We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

@babystepper This is all a bit of a grey area at the moment. In principle, lenders will not consider one off grants as income for affordability purposes. Having said that, sole traders who are now doing their 20-21 SA302s are expected to include the SEISS as income so they can be taxed on it.BabyStepper said:Hi there

I wondered if you have any info about how SEISS grants are effecting mortgage applications? Just to explain, my OH is permanently employed PAYE and his income is our main household income at the minute. I'm self-employed, still working but with a reduced income since the pandemic. As I was eligible, I have taken all 3 SEISS grants to date and will probably be able to claim the next one too.

We're trying to figure out what our budget for a new home will be and wondered if SEISS grants are being accepted as income?

Many thanks for any insight you can offer. I understand this situation might be changing all the time.

It's not yet clear what approach lenders will take in general to this. I asked a few lenders for a client in a similar position and they said that the SEISS grants will need to be taken off the net-profit but others also say that they will go off of the 20-21 SA302s but may require a declaration re Covid and latest accounts.

Once there starts to be a steady stream of sole-traders coming in with their 20-21 SA302s which include SEISS grants, lenders will start clarifying their approach in a better manner.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

K_S said:@scorpiogal13 If you're referring to things like proceeds of selling your car, furniture, electronic equipment, etc, none of that is likely to be an issue as long as there's something to back up the larger bank credits (eg: car sold for £15k, some form of proof of the sale) if queried. I hope that makes sense.Yes, makes total sense KS. Thank You.If only i had a 15k Car to sell! Lol0

-

What's the likelyhood getting a morgatge for a property?

- £240k

- deposit of £70k potentially £100kand

- Salary of £28080k

0 -

Hello.

im going through a pretty rough application with Barclays. 6 times they have reviewed and asked for more documents. (FTB joint application, both PAYE and no questionable debts or affordability.)

In our latest review we have been told

‘application proceeds as Non PRR hence we require consent to request for employers reference’.Of course I will ask my broker tomorrow what this means, but if someone could put me out of my confusion this afternoon I’d really appreciate it.I have read about PRR in relation to mortgages as ‘Private residence relief’ but cannot understand how this would apply to us or involve our employers.Thanks0 -

@stger2021 Any of the applicants on a visa or non-UK nationals?stger2021 said:Hello.

im going through a pretty rough application with Barclays. 6 times they have reviewed and asked for more documents. (FTB joint application, both PAYE and no questionable debts or affordability.)

In our latest review we have been told

‘application proceeds as Non PRR hence we require consent to request for employers reference’.Of course I will ask my broker tomorrow what this means, but if someone could put me out of my confusion this afternoon I’d really appreciate it.I have read about PRR in relation to mortgages as ‘Private residence relief’ but cannot understand how this would apply to us or involve our employers.ThanksI am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Thanks for the quick reply, seems like you may be onto something. My wife is Italian pre-settled

@stger2021 Any of the applicants on a visa or non-UK nationals?stger2021 said:Hello.

im going through a pretty rough application with Barclays. 6 times they have reviewed and asked for more documents. (FTB joint application, both PAYE and no questionable debts or affordability.)

In our latest review we have been told

‘application proceeds as Non PRR hence we require consent to request for employers reference’.Of course I will ask my broker tomorrow what this means, but if someone could put me out of my confusion this afternoon I’d really appreciate it.I have read about PRR in relation to mortgages as ‘Private residence relief’ but cannot understand how this would apply to us or involve our employers.Thanks0 -

@stger2021 This is probably Barclays being Barclays, absolutely useless at doing the most straightforward of tasks as soon as it comes to a human getting involved.stger2021 said:

Thanks for the quick reply, seems like you may be onto something. My wife is Italian pre-settled

@stger2021 Any of the applicants on a visa or non-UK nationals?stger2021 said:Hello.

im going through a pretty rough application with Barclays. 6 times they have reviewed and asked for more documents. (FTB joint application, both PAYE and no questionable debts or affordability.)

In our latest review we have been told

‘application proceeds as Non PRR hence we require consent to request for employers reference’.Of course I will ask my broker tomorrow what this means, but if someone could put me out of my confusion this afternoon I’d really appreciate it.I have read about PRR in relation to mortgages as ‘Private residence relief’ but cannot understand how this would apply to us or involve our employers.Thanks

Has you wife been a UK resident for more than 2 years? If yes, then with pre-settled status she should be treated the same as PRR (permanent right to reside), at least as per Barclays criteria.

If she hasn't been in the UK for 2 years, then what they've said is indeed correct. It should only be a matter of getting an employer reference.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Thank you, a very clear answer.K_S said:

@stger2021 This is probably Barclays being Barclays, absolutely useless at doing the most straightforward of tasks as soon as it comes to a human getting involved.stger2021 said:

Thanks for the quick reply, seems like you may be onto something. My wife is Italian pre-settled

@stger2021 Any of the applicants on a visa or non-UK nationals?stger2021 said:Hello.

im going through a pretty rough application with Barclays. 6 times they have reviewed and asked for more documents. (FTB joint application, both PAYE and no questionable debts or affordability.)

In our latest review we have been told

‘application proceeds as Non PRR hence we require consent to request for employers reference’.Of course I will ask my broker tomorrow what this means, but if someone could put me out of my confusion this afternoon I’d really appreciate it.I have read about PRR in relation to mortgages as ‘Private residence relief’ but cannot understand how this would apply to us or involve our employers.Thanks

Has you wife been a UK resident for more than 2 years? If yes, then with pre-settled status she should be treated the same as PRR (permanent right to reside), at least as per Barclays criteria.

If she hasn't been in the UK for 2 years, then what they've said is indeed correct. It should only be a matter of getting an employer reference.First of all Barclays... if I knew before I would have paid higher interest and avoided, the seller is rightly anxious as it must look like we are the ones stalling.Residency is complicated to say the least, although she has been here for other 2 years, last year we spent a year as ex-pays, this has surely complicated it more. Let’s hope her employer responds quick to the requests!1 -

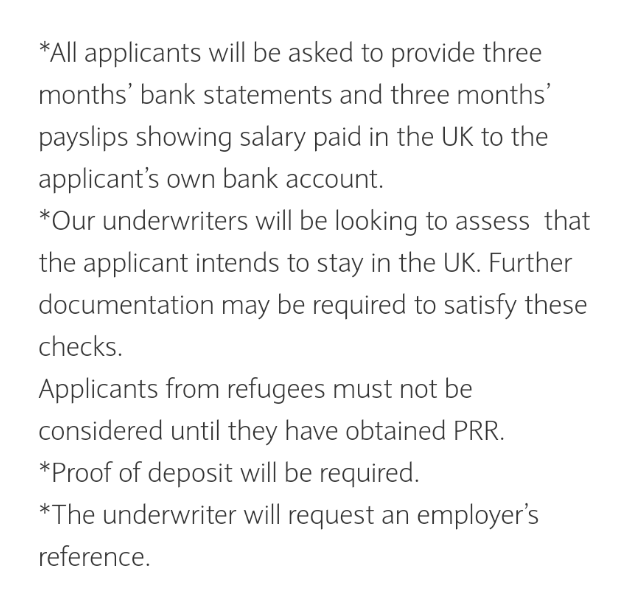

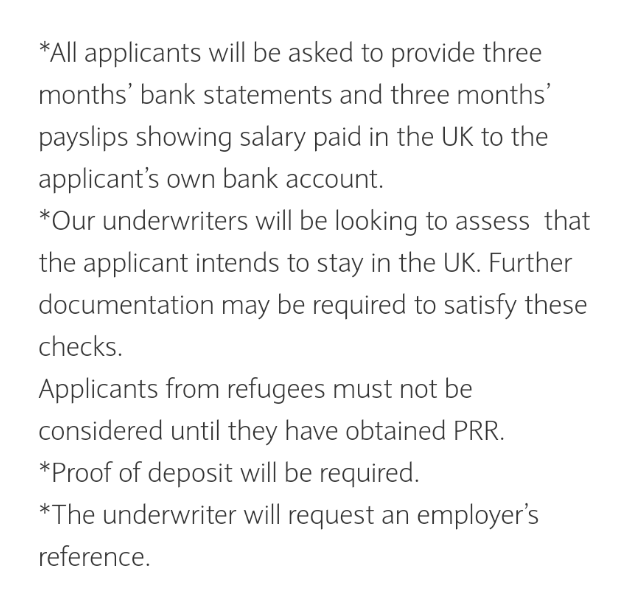

@stger2021 These are the boxes they need to tick in that case. Good luck!stger2021 said:

Thank you, a very clear answer.K_S said:

@stger2021 This is probably Barclays being Barclays, absolutely useless at doing the most straightforward of tasks as soon as it comes to a human getting involved.stger2021 said:

Thanks for the quick reply, seems like you may be onto something. My wife is Italian pre-settled

@stger2021 Any of the applicants on a visa or non-UK nationals?stger2021 said:Hello.

im going through a pretty rough application with Barclays. 6 times they have reviewed and asked for more documents. (FTB joint application, both PAYE and no questionable debts or affordability.)

In our latest review we have been told

‘application proceeds as Non PRR hence we require consent to request for employers reference’.Of course I will ask my broker tomorrow what this means, but if someone could put me out of my confusion this afternoon I’d really appreciate it.I have read about PRR in relation to mortgages as ‘Private residence relief’ but cannot understand how this would apply to us or involve our employers.Thanks

Has you wife been a UK resident for more than 2 years? If yes, then with pre-settled status she should be treated the same as PRR (permanent right to reside), at least as per Barclays criteria.

If she hasn't been in the UK for 2 years, then what they've said is indeed correct. It should only be a matter of getting an employer reference.First of all Barclays... if I knew before I would have paid higher interest and avoided, the seller is rightly anxious as it must look like we are the ones stalling.Residency is complicated to say the least, although she has been here for other 2 years, last year we spent a year as ex-pays, this has surely complicated it more. Let’s hope her employer responds quick to the requests!

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Annoying but fair...K_S said:

@stger2021 These are the boxes they need to tick in that case. Good luck!stger2021 said:

Thank you, a very clear answer.K_S said:

@stger2021 This is probably Barclays being Barclays, absolutely useless at doing the most straightforward of tasks as soon as it comes to a human getting involved.stger2021 said:

Thanks for the quick reply, seems like you may be onto something. My wife is Italian pre-settled

@stger2021 Any of the applicants on a visa or non-UK nationals?stger2021 said:Hello.

im going through a pretty rough application with Barclays. 6 times they have reviewed and asked for more documents. (FTB joint application, both PAYE and no questionable debts or affordability.)

In our latest review we have been told

‘application proceeds as Non PRR hence we require consent to request for employers reference’.Of course I will ask my broker tomorrow what this means, but if someone could put me out of my confusion this afternoon I’d really appreciate it.I have read about PRR in relation to mortgages as ‘Private residence relief’ but cannot understand how this would apply to us or involve our employers.Thanks

Has you wife been a UK resident for more than 2 years? If yes, then with pre-settled status she should be treated the same as PRR (permanent right to reside), at least as per Barclays criteria.

If she hasn't been in the UK for 2 years, then what they've said is indeed correct. It should only be a matter of getting an employer reference.First of all Barclays... if I knew before I would have paid higher interest and avoided, the seller is rightly anxious as it must look like we are the ones stalling.Residency is complicated to say the least, although she has been here for other 2 years, last year we spent a year as ex-pays, this has surely complicated it more. Let’s hope her employer responds quick to the requests!

The stressful thing is they seem to review until a document is needed then reply requesting it and you’re back in the queue, rather thank full review and list of all docs needed.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards