up with your broker for an answer before the weekend, she should be able to get a quick answer on phone call.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards