We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

10 years to go .... maybe, with a fair wind

Comments

-

Still January .... unbelievable it's still another 4 days till payday but at least the sun is shining. This month I have mostly been trying very hard to not jump in and book holidays. All my friends seem to be off doing exciting things, but I'm attempting to remain cautious and wait until there's a decent chunk of money in my holiday fund before jumping in and over-stretching myself. First world problems, but mentally hard!

Just received my annual mortgage statement for last year, and the good news is that my standard payment has been reduced due to my OPs. I do have a fixed payment which means that I'll now be OPing £35 per month on the difference between the required payment and the fixed amount. It's been £20 in 2023 so another easy £15/month.

Only a few bits and bobs gathered to save for OPs this month - sh0pp1x / pr0lific etc and some interest on a savings account makes £70 in total. Still, a good start to the year, and the next couple of months there are chunkier OPs to come with no Council tax or water to pay.

Off to get some vitamin D from the sun now whilst it lasts. Happy remainder of January all.Aiming for mortgage free by September 2030

Balance 1.1.20 - £69,701.80

Balance 1.1.21 - £63,699.80

Balance 1.1.22 - £57,762.80

Balance 1.1.23 - £53,074.20

Balance 1.1.24 - £47,902.00

Balance 1.1.25 - £44,141.20

over payments 2025 = £1,800/£1,500 /// invested 2025 = £1,500/£1,500 = TOTAL (YTD) £3,300/£3,0003 -

Well done on the OPs and not getting caught up in other's holiday fever. I'm about to move - and someone suggested I use some of my equity for a holiday. I looked at them like they'd grown 2 heads!!Achieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £171.3K Equity 36.55%

2) £2.6K Net savings after CCs 10/10/25

3) Mortgage neutral by 06/30 (AVC £30.9K + Lump Sums DB £4.6K + (25% of SIPP 1.25K) = 35.5/£127.5K target 27.8% 14/11/25

(If took bigger lump sum = 62K or 48.6%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.1K updated 14/11/252 -

That reminds me of when someone suggested I could borrow more at remortgage time to do up the flat 😱 (although 7 years on and it's still not done 🤔!)Mortgage start: £65,495 (March 2016)

Cleared 🧚♀️🧚♀️🧚♀️!!! In 5 years, 1 month and 29 days

Total amount repaid: £72,307.03. £1.10 repaid for every £1.00 borrowed

Finally earning interest instead of paying it!!!2 -

February isn't a very exciting month when it comes to being MSE and overpaying the mortgage. A reasonably chunky OP from the non-payment of water and council tax this month, but the rest of my little wins are all going into the holiday fund instead ... still nothing booked and every day my itchy feet are getting itchier! Hopefully we'll be able to join some really good friends at their holiday house in the Hebrides which would be a proper adventure (not to mention a very long drive). The pennies are building up slowly but surely and hopefully we'll be able to book some ferry tickets soon.

I know we're not there yet, but definitely enjoying signs of spring. Things always look brighter when the sun shines. Had a lovely day out over half term with my mum and the small one at some snowdrop gardens in the sun, followed by a delicious and not too spendy lunch, then a couple of joyful hours in a favourite bookshop. The only other spendy part of half term was ice skating yesterday which left my 40 something body achy all over. So seem to have survived the holidays relatively unscathed.

Happy February all

Aiming for mortgage free by September 2030

Balance 1.1.20 - £69,701.80

Balance 1.1.21 - £63,699.80

Balance 1.1.22 - £57,762.80

Balance 1.1.23 - £53,074.20

Balance 1.1.24 - £47,902.00

Balance 1.1.25 - £44,141.20

over payments 2025 = £1,800/£1,500 /// invested 2025 = £1,500/£1,500 = TOTAL (YTD) £3,300/£3,0002 -

I love snowdrops too. Saw some on my walk recently.

Achieve FIRE/Mortgage Neutrality in 2030

Achieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £171.3K Equity 36.55%

2) £2.6K Net savings after CCs 10/10/25

3) Mortgage neutral by 06/30 (AVC £30.9K + Lump Sums DB £4.6K + (25% of SIPP 1.25K) = 35.5/£127.5K target 27.8% 14/11/25

(If took bigger lump sum = 62K or 48.6%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.1K updated 14/11/252 -

Have read through your first @Lauraebrad I think You've done an amazing job getting the mortgage down so much in such a short space of time. I can't wait to see ours dip into the next 10000 below where it is now! Jan and Feb have been long months for us too, and although Feb was good on overpayments, Jan was about just getting to the next payday 🙈

Bookmarked to follow along and cheer you on 🎉Emergency Fund- £717.773 -

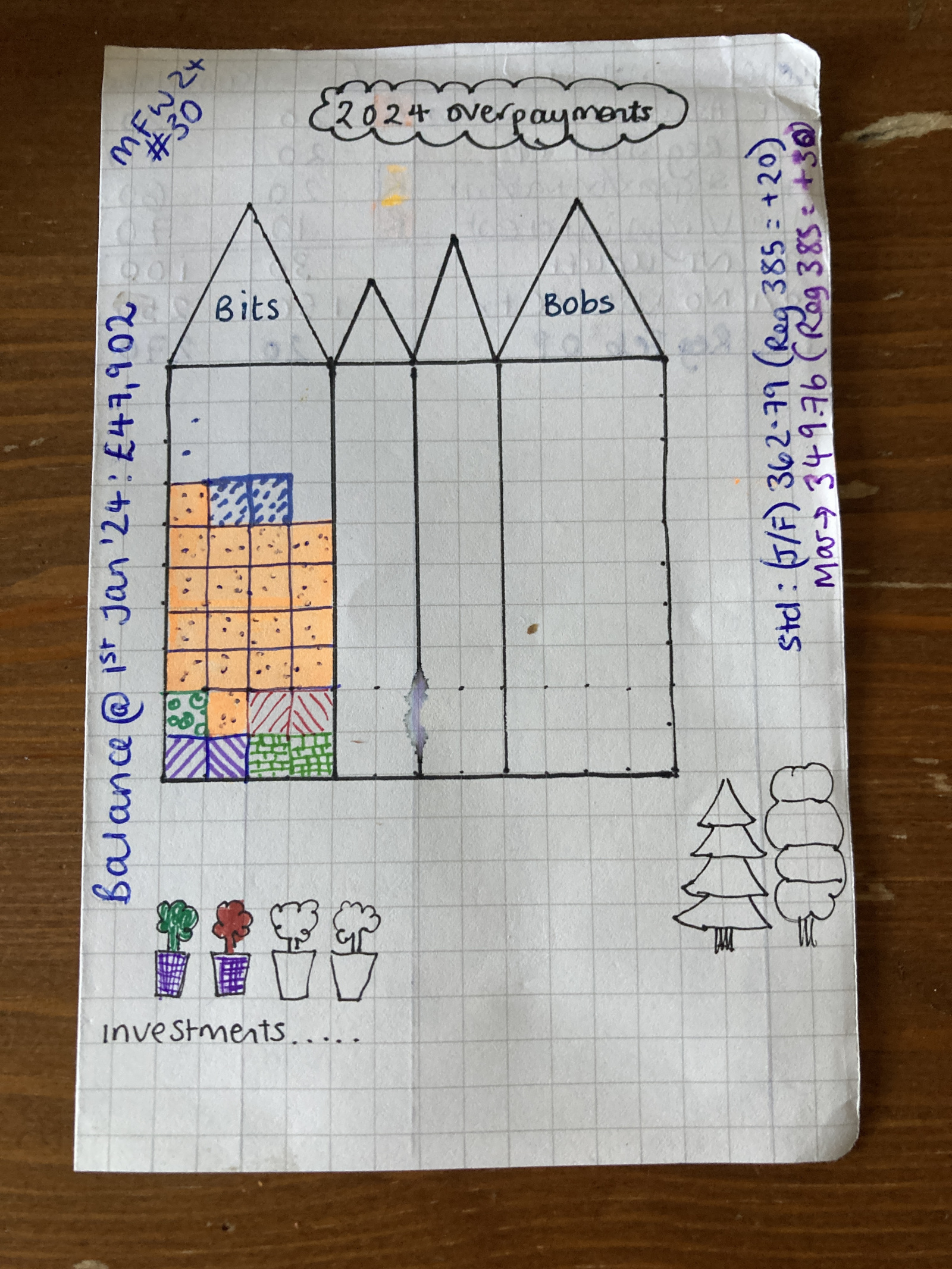

Inspired by @debtfreewannabe321 I thought I'd share my own OPs house tracker. Mostly as a reminder to myself to be honest! Early in the year so not very full yet ...

After a conversation with a friend the other day about 'enjoying the journey' aka living in the moment rather than putting off fun until some later stage that we may never arrive at - I decided that I'd start making a note of the little things I'm doing (a) to enjoy every day and (b) enable future freedom or fun, so that I can make sure I'm getting the balance right.

So in that spirit here are this week's little savings so far - none of which have taken any of the enjoyment out of the present!

- Parking for free and walking a bit further to meet a friend, ordering a book from the library rather than buying it, walking home from work instead of getting the tram, using some vouchers from my credit card to buy new M%S squishy socks and undies, complaining about a sub-par product and getting a refund, doing some pr0lif1c surveys whilst on hold to sort out an issue on the phone.

Hoping that noticing these things will keep me on track! Happy weekend all.

Aiming for mortgage free by September 2030

Balance 1.1.20 - £69,701.80

Balance 1.1.21 - £63,699.80

Balance 1.1.22 - £57,762.80

Balance 1.1.23 - £53,074.20

Balance 1.1.24 - £47,902.00

Balance 1.1.25 - £44,141.20

over payments 2025 = £1,800/£1,500 /// invested 2025 = £1,500/£1,500 = TOTAL (YTD) £3,300/£3,0004 -

Hellooooo @Lauraebrad (((waves)))Have just read your diary popping over from @debtfreewannabe321 's dairy. I love the house brick chart. SO good to have a visual motivator!!You have done so so well with your mortgage O/Ps you are smashing your goals!Flowers x(i'm off to make my house chart!!)♥️ ♥️ ♥️🌸🌸🌸🌸🌸🌸🌸🌸Decluttering 2025 So far 403 / 2025

Decluttering 2024🏅🏅🥇🏅🏅🏅⭐⭐⭐🌸 DS2🏅🏅DD🏅🥇🌸

25 in 25 So far 1 /25

⭐My rambling savings Diary ~⭐3 -

Hi @~FlowerPot~ thank you so much! Enjoy designing your house chart

Aiming for mortgage free by September 2030

Balance 1.1.20 - £69,701.80

Balance 1.1.21 - £63,699.80

Balance 1.1.22 - £57,762.80

Balance 1.1.23 - £53,074.20

Balance 1.1.24 - £47,902.00

Balance 1.1.25 - £44,141.20

over payments 2025 = £1,800/£1,500 /// invested 2025 = £1,500/£1,500 = TOTAL (YTD) £3,300/£3,0002 -

thank you I finally did it and i have posted it up on my diary if you want to see it. It not terrible exciting, but Im pleased I have worked out a sheet that will work for us!!Flowers x♥️ ♥️ ♥️🌸🌸🌸🌸🌸🌸🌸🌸Decluttering 2025 So far 403 / 2025

Decluttering 2024🏅🏅🥇🏅🏅🏅⭐⭐⭐🌸 DS2🏅🏅DD🏅🥇🌸

25 in 25 So far 1 /25

⭐My rambling savings Diary ~⭐3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards