We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

DB pension transfer - IFA fee

Comments

-

/Preacher64 said:You’re stating that it’s mathematically impossible that two different funds, with different charges, will return different rates.You need to re-read the pamphlet on investing that made you such a guru, just to double check.

You're misinterpreting what I said, which is that for all investors as a whole, lower costs of investing = a higher return net of costs, by definition. I never said anything about individual funds. Please don't mock me for stating obvious facts that you don't like to hear, thanks

There really is a concerted effort being made in this forum to discredit me, can't think why.

1 -

Callaghan is being rather wilfully misconstrued imo.

All else being equal, lower costs=higher returns for the investor.

And worth repeating on pages where it is often stressed that maximising returns is not what you pay your adviser for.3 -

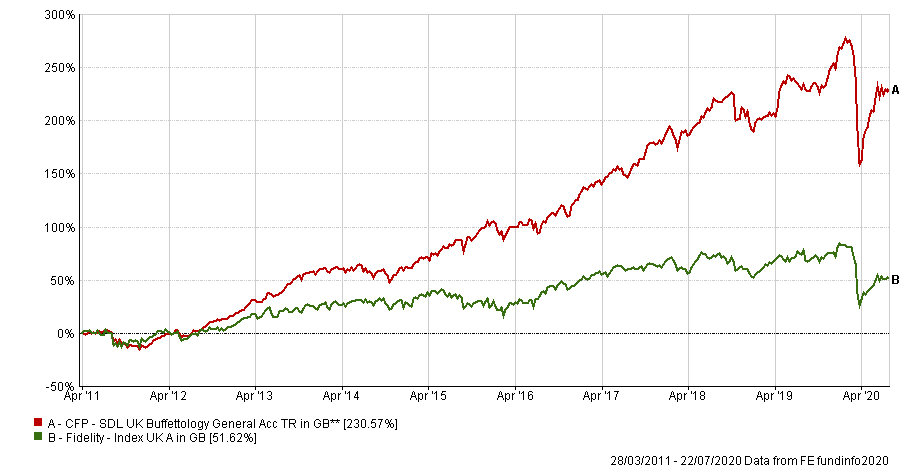

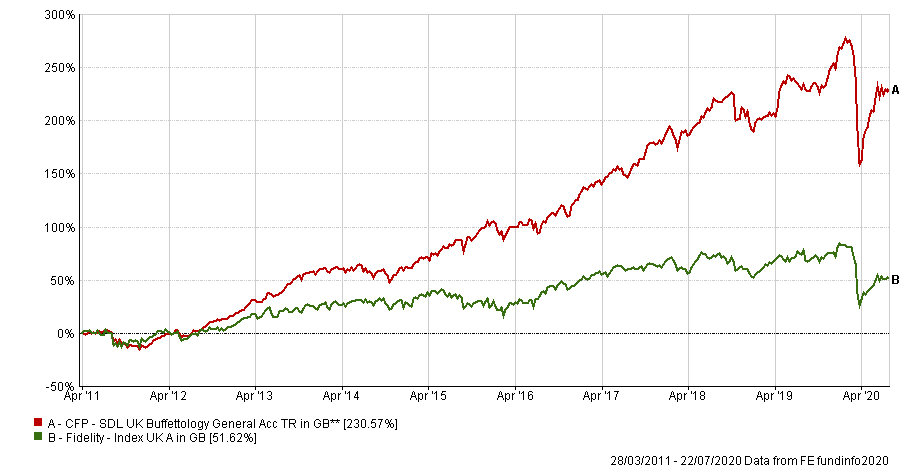

Above we have two UK equity funds. The low cost Fidelity UK index costing 0.06% pa and the Buffetology fund costing 1.19%. A fund that is actually very expensive in terms of managed funds.

Would you rather 51.62% after charges of 0.06% p.a. or 230.57% after 1.19% p.a?

How do you explain the higher charged fund doing better when you say that charges mean it will have a lower return.All else being equal, lower costs=higher returns for the investor.But things are not equal though and that isn't what he said. Even if he meant that.

If things were equal and closet trackers were being compared with low cost trackers then it would be correct. However, even the lowest cost trackers can be beaten by higher cost trackers due to tracking error.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

/dunstonh said:

Above we have two UK equity funds. The low cost Fidelity UK index costing 0.06% pa and the Buffetology fund costing 1.19%. A fund that is actually very expensive in terms of managed funds.

Would you rather 51.62% after charges of 0.06% p.a. or 230.57% after 1.19% p.a?

How do you explain the higher charged fund doing better when you say that charges mean it will have a lower return.All else being equal, lower costs=higher returns for the investor.But things are not equal though and that isn't what he said. Even if he meant that.

If things were equal and closet trackers were being compared with low cost trackers then it would be correct. However, even the lowest cost trackers can be beaten by higher cost trackers due to tracking error.

You are still wildly and wilfully misconstruing what I said. I don't need to prove you wrong and I am going to stop replying now.

If all investors as a whole all used an IFA, an expensive active manager, an expensive platform etc., then their aggregate return would be exactly less by those costs. A minority would be above average, a majority would be below average, and the proportion of above averages gets smaller over time. That is what I said.

There will always be plenty of retrospective counter examples in the strange business of investing.

But on average, for most people, it's a business where at least financially, you get what you don't pay for. But many investors do not make investing decisions for purely financial reasons, and that's fine, that's up to them. That does not, however, change the laws of mathematics.

Just google "gotrocks family".

1 -

With equity investing "all else" is never equal. Other factors play a much larger part in determining returns than charges.Diplodicus said:Callaghan is being rather wilfully misconstrued imo.

All else being equal, lower costs=higher returns for the investor.

And worth repeating on pages where it is often stressed that maximising returns is not what you pay your adviser for.0 -

With equity investing “all else” is never equal.

But to illustrate the truism - lower charges=higher returns - it helps to isolate the effect of lower charges from any other determinate.

Callaghan has already explained this adequately and repeatedly to the reader; as one schooled as an actuary, he may have said, smoking shortens a smokers life: of course that doesn’t mean one smoker will die before one non-smoker; the refutation of which seems to be the basis of the counter-argument.3 -

Cheapest I've seen so far, can you introduce me?ossie48 said:I've been quoted 2.5% by the IFA - does this seem reasonable ?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards