We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

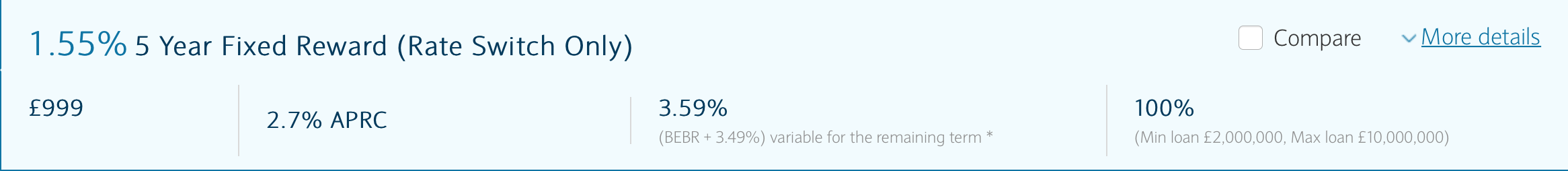

5 Year Fixed 1.55%

wes001

Posts: 9 Forumite

Hi All,

Looking for a bit of advice, my current Barclays fixed rate mortgage is due to end in October so I have started looking to see what rates are out there. Barclays are offering a rate switch of 1.55% fixed for 5 years. My current LTV is around 80% but the fixed rate covers up to 100% LTV

What is peoples opinions of this rate, would a broker be able to get me a better rate, it seems good to me.

Any advice would be great!

Looking for a bit of advice, my current Barclays fixed rate mortgage is due to end in October so I have started looking to see what rates are out there. Barclays are offering a rate switch of 1.55% fixed for 5 years. My current LTV is around 80% but the fixed rate covers up to 100% LTV

What is peoples opinions of this rate, would a broker be able to get me a better rate, it seems good to me.

Any advice would be great!

0

Comments

-

That’s a really good rate imo. We’ve just been quoted 1.84% fixed for 5 years on a new mortgage if we move. Many of the lowest rates eg 1.2% are only on a 2yr fixed basis0

-

That looks quite enviable to me. You'd do well to find anything better IMHO.There is no honour to be had in not knowing a thing that can be known - Danny Baker0

-

Sounds good to me.

Are you planning on staying in the house for at least 5 years ?0 -

That 1.55% rate look like the 75% LTV rate with £999 (no fee 1.85%)

80% rate is 1.77% £999 fee (not a no fee option)

how big is the mortgage you need to check if the fee is worth paying.

0 -

I got the 1.55% from the website, below is the screen shot.getmore4less said:That 1.55% rate look like the 75% LTV rate with £999 (no fee 1.85%)

80% rate is 1.77% £999 fee (not a no fee option)

how big is the mortgage you need to check if the fee is worth paying.

0 -

Just to check OP but is your loan between 2 million and 10 million pounds because the product is only valid for loans between those sizes4

-

Even 1.77% is a decent rate for a 5 year fixTotal Value of wins in 2009: £900 appox. 2010: £730Wins 2011: Carlisle Utd Tickets (twice!), Baby Food Hamper, Straighteners, Chugginton Toy0

-

dimbo61 said:Sounds good to me.

Are you planning on staying in the house for at least 5 years ?

I always feel like this is irrelevant these days? I would rather have a sum of money at 1.55% and pay for extra at a higher rate than secure something short term because I am moving, porting is in effect applying for a new mortgage anyway, so don't understand the issue of moving impacting 2 year vs 5 year0 -

@IAMIAM You may not be able to port the product. If you can port the product but want to buy a house which is more expensive or borrow additional funds then you can end up with 2 products which have different expiry dates which again gets tricky when you want to remortgage or move.IAMIAM said:dimbo61 said:Sounds good to me.

Are you planning on staying in the house for at least 5 years ?

I always feel like this is irrelevant these days? I would rather have a sum of money at 1.55% and pay for extra at a higher rate than secure something short term because I am moving, porting is in effect applying for a new mortgage anyway, so don't understand the issue of moving impacting 2 year vs 5 year

The product could have eye-wateringly high early redemption fees.

If the OP knows they are going to stay longer than 5 years they want to lock in if Barclays are offering a good deal.

"Everything comes to him who hustles while he waits" Thomas Edison

Following the Martin mantra "Earn more, have less debt, improve credit worthiness" :money:1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards