We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Why do people say when interest rates are low, borrowing is cheaper?

Comments

-

Your wish has been granted as they already are..CreditCardChris said:Rates should be given to people based on their credit history

Now how good does that feel? What a result!0 -

Borrowing is cheaper when interest rates are lower. The rates offered by lenders is not dictated by the BOE rate. Often it does follow, particularly if it goes up but as the rate is practically zero now (to help the government who are now borrowing shed loads of money) there is no way lenders will lend at that rate, regardless of your financial situation. I would think the lowest is around 4% so if you have been offered that I should count yourself lucky or not borrow. Borrowing rates are set according to supply and demand and they also build in an element of bad debt to cover themselves in case people default.I’m a Forum Ambassador and I support the Forum Team on the Debt free Wannabe, Budgeting and Banking and Savings and Investment boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

The 365 Day 1p Challenge 2025 #1 £667.95/£391.55

Save £12k in 2025 #1 £12000/£120001 -

You seem to have based your whole inequality arguement upon rich people being offered much lower rates. Have you got any evidence for that?

2% is perfectly doable for the average Joe, as long as you have an asset to secure the loan against.Im A Budding Neil Woodford.0 -

Well I'm not a home owner so I don't.benbay001 said:You seem to have based your whole inequality arguement upon rich people being offered much lower rates. Have you got any evidence for that?

2% is perfectly doable for the average Joe, as long as you have an asset to secure the loan against.

And yes I do have evidence because the government are lowering interest rates to encourage borrowing but if the rates being offered by banks to everybody are the same as they were 6 months ago then how is this encouraging people to borrow? Unless the people they really want to encourage to borrow are the rich, so it's obvious the rich are the ones being offered the ~1% rates while the normal people are still being offered ~4%.

The truth is banks don't want normal people to take advantage of low interest rates because god forbid that might mean we can buy things "on the cheap", they just want the rich to borrow because its a system for the rich by the rich it seems.

I'm not just making all this up by the way, I watched a mini documentary about how banks offer their best clients rock bottom interest rates, basically force feeding them credit. Meanwhile if the average Joe with perfect credit history and responsible spending habits wants to buy a home or a new car they have to accept 3% - 4% interest rates...

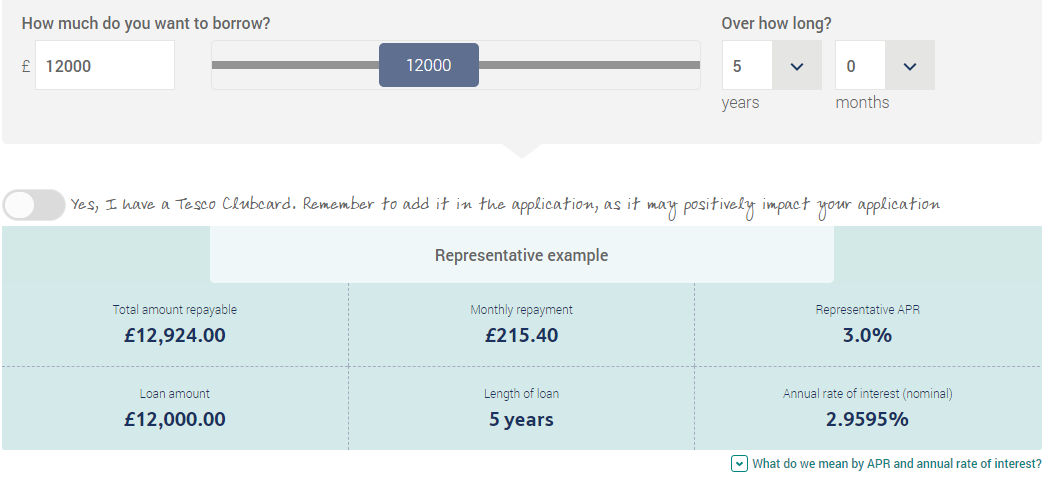

For example

0 -

You’re saying the best you can get is 4% and then show a quote for a fraction under 3. Ignoring the base rate, that is remarkably good in historic terms. If a bank can borrow at 0.1%, pay their staff, buildings, computers, payment network, advertising costs, cover bad debts and make a profit on less than 3% they are doing very well and so are you.

What you have to remember is that while one of these costs - the base rate - has gone down, others will have gone up. Paying and setting up staff to work from home, social distancing measures in branches, increased call centre staff and most importantly a higher level of bad debt mean we are still very fortunate that rates are as low as they are.2 -

Totally. 25,000 laptops purchased since March, chairs and monitors supplied to those who need them to work from home, offices running @ 1/3 capacity to allow for social distancing, offices closed at a moments notice for 48 hours to allow for deep cleaning when covid cases are suspected. Staff on full pay but only working 1/2 to 2/3 of their hours to allow for social distancing. Branches only open for 4 hours a day, reduced opening times in contact centres as so many staff off self isolating or caring for others, unable to meet the previous opening hours staffing commitments, calls to these centres up 100's of % over normal. Profits down 95%, share price collapsed. Yes- borrowing has never been so cheap all things considered.Nebulous2 said:You’re saying the best you can get is 4% and then show a quote for a fraction under 3. Ignoring the base rate, that is remarkably good in historic terms. If a bank can borrow at 0.1%, pay their staff, buildings, computers, payment network, advertising costs, cover bad debts and make a profit on less than 3% they are doing very well and so are you.

What you have to remember is that while one of these costs - the base rate - has gone down, others will have gone up. Paying and setting up staff to work from home, social distancing measures in branches, increased call centre staff and most importantly a higher level of bad debt mean we are still very fortunate that rates are as low as they are.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.7K Banking & Borrowing

- 253.4K Reduce Debt & Boost Income

- 454K Spending & Discounts

- 244.7K Work, Benefits & Business

- 600.1K Mortgages, Homes & Bills

- 177.3K Life & Family

- 258.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards