We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Working from home for last few years, can I cut taxes?

Saria

Posts: 96 Forumite

in Cutting tax

So I have been working from home for a few years now and never realised I might be able to cut taxes for this. Only just read an article on the BBC about it, but I'm not sure if it applies to me and how this works.

I started working for a small company in 2014 and we had an office back then as there were a few people. However after a year or so everyone apart from me was let go, meaning I am the only employee left in the company. It was pointless to have an office for just me, so I've been working from home for a few years now. I use my own laptop for this, the only thing my boss paid for is my drawing tablet.

But as I am home all the time for work, I obviously will be using more electricity and gas while working. The HMRC website mentions the following:

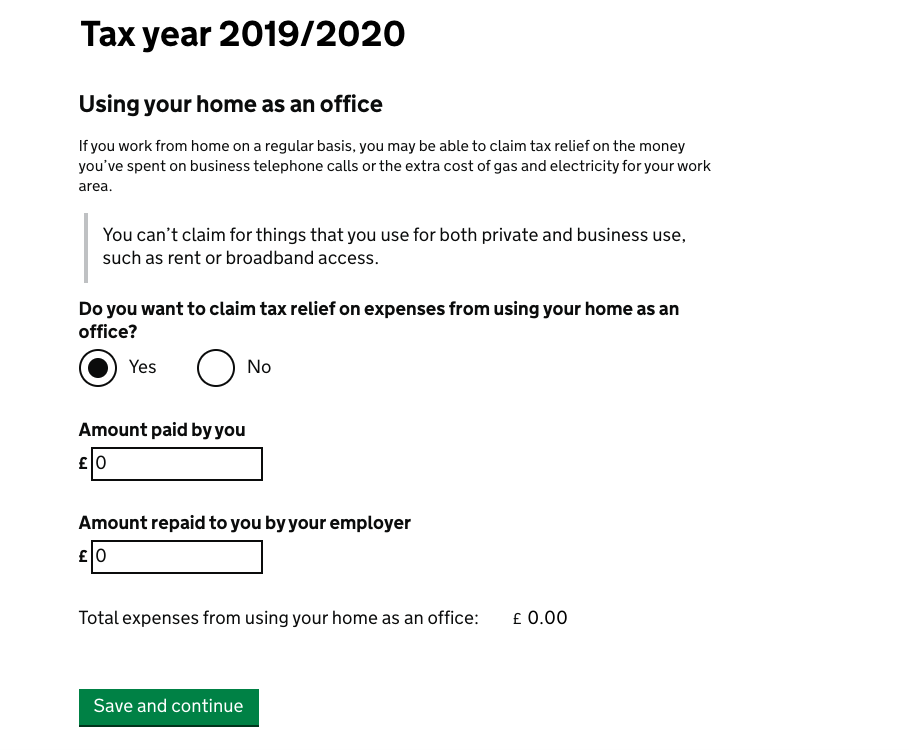

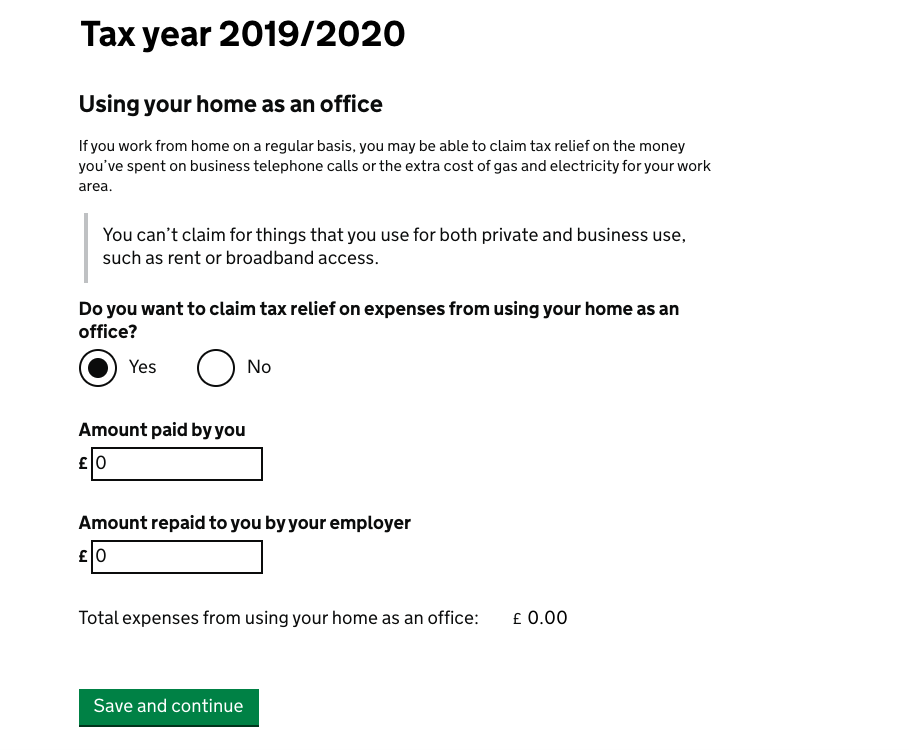

So how would I be able to claim for anything? My boss doesn't cover any costs by the way.

Thanks for any help or advice!

I started working for a small company in 2014 and we had an office back then as there were a few people. However after a year or so everyone apart from me was let go, meaning I am the only employee left in the company. It was pointless to have an office for just me, so I've been working from home for a few years now. I use my own laptop for this, the only thing my boss paid for is my drawing tablet.

But as I am home all the time for work, I obviously will be using more electricity and gas while working. The HMRC website mentions the following:

If you work from home on a regular basis, you may be able to claim tax relief on the money you’ve spent on business telephone calls or the extra cost of gas and electricity for your work area.

It is asking me how much I have spent, but I have no way of working this out... So how would I be able to claim for anything? My boss doesn't cover any costs by the way.

Thanks for any help or advice!

0

Comments

-

You don't mention, do they still have the office available? Or are you working from home because they got rid of the office?You keep using that word. I do not think it means what you think it means - Inigo Montoya, The Princess Bride0

-

Oh sorry, there is no office. They were renting office space but stopped that when it was only me left as an employee. So my boss works from his home and I work from mine.unholyangel said:You don't mention, do they still have the office available? Or are you working from home because they got rid of the office?

0 -

You should meet the condition of being required to work from home, as there is nowhere else you can work. Expenses have to be wholly, exclusively and necessarily incurred in the performance of your duties. HMRC permit a claim of £6 a week (£4 before 6 April 2020) without evidence. If you want to claim more, you need to keep receipts and records.0

-

Thank you. I can't figure out how to claim for the £6 though? It is specifically asking me how much I have spent, but surely if I put in £0, I won't get anything?Jeremy535897 said:You should meet the condition of being required to work from home, as there is nowhere else you can work. Expenses have to be wholly, exclusively and necessarily incurred in the performance of your duties. HMRC permit a claim of £6 a week (£4 before 6 April 2020) without evidence. If you want to claim more, you need to keep receipts and records. 0

0 -

-

Its £4 per week for the 19/20 year. £6 a week only applies from 6 April 2020. You just multiply by the number of weeks you're working from home and put that figure in the box.Saria said:

Thank you. I can't figure out how to claim for the £6 though? It is specifically asking me how much I have spent, but surely if I put in £0, I won't get anything?Jeremy535897 said:You should meet the condition of being required to work from home, as there is nowhere else you can work. Expenses have to be wholly, exclusively and necessarily incurred in the performance of your duties. HMRC permit a claim of £6 a week (£4 before 6 April 2020) without evidence. If you want to claim more, you need to keep receipts and records.

You keep using that word. I do not think it means what you think it means - Inigo Montoya, The Princess Bride0 -

It's not £6, it's the tax you would pay on £6, so you'll get tax relief of £1.20. As pointed out above, to claim more you'll need to provide proper accounts: a share of gas, electricity, water, telephone and broadband, IT, stationery, etcNo free lunch, and no free laptop

0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards