We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

AA early settlement differing figures

Hi have a loan from the AA and applied online for a top up loan and was given a settlement figure. I didn’t go through with the top up as I couldn’t extend the term of loan from 30mths to 5 years. It was agreed in principle with a reference number on 7/9/2020 and was on hold. Called them on 8/9/2020 to check figure for settlement was the same but was told by customer service they couldn’t give me it as I had top up on hold as I hadn’t went ahead with it they would cancel and to call tomorrow. I called back today 9/9/2020 and got a settlement figure but it has now increased £120 from online figure. They can give no explanation and say that will be the figure as that’s what the system generated. Anyone got any further advice?

0

Comments

-

I would ask them why the system generated a different figure.2

-

Perhaps the first one forgot to apply the early settlement fee?1

-

Or on line figure perhaps just the balance mistaken for the settlement?jonesMUFCforever said:Perhaps the first one forgot to apply the early settlement fee?3 -

They couldn’t provide an answer to that neither the call handler or supervisor.Nearlyold said:venison said:I would ask them why the system generated a different figure.

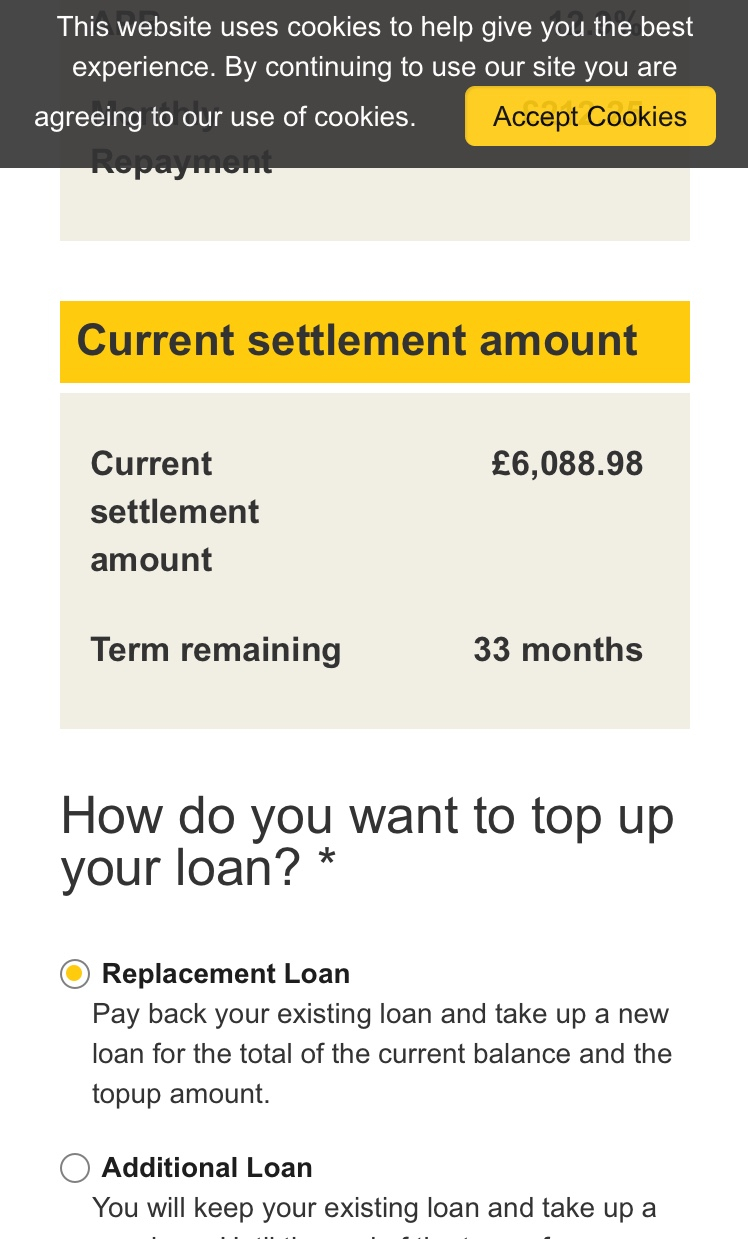

The online figure doesn’t display the balance of the loan it clearly gives the figure of the settlement amount which is £120 less than when I phoned up. I have email copy of the top up extension and a screen shot of online quoted figure. I’ve been advised by citizens advice to wait until I receive a letter from complaints department then get back to them for more advice.

Or on line figure perhaps just the balance mistaken for the settlement?jonesMUFCforever said:Perhaps the first one forgot to apply the early settlement fee?0 -

So one settlement figure was done online as part of a request for a new larger loan whereas the other was simply a phone based settlement figure without the additional borrowing?

Sounds like something has been waived when you were looking to get a bigger loan and consolidate the original loan into it2 -

I wondered that, according to the website there are two top up options a) Take out a seperate "Top Up" loan and keep the original loan running or b) Incorporate the balance of the original loan into the new loan. Baldrico1 says that he didn't go ahead with the top up because he couldn't extend the term of the original loan which would suggest he was applying for option (a) rather than consolidating.Sandtree said:So one settlement figure was done online as part of a request for a new larger loan whereas the other was simply a phone based settlement figure without the additional borrowing?

Sounds like something has been waived when you were looking to get a bigger loan and consolidate the original loan into it

It might help if the screen shot of the on line Settlement Quote was posted up on here (with all personal details removed)1 -

Nearlyold said:

Nearlyold said:

I wondered that, according to the website there are two top up options a) Take out a seperate "Top Up" loan and keep the original loan running or b) Incorporate the balance of the original loan into the new loan. Baldrico1 says that he didn't go ahead with the top up because he couldn't extend the term of the original loan which would suggest he was applying for option (a) rather than consolidating.Sandtree said:So one settlement figure was done online as part of a request for a new larger loan whereas the other was simply a phone based settlement figure without the additional borrowing?

Sounds like something has been waived when you were looking to get a bigger loan and consolidate the original loan into it

It might help if the screen shot of the on line Settlement Quote was posted up on here (with all personal details removed)

0 -

Quite in phoning was £6209.230

-

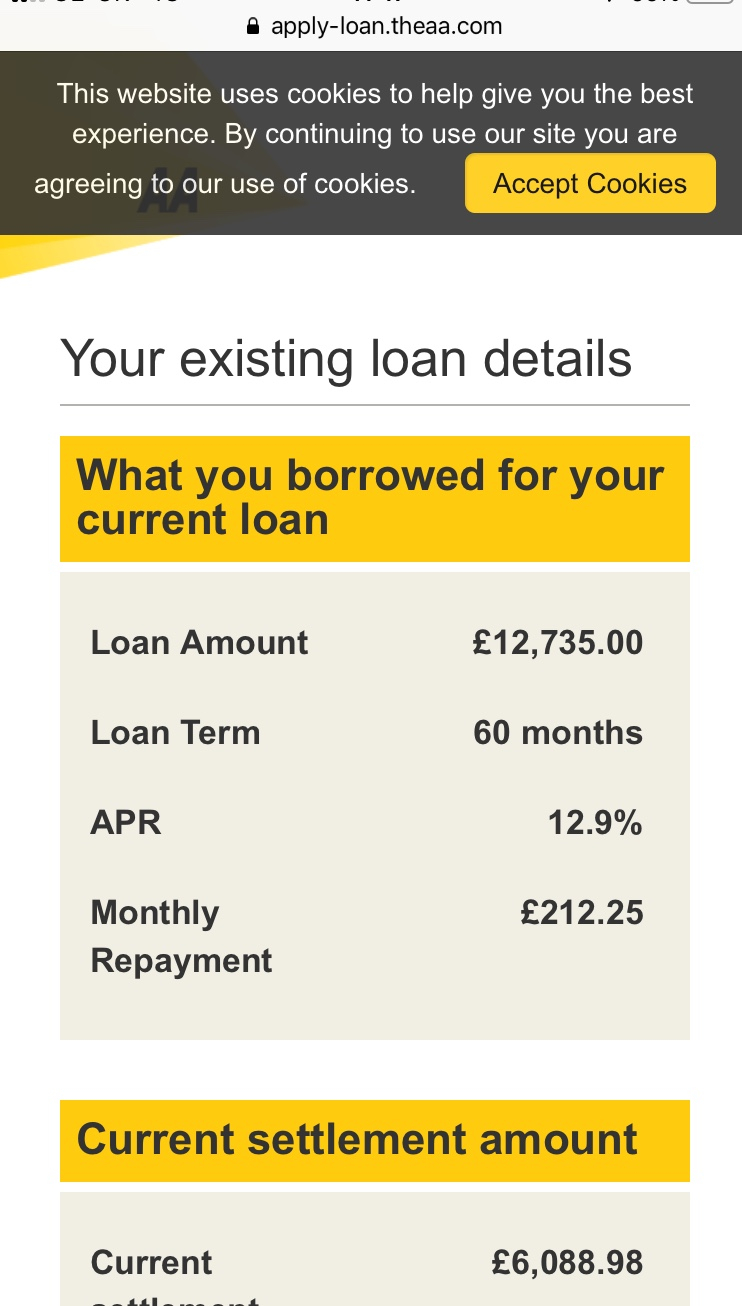

Hmm, not sure that helps unfortunately, the figures for your current loan don't add up, it says you originally borrowed £12735 over 60 months @ 12.9% and quotes a monthly repayment of £212.25 however £12735 @ 12.9% APR over 60 months would have required a monthly payment of approx £289 & you'd currently owe more than £8,000. The monthly repayment of £212.25 would exactly pay back £12735 over 60 months which would mean an APR of 0%.

What is your current monthly payment and have you made any previous partial settlements?

Having said all that I think that Sandtree is correct in that because you were proposing transferring the balance over into the new loan they were not using the Early Settlement Regulation's method of calculating the amount due (which allows up to 58 days interest to be charged) but are using that method when you've asked for a settlement figure on a stand alone basis ie without incorporating the old loan into the new "Top Up"

2 -

£12735 is including interest original loan was £9500. Will just need to see if they get back to meNearlyold said:Hmm, not sure that helps unfortunately, the figures for your current loan don't add up, it says you originally borrowed £12735 over 60 months @ 12.9% and quotes a monthly repayment of £212.25 however £12735 @ 12.9% APR over 60 months would have required a monthly payment of approx £289 & you'd currently owe more than £8,000. The monthly repayment of £212.25 would exactly pay back £12735 over 60 months which would mean an APR of 0%.

What is your current monthly payment and have you made any previous partial settlements?

Having said all that I think that Sandtree is correct in that because you were proposing transferring the balance over into the new loan they were not using the Early Settlement Regulation's method of calculating the amount due (which allows up to 58 days interest to be charged) but are using that method when you've asked for a settlement figure on a stand alone basis ie without incorporating the old loan into the new "Top Up"1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards