5.18 kWp PV systems (3.68 E/W & 1.5 E).

Solar iBoost+ to two immersion heaters on 350L thermal store.

100% composted food waste

Mini orchard planted and vegetable allotment created.

We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Pensions and paying for Covid

Comments

-

I've never understood that. Nil NI from pension income is one thing, but I can't see why it shouldn't be paid from salaries. After all, NI pays for so much more than just the State pension.nigelbb said:

No problem as we pensioners don't pay NI on our salary anyway which is a nice bonus for those of us who are still in work.zagfles said:NedS said:

So where , exactly, is the 27% of my salary that my employer 'pays' each month? This is not like a private sector final salary pension that has a pot of money invested to meet future liabilities. Like nigelbb said, it's simply a deferment, a promise.zagfles said:nigelbb said:

Employer pension contributions in public sector DB pensions are theoretical. A DB is effectively deferred salary paid in retirement which will in turn be taxed.zagfles said:NedS said:Most remaining DB schemes also have employee contributions and these contributions (together with any additionally purchased DB pension) would presumably be subject to the same tax relief rules as those making contributions to DC schemes.The discussion here is not about the inequality of DB vs DC schemes, but rather what changes the Chancellor may make to pension tax relief and how it may be implemented.You're not getting it. The point is:1. Employee conts can be treated the same whether DB or DC. HRT relief could be abolished. That's easy. But not the issue.2. Typical public sector DB pensions also require an employer contribution of typically around 25%. Which is totally free of NI and tax.3. Typical private sector employer contributions to DC schemes are under 10%.4. If 2. remains free of NI and tax (ie doesn't become a taxable benefit) then it would be totally unfair not to allow private sector employers and employees to agree to a contract change (ie sal sac) where the employer makes similar level of pension contribution as public sector employer make totally free of NI and tax.Like I said above it could be limited, it could also be less flexible. But banning it totally would be hugely discriminatory, it would say public sector workers can get employer conts of 25% totally tax free but private sector workers can't.Err, yes, as are all pensions, DB or DC. The point is NI is not paid on that "deferred salary", plus if higher rate relief were stopped, deferring salary through a generous pension scheme (whether a public sector DB or a sal sac created large DC pot) would effectively give that higher rate relief.So banning sal sac for people in DC schemes with 8% employer conts while people in DB schemes with 25% employer conts remain would be hugely discriminatoryAll DB schemes, funded or not, are a "promise". That promise can be valued at the time it's made, ie during accrual of the pension benefits. As already happens for annual allowance purposes.Alternatively - just have actual deferred salary and pay NI on it when taking it, would that be preferable 1

1 -

It will be interesting to see how the actual announcement compares to all the speculation in the press that is being presented almost as fact.

0 -

Anonymous101 said:How long do you think it would take to sort out removing the Higher Rate Tax Relief?

As others have said it would also mean a likely end to Salary Sacrifice schemes. The administrative cost taking up alternative schemes doesn't appear insignificant to me so presumably when it is announced there would have to be a year or two's notice for new systems to be put in place.

Purely a selfish question. I take full advantage of the tax relief through Sal Sac and would want to continue to make use of the benefit for another 3 or 4 years if possible.I would think if they were to announce something in the November budget, they could implement it for April 2021Our green credentials: 12kW Samsung ASHP for heating, 7.2kWp Solar (South facing), Tesla Powerwall 3 (13.5kWh), Net exporter0 -

So quickly? I had it in my mind that due to the popularity of the schemes and the structural changes required to the way the contributions are made it would be 12 months at least.NedS said:Anonymous101 said:How long do you think it would take to sort out removing the Higher Rate Tax Relief?

As others have said it would also mean a likely end to Salary Sacrifice schemes. The administrative cost taking up alternative schemes doesn't appear insignificant to me so presumably when it is announced there would have to be a year or two's notice for new systems to be put in place.

Purely a selfish question. I take full advantage of the tax relief through Sal Sac and would want to continue to make use of the benefit for another 3 or 4 years if possible.I would think if they were to announce something in the November budget, they could implement it for April 2021

0 -

Given the opprobrium the government's received recently for certain quick, on-the-hoof, changes, and subsequent U-turns, I highly suspect that 2021 would be a rather optimistic assessment of when this sort of change would take effect...NedS said:I would think if they were to announce something in the November budget, they could implement it for April 2021

Conjugating the verb 'to be":

-o I am humble -o You are attention seeking -o She is Nadine Dorries0 -

I read that this was one of the things the Gov were looking at changing.nigelbb said:

No problem as we pensioners don't pay NI on our salary anyway which is a nice bonus for those of us who are still in work.zagfles said:NedS said:

So where , exactly, is the 27% of my salary that my employer 'pays' each month? This is not like a private sector final salary pension that has a pot of money invested to meet future liabilities. Like nigelbb said, it's simply a deferment, a promise.zagfles said:nigelbb said:

Employer pension contributions in public sector DB pensions are theoretical. A DB is effectively deferred salary paid in retirement which will in turn be taxed.zagfles said:NedS said:Most remaining DB schemes also have employee contributions and these contributions (together with any additionally purchased DB pension) would presumably be subject to the same tax relief rules as those making contributions to DC schemes.The discussion here is not about the inequality of DB vs DC schemes, but rather what changes the Chancellor may make to pension tax relief and how it may be implemented.You're not getting it. The point is:1. Employee conts can be treated the same whether DB or DC. HRT relief could be abolished. That's easy. But not the issue.2. Typical public sector DB pensions also require an employer contribution of typically around 25%. Which is totally free of NI and tax.3. Typical private sector employer contributions to DC schemes are under 10%.4. If 2. remains free of NI and tax (ie doesn't become a taxable benefit) then it would be totally unfair not to allow private sector employers and employees to agree to a contract change (ie sal sac) where the employer makes similar level of pension contribution as public sector employer make totally free of NI and tax.Like I said above it could be limited, it could also be less flexible. But banning it totally would be hugely discriminatory, it would say public sector workers can get employer conts of 25% totally tax free but private sector workers can't.Err, yes, as are all pensions, DB or DC. The point is NI is not paid on that "deferred salary", plus if higher rate relief were stopped, deferring salary through a generous pension scheme (whether a public sector DB or a sal sac created large DC pot) would effectively give that higher rate relief.So banning sal sac for people in DC schemes with 8% employer conts while people in DB schemes with 25% employer conts remain would be hugely discriminatoryAll DB schemes, funded or not, are a "promise". That promise can be valued at the time it's made, ie during accrual of the pension benefits. As already happens for annual allowance purposes.Alternatively - just have actual deferred salary and pay NI on it when taking it, would that be preferable 0

0 -

They could implement a ban on higher rate relief for employee conts and personal conts by April, that's the easy bit. They could probably also at least limit sal sac by then. The pure option of restricting higher rate relief fairly would be to make all employer pension contributions (or deemed contributions) a taxable benefit with basic rate relief as a top up/refund, that would be very complicated and I doubt they could to that by 2021. So they could do it in stages.0

-

Ahhh, take things all the way, & you'll remember money itself is just a promise. Read your nearest banknote!zagfles said:NedS said:

So where , exactly, is the 27% of my salary that my employer 'pays' each month? This is not like a private sector final salary pension that has a pot of money invested to meet future liabilities. Like nigelbb said, it's simply a deferment, a promise.zagfles said:nigelbb said:

Employer pension contributions in public sector DB pensions are theoretical. A DB is effectively deferred salary paid in retirement which will in turn be taxed.zagfles said:NedS said:Most remaining DB schemes also have employee contributions and these contributions (together with any additionally purchased DB pension) would presumably be subject to the same tax relief rules as those making contributions to DC schemes.The discussion here is not about the inequality of DB vs DC schemes, but rather what changes the Chancellor may make to pension tax relief and how it may be implemented.You're not getting it. The point is:1. Employee conts can be treated the same whether DB or DC. HRT relief could be abolished. That's easy. But not the issue.2. Typical public sector DB pensions also require an employer contribution of typically around 25%. Which is totally free of NI and tax.3. Typical private sector employer contributions to DC schemes are under 10%.4. If 2. remains free of NI and tax (ie doesn't become a taxable benefit) then it would be totally unfair not to allow private sector employers and employees to agree to a contract change (ie sal sac) where the employer makes similar level of pension contribution as public sector employer make totally free of NI and tax.Like I said above it could be limited, it could also be less flexible. But banning it totally would be hugely discriminatory, it would say public sector workers can get employer conts of 25% totally tax free but private sector workers can't.Err, yes, as are all pensions, DB or DC. The point is NI is not paid on that "deferred salary", plus if higher rate relief were stopped, deferring salary through a generous pension scheme (whether a public sector DB or a sal sac created large DC pot) would effectively give that higher rate relief.So banning sal sac for people in DC schemes with 8% employer conts while people in DB schemes with 25% employer conts remain would be hugely discriminatoryAll DB schemes, funded or not, are a "promise". That promise can be valued at the time it's made, ie during accrual of the pension benefits. As already happens for annual allowance purposes.Alternatively - just have actual deferred salary and pay NI on it when taking it, would that be preferable Plan for tomorrow, enjoy today!1

Plan for tomorrow, enjoy today!1 -

Exactly - and the govt have no problem valuing, and applying taxes and NI, to that "promise", do theycfw1994 said:

Ahhh, take things all the way, & you'll remember money itself is just a promise. Read your nearest banknote!zagfles said:NedS said:

So where , exactly, is the 27% of my salary that my employer 'pays' each month? This is not like a private sector final salary pension that has a pot of money invested to meet future liabilities. Like nigelbb said, it's simply a deferment, a promise.zagfles said:nigelbb said:

Employer pension contributions in public sector DB pensions are theoretical. A DB is effectively deferred salary paid in retirement which will in turn be taxed.zagfles said:NedS said:Most remaining DB schemes also have employee contributions and these contributions (together with any additionally purchased DB pension) would presumably be subject to the same tax relief rules as those making contributions to DC schemes.The discussion here is not about the inequality of DB vs DC schemes, but rather what changes the Chancellor may make to pension tax relief and how it may be implemented.You're not getting it. The point is:1. Employee conts can be treated the same whether DB or DC. HRT relief could be abolished. That's easy. But not the issue.2. Typical public sector DB pensions also require an employer contribution of typically around 25%. Which is totally free of NI and tax.3. Typical private sector employer contributions to DC schemes are under 10%.4. If 2. remains free of NI and tax (ie doesn't become a taxable benefit) then it would be totally unfair not to allow private sector employers and employees to agree to a contract change (ie sal sac) where the employer makes similar level of pension contribution as public sector employer make totally free of NI and tax.Like I said above it could be limited, it could also be less flexible. But banning it totally would be hugely discriminatory, it would say public sector workers can get employer conts of 25% totally tax free but private sector workers can't.Err, yes, as are all pensions, DB or DC. The point is NI is not paid on that "deferred salary", plus if higher rate relief were stopped, deferring salary through a generous pension scheme (whether a public sector DB or a sal sac created large DC pot) would effectively give that higher rate relief.So banning sal sac for people in DC schemes with 8% employer conts while people in DB schemes with 25% employer conts remain would be hugely discriminatoryAll DB schemes, funded or not, are a "promise". That promise can be valued at the time it's made, ie during accrual of the pension benefits. As already happens for annual allowance purposes.Alternatively - just have actual deferred salary and pay NI on it when taking it, would that be preferable

1 -

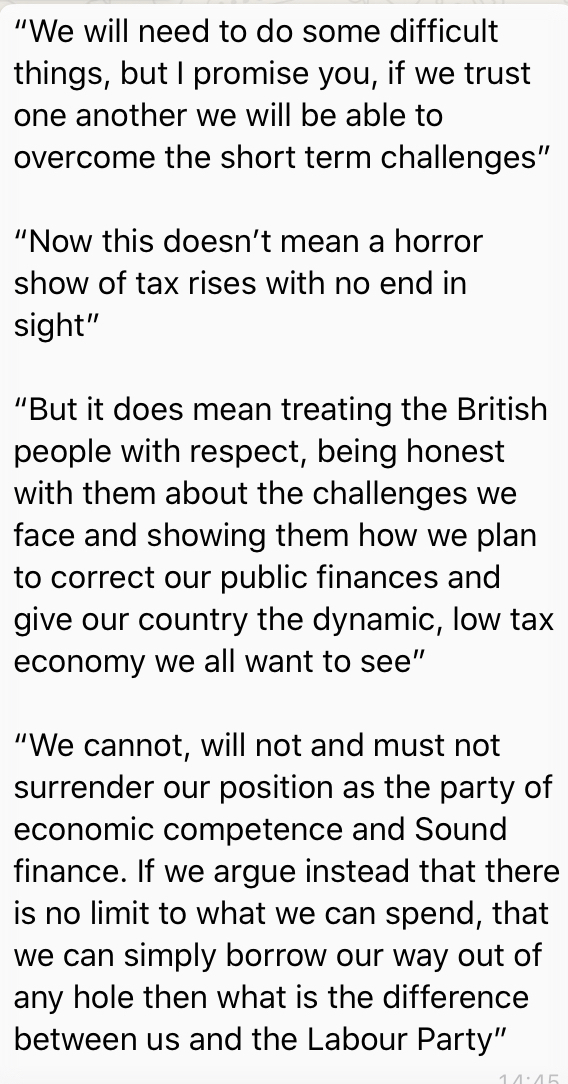

This is some of Rishi Sunak's brief to Conservative MPs this afternoon. It looks like some pain is coming.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards