We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Debt

Comments

-

Thank you I am so so scared and I am not prepared to live in a dive. I am so mad with my husband but I also want to support him to. My mental health is taking a massive impact. I just don't want to end up with nothing due to his bad choices in life. There is one thing for sure it will never happen again.JayRitchie said:

Cool. Hopefully someone will be along shortly who can give detailed advice. My vague recollection is that its very difficult for creditors to force the same of a jointly owned home, especially if the owner who does not owe them money is living at the address.Treesandbird2020 said:

It's joint ownershipJayRitchie said:Do you have joint ownership of the house or is he the owner?

I wouldn't risk selling until you are clear on this and have reviewed all your finances.0 -

I know it will take time to prepare and you'll get a lot of questions (some of which are just irrelevant) but please start to work on an SOA. People will be able to give you good advice, and point you in the right direction for more information. Might be worth a trip to the Citizens Advice Bureau just so you feel a bit more informed and empowered.

I'm sure when you have all the facts it just won't look so scary. You just need to be careful not to spend any money which is not his on paying his debts until you are sure it is the right thing to do (and I mean right in a practical sense). Don't worry about the creditors - its their problem not yours.0 -

JayRitchie said:I know it will take time to prepare and you'll get a lot of questions (some of which are just irrelevant) but please start to work on an SOA. People will be able to give you good advice, and point you in the right direction for more information. Might be worth a trip to the Citizens Advice Bureau just so you feel a bit more informed and empowered.

I'm sure when you have all the facts it just won't look so scary. You just need to be careful not to spend any money which is not his on paying his debts until you are sure it is the right thing to do (and I mean right in a practical sense). Don't worry about the creditors - its their problem not yours.

Thank you again. My husband has done this. It is very simple we get 400 joint universal credits he has a few outgoings for himself and pays 126 debt per month . Currently I don't include my income and bills etc as I sort all that and the debt isn't joint

Do I include my income etc in it to? And I m sorry I don't know what you mean about practical sense?0 -

Yes - include both yours and your partners income, assets and liabilities - best to show these separately if they belong to just one of you. This is different from his SOA for whatever DMP he is on as its a go at understanding your finances and how they fit in with your partners - therefore people need to see the joint position.

'In a practical sense' - I mean you do not want to pay any money towards his debts until it is a thought through good option. Not because you feel some sense of fear, or responsibility.0 -

.0

-

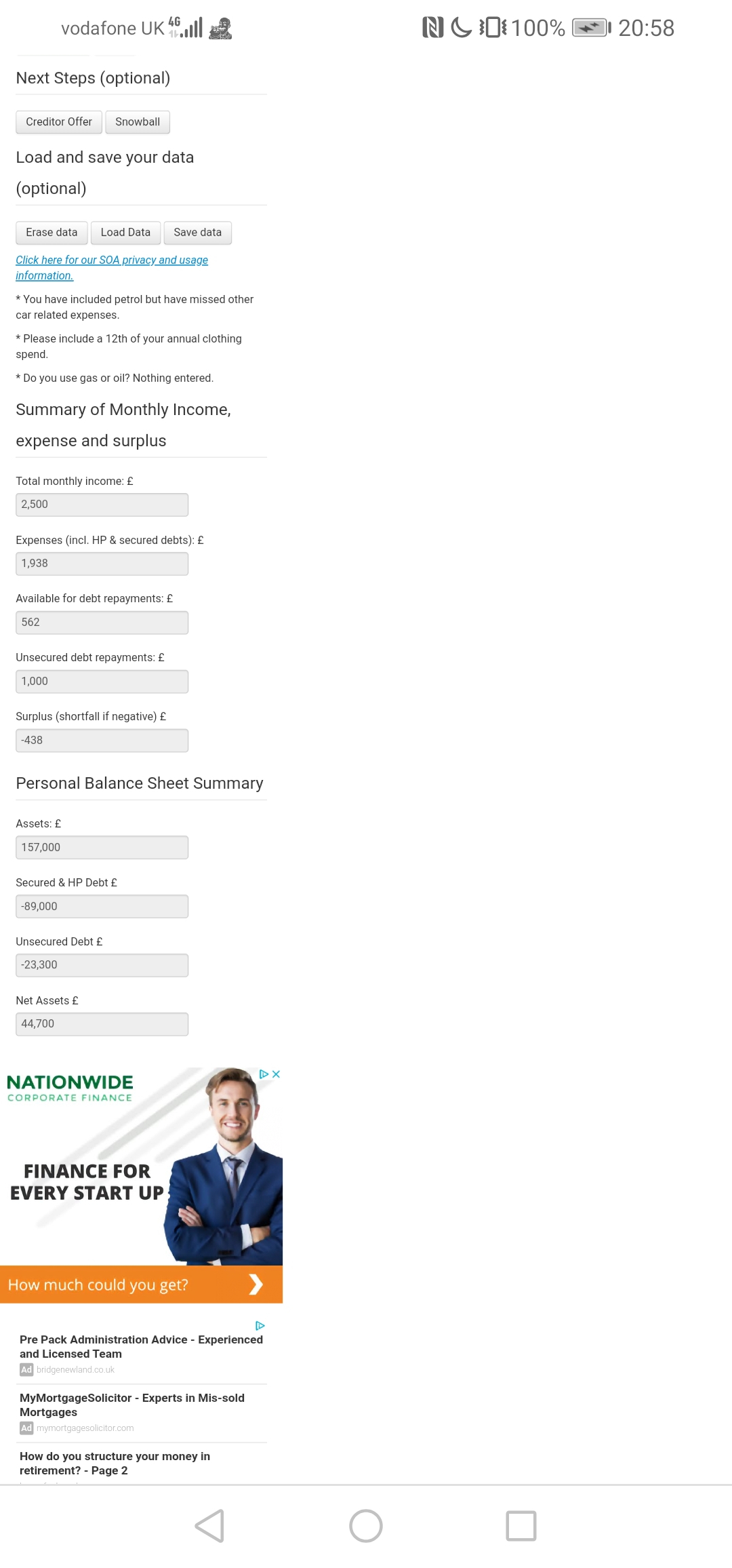

This is estimated I will have a proper look tomorrowsaid:0 -

This is joint amountTreesandbird2020 said:

This is estimated I will have a proper look tomorrowTreesandbird2020 said: 0

0 -

Have a look at some other threads to see what people include in their SOAs:

https://forums.moneysavingexpert.com/discussion/6099556/help-with-debt-please/p1

0 -

No he is not currently earning just benefits due to disabilityJayRitchie said:Just to add as I wasn't clear on earlier posts. Is you SO earning at the moment? If not - or if he is on a low income please look carefully into your options before stretching to pay off debts which are in his name only.0 -

Get him to contact Step Change and advise them that he is not currently earning and they will adjust his payments to token payments until he is earning again. I know that you are worried about the household finances but as long as you are paying the mortgage and council tax etc, your husbands creditors will not be able to take the house. Unfortunately if you do sell, you may struggle to rent if your husband is not earning and has a DMP. Sadly Most landlords/ agents are not keen to rent out properties to people on a DMP. Unfortunately He probably won’t pass the credit check. We are a friendly bunch here and will never judge.2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards