We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Help with BR expenditure!

bvizion

Posts: 25 Forumite

Hi

I have been on IVA since the 1 of January but I have informed them this month that I will terminate the IVA and save for BR as a better option. I should have done this from the start but I was told IVA could be a better option. The main reason is a concern for the stability of my job for the future and BR would offer better peace of mind if things go wrong. I am saving for the cost of BR for the next few months and already filled the BR application but would like your help and wouldn't want anything to raise eyebrows to BR agent.

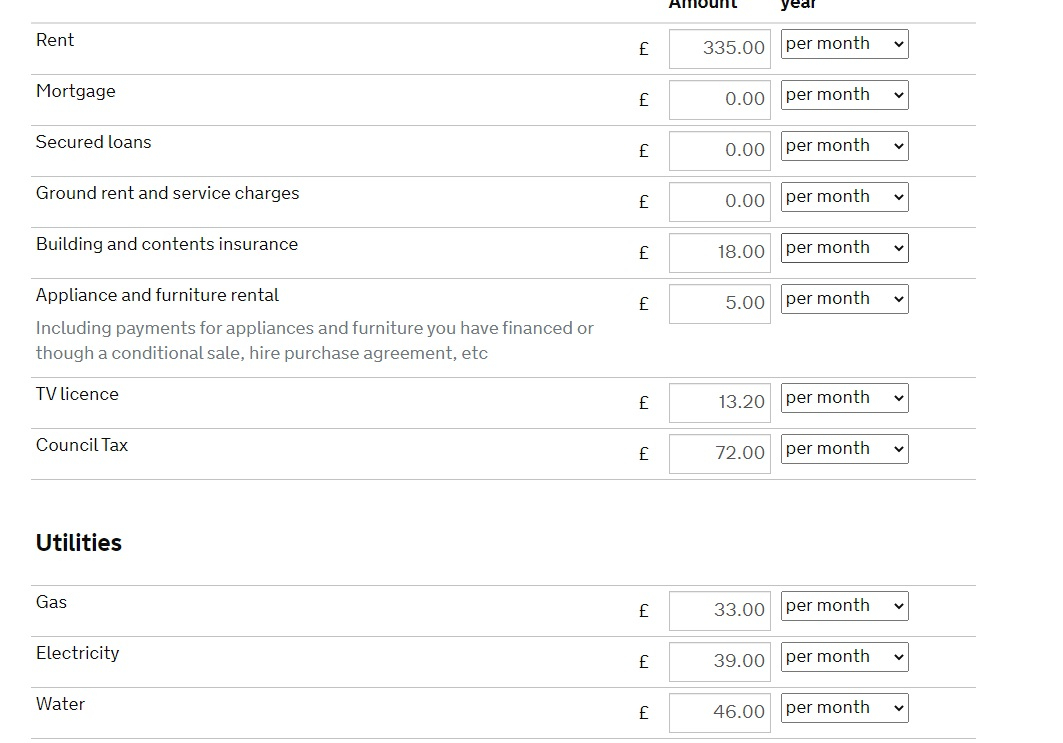

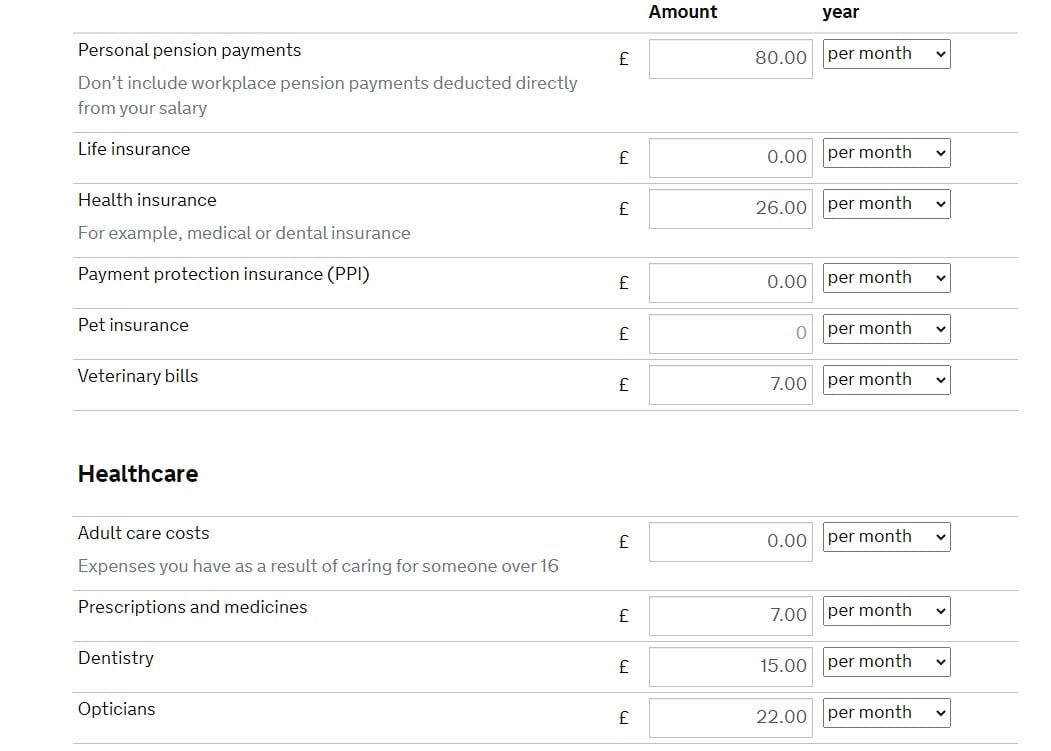

I will attach in this email my expenditure (exactly as it is on BR application) My salary is £1500 monthly (including occasional overtime) without the overtime is £1450)

If you have any questions, please ask me and I will explain. Thinking of submitting the application in about 3 months.

I have been on IVA since the 1 of January but I have informed them this month that I will terminate the IVA and save for BR as a better option. I should have done this from the start but I was told IVA could be a better option. The main reason is a concern for the stability of my job for the future and BR would offer better peace of mind if things go wrong. I am saving for the cost of BR for the next few months and already filled the BR application but would like your help and wouldn't want anything to raise eyebrows to BR agent.

I will attach in this email my expenditure (exactly as it is on BR application) My salary is £1500 monthly (including occasional overtime) without the overtime is £1450)

If you have any questions, please ask me and I will explain. Thinking of submitting the application in about 3 months.

0

Comments

-

Overview, Income 1500, spending 1430.20. I am single. Also, I must add that a personal pension account has started recently. I am not sure if this will be OK.0

-

Hi,

I would increase your groceries cost by £30 pm and your leisure costs by the same amount. I would keep your other costs as they are. Normal pension contributions will be allowed, excessive one's will not be.

DD

Debt Doctor, Debt caseworker, Citizens' Advice Bureau .

Impartial debt advice services: Citizens Advice Bureau Find your local CAB *** National Debtline - Tel: 0808 808 4000*** BSC No. 100 ***2 -

Many thanks for your reply. I will do that, as in reality, I spend a lot on groceries and I buy everything using my bank card so they can check that easy if they want. I very rarely use cash. Another concern I have is, the private pension has just been opened now. I do not plan to submit the application until the end of August or September. It may look as I am trying to lower the surplus, but in reality, I am just trying to plan a stable retirement (51 years old now) and not wanting to relly anymore on depts and find myself again on the same situation. But if they disagree with £80 amount I pay monthly, I will just have to decrease it.debt_doctor said:Hi,

I would increase your groceries cost by £30 pm and your leisure costs by the same amount. I would keep your other costs as they are. Normal pension contributions will be allowed, excessive one's will not be.

DD

0 -

Your pension shouldn't be a problem1

-

On preparation for BR, there is a section under expenditure "Caring for someone". I do, but I am not sure if this is gonna be valid in my case. I do care for my brother who is disabled (I and the other 2 brothers share the cost equally) but they live abroad. I only send them small amounts (usually £100 -£150) every 3 to 4 months. I am not sure if I should add this or simply explain it to OR during the interview?

Thanks again.

0 -

a few comments on your proposed expenditure- smoking isnt generally one of the expenses they will give an allowance for in bankruptcy- optical and dental costs both seem a little high £180 a year for dental and £264 for optical, many don't need new glasses each year(and don't expect designer frames etc), and if using an NHS dentist half your figure goes a long way. And all this is after paying insurance , whats that for ?- hobbies £56, I think that'll be too rich for OR, esp with £26 alcahol too- savings £30, normally you'd be allowed £20 I think1

-

Thanks for your advice.mwarby said:a few comments on your proposed expenditure- smoking isnt generally one of the expenses they will give an allowance for in bankruptcy- optical and dental costs both seem a little high £180 a year for dental and £264 for optical, many don't need new glasses each year(and don't expect designer frames etc), and if using an NHS dentist half your figure goes a long way. And all this is after paying insurance , whats that for ?- hobbies £56, I think that'll be too rich for OR, esp with £26 alcahol too- savings £30, normally you'd be allowed £20 I think

If smoking is not one of the expenses they will allow an allowance, I wonder why do they include it in the BR application questionnaire form? It can't be just for their own curiosity! I have just answered what they have asked. Optical. £19 a month for 30 contact lenses, plus mist for dry eyes. I am on a computer screen for 8 hours nonstop. I don't use the NHS dentist, I have 26 dent plan insurance. I also buy toothbrushes, toothpaste, Listerine to maintain regular Hygiene. And by the way, it is not just Hobbies. It is "Hobbies, leisure, and Sport" including socializing, eating out, and drinking out. Let me break it down. £22 pm Pure Gym. £8 pm Cinema. £36 pm eat out, drink, coffee with mates once a month! I believe that's quite reasonable (but OR may think it isn't) and If I am honest, I have spent a lot more, but then again that is one of the reasons why I ended up here. As for Alcohol! A bottle of wine a week, £6.50 when it is on offer at Morrisons. I could be wrong, but I believe going BR doesn't mean stopping drinking or smoking. As long as I don't overspend. Yeah, I suppose I could save just £20 instead of £30, don't think that's gonna make much difference. Anyway, your suggestion is much appreciated, thanks.0 -

Hi I see Debt Doctor has replied on your SOA he has a great deal of experience in this field and has helped many posters avoiding IPAs, I would re read his post2

-

Many thanks. I have read Debt Doctor's posts across this forum and seems very very knowledgeable on these subjects. I have followed his advice.luvchocolate said:Hi I see Debt Doctor has replied on your SOA he has a great deal of experience in this field and has helped many posters avoiding IPAs, I would re read his post2 -

bvizion said:

Thanks for your advice.mwarby said:a few comments on your proposed expenditure- smoking isnt generally one of the expenses they will give an allowance for in bankruptcy- optical and dental costs both seem a little high £180 a year for dental and £264 for optical, many don't need new glasses each year(and don't expect designer frames etc), and if using an NHS dentist half your figure goes a long way. And all this is after paying insurance , whats that for ?- hobbies £56, I think that'll be too rich for OR, esp with £26 alcahol too- savings £30, normally you'd be allowed £20 I think

If smoking is not one of the expenses they will allow an allowance, I wonder why do they include it in the BR application questionnaire form? It can't be just for their own curiosity! I have just answered what they have asked. Optical. £19 a month for 30 contact lenses, plus mist for dry eyes. I am on a computer screen for 8 hours nonstop. I don't use the NHS dentist, I have 26 dent plan insurance. I also buy toothbrushes, toothpaste, Listerine to maintain regular Hygiene. And by the way, it is not just Hobbies. It is "Hobbies, leisure, and Sport" including socializing, eating out, and drinking out. Let me break it down. £22 pm Pure Gym. £8 pm Cinema. £36 pm eat out, drink, coffee with mates once a month! I believe that's quite reasonable (but OR may think it isn't) and If I am honest, I have spent a lot more, but then again that is one of the reasons why I ended up here. As for Alcohol! A bottle of wine a week, £6.50 when it is on offer at Morrisons. I could be wrong, but I believe going BR doesn't mean stopping drinking or smoking. As long as I don't overspend. Yeah, I suppose I could save just £20 instead of £30, don't think that's gonna make much difference. Anyway, your suggestion is much appreciated, thanks.You might find these bits of the bankruptcy manual interesting, it's possible the OR won't notice or would be more generous than required, but its far from certain31.7.113 Social and entertainment expenses (amended April 2012) 31.7.114 Sports memberships and activities (amended April 2012)31.7.122 Health care provision, including dentists and opticians

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards