We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

SKF (GSK) pension forecast and CETV value confusion

Comments

-

Pension fund cannot forecast. Unless they've a crystal ball that predicts inflation. Not their remit to speculate. As could be deemed misleading.Parking_Trouble said:

Will chase WTW to get a proper forecast which should end up £3k more than Equiniti.1 -

In 2018 Equiniti gave me a forecast to NRD using an estimated CPI for the remaining years.Thrugelmir said:

Pension fund cannot forecast. Unless they've a crystal ball that predicts inflation. Not their remit to speculate. As could be deemed misleading.Parking_Trouble said:

Will chase WTW to get a proper forecast which should end up £3k more than Equiniti.As we do not know what the future inflation will be, I have used an assumed rate of 1.9% a year (compound) to revalue your Excess pension between now and your Normal Retirement Age.They could also provide a 100% accurate figure for pension accrued to date.

Therefore, the figures below are estimates only and cannot be guaranteed.

Estimated Benefits at Age 65

I estimate that your benefit options at your Normal Retirement Age of 65 would be as follows:

Option 1 TOTAL Estimated Pension £2,934.84 a year

Sending people GMP and Excess pension figures and a complex often obscure calculation method is not good enough.

Mr Straw described whiplash as "not so much an injury, more a profitable invention of the human imagination—undiagnosable except by third-rate doctors in the pay of the claims management companies or personal injury lawyers"0 -

So after a long wait WTW have sent me a pension forecast.HMRC records confirm that your Guaranteed Minimum Pension revalues in deferment by the Limited Rate, not Fixed. We have therefore assumed future increases of 2.3% from this year to your date of retirement in our figures, in line with current scheme practice

This contradicts their earlier statement when I double checked with them the method of calculation.

I can confirm that leavers of the Scheme who left between 6 April 1978 and 5 April 1988 have their GMP revalued by 8.5%. As you left the Scheme on 24 April 1987, your GMP is revalued by 8.5%.So they are forecasting £3,216 pa

or, £14,639 lump sum and £2,196 pa

The £153k CETV they gave me in July now looks very attractive at 47 times projected pension, but I now wonder if they'll go back on that. I've also lost many weeks getting clarity and the CETV quote expires in a months time.

I still do not understand how these figures have changed from a fixed rate to limited rate. I don't really trust them, other than £153k CETV looks like the best option, if it's still possible to get it.

Mr Straw described whiplash as "not so much an injury, more a profitable invention of the human imagination—undiagnosable except by third-rate doctors in the pay of the claims management companies or personal injury lawyers"0 -

I still do not understand how these figures have changed from a fixed rate to limited rate.

https://www.barnett-waddingham.co.uk/comment-insight/blog/what-is-a-gmp/

GMP revaluation

The GMP must be increased for each complete tax year in the period from leaving pensionable service to retirement or death. COSR schemes can adopt one of the following ways to revalue GMP.

The first way uses an index based on National Average Earnings, known as Section 148 Orders or ‘full rate’ revaluation.

The other way to revalue GMPs is the ‘fixed rate' method.

Another historic method is ‘limited rate revaluation’ where the increase is also linked to the rise in the National Average Earnings index over the period from a member’s date of leaving and retirement, but limited to a maximum of 5% per annum over the whole period. A Limited Revaluation Premium was paid to NICO to reflect the difference between limited rate and full rate revaluation. Limited rate revaluation was abolished from 6 April 1997.

Usually a scheme’s Trust Deed and Rules will give the trustees freedom to adopt any of the three methods of revaluation at the commencement of the scheme. Fixed rate is most common in private sector schemes.

Re GMP Reconciliation Exercise

You could try an enquiry with TPAS.

1 -

Ah, that sheds a bit more light on it.

WTW are stating what the HMRC view is but I have a signed document from the trustees (dated 2000) stating a fixed rate. Maybe a mismatch and they should take what the trustees say,

I'll look into TPAS. I'd like to get to the bottom of it.Mr Straw described whiplash as "not so much an injury, more a profitable invention of the human imagination—undiagnosable except by third-rate doctors in the pay of the claims management companies or personal injury lawyers"1 -

I'll look into TPAS. I'd like to get to the bottom of it.Let us know how things pan out. I have to admit to an interest in GMP related matters since I had to look into its ramifications a few years back.

I know, I need to get out more..... 1

1 -

Very brave but it is important. It feels like a lot of smoke and mirrors and very little clarity. We need to be able to validate numbers and trust the figures we are given.

Very brave but it is important. It feels like a lot of smoke and mirrors and very little clarity. We need to be able to validate numbers and trust the figures we are given.

Phoned TPAS and spoke to a nice lady. I need to go back to WTW to get them to explain their calculations. Feels like another circle about to start. She said I could use the GOV.UK GMP calculator. I can't - seems it's only for administrators.

If I don't get any joy with WTW I need to put in a compliant and if still resolution I go to the ombudsman.

Mr Straw described whiplash as "not so much an injury, more a profitable invention of the human imagination—undiagnosable except by third-rate doctors in the pay of the claims management companies or personal injury lawyers"0 -

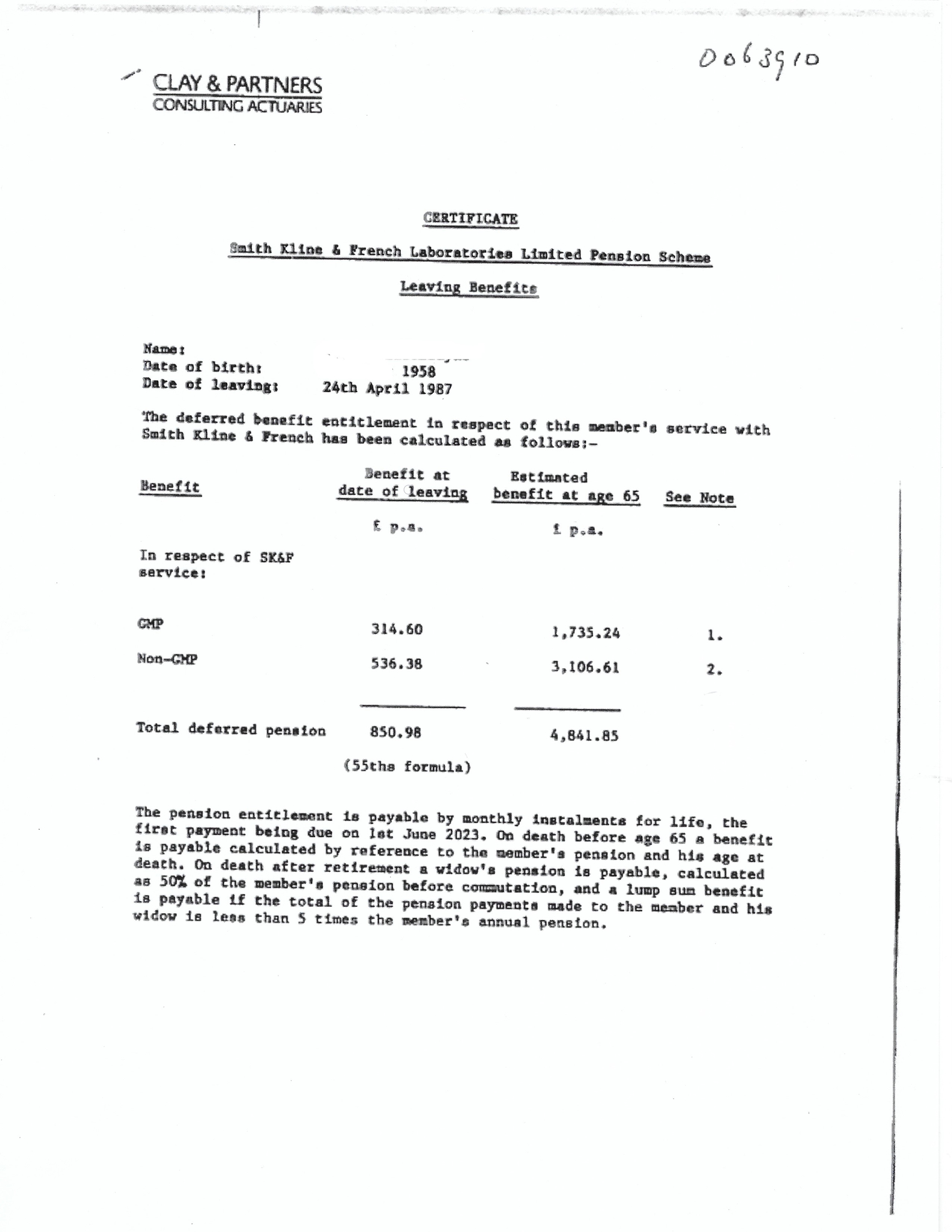

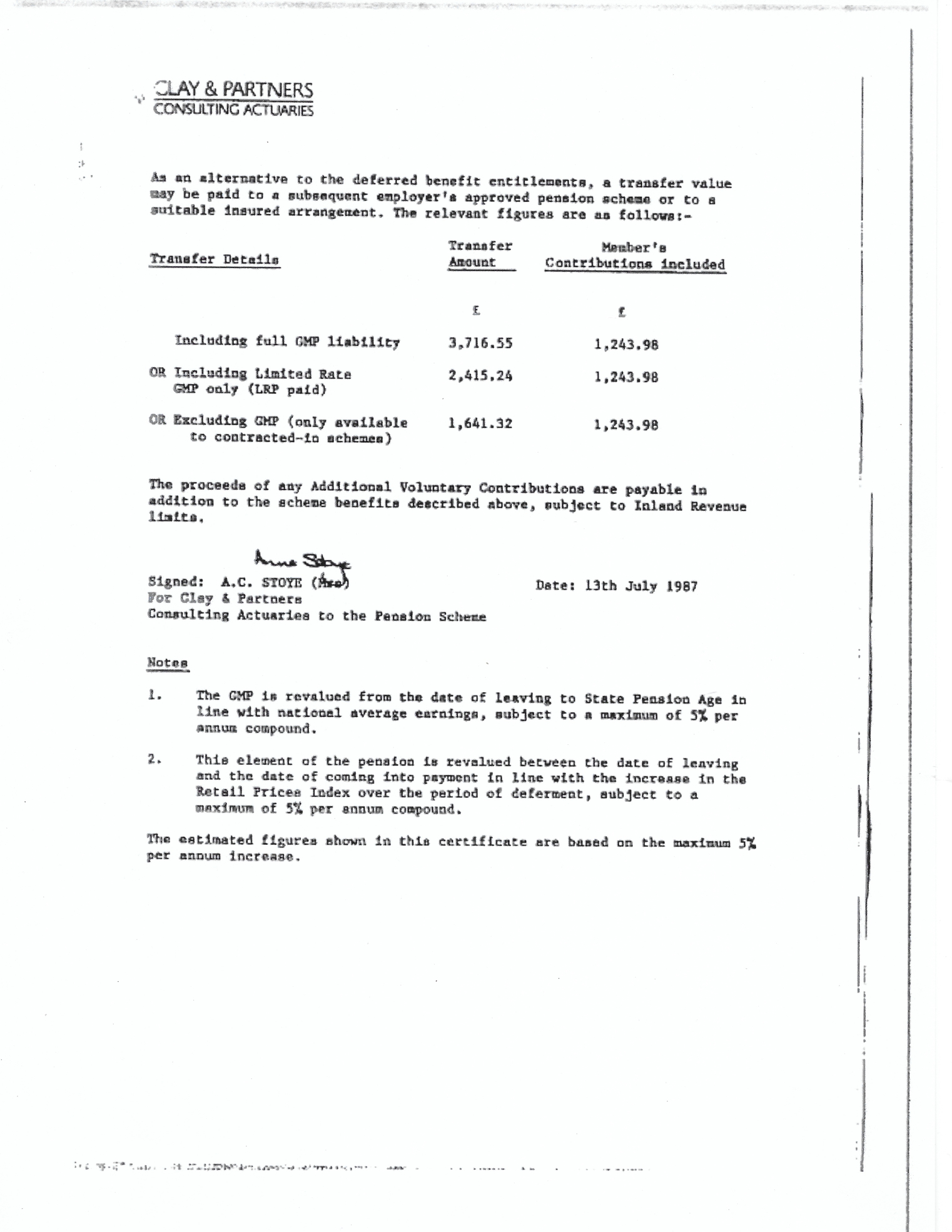

Searched through past emails and documents and I guess the end of this leaving statement lays out the correct method of GMP calculation. I think they may have changed to CPI at some point.

The statement I had in 2000 appears to be wrong.

The last CETV was almost certainly wrong (by a large amount) but my IFA needs the full 3 months to do his stuff and WTW will not extend the deadline. I'll get another free CETV next year and see what they say. Anticipating waiting to take the DB pension in 3 years time.

Mr Straw described whiplash as "not so much an injury, more a profitable invention of the human imagination—undiagnosable except by third-rate doctors in the pay of the claims management companies or personal injury lawyers"2 -

The GMP is revalued from the date of leaving to State Pension Age in line with national average earnings, subject to a maximum of 5% per annum compound.

Which being interpreted, Limited Rate Revaluation.

https://www.oldmutualwealth.co.uk/Adviser/literature-and-support/knowledge-direct/pensions/escalation-and-revaluation/guaranteed-minimum-pension-benefits/#:~:text=Limited revaluation revalues in line,when a member left service.Limited revaluation

Limited revaluation revalues in line with Section 148 orders, limited to a maximum of 5% per annum.

When a scheme applied limited revaluation a ‘Limited Revaluation Premium’ (known as a LRP) was paid to the Department for Work and Pensions by the scheme when a member left service. This covered the estimated cost of the state providing any increases above 5%, up to full revaluation under Section 148 orders.

Limited revaluation was abolished for leavers on or after 6 April 1997. However, it is still possible for preserved pension accrued before 6 April 1997 to have limited revaluation applied to the GMP element.

1 -

With regard to the excess over GMP, the method being used is Limited Price Indexation.

As to the change from RPI to CPI, see https://www.pensionsadvisoryservice.org.uk/content/spotlights-files/uploads/RPI_TO_CPI_Spotlight_October_2019.pdf1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards